The Indian market is witnessing a phenomenon where demand continues to be high for affordable homes (priced between Rs. 40-50 lakh), although sales have come down in the category ever since the COVID-19 pandemic. Sales figures have come down throughout India’s top-7 cities, plunging to around 19% in 2023 from 38% in the pre-pandemic period. Experts feel that consumers in the category have taken a hit due to the pandemic, while incentives offered to customers and developers have also expired over the last 1-2 years.

This has led to curtailed supply from developers in the affordable housing category. New launches have come down significantly throughout Tier-1 and Tier-2 cities alike in the last couple of years. Tier-1 cities saw de-growth in new launches by 14% (year-on-year) in 2023 and this is expected to fall to 28% in 2024. Tier-2 cities saw a drop of approximately 26% last year, with the decline forecasted at 27% this year. With increasing real estate prices in almost every major city by 50-100% in the last two years, construction costs have also gone up considerably.

There is more demand for bigger homes after the pandemic, thereby leading to an increase in ticket sizes of each property, while developers are also finding it less-lucrative to focus on the affordable segment as per several experts. They are now concentrating more on the luxury and premium categories which are doing better and have higher margins than the affordable segment.

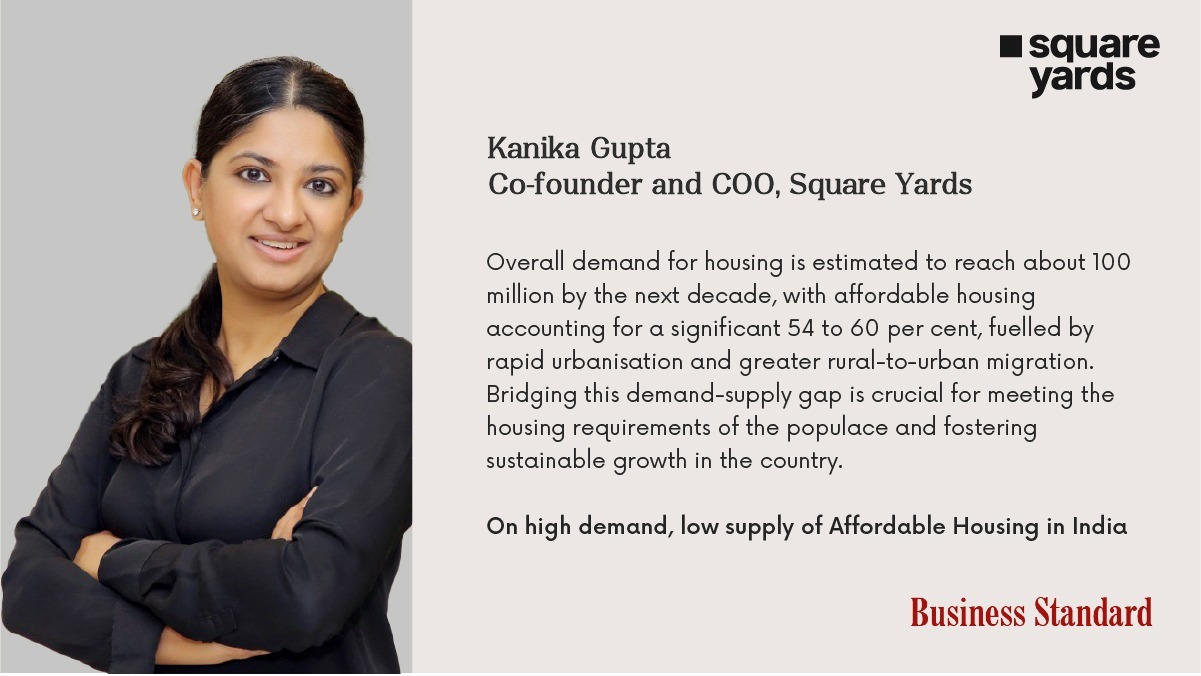

Yet, the Chief Operating Officer and Co-Founder at Square Yards, Kanika Gupta Shori, feels that demand remains steady for affordable housing, forecasting overall demand to touch around 100 million units over the coming decade. She also states that affordable housing may take up 50-60% of the overall market, particularly due to higher rural-to-urban migration and swift urbanization as a whole. She also states how it is crucial to fill up the gap in demand in order to meet housing requirements and ensure sustainable growth throughout the country.

However, other experts feel that fresh incentives are required for both developers and buyers to revitalize the segment, since they feel that it is not expected to witness a revival anytime soon. From increasing the tax rebate on home loan interest under Section 24 to changing qualifying standards to make more buyers eligible for additional deductions including GST, there are several ways of sparking a revival in the segment according to them.

For a detailed report on this read the articles we were featured in:

Business-Standard: https://bit.ly/3wZoF1g

Published Date: 31 May, 2024