We’re all aware that GST is an individual tax applied on goods and services supply. Applicable throughout India, it is often in the news due to fluctuating rates. It keeps taxpayers on their toes as they are constantly worried about increasing rates. To tackle this problem, the government introduced the composition scheme under GST.

In this blog, we’re going to discuss this scheme in complete detail to understand its significance. Scroll down to get started.

What is the GST Composition Scheme?

The Composition Scheme is a simple scheme that comes under Goods and Services Tax for taxpayers. It allows taxpayers, especially those paying a small amount, to eliminate boring GST-related formalities and pay it at a fixed turnover rate.

Who can Choose the Composition Scheme in GST ?

Taxpayers with less than ₹1.5 crores turnover can opt for this scheme. For taxpayers from Himachal Pradesh and North-Eastern states, this limit is ₹75 lakhs. The CSGT Act of 2018 (Amendment) also states that a composition dealer can supply services to almost 10% of turnover or ₹5 lakhs, which amount is greater. This amendment became effective on February 1st, 2019.

Who Cannot Choose the Composition Scheme?

Here’s a list of people who are excluded from choosing the Composition Scheme under GST:

- Pan Masala, Tobacco and Ice Cream Manufacturers

- Businesses supplying goods via e-commerce operators

- An individual who makes interstate supplies

- A non-resident but taxable individual

- A casual taxable individual

- Businesses who have bought goods from unregistered dealers or suppliers

- Suppliers dealing in the supply of goods that are exempted by the GST act

- Suppliers who supply services and goods

Composition Scheme Under GST – Advantages

Wondering about the benefits the composition scheme under GST offers, look at the points below.

- Less compliance (invoice issuing, record/books maintenance, returns)

- Reduced tax liability

- High liquidity as taxes are at a lower rate

- Since the rate for taxes is less, the liquidity is more.

Drawbacks of the Composition Scheme

The benefits of the GST Composition Scheme also come with a certain set of drawbacks. Make sure you take note of those as well.

- Business territory gets limited as the dealer cannot perform inter-state transactions.

- Dealers do not get an input tax credit

- The taxpayer cannot supply goods that are non-taxable under the Goods and Services Tax. This includes alcohol and other goods from eCommerce websites.

GST Composition Scheme – Latest Applicable Tax Rates

As previously mentioned, choosing the Composition Scheme in GST makes you eligible to pay a fixed rate. The latest rates for different types of taxpayers are

| Type of Taxpayer | Tax Rates |

| Traders and Goods Manufacturers | 1% GST (out of which 0.5% is CGST and 0.5% is CGST) |

| Service Providers | 6% GST (out of which 3% is CGST and 3% is CGST) |

| Non-alcohol serving restaurants | 5% GST (out of which 2.5% is CGST and 2.5% is CGST) |

NOTE: The tax rates are subject to change. Make sure you double-check these rates from the official CBIC GST website.

How Does one Opt for the GST Composition Scheme?

Any taxpayer who wishes to opt for the composition scheme under GST must intimate the same when the Financial Year begins. The taxpayer has to file GSG CMP-02 and then apply for the composition scheme by signing into the official GST portal.

Steps for Applying to the Composition Scheme GST

Follow the step-by-step guide to applying for the Composition Scheme in GST. Read all the steps carefully and make sure you don’t skip any.

Step 1: Go to the official GST (Goods and Services Tax) portal – https://www.gst.gov.in/

Step 2: From the menu, select Services and choose the New Registration option.

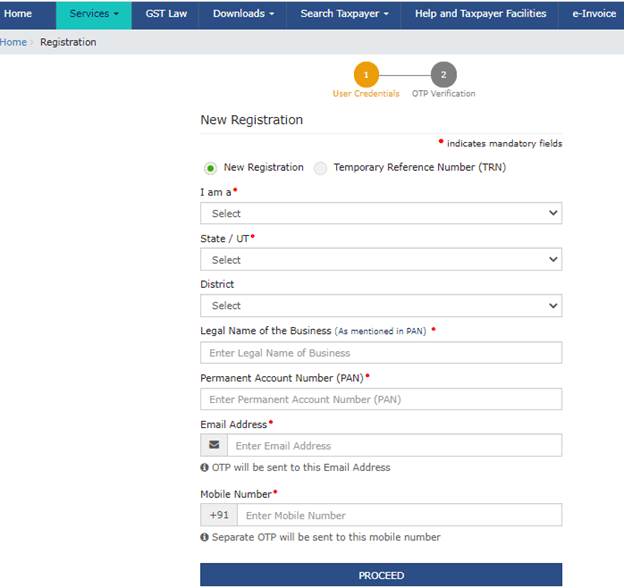

Step 3: A new page will open on your screen after clicking on New Registration. Now follow the instructions.

- Here, you need to select which type of taxpayer you are from the drop-down.

- Then choose your district and state

- Type a legal entity or business name as previously given for the PAN database.

- After that, type the proprietor’s PAN or Business PAN.

- Then, enter the primary authorised signatory’s valid email address and mobile number.

- You will then receive an OTP on your provided phone number and email address for verification purposes.

- Enter the correct OTP followed by the visible Captcha.

- Finally, click on the Proceed button to complete the registration process.

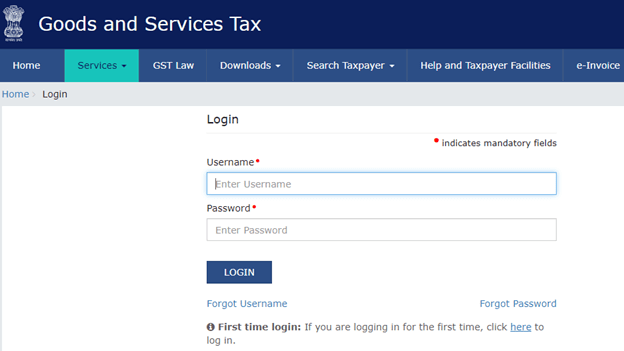

Step 4: You are now ready to log in. So, click on Login. A page with username and password fields to open.

Step 5: Type your username and password followed by the correct Captcha code in the designated fields, and then click on Login.

Step 6: After successfully logging in, you now need to click on the “Application to Opt for Composition Levy” available under the service tab of the GST portal home page.

Step 7: A new page will be visible on your screen displaying details related to the Application to Opt for Composition Levy.

- GSTIN

- Business’ Legal Name

- Trade Name (if any) along with

- Official and Complete Principal Place of Business Address

Step 8: Underneath these details, you will also see details such as the Nature of business and Jurisdiction.

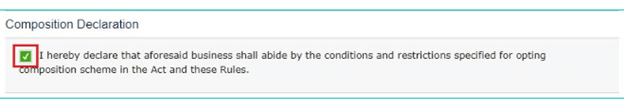

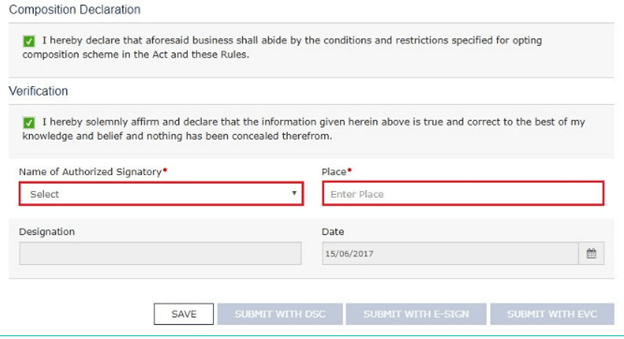

Step 9: Scrolling down further, there will be a display of the Composition Declaration. You need to click on the check box to agree to follow the conditions and rules listed in the Composition Levy.

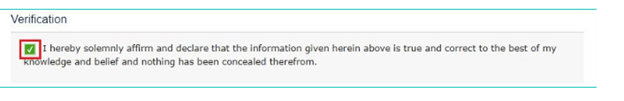

Step 10: Before you submit the application, click on the Verification Process check box. This will help you verify if you have provided all the correct information or not. Any error could put your application on hold, so be careful while checking the details.

Step 11: Choose the Authorised Signatory option from the available dropdown.

Step 12: Type the location/place where you are applying the designated “Place” field.

Step 13: Choose the Save button for saving the application forms and retrieve all of this data later.

Step 14: Filing out all the fields will activate the Submit Form button. Click on the same to proceed further.

Step 15: Now, sign the form digitally, i.e., DSC (Digital Signature Certificate) or the EVC option. Choosing any of these options will send an OTP to your phone number,

Step 16: If you chose the DIgital Signature Certificate option, you would have to opt for the registered DSC from the emSigner popup screen and follow the onscreen instructions.

Step 17: Type the received OTP and press the Click on the button that says Validate OTP,

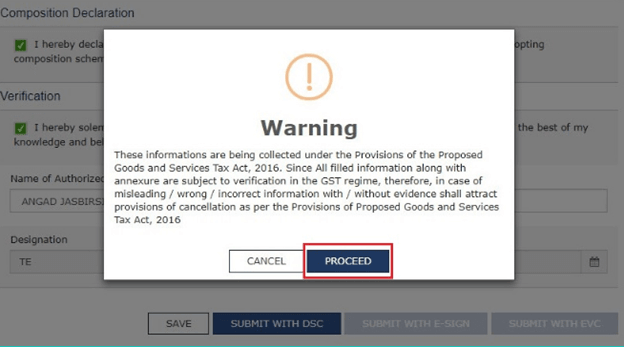

Step 18: You will receive a prompt response to confirm your action. Confirm the same and then move forward by clicking on the Proceed button.

Step 19: The system will retrieve the installed digital signatures via GST emSigner. You will get a pop-up message to choose the correct DSC.

Step 20: Upon successful signature retrieval, a confirmation message will appear on your screen.

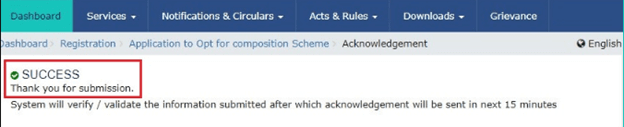

Step 21: You will also receive a confirmation from the GST Portal on your registered e-mail-ID and mobile phone number.

Step 22: Upon successful submission of the application, a unique ARN (Application Reference Number) will be generated by the system. You will receive the same on your email and registered mobile phone number.

How Do Composition Dealers Raise a bill?

Composition dealers do not have the provision for issuing a tax invoice. They cannot charge taxes to customers but pay them from their pockets. Thus, they require issuing a Bill of Supply. At the top of the Bill of Supply, dealers have to mention “composition taxable person, not eligible for collecting tax on supplies”.

How do Composition Dealers make GST Payments?

The GST payment to be initiated by a composition dealer for the supplies made comprises the following:

As mentioned previously, composition dealers have to pay GST payments from their pockets. The total payment is based on the following:

- GST on the overall supplies made

- Reverse charge tax

- Tax on buying from unregistered dealers.

Returns to be Filed By Composition Dealers

Composition dealers have to pay taxes in a quarterly statement CMP-08 by the 18th of every month after the quarter-end. The return in form GSTR-4 is to be filed yearly by April 30th of next FY from 2019-20.

Conclusion

We hope you now have all the required information on the Composition Scheme under GST. We have tried covering every aspect for your help and ease. However, if you still have any doubts or queries in this regard, we suggest you look at the FAQs section below. You can also visit the official GST portal to find answers to your queries.

You May Also Read

Frequently Asked Questions (FAQ’s)

Is the Reverse Charge Mechanism liability a part of the Composition Scheme in GST?

Composition dealers require paying tax under the reverse charge mechanism wherever necessary. The applicable rate is the rate at which GST needs to be paid. The rate under the composition scheme shouldn’t be used for reverse charge. Moreover, no input tax credit is available for taxes paid under reverse charge for composition dealers.

I am buying goods from an unregistered dealer. Will I have to pay taxes?

Under this scheme, dealers had to pay normal rates on the purchase of goods from unregistered deals for July and August 2017. Real estate builders require paying taxes on a reverse charge basis at 18% for any deficit of more than 80% on purchases from registered vendors.

Do I have to pay IGST on interstate purchases to attract reverse charges?

No, composition dealers don’t have to pay IGST (Integrated Goods and Services Tax). Composition dealers that pay taxes under reverse charge, purchase from unregistered dealers, or service imports only have SGST and CGST.

How is the tax amount computed?

Composition dealers have to pay taxes at a certain rate on total sales. Moreover, they have to pay reverse charges tax on unregistered dealers, specific purchases and service imports.

Do composition dealers require maintaining detailed records?

No, composition dealers do not require maintaining detailed records like a normal taxpayer.

Is availing Input Tax Credit possible for composition dealers?

No, composition dealers cannot avail of an input tax credit.

Is it possible for composition dealers to issue tax invoices?

No, issuing tax invoices is not possible for composition dealers. Instead, they have to issue a Bill of Supply and pay taxes from their pockets.

Can composition dealers collect taxes from buyers/customers?

No, composition dealers cannot collect tax from buyers or customers.

Are dealers engaged in interstate supplies eligible for the composition scheme?

No, dealers engaged in interstate supplies are not eligible for the Composition Scheme GST. Those engaged in intra-state supplies, however, are eligible for it.

What were the provisions if a business shifts from a composition scheme to regular taxation under the previous tax rules?

As per the previous tax rules, taxpayers registered under the composition scheme could take credit for stock, semi-finished or finished goods inputs help on the day or before choosing composition schemes.

What conditions should be remembered to avail input credit on stock lying at transition time?

The conditions include:

● The CENVAT (Central Value Added Tax) Credit was allowed to be claimed as per the tax rules earlier. But one cannot claim it under the composition scheme.

● Input Tax Credit can be availed

● The taxpayer has to pay bills of input tax on those goods

● Invoices shouldn’t be older than a year from July 1st, 2017.

Can one choose a composition scheme in one year and opt out of it the next year?

Yes, it is possible. You may do it based on your turnover. But you have to remember that it impacts how you issue tax involves and file returns. You need to visit the GST portal to submit a change declaration.

Does the composition scheme in GST apply to each branch if I have multiple branches?

All the businesses with a PAN can opt for the composition scheme.

Can composition dealers sell products at a lesser price than regular dealers?

Yes, it can happen because they cannot charge GST in the bill of supply charge GST.

Will there be any challenges if I opt out of the composition scheme mid-year?

When composition dealers opt out of the scheme, all the normal taxpaying rules are applicable.