The Indian government has mandated that all citizens must register themselves under Aadhaar Seva Yojna. The mandate also brings NRIs (Non-Resident Indians) under its purview. Non-Resident Indians who are Indian citizens must also register under the Aadhaar scheme. Moreover, NRIs living in certain countries like UAE have been exempted from the Aadhar card necessity while filing income tax returns.

Exemptions aside, getting an Aadhaar card comes with its own set of perks. The registration fee for an Aadhaar card is free of cost for every Indian citizen (Residents and Non-residents). Even the documentation requirements are the same for everyone. Besides, the individual must be physically present during the NRI Aadhar Card enrollment period. If you’re an NRI struggling with the UIDAI Aadhaar card registration, this guide will walk you through the complete process. Let’s have a look:

Table of contents

Aadhaar Card is Significant for Non-Resident Indians

If an NRI decides to return to India and wishes to stay here for a longer duration, the NRI must have a valid Aadhaar card. Other than this, there are numerous other instances where an Aadhaar card can turn out very handy for an NRI. Mentioned below are the cases which highlight the significance of an NRI Aadhaar card:

- An Aadhar Card can expedite eKYC methods for all citizens.

- It is among the most commonly accepted authentic documents in various situations, such as real estate documentation, opening bank accounts, etc. Moreover, an NRI must have an Aadhaar card to work in government departments.

- Enrolling yourself under section 139AA to file Income Tax Returns is compulsory. This allows the entire ITR filing process much easier for users.

Application Process for Aadhaar Card for NRI

An NRI can book an appointment for Aadhaar Card online and offline. The Aadhaar application process in both the offline and online modes are mentioned below:

Online Process for Aadhaar Card for NRI

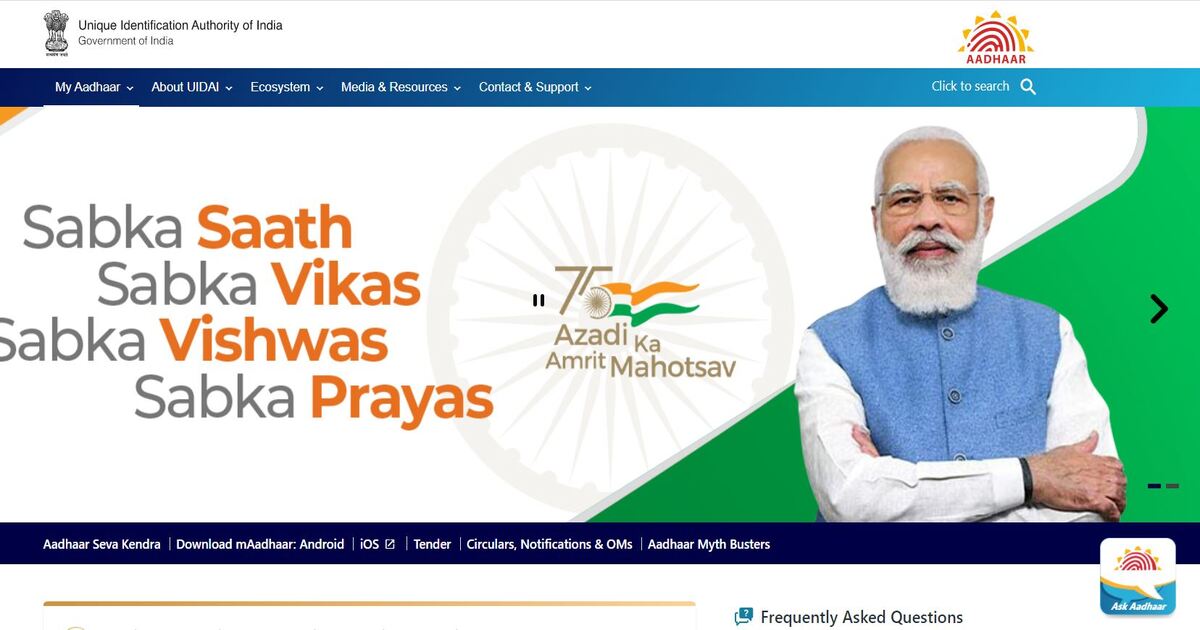

Step 1: Visit the official UIDAI website.

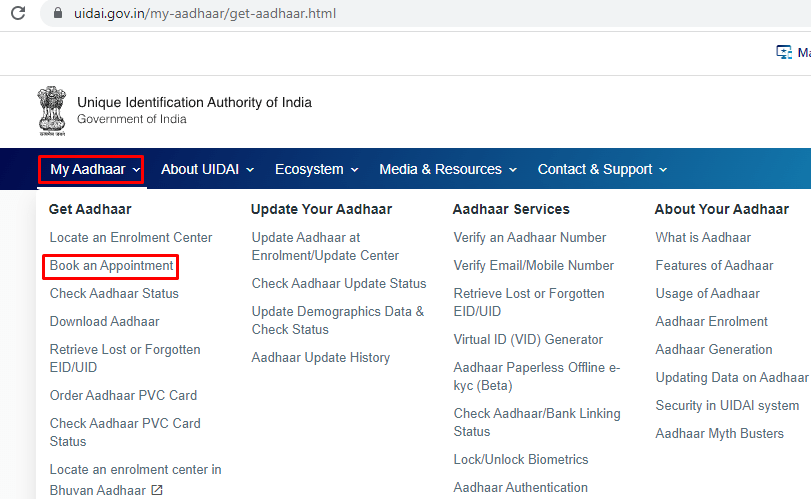

Step 2: Under the ‘My Aadhaar’ category, select the ‘Book An Appointment’ option.

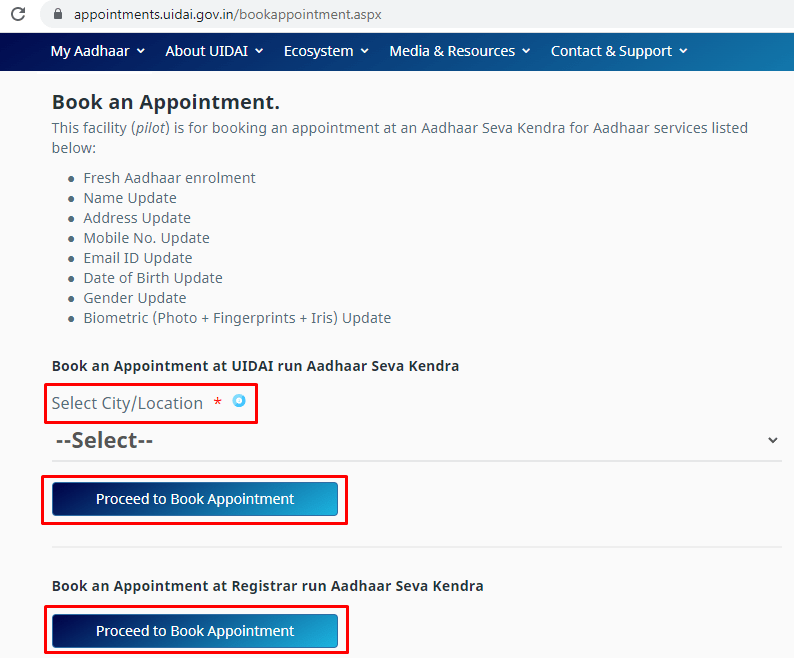

Step 3: On the new page, fill out the details such as fresh Aadhaar enrolment, full name, address proof, contact number, biometric fingerprints, and so on. Moreover, select the city or location and click on the ‘Proceed to Book Appointment’ button.

Step 4: Enter the ‘Mobile Number’ and valid ‘Captcha Code’ to avail of the service. Further, to receive the OTP, click on the ‘Generate OTP’ button and submit it.

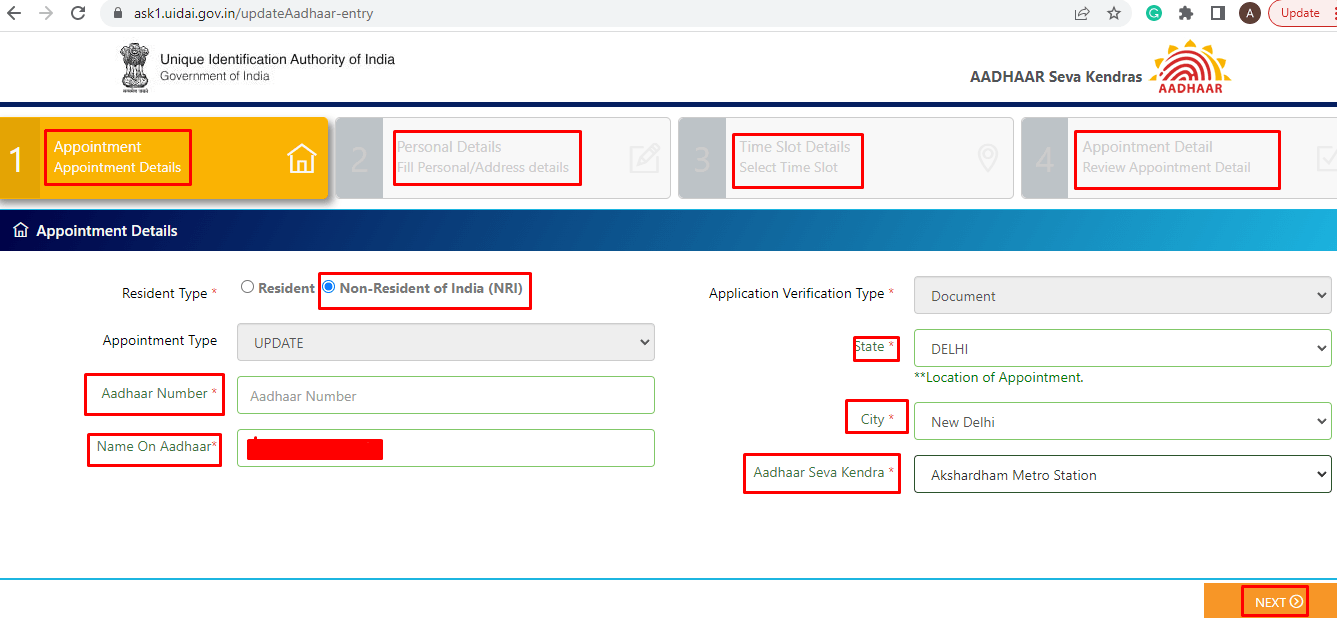

Step 5: A new page will appear on the screen consisting of the final four steps of the Aadhaar Card for the NRI registration appointment.

Step 6: In the initial process, fill out the ‘Appointment details’ such as Appointment type, Aadhaar Number, City, Aadhaar Seva Kendra, and so on.

Step 7: After filling in the required details, you will be redirected to the second phase, where you must enter your ‘Personal details’ such as full name, email address, address information, etc.

Step 8: Select the ‘Time Slot details’ and press the ‘Next’ button.

Step 9: Finally, review all the entered information and submit it.

Offline Process for Aadhaar Card for NRI

The Aadhaar card for NRI registration can also be done offline by visiting the nearest Aadhar Seva Kendra. The steps for the NRI Aadhaar Card registration process are mentioned below:

Step 1: Visit the nearest centre of Aadhaar Seva Kendra, and do not forget to carry the required documents like an Indian passport.

Step 2: Fill out the details such as name, mobile number, email, passport number, and so on.

Step 3: Enter the biometric information like fingerprint, photo and signature.

Step 4: Review the entered details and collect the enrollment slip. The slip consists of the enrollment id, appointment date and time stamp.

Note: For an NRI, providing a valid Email Id is mandatory because the declaration form is slightly different compared to Indian residents.

Don’t Miss Out!

Latest Documents on Aadhaar Card

| eAadhaar | Eaadhar Download, Benefits & Check UIDAI E-Aadhar Status |

| Lost Aadhaar Card | How to Get Duplicate Aadhaar Card? |

| Aadhar Download | How to Download & Print Aadhaar Card? |

| WBPDS | How Link Aadhaar Link with WBPDS? |

| eSign Aadhaar | How to Validate esign Aadhaar? |

| PM Kisan Aadhaar Link | How to Link Aadhaar with PM Kisan? |

| Masked Aadhar | How to Download Masked Aadhaar |

| Aadhaar VID | How to Generate Aadhaar Virtual ID? |

| Aadhaar Face Authentication | How to Download Aadhaar Card through Face Authentication? |

| AePS | Aadhaar Enabled Payment System |

| maadhaar | How to Download maadhaar App? |

| SSUP UIDAI | Aadhaar Self Service Update Portal |

Documents Required for NRIs for Aadhaar Card

NRIs who want to register in the Aadhaar Seva Yojna must bring a few essential certificates. The UIDAI accepts the following required documentation when applying for an Aadhaar Card for NRI:

- Certificate of Birth

- Proof of Identity and Address

- Education Certificates

However, in addition to these documents, NRIs must also provide specific documents like correlations to birth country. Further, all these documents are scrutinized by government officials and supervisory authorities to evaluate their validity and eligibility for an NRI Aadhaar card.

What are the Eligibility Criteria for NRIs to Apply for Aadhaar?

According to the Aadhaar Card for NRI Act of 2016, all applicants who have been approved as Indian Residents under the act are eligible to apply for an Aadhar Card. Thus, only NRIs (Non-Resident Indians), as well as Persons of Indian Origin (PIO) and Overseas Citizen of India (OCI) cardholders, can apply for an Aadhar Card. Noteworthy is the fact that an NRI must be above three years to apply for Aadhaar. Also, gone is the 182 days of the waiting period and now NRIs can apply for Aadhaar card, right after their arrival.

NRIs Income Tax Return in India

In India, if any NRI is eligible for taxable income, they must file for income tax return. For instance, Non- Resident Indians own a residential property and earn income through rental. Moreover, delaying filing income tax returns tends to draw a monthly penalty charge of 1% on the interest try. In addition, if the repayment is not submitted within one year before the fiscal year, a fine of Rs 5,000 may be imposed as a penalty. As a result, NRIs must file returns on time.

However, In India, an NRI is not obligated to file while earning until the stipulated criteria are fulfilled. For instance, the NRI’s total income in the fiscal year must be entirely comprised of investment income. Alternatively, the NRI’s income could come from tax-free long-term capital gains. However, in both cases, income tax must be deducted from the source of the income.

Furthermore, an individual must file Income Tax Return before the 31st of July of every fiscal year. However, if the NRI is continuing to work with a company, then the applicant’s records must be audited before September 30 every year. If the taxpayer forgets to meet the deadline, they may file a late repayment.

Wrapping Up

The Aadhaar card e-signature is intended to promote immediate access to and monitoring of user (Residents and Non Residents) data across India. This not only allows the government to communicate and supervise each citizen’s operation but also encourages users to be responsible for the same. It also acts as a safeguard, preventing any misconduct, robbery, or redundancy of operations. Now that you have a good understanding of the Aadhaar card for NRI, you should not skip these significant steps to assist the government and yourself in maintaining a corruption-free and methodically functioning governance.

FAQ’s about Aadhaar Card for NRIs

Q1. Can an NRI apply for an Aadhar card?

Yes, an NRI can apply for an Aadhar with a valid Indian passport through any

Aadhar Seva Kendra or online through the UIDAI portal.

Q2. Does NRI have to link Aadhaar with a PAN card?

No, an NRI does not have to link Aadhaar with a PAN Card.

Q3. What happens to an Aadhar Card after US Citizenship?

You can keep the Aadhaar Card even after the US Citizenship only on one condition

that is, in your passport, your spouse’ (if any) name must be there. This helps the government as proof of your identity. On the other hand, if your spouse is NRI then a valid

Indian passport of an individual is compulsory as Identity proof.

Q4. Is the Aadhaar Card mandatory for NRI to file Income Tax Returns?

No, Aadhaar Card is not compulsory for the NRIs to file Income Tax Returns.

Q5. Can I apply for Aadhar Card in the USA?

No. A person residing in the USA cannot apply for Aadhaar Card because

Aadhaar Card is only applicable in India.