Form 15G, a declaration form, is for the people who are holders of a fixed deposit account to fill out. These individuals must be 60 years or less or HUFs. This form is filled out by the FD holders to make sure that the TDS (Tax deducted at source) is not deducted from the interest income earned for that year.

According to the rules of the Department of Income Tax, it is a mandatory requirement of the bank to deduct the tax at the source. This tax is supposed to be deducted on the fixed deposit or recurring deposit if the interest earned is more than ₹10,000 in one financial year. In recent times, a facility was launched by the Unified portal of EPFO in which a fixed deposit account holder can submit an EPF form 15G which would allow them to withdraw their PF in an online manner. This facility helps you to avoid TDS deduction.

Table of contents

Why Do You Need EPF Form 15G

Form 15G and 15H are self-declaration forms that one needs to submit if he wants to request for no deduction of tax from the interest income because the income is below the exemption limit.

What Is The Eligibility Criteria For Form 15G

If you meet the below eligibility criteria then you can fill out the declaration form 15G for PF.

- If you are a resident Indian individual or a HUF (Hindu Undivided Family)

- If your age is less than 60 years

- If your tax liability is nil

- If the total income you have earned is less than the basic limit of the tax slab. So, your aggregate interest income should be less than ₹2.5 lakh. This was the threshold limit for the years 2021-2022.

Related EPF Form

| EPF Form 2 | EPF Form 31 |

| EPF Form 5 | EPF Form 19 |

| EPF Form 10D | EPF Form 20 |

| EPF Form 11 | PF Transfer Form 13 |

Where Can You Acquire Form 15G From?

It is very easy to get Form 15G to reduce the burden of TDS deduction. You can easily download it from all the websites of major banks and from the EPFO portal for free. This form could also be availed from the website of the Department of Income Tax. An additional facility is provided to you that you can submit the Form 15G on the websites of the major banks in India, online.

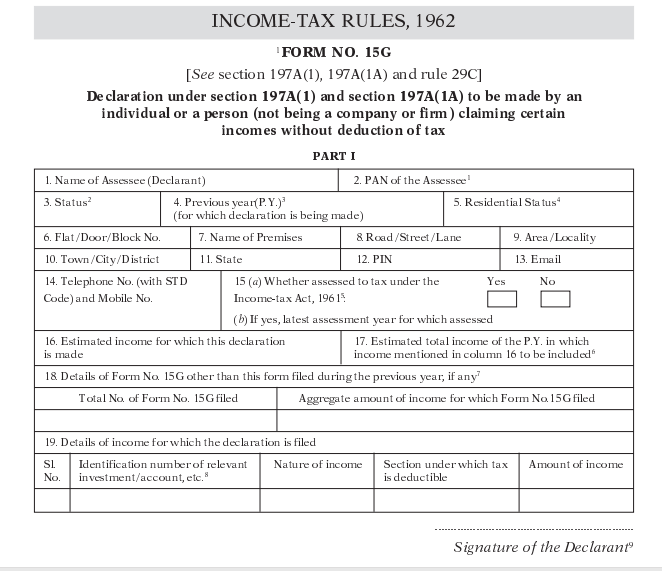

Sample of Form 15G

Have a look at the image below to find a sample of Form 15G.

TAX on EPF Withdrawal Rules

It is important to know about the TDS in relation to the EPF withdrawal before you start filling out the form 15G for PF. These EPF withdrawal rules are stated under section 192A, Finance Act of 2015.

When The Tax Is Applicable

- According to the act, your EPF withdrawal is bound to attract a Tax Deducted on Source (TDS) if you have withdrawn an amount of more than ₹50,000 and have worked for a period of 5 years or less. This limit was raised in the budget of 2016. Before 2016 the maximum limit of this type of TDS was set at an amount bigger than ₹30,000 or more than the withdrawal amount.

- The TDS is deducted 10% when the employee submits a PAN card.

- But if the employee is not able to submit the PAN card then the TDS will be charged at 34.6%.

When The Tax is not Applicable

- When one transfers his EPF account to some other account.

- When the service of the employee is terminated due to loss of health, project completion etc.

- If the employee withdraws the whole amount after his 5 years of service.

- If the amount of the EPF is less than ₹50,000 but the employee has rendered his service for less than 5 years.

- If the employee withdraws the money more than or equal to ₹50,000. His employment is also less than 5 years but he is able to submit Form 15G/15H along with his PAN card.

There is another form similar to Form 15G, Form 15H. The difference between these two forms is that Form 15G is made for the people who are less than the age of 60 years and 15H is for the people who are above the age of 60 years.

Uses of Form 15G and Form 15H

Instructions To Fill Form 15G For PF Withdrawal

You are now aware of the basics of what Form 15G for PF is, and why it is important to fill out this form, now let us have a look at the steps to fill this form for PF withdrawal. Follow these simple steps for a better understanding.

- All you have to do is log in to the EPFO UAN (Unified Portal) for the members.

- Now, select the option ‘ONLINE SERVICES’ – Claim (Form 31,19,10C).

- Then, you need to substantiate the last four digits of the bank account number.

- Search for ‘I want to apply for’ and below that select ‘Upload Form 15G’.

Once you have completed the above steps and found the portal to upload the form, you then need to fill out the form in the two sections of Form 15G. The first section of the form is for those who want to claim no deduction on the interest income. Fill out the following fields in the foremost section of the Form 15G.

- Name of the Assessee – the name which is mentioned in your Permanent Account Number (PAN) card.

- PAN of the Assessee – you need to have a valid PAN card to file Form 15G, otherwise your declaration can be treated as void. Also, the declaration through Form 15G can only be given by an individual and not by any company or business.

- Status – you have to provide the status of your income tax which can be any HUF (Hindu Undivided Family)/ Individual or AOP.

- Previous year – choose the last year as your financial year, which is the year you are planning to claim no deduction of the TDS.

- Residential status – you need to mention your status as that of a residing individual because an NRI cannot fill the declaration Form 15G for PF.

- Address – fill in your residential and communication address along with the PIN code.

- Phone number and Email ID – for any further communication fill in your correct phone number and email ID.

- (A)- whether you are assessed to tax under the Income Tax Act, 1961 – click on yes if you have been assessed to tax under the Income Tax Act in any of the previous financial years.

(B)- if you answered yes then mention the last assessment year for which the returns had been assessed.

- Estimation of income – mention the estimated income for which this declaration is being filled.

- Estimation of total income – in this field the estimated total income of the financial year has to be mentioned.

- Details of the Form 15G other than this form, if any – if you have filled out any other declaration in Form 15G in the financial year then you need to mention it in this section. You also need to mention the total sum of income.

- Details of the income regarding which the declaration is being filed – this last point of section 1 will ask you to mention the investment details for which this declaration form is being filed. You also need to enter your investment account number (employee code/life insurance policy number etc.).

After you have filled in all details in the form make sure to recheck it again so that there is no error in your declaration.

Summarizing the above

Form 15G for PF is an essential declaration document that can help you avoid TDS on the interest income. But, if you misuse it to file a fake declaration then there can be a heavy penalty levied on you. You can be fined or even imprisoned for committing this fraud under section 277, Income Tax Act, 1961.

The EPF Form 15G also has another section that will be filled out by the TDS Deductor.

You May Also Like

Frequently Asked Questions (FAQ’s)

What if I forget to submit Form 15G?

After you have filled in the IT returns, the TDS amount will be deducted by the Department of Income Tax. The TDS is deducted quarterly by the majority of the banks. So, if you had forgotten to fill and submit the Form 15G and 15H then you need to submit it immediately on their website or at the bank. This would help you prevent any further TDS deductions.

When should we submit Form 15G for PF?

The validity of Form 15G and 15H is one financial year. So you need to submit Form 15G every year at the beginning of the financial year. This would prevent the banks from deducting any TDS on your interest income.

What is the difference between Form 15G and Form 15H?

Form 15G is applicable only to the individuals who are residents or HUF who have an annual taxable income of less than ₹2.5 lakh. They should be below the age of 60. This declaration form helps in claiming a certain amount of income without the deduction of tax.

Form 15H is applicable to people between the age of 60-80 years who have a taxable income of less than ₹3 lakh/annum. For those who are 80 and above, their annual income should not exceed ₹5 lakh. This declaration form too helps in claiming a certain amount of income without the deduction of tax.