India is notorious for its complicated tax systems. It’s almost impossible for new businesses and start-ups to understand direct and indirect tax systems. This problem aggravates even further when persistent changes are made to taxes every financial year. With GST however, things changed. Referred to as a simple tax by the Prime Minister of India, it is an indirect tax that is imposed on the supply of goods and services. While things have become a lot easier since the introduction of GST, citizens still have to keep up with the GST-related updates. The most recent one includes Aadhaar Authentication in GST.

Read on to learn more about the Aadhaar Authentication process, its eligibility criteria and its purpose.

Table of contents

- What does Aadhaar Authentication Mean?

- Purpose of Aadhaar Authentication in GST

- Eligible Criteria for Aadhaar Authentication

- In Which Cases is Aadhaar Authentication Mandatory?

- Deemed Approval Cases of GST Registration Application

- A Step by Step Guide to Aadhaar Authentication in GST

- Existing Taxpayers Aadhaar Authentication Procedure

- FAQ’s about Aadhaar Authentication in GST

What does Aadhaar Authentication Mean?

Aadhaar card authentication is a verification process in which the citizen’s Aadhar number and other biometric information are submitted to the CIDR (Central Identities Data Repository). The CIDR checks the authenticity of this data based on the available information in their database.

Purpose of Aadhaar Authentication in GST

The objective of this Aadhaar authentication is to make a virtual platform that allows Indian citizens to validate their identity anytime/anywhere using Aadhaar. The authentication process also helps keep a tab on criminal or illegal activities happening under the Goods and Services Tax law.

Eligible Criteria for Aadhaar Authentication

The people listed in the table below are eligible for authentication of Aadhaar number under GST.

- The registered individual’s authorised signatory

- A specified person as per the following table

| Registered Individual | Specified Person |

| Partnership firm | Any partner |

| Proprietorship | Proprietor |

| Hindu Undivided Family | Karta |

| Company | Managing Director |

| Society/BOI/AOP | Any Member of the Managing Committee |

| Trust | Trustee |

In Which Cases is Aadhaar Authentication Mandatory?

According to CGST Act’s Section 25(6C), Aadhaar Authentication in GST is mandatory for the below-mentioned individuals. Going by Rule number 8 of the CGST Act, the following individuals have to authenticate their Aadhaar number to become eligible for GST registration.

- Authorised signatory of all kinds

- Karta of a HUF (Hindu Undivided Family)

- Authorised partners of a partnership firm

- Managing Director or whole-time director of a company

Are There Any Exceptions?

Yes, if an individual is not an Indian citizen, or does not fall in any of the below-mentioned categories, he/she is an exception:

- Individual

- Authorised signatory of all kinds

- Karta of a HUF (Hindu Undivided Family)

- Authorised partners of a partnership firm

- Managing Director or whole-time director of a company

Deemed Approval Cases of GST Registration Application

An application is deemed to be approved by the officers in case the officer doesn’t take any action within the timelines specified against the below cases:

| Cases | Timeline |

| The individual has completed authentication of Aadhaar number under GST successfully or is exempted from the requirement of Aadhaar authentication. | 3 days (working) from the date of application submission. |

| The individual has opted but was unable to complete the Aadhaar authentication procedure | 21 days (working) from the date of application submission for sending the notice in form REG-3 |

| The individual did not opt for the authentication of Aadhar | 21 days (working) from the date of application submission |

| The individual has opted but was unable to complete the Aadhaar authentication procedure. The notice is issued in the GST REG-3 Form and the individual responded in REG-4. | 7 days (working) from the date of receipt, required documents, or information response. |

Don’t Miss Out!

Latest Documents on Aadhaar Card

| AePS | Aadhaar Enable Payment Ststem |

| UIDAI | UIDAI: A Comprehensive Guide for Aadhaar UIDAI Card |

| Aadhar PVC Card | How to Download PVC Aadhaar Card? |

| mAadhar | Download mAadhaar app |

| Aadhaar Update History | How to Check Aadhar Update History? |

| Aadhar Card Lost | How to Recover Lost Aadhaar UID & EID Number |

| Masked Aadhar | How to Download Masked Aadhaar |

| eaadhaar | Eaadhar Download, Benefits & Check E-Aadhar Status |

| Blue Aadhaar Card | How to Download Blue Aadhar Card? |

| NPS Aadhaar Link | How to Link Aadhaar Link with NPS? |

| Jan Aadhar Card | How to Download Jan Aadhar Card? |

A Step by Step Guide to Aadhaar Authentication in GST

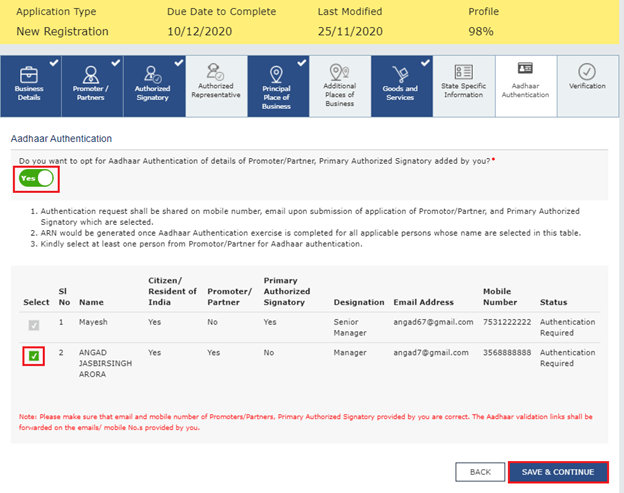

Follow these steps to authenticate your Aadhaar number while applying for GST registration.

Step 1: Choose the Aadhaar Authentication option and choose Yes when filling the Part B of the application.

In case you choose No, a new window will appear on your screen. When that happens, click on OK and attach the KYC documents of the signatory or one of the partners/promoters. Complete the verification process by filling out related details.

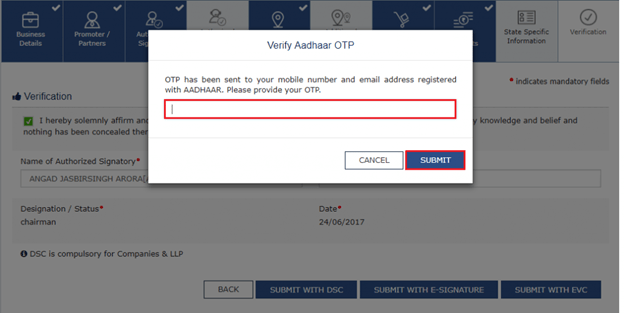

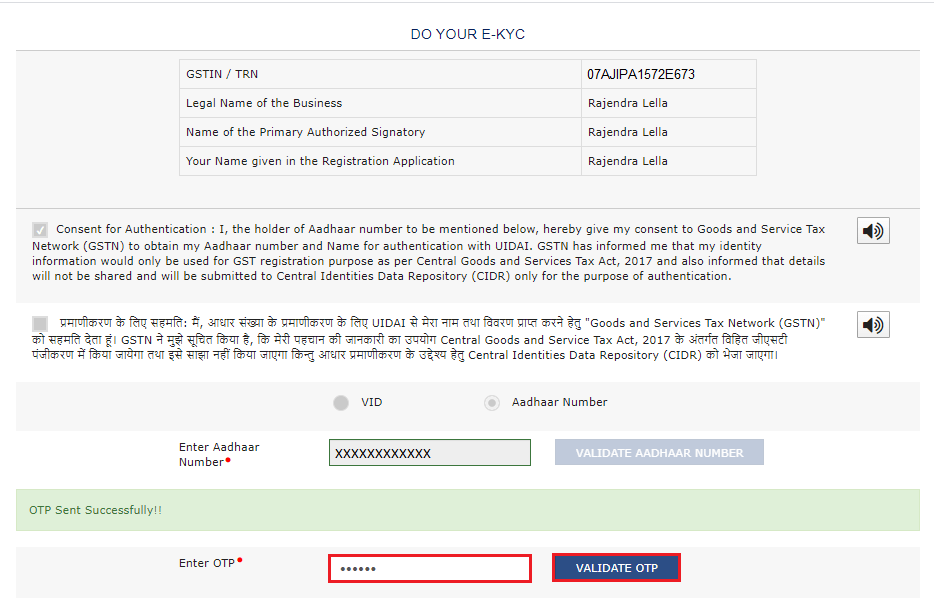

Step 2: The authentication link will be sent to the registered email address and mobile phone number of the signatory, partner or promotor as given in the application. Click on the link and wait for a new window to open. In this window, you will have to enter the Aadhaar Number with OTP received on email and mobile number.

NOTE: The validity of the link is only 15 days. It won’t work/open after that.

Step 3: After entering the correct OTP, a confirmation display on your screen with a message your Aadhaar authentication was successful.

To get the authentication link once again, simply visit the GST portal. Click on the My Saved Applications option followed by clicking on

- Aadhaar Authentication Link

- Resend Verification Link

And you will receive a new link to authenticate your Aadhaar number.

Existing Taxpayers Aadhaar Authentication Procedure

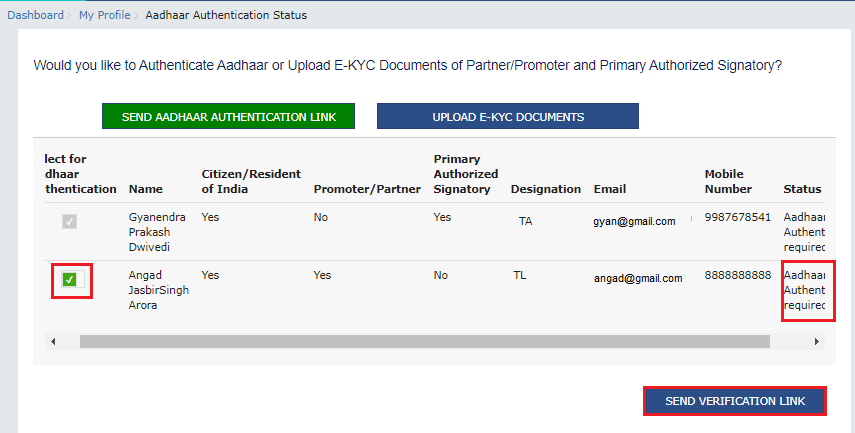

Step 1: Sign in to the official GST portal. Look for the My Profile option, click on it and choose Aadhaar Authentication status. A window with 2 options will appear:

- Send Aadhaar Authentication Link

- Upload E-KYC Documents

Step 2: Select any of the 2 options.

In case you select “Send Aadhaar Authentication Link”, check received links on the mobile phone number or email address of the partner/signatory or partner. Complete the verification process by entering the correct OTP.

If you choose the Upload E-KYC Documents option, remember to attach the correct documents. The tax officer will verify them and can either Reject or Approve them.

NOTE: Approval of these documents will make the taxpayer KYC authenticated not Aadhaar authenticated.

Wrapping Up

Aadhaar authentication is mandatory for GST registration. It validates the Aadhaar holder’s identity and reduces the chances of fraud/criminal activities. In the above blog, we have provided all the necessary steps to complete the authentication procedure. However, if you have any concerns or questions, we suggest using the GST helpline. You may also scroll down to find answers to some of the commonly asked questions in our FAQ section.

FAQ’s about Aadhaar Authentication in GST

Q1. How to complete Aadhar authentication for GST registration?

To complete Aadhaar authentication for GST click on the Authentication link received on the mobile phone number or email address. Then enter the OTP to complete the procedure.

Q2. How long does Aadhar authentication work in the GST portal?

It takes only a few minutes to complete the process of Aadhaar Authentication under GST. Just make sure you fill out all the correct details and do not skip any step in between.

Q3. How can I update my Aadhaar authentication in the GST portal?

You only need to visit the official GST portal for updating your Aadhaar Authentication details.

Q4. Is physical verification compulsory for GST registration?

No, physical verification is not compulsory for GST registration. However, the concerned tax officer may request physical verification to validate the registration in some cases.