Before you dig deep into the bitcoin price history and the factors driving it, first Understand the basics of cryptocurrency. In case you aren’t familiar with the fundamentals of bitcoins or bitcoin mining, we suggest you first read our blog on what is bitcoin and bitcoin mining. Once you are thorough with them, you will have a better understanding of the elements responsible for bitcoin’s price.

We will start with the current rate of bitcoin, then move on to the bitcoin price history, and later, discuss what causes the BTC rate to go up and fall down. Without any further ado, let’s get started!

Current Market Price of Bitcoin

Currently, the price of bitcoin is 46,031.76 USD which is quite less than the price of bitcoin in April 2021, when it hit an all-time highest of approximately 65,000 USD.

Also, the current market capitalization of bitcoin is $883.88 billion, as of 15th August 2021. Obviously, it’s the highest contributing cryptocurrency in the world with the most capitalization.

Bitcoin is completely decentralized and that’s what makes it different from traditional currencies. Also, no bank or any single institution can control the bitcoin network. Setting up an account here is very simple and it is completely simple.

Since its creation, the bitcoin price index i.e. its average price across leading global exchanges) has also surged significantly, growing from $367 in January 2016 to a high of over $13000 at the end of December 2017.

Let’s move on to discover the Bitcoin Price History.

Bitcoin Price History

Bitcoin has had quite an interesting history. Starting from $0.0008 to $0.08 per coin in July 2010 to $65000 in April 2021, and then to the current price of bitcoin at 46,031.76 USD, the crypto has gone through a lot of ups and downs. Undoubtedly, it’s one of the most volatile things on the planet.

But one thing is clear- whoever owns bitcoin is simply rich. Satoshi Nakamoto, the person or the group of people who created bitcoin is considered to have the most bitcoins in the world .i.e. approximately 1 million bitcoins.

Now since we are talking about Bitcoin price history, let’s start with the year it was incepted-

August 2008

The domain name bitcoin.org was registered on 18 August 2008.

January 2009

On 3rd January 2009, the first bitcoin block known as ‘Genesis Block’ or Block 0 was mined.

Then, just a few days later, on 8th January 2009, bitcoin’s first version of the software was announced on the cryptography mailing list.

Later, that month on 9th January 2009, the second block is known as ‘Block 1’ was mined.

On January 12th, the first bitcoin transaction for block #170 was processed by Satoshi Nakamoto to Hal Finney.

This year, the price of bitcoin was $0. No value at all, not even in cents.

October 2009

Then on October 5th, the first Bitcoin course towards exchange dollar was published: 1 USD = 1,309.03 BTC. A public sale was launched on the New Liberty Standard stock exchange.

On October 9th, the #bitcoin-de channel was registered on IRC.

Finally, on December 16th Bitcoin software version 2, namely v0.2. was launched.

February 2010

The first crypto exchange was launched on 6th February 2010

May 2010

On May 22, 2010, the first notable transaction of 10,000 BTC was done at Papa John’s Pizzas in exchange for two pizzas. Hence, this day is celebrated as the world’s bitcoin pizza day every year. The bitcoin value was 0.0025 cents for 1 coin and cost 25 USD.

July 2010 to December 2010

In July, the software version third was introduced. On October 17th 2021, the Bitcoin exchange rate began to escalate, after various months stuck at USD $0.06 per BTC.

Then, on 6th November 2010, Bitcoin share capital grew 1 million USD. Its exchange rate on MtGox touched USD$0.50 per BTC.

The first Bitcoin block, on 16th December 2010, using a mining pool under user Sluch was introduced.

Besides these, various other events took place.

January to December 2011

The bitcoin price raised to 31.91 USD and stayed at the same price for the six days straight and then, decreased to USD 10.

March to December 2012

50000 BTC were stolen after a security upgrade in Linode making it the biggest bitcoin theft ever. Besides, the biggest block in the chain, # 181919 was created which included a total of 1,322 transactions.

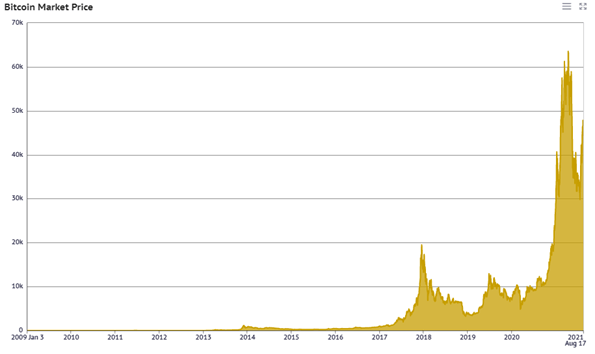

For a more detailed insight into the bitcoin price from 2009 to 2021, have a look at the graph provided below by Knoema.com.

As you can see from the graph, 2021 has been the remarkable year where the old crypto of the world witnessed a wild surge and then a tragic downfall. The reason behind the fall was the decrease in demand due to some FOMO frenzy posts by investors like Elon Musk and others. Another biggest reason was the ban by China, where most Bitcoins are mined.

What Determines the Price of Bitcoin? Discover All the Factors Responsible

There isn’t just one but various factors that drive the price of bitcoin. Supply and demand is the most important and popular factor that has a direct influence of bitcoin’s price. Apart from this, bitcoin market capitalization, competition, cost of production, etc. also have a significant impact on the BTC value.

Similarly, there are other elements that regulate the value of bitcoin. They are as follows:

1. Supply and Demand

The price of bitcoin increases with the increase in demand and decreases with the fall in demand. You should know that the number of bitcoins in circulation is limited and the creation of new bitcoins are being done at a predictable and decreasing rate. This implies that demand has to follow this level of inflation to keep the price constant. This played quite a role in the bitcoin price history.

Since bitcoin still remains a small market when compared to what it could be, it doesn’t demand enormous amounts of capital to move the market price up or down, and hence, the price of a bitcoin is still quite volatile.

2. Cost of Production- Bitcoin Mining

If you have studied our previous blog on bitcoin mining, you would understand how expensive it is to produce 1 block of bitcoin. They incur a real cost of production including the mining hardware tool and electricity consumption, which is the most crucial consideration by the way.

Now, we know that bitcoin mining depends on a complex cryptographic mathematical problem that every miner compete to solve. The first one to come up with the solution gets rewarded with an entire block of newly minted bitcoins and any transaction charges that have been collected since the mining of the last block.

Something that makes the production of bitcoin stands out is its algorithm. Unlike other produced goods, miners can only mine one block of bitcoins once every ten minutes, on average.

As a result, if more miners step in for the competition, they will make the problem even more complex and hence, more expensive- to solve so that they can save that ten-minute interval.

According to studies, the bitcoin price USD depends closely on the marginal cost of production.

3. Competition

Bitcoin may be the most popular crypto in the world but it isn’t the only one in the market. In fact, it has to compete with over 7000 other virtual currencies. While bitcoin is still the one with the highest market capitalization, altcoins including Etherreum (ETH), Binance Coin (BNB), Tether (USDT), Cardano (ADA), and Polkadot (DOT) are its closest competitors, as of March 2021.

Moreover, new ICOs (Initial Coin Offerings) are constantly on the edge and are ready to enter the market as there are just a few barriers. Now if we talk about investors, the competition and more crowd is quite a good thing as it keeps the prices down. And for Bitcoin, fortunately, its high visibility offers it a surface over its competitors.

4. Crypto Exchanges on Which Bitcoins Trade

Just like stocks trade over indexes like BSE, NSE, NYSE, NASDAQ, and the FTSE, cryptocurrencies too have their different exchanges. Crypto investors trade cryptos over platforms like Coinswitch Kuber, GDAX, Coinbase, WazirX, CoinDCX, ZebPay, and more.

Now the question is- how does the exchange influence the bitcoin’s price? The thing is- exchanges with more popularity attract more people to produce a network effect. And with funding on its market clout, it may come up with standards administering how other currencies are added.

Irrespective of the legal grey field in which cryptos operate, the presence of bitcoin on these exchanges signifies a level of regulatory compliance.

5. Forks and Governance Stability

Bitcoin price history is proof that governance stability plays an important role here. Unlike traditional currencies, bitcoin isn’t governed by any central authority. Rather, miners and developers are the ones who process the transactions and safeguards the blockchain.

Software changes of bitcoins are driven by consensus which aggravates the bitcoin community since fundamental issues demand a long resolution time. Besides, the scalability issue has been a specific pain point. The number of processed transactions rely on the size of blocks. But presently, bitcoin software is able to process only approximately three transactions per second.

When the demand for cryptos was less, low transaction processing was never an issue. However, today, slow transactions are more likely to push investors towards competitive cryptocurrencies and that’s what many worry about.

The entire bitcoin community is split over the best way to amplify the number of transactions. Changes to the rules administering the usage of underlying software are known as “forks.”

Soft forks refer to the changes in rules that do not offer any outcome related to the creation of a new cryptocurrency. On the other hand, a hard fork pertains to software changes that result in the creation of new cryptocurrencies. Bitcoin cash and bitcoin gold are the creation of the past bitcoin hard forks.

6. Regulations Pertinent to Bitcoin

Since many countries are now planning to come up with their own set of crypto regulations, bitcoins and other cryptos are poised to become more prevailing.

Governments have become extremely concerned and keeping an eagle eye on every activity involving money laundering, and other elements that may have any involvement in the use of bitcoins. If the regulations are imposed, it will make the digital money become more centralized and will cause a considerable influence on cryptocurrency prices. In short, regulations do have a direct impact on the bitcoin price.

Closing Remarks

Bitcoin is a highly volatile currency in the crypto market and hence, its price keeps fluctuating wildly. Supply and demand are some of the most crucial factors that drive the price of bitcoin up and down. When the demand increases, the price of bitcoin rises up and when the demand decreases, the price of bitcoin goes down. Besides the bitcoin price history represents how bitcoin price kept going up and down.

Besides supply and demand, the cost of production, regulations, competition, availability of cryptos, etc. also play quite a vital role in driving the crypto’s price high and low.

Whatever it is, the people seem pretty interested in investing in cryptos and are becoming more inclined to blockchain technology and digital ledgers. Now, since governments are also taking interest in them and are planning to bring their own set of regulations for cryptos, bitcoin and others are going to stay for long.

You Might Also Like

| Market Capitalization | What is Equity | Upcoming Public IPO |

| Guide to Bitcoin | Bitcoin Mining | Cryptocurrency |

Frequently Asked Questions (FAQ)

What determines the price of bitcoin?

The following factors determine the price of bitcoin and are responsible for any ups and downs:

● Supply and demand

● The cost of production

● The number of competing cryptos

● The internal governance

● Crypto exchanges

● Regulations that govern its sales

● The cost of producing a bitcoin using the mining process

Why is one bitcoin worth so much?

Bitcoins have a high worth because they are as rewarding as a cash prize. They possess the characteristics of money based on the properties of mathematics such as portability, scarcity, fungibility, durability, recognizability, and divisibility than relying on trust in central authorities like fiat currencies or physical properties such as gold and silver.

In a nutshell, it is supported by mathematics. Bitcoins having these features hold all that is needed for a kind of money to retain value is trust and adoption.

Another potential reason why it is of so much worth is its growing popularity among merchants, businesses, etc.

How many bitcoins are left?

As of 16th August 2021, a total of 18,787,825 bitcoins are left to be mined.

Can a bitcoin crash?

Yes, it can surely crash as it already has many times. In fact, this year only a few months earlier, the world’s oldest crypto crashed badly and went below 50% of its all-time highest price.