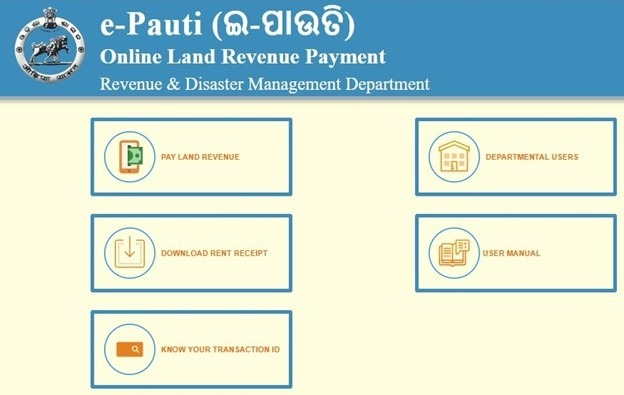

Similar to other states, online land tax payments can be made on the Odisha Revenue and Disaster Management Department’s official website. The department has made an initiative through e-Pauti Odisha portal or the website of Odisha land revenue payment which enables the landowners to make the important payments online with ease. The citizens of Odisha can make the payment of land revenue anytime and anywhere using the portal or the PAUTI mobile app.

The e-Pauti portal has been instituted by the National Informatics Centre, Bhubaneswar, Odisha and was officially launched on 5th August 2020.

Table of contents

- Services Provided by the e-Pauti Portal

- Details Required for Land Revenue Payment

- How to Pay Online Land Tax?

- What is Khajana in Odisha?

- How Can I Pay Offline Land Revenue Payment?

- How to Download Rent Receipt on Odisha e-Pauti?

- How do I Find My Transaction ID?

- About e-Pauti Mobile App

- FAQ’s About e-pauti:-

Services Provided by the e-Pauti Portal

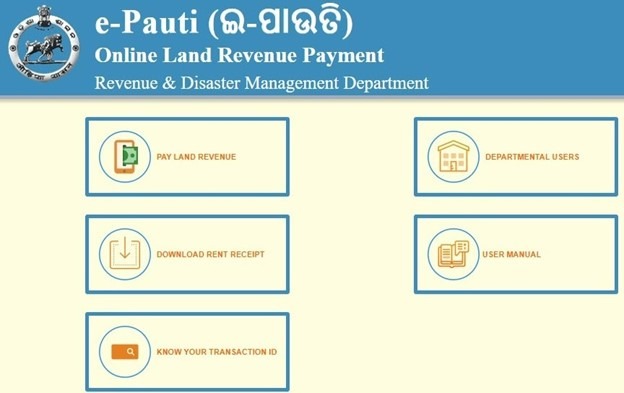

Users can benefit from a number of services through the Odisha e-Pauti portal which includes access to transaction IDs, online land revenue payment, downloading and verification of the rent receipts among others.

Details Required for Land Revenue Payment

The landowners in the state of Odisha must have the given below details if they want to make an online payment of the land revenue or khajana.

- Record of rights Odisha

- Khata number

- Registered mobile number

- Net-banking credentials/Debit card/ UPI details

How to Pay Online Land Tax?

The step-wise procedure for the online payment of land revenue is explained below.

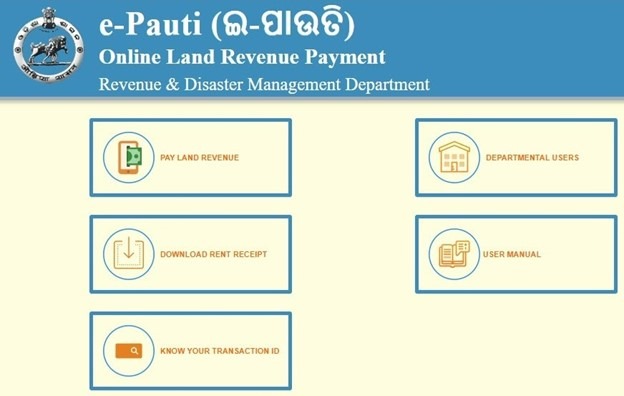

Step 1: Head to the official e-pauti portal i.e www.odishalandrevenue.nic.in website and choose ‘Pay Land Revenue’.

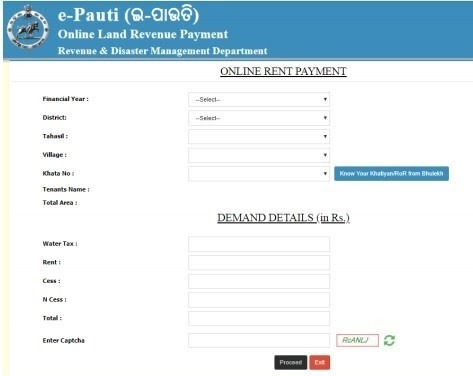

Step 2: On the consequent page, carefully fill in all the required details including the captcha and then press the ‘proceed’ option. The details to be filled in are the fiscal year for which the khajana is being paid, the names of tehsil, village and district, the land’s total area, khata number, and the name of the tenant. Details regarding rent, water tax, N Cess, cess etc. also have to be provided.

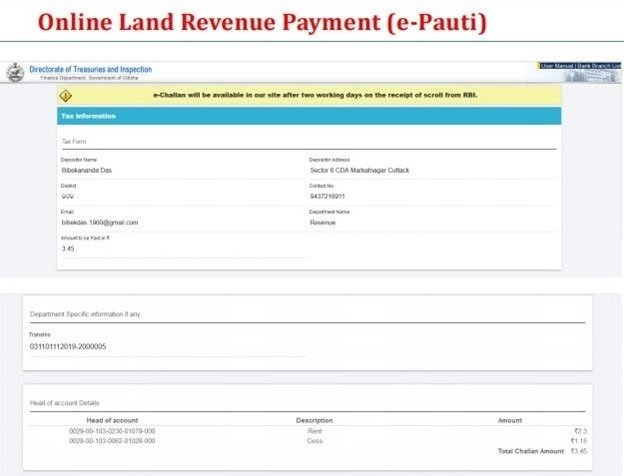

Step 3: Fill in the name of the depositor, his relation with the said recorded tenant, depositor’s address, email ID and mobile number. Then, select ‘continue’.

Step 4: The payment gateway page will appear on the screen. Choose the payment mode from the multiple options accessible to you. The options are net banking, debit card and UPI. Select your preferred option and head on to make the payment.

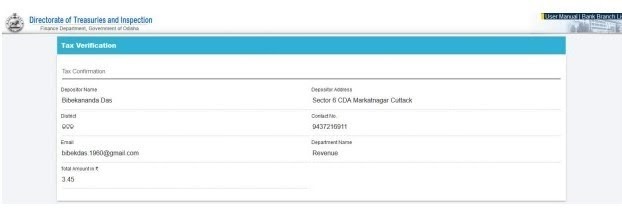

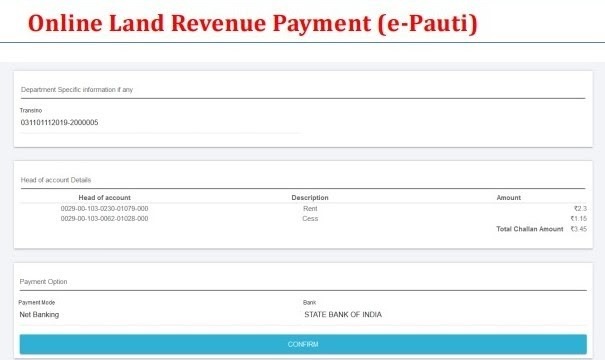

Step 5: After you have clicked on the ‘Proceed’ button on the treasury page, you will be redirected to the confirmation page. Select the ‘confirm’ option.

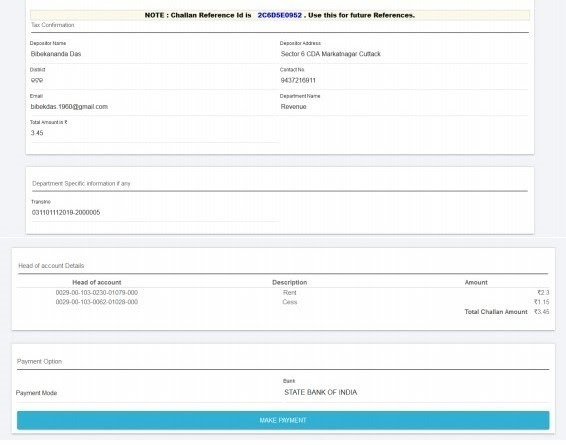

Step 6: In the next step, your Treasury Challan Reference ID will be created. Save this Treasury Challan Reference Number for future use.

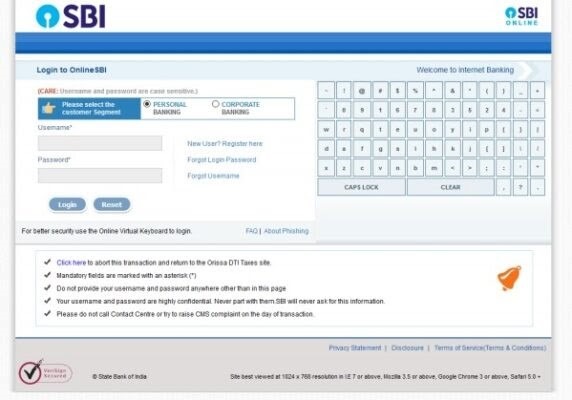

Step 7: After you select the ‘Make Payment’ option, your bank’s payment gateway will come up on the screen. In case you have chosen the net banking option, the given below page will appear on the screen.

Step 8: A receipt of payment acknowledgement will be initiated after the payment is successful. You can preserve this information for future use.

What is Khajana in Odisha?

The term khajana which comes from the language Odia means land revenue. People who own land in Odisha have to make a payment of khajana or which is called land revenue, every year.

You need to have your khatiyan details before you proceed to make an online payment on the e-Pauti website. Ensure that you keep your challan reference number and transaction number for future reference. The ‘bank transaction ID’ or ‘reference number’ can be noted after the payment. This will come in handy if there is any fault/failure in payment.

The e-Pauti Odisha treasury site provides three payment options to the users. These include credit/debit cards (SBI ePay), net-banking, and ICICI debit cards.

How Can I Pay Offline Land Revenue Payment?

Land revenue can be paid offline by the landowners through the Odisha CSCs or Common Service Centers.

How to Download Rent Receipt on Odisha e-Pauti?

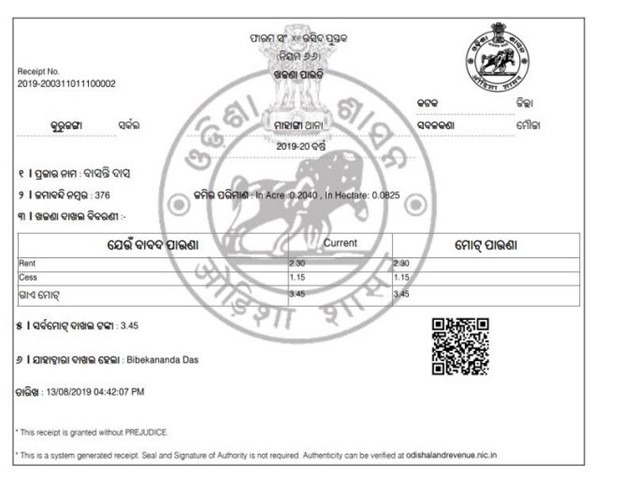

The procedure to download the rent receipt on the Odisha e-Pauti portal has been described below.

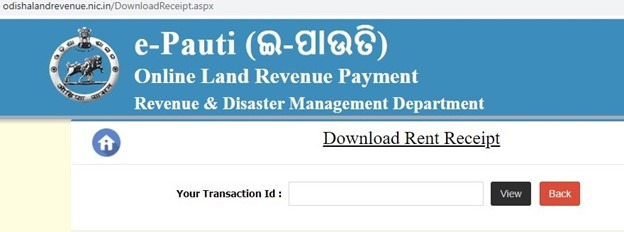

Step 1: Head to the portal of e-Pauti Odisha and select ‘Download Rent Receipt’.

Step 2: Insert your Transaction ID and select ‘View’.

The rent receipt will now be displayed on the screen as given below. You can save the receipt for future reference.

How do I Find My Transaction ID?

The transaction ID can be used for various purposes which includes downloading and verifying the rent receipts on the official e-Puati Odisha portal. If you are not able to get hold of your transaction ID, you can recover it from the e-Pauti portal.

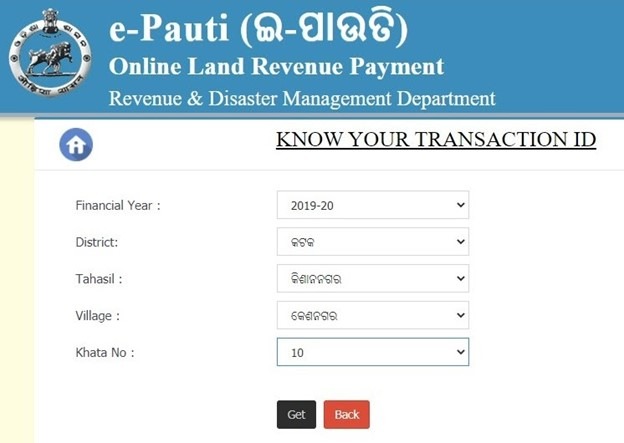

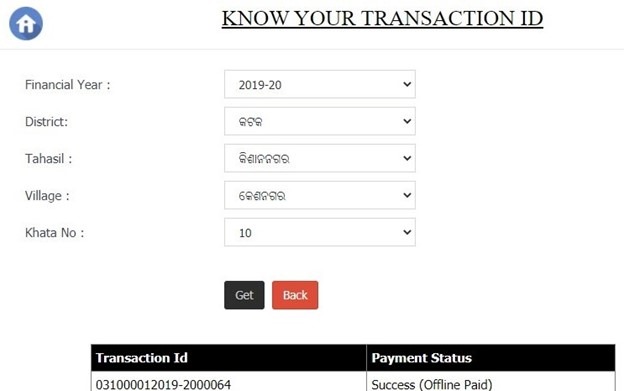

The procedure to get your transaction ID has been explained below in detail.

Step 1: Head to the official portal www.odishalandrevenue.nic.in.

Step 2: Choose the option ‘Know your Transaction ID’. You will be redirected to a new page.

Step 3: You will have to select the options given from the drop-down menu and insert the details like district, the fiscal year, village number, khata number and tehsil.

Step 4: Select the ‘Get’ button. The page that appears will show the transaction ID as well as the land revenue payment status.

About e-Pauti Mobile App

Landowners with smartphones can now access the services of e-Pauti through the e-Pauti mobile application. The app will be useful for taxpayers to pay the required khajana from anywhere. The app offers the following features:–

- Digital payment of land revenue

- Download of rent receipt for printing and verification purposes.

- Access to Khatiyan

- To know the transaction ID

You May Like Also:-

FAQ’s About e-pauti:-

How can I pay Pauti online?

You can pay the Odisha land revenue through the e-Pauti treasury site. There are three options of making the payment: credit/debit card, ICICI debit card and net banking.

What is e-Pauti Odisha?

e-Pauti is the land revenue payment website for the landowners in Odisha.

What is Malgujari receipt?

In simple terms, Malgujari receipt means tax or revenue. The word is written on the form when the tax is being paid.