Have you ever been in a situation where you were asked to submit what is known as a cancelled cheque, and you had little or no clue about it? This could be when you were in the process of getting insurance or when you cleared a job interview; you were asked about it during the background verification process. Here we have shed some light on a cancelled cheque leaf, its format, its use cases, and how to cancel a cheque.

What is a Cancelled Cheque?

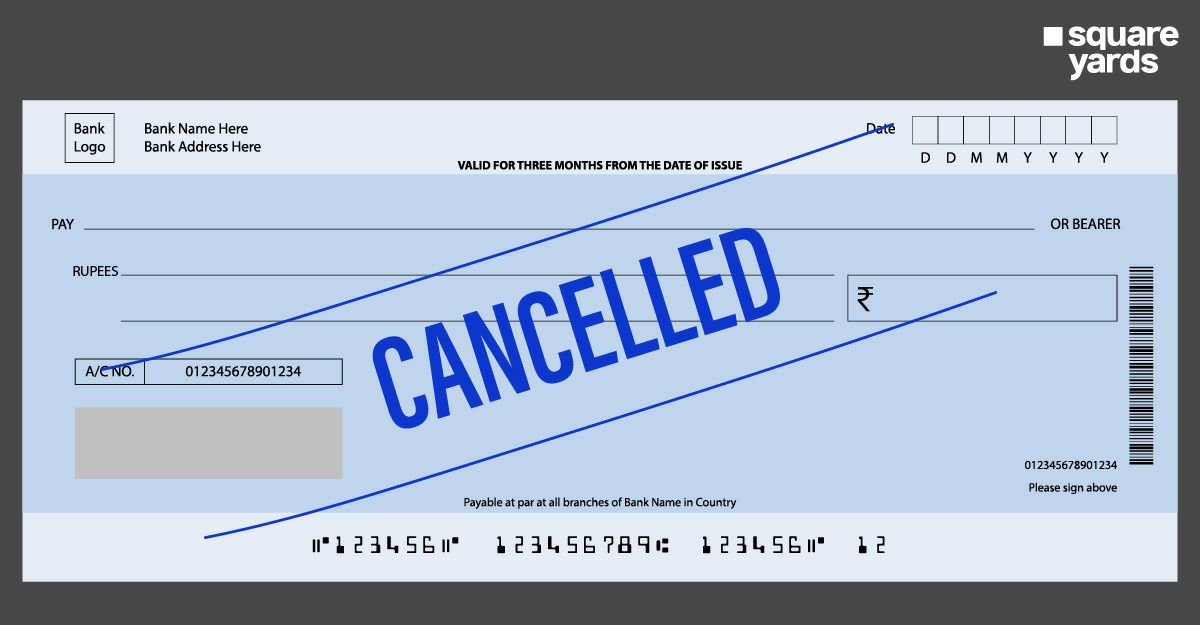

A cancelled cheque has two parallel lines drawn across the leaf with the “cancelled” written within it. A cancelled cheque leaf needs to be blank without any signature. Its significance lies in establishing the authenticity of the ownership.

A cheque’s details are account number, bank branch address and IFSC Code, MICR Code, and most importantly, the account holder’s name. A cancelled cheque leaf cannot be used to make any transactions as its purpose remains with ascertaining Know-Your-Customer (KYC).

Cancelled Cheque Format

If you ask, “how to cancel a cheque?” it will benefit you if you get an overview of the cancelled cheque leaf format. A cancelled cheque format is not very complicated. It contains two lines crossed over the cheque leaf with “cancelled” written in capital letters. Mentioning the term “Cancelled” is mandatory to set it apart from a regular cheque.

This way, a regular cheque becomes a cancelled cheque leaf.

Also, it is to be noted that while making a cancelled cheque, there is no information entered, such as the payee’s name or the owner’s signature. This can potentially become a tool for fraudulent activities. Lastly, a cancelled cheque leaf submission should only be made to a trustworthy agency.

When Would You Need a Cancelled Cheque?

There are few uses of a cancelled cheque. It is generally asked for by any financial institution or company that may require their customer’s KYC. The cancelled cheque can link the account holder of a certain bank with the person. Since it contains information such as the account holder’s name, bank account number, branch, IFSC code, and MICR code, enquirers can directly regard the cheque’s link with the person in question.

General scenarios where a cancelled cheque leaf is used are:-

- A New Bank Account – A cancelled cheque must be submitted to the bank when opening another new bank account.

- Insurance – Cancelled cheques are asked by the insurance providers when applying for a policy.

- Demat account – Demat is an online tool that provides a platform for investors who can keep their funds and securities in digital form. It allows investors to invest in stocks and shares. To open a Demat account, one has to go through the necessary steps to complete their KYC, and a cancelled cheque leaf can serve as the essential document to ascertain the user’s bank account.

- Equated Monthly Instalments (EMIs) – Since its introduction, EMIs have been one of the most common ways to make a payment. Customers buying products ranging from tech gadgets to bank loans opt for EMIs to reduce the burden of payments. To validate the customer’s bank account, they have to submit a cancelled cheque to establish their account linked with a bank.

- Employee Provident Fund (EPF) withdrawal – EPF is contributed by employees while at their job. They can contribute a small amount of their salary to be set aside as an investment that they get back after they leave the company. The Employee Provident Fund withdrawal process includes the submission of a cancelled cheque to link to the employee’s bank account.

- Electronic Clearance System (ECS) – If one has a subscription, such as mutual funds and OTT platforms, they can set up an Electronic Clearance System (ECS), which enables automatic regular deductions from one bank account to another. To set up ECS, one must include a cancelled cheque in their document listing to be submitted as a part of the KYC.

- Know Your Customer (KYC) – KYC is the process of confirming an identity of an individual in terms of his identification, residence, and bank details. Generally, KYCs are done for availing various benefits ranging from getting an Aadhaar Card to getting a bank loan sanctioned. An essential step for anything involving transactions would include the submission of a cancelled cheque.

- Employment Formalities – Often, post-clearing an interview for a company, the potential employer can ask the candidate for a cancelled cheque to ascertain their bank account link and background verification.

- Void a Written Cheque – There could be times when spelling errors and ink leakage happens when writing cheques. There is no other choice but to discard such a cheque. In these cases, cancelling a cheque is prudent to avoid getting them in the wrong hands and escalating fraud.

- Denoting Transaction Success – Banks cancel cheques after the requested transaction is completed. There is proper labelling suggesting that a particular cheque no longer needs to be entertained.

Now you may have come across any of these above-mentioned situations and asked yourself, “what is a cancelled cheque?” or “how to cancel a cheque?” Read on to know how to cancel a cheque.

Points to Note While Cancelling a Cheque Leaf

Cancelling a cheque is a fairly easy and fast process. One needs a blank cheque leaf issued from their respective banks and a pen. Diagonally construct two lines parallel to each other with enough space in between across the blank cheque. Input the term “Cancelled” in capital letters in between these parallel lines.

Given below are the things to keep in mind:-

- Do not use thick ink to cover details in the cheque.

- Avoid drawing over the details of the cheque such as MICR code, account holder name, IFSC code of the bank, etc.

- Do not sign the cheque!

These steps, if followed correctly, can give a definite understanding of how to cancel a cheque.

You May Also Like

| Savings Account Interest Rates | HDFC NetBanking |

| SBI Balance Enquiry | Post Office Savings Account |

| Saving Account | Different Types of Savings Account |

| Zero Balance Saving Account |

Frequently Asked Questions – FAQs

How to cancel a cheque?

You can write a cancelled cheque by taking a blank cheque and constructing two lines parallel to each other drawn diagonally across the cheque leaf. Write “CANCELLED” between the spaces of the lines to mark it cancelled. This way, you have successfully created a cancelled cheque. It is highly recommended not to sign this cheque.

Does the cancelled cheque require a signature?

It is always advised not to sign a cancelled cheque leaf to avoid misuse. A blank cheque with “cancelled” written across is enough to consider a cheque as cancelled. Such an instrument proves that a bank account belongs to a certain individual.

How to get a cancelled cheque online?

A cancelled cheque can be obtained online via net banking services of the respective banks. Customers using the net banking services can get them online for free via bank websites.

Is it safe to give a Cancelled cheque?

The risk involved with a cancelled cheque is rare. It is only a problem when a cancelled cheque leaf gets into the wrong hands, thus opening the possibility of a fraudulent transaction. Cancel a cheque the right way to avoid misuse by using waterproof ink, not signing the cheque, and handing it over only to trusted entities.

Can a Cancelled cheque be misused?

A cancelled cheque can be immune to misuse owing to the ‘cancelled’ tag inscribed on the cheque leaf. The tag is highly effective in disabling the transaction power of the instrument. A cheque with cancelled written on it voids the cheque’s usability. The only thing that remains is its link to the account holder, enabling identity authentication.

Can a Cancelled cheque be used multiple times?

A cancelled cheque is an instrument that pins down the account holder’s link with the bank account they claim to have an account with. Although it cannot be used for transactions, the cheque with cancelled written on it can be used multiple times for KYC purposes.

Why do companies ask for a Cancelled cheque?

Many companies ask for a cancelled cheque from their employees to authenticate the association of the latter’s bank account with their name. This is essential for the employees as they need to provide a genuine bank account to get their salaries credited. Other than that, a cancelled cheque may be asked by companies to candidates for a background check.

Why is a Cancelled cheque required for a loan?

Cancelled cheques are a verification point for lenders to ascertain the borrower’s bank related information and financial status. They can use the details provided in a bank leaf to cross-check their queries. However, the background verification is done with the borrower’s permission nonetheless.

Can anyone withdraw money with a cancel cheque?

No one has the authority to withdraw money by using a cancelled cheque. Using the same for transactions will be subject to immediate rejection by the banks.