Economically Weaker Sections Flats are provided to those sections of the population who are underprivileged and who have traditionally been forced to remain at the lower rungs of the society. Their income is below a threshold level which is decided by the government. Income is the main criterion in deciding on the economic weakness of the citizen or household.

Factors to decide on Economically weakness of a citizen

There are several economic factors in deciding on the economic weakness of a citizen or a household, income is considered with greater emphasis and the term is to be appreciated in the light of Preamble of the Constitution of India.

The categorisation of EWS is distinct from other categories like disadvantaged sections of society that refers to people belonging to scheduled caste, scheduled tribe and other backward classes of the community. They are disadvantaged owing to social, cultural, linguistic and other factors although Below Poverty Line is included in the category of Economically Weaker Sections.

EWS House Size is determined by the governments and its various acts and laws that are revised from time to time. This Scheme is provided by the government, especially the central government which bases its judgement on the income of the citizen or the household. Housing Projects are many in numbers across India and the responsibility of implementing them rests on the governments of the states and the Union Territories.

Definition of Economically Weaker Sections

There is no single definition for EWS in India because it is defined differently. It is differently defined because its definition depends on different schemes run by the government. Different state governments and UTs are free to set their criteria for deciding on EWS status. There are income ceiling levels affixed by the governments and they are periodically reviewed and re-fixed.

EWS status is confirmed by the Income certificate issued by a Revenue Officer who is of a minimum level of Tehsildar, BPL ration card or Antodya Anna Yojana Ration card, a card issued to the poorest of the poor. It is also confirmed based on Food Security Card issued by the respective state governments. A legal affidavit is also allowed in some places.

There was interest subsidy for housing the urban poor (ISHUP) started by the central government in 2009. It was to provide interest subsidy on housing to the urban poor. The aim was to make housing affordable and within paying capacity of EWS and LIG. It was aimed at encouraging this section to avail of loan from commercial banks and housing and urban development corporation for constructing a house and also to get 5% subsidy in the interest payment for loans up to Rs 1 lakh. Under the scheme, the EWS was classified. The households with a monthly income between Rs 3300 and 7300 were classified as Lower Income Group. Later on, the government revised the ceiling from 3300 to 5000 per month for EWS and Rs 10000 from 5001 for LIG group. The revision was based on the criteria of per capita income, minimum wages for agricultural workers, monthly expenditure, the national housing bank’s residential price index and consumer price index.

Rajiv Rin Yojana

RRY has been brought into practice through modification in the interest subsidy program for the housing of the urban poor. Central scheme which is applicable in all urban areas of India. RRY is a medium to address the housing needs of the EWS and LIG segments in the cities or urban areas. It was also brought in to channelize institutional credit to the poorer sections of the society and in a way increasing the number of home ownerships. Under RRY, there is a provision of 5% interest subsidy that is limited up to the first 5 lakh of the loan.

PM Awas Yojana – What are the Benefits?

| Particulars | EWS |

| Annual Income of the family | Up to Rupees 3 lakhs |

| Area of the House | Up to 30 sq metres Carpet area |

| Interest Rate on subsidy | 6.50% |

| Maximum loan eligibility for subsidy | Rupees 6 lakhs |

| Maximum tenure on loan | 20 yrs. |

Salient Features of PMAY:

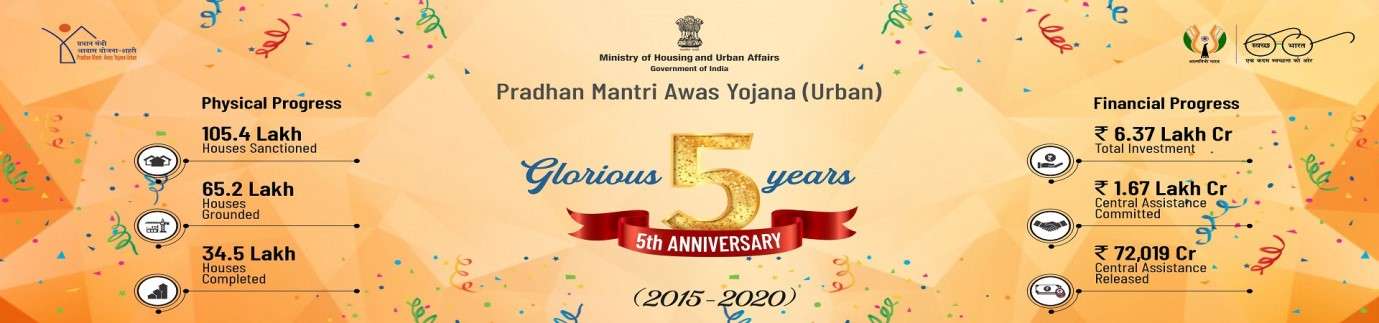

- The Prime Minister’s Awaas Yojana was launched in 2015 to provide housing for all by 2022.

- The income of EWS households has been defined in the range of income up to Rs 3,00,000.

- The states have been given the flexibility to vary the income limit depending on the local factors with a consultation with the centre.

- Housing up to the area of 30 sq metre carpet area has been supported with basic civic amenities.

- The ownership is registered preferably in the name of a female member of the household who’s the head of the family.

- The scheme is aimed at addressing the housing requirements of urban poor that include urban slum dwellers.

There is rehabilitation scheme for slum dwellers with the PPP (Public Private Participation) Model. The land will be used as a reserve that will be provided at concessional rates by the governments. There is a provision of providing supporting Affordable Housing for EWS by providing credit linked subsidy.

The burgeoning population of India

The population of India has exponentially increased from 1971 and in 2011 it was 377 million which is expected to grow up to 600 million by 2030. The urbanization has its basket of benefits that includes opportunities for employment and growth of individuals but at the same time, there are fallouts of the explosion of slums, preposterous escalation of land prices and building materials. All these make housing for the people at the bottom of the pyramid insurmountable. There are predictions of the slum population to spiral up of slum population to 65 million in 4000 towns. There is a housing shortage of 18 million during the current plan. 90 per cent of this shortage will be in the economically weaker section and low-income group. Efforts are needed to substantially increase the number of houses for the weaker and poorer sections. There are the Jawaharlal Nehru National Urban Renewal Mission and Rajiv Awas Yojana to take up the supply-side initiative to undertake the solution for the problems related to slums. Private sector partnership is encouraged to bridge the gap of the housing shortage.