In this article, detailed information on EPFO home loans, pensions, various EPFO schemes will be provided. This will help the employees or workers to know more about the facilities offered by the Ministry of Labour and Employment under the government of India.

A brief introduction of EPFO Home Loan and its home loan schemes

Employee Provident Fund Organisation launched in 1952 under Employees Provident Funds and Miscellaneous Provisions Act, manages EPF or Employee Provident Fund schemes. In this scheme, a 12 Percent of the employee’s salary is deducted and deposited in his/her pf account, at the time of retirement, the total amount saved along with the interest earned is given to the employee. To the employee pf account, 13.61% is contributed by the employer. EPF withdrawal for an EPFO home loan can be done only if the individual has been in the service for a minimum of 5 years.

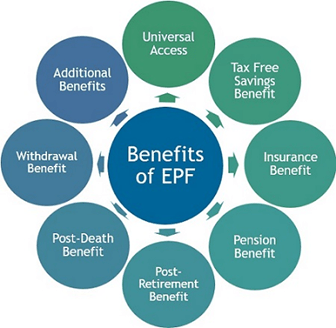

The benefits of EPFO Home Loan schemes are-

- Tax-free savings except for premature withdrawal that is before 5 years of account opening.

- Long term financial security.

- Monetary security to retired employees.

- Helps during emergencies. In special cases, pre withdrawal is allowed.

- Meet expenses during sudden unemployment or loss in income.

- 75 per cent Withdrawal money after the resignation and in the first month of unemployment.

- In case of the sudden death of the employee, the accumulated amount is given to his family members.

- Monetary support in sudden disability of an employee.

- Pension Scheme.

- Insurance Scheme.

An EPF employee is allowed to make 90 per cent EPF withdrawal for EPFO home loans to make easy down payments and pay EMIs from that account. To apply for the scheme,

- The employee is needed to be an active member of the scheme.

- He must be working for an organisation that is directly eligible to avail Provident Fund.

- The organisation must have 20 employees, only in that case they can offer EPF benefits.

- People residing in Jammu and Kashmir are not applicable.

For what reasons can you avail EPF loans?

To withdraw from a pf account, one needs a valid reason. Following are the reasons, under which an individual can avail EPF loans.

- One can withdraw from pf account for his/her marriage or child’s marriage.

- Withdrawal for education purpose.

- To purchase a home or a plot.

- Medical treatment to cure a serious illness.

- Payment of home loans

- For any natural calamity

- Renovation or expansion of houses

- During lockout when he/she stops getting a salary.

- One year before the retirement for any purpose.

EPF Loan Eligibility Calculation

- Education – If the employee is withdrawing money for his education or child’s education after class 10, then an amount up to 50% can be withdrawn only if he has been in the service for at least 7 years.

- Marriage – Up to 50 per cent of the employee’s share can be withdrawn for his marriage or child/siblings marriage only when he has worked for a minimum of 7 years.

- Purchase of home or plot – EPF withdrawal for housing loans can be made up to 36 times his monthly salary along with dearness allowance if and only if he worked for a minimum 5 years and the land is in the name of the Employee, spouse, or jointly owned. For plot purchase, all the criteria remain the same and 24 times of the monthly salary with dearness allowance can be withdrawn.

- Medical treatment – six times of the salary plus dearness allowance will be provided if the employee or spouse, mother, father, or child is undergoing medical treatment and is hospitalized for a month. In the case of cancer, TB, paralysis, leprosy, or heart ailments, mental derangement, hospitalization is not mandatory.

- Payment of Home loan – EPF home loan is a maximum of 90 per cent from both the employee and the employer contribution. For this, the land on which house is to be built, must be in the name of the employer or the spouse, else it should be held jointly, all the valid documents relating to the land must be there, and the total amount of money in the pf account must be above Rs. 20,000. One can withdraw only if he is in service for a minimum of 10 years.

- Calamity – Up to 50 per cent of the employee’s share can be withdrawn but the certificate of damages must be produced.

- Renovation or expansion of houses – If the employee has worked for a minimum of 5 years, the house was constructed 5 years ago, and the land is owned by him, or spouse, or together, then he can get 12 times of his wage under the scheme.

- Lockout – If the company is closed for at least 15 days or if the worker is not getting a salary for the last two months then he can get an equal amount of his unpaid wages.

- Withdrawal before retirement – If he has worked for a minimum 57 years, then he can withdraw 90 per cent of the accumulated balance along with the interest earned.

Supreme Court judgement on EPF Pension will allow employees to earn higher pensions. Now the employees can contribute to their pension fund irrespective of any capped salary and the basis for calculating the pensionable salary will no more be the 60 months salary, instead, it will be counted on the salary made for the last 12 months.

How to claim for EPF advance?

Step 1 – Visit the Member Interface of EPFO website.

Step 2 – Use UAN and password to log-in.

Step 3 – Go to ‘manage’ and select ‘KYC’ option to verify the details.

Step 4 – Go to ‘online services’ and select “Claim (Form-31, 19 & 10C)”.

Step 5 – Enter all the member details properly, and add the last four digits of your bank account number and select “verify” button.

Step 6 – Click on “Yes”.

Step 7 – Click on ” Proceed for Online Claim ” and go to ” I want to apply for ” tab to select the claim type, along with the purpose of the claim, the amount required and the address of the employee.

Step 8 – Submit the online request and employer’s approval.

How to check the status of EPF Advance Claim?

Step 1 – Visit the official website of EPFO.

Step 2 – Go to “Services” and select “For Employees”.

Step 3 – Once you get redirected to a page, go to “services” and select ” know your claim status”.

Step 4 – Enter UAN and password as login credentials.

Step 5 – Enter EPF account number, establishment code and state of your PF office.

Step 6 – Check your claim status.

Rules for EPF Withdrawal

- A tax is charged if the amount from the provident fund is withdrawn with five years of account opening.

- If you are changing employer than it is not necessary to withdraw the pf fund as it can easily be transferred to your new account.

- If you are currently employed, then according to the rules you cannot withdraw provident fund balance.

- For some special reasons that come under the eligibility criteria of withdrawing provident fund balance, only a loan can be applied or partial withdrawal.

- After the age of 54 years, 90 per cent of the provident fund balance can be withdrawn as per the new rules and regulations.

- If an employee leaves a job and remains unemployment for one month then he can withdraw 75 per cent of his pf balance and for the remaining 25 per cent, he can withdraw in the second month of unemployment.

PF Withdrawal for Home Loans

EPF members who have been in service for a minimum 3 years can apply for a 90 per cent Withdrawal of the pf balance to make down payments of the house or for EMI payments. But the minimum balance in the pf account must be above Rs. 20,000 either individually or together with his/her spouse. Only once in a lifetime can he withdraw the PF balance. Some of the key features of EPF home loans are –

- The applicant should be a registered housing society member, having a minimum of 10 members in the society.

- To calculate the EMI’s for withdrawal, the bank can ask for the commissioner’s certificate of PF contributions.

- To avail this facility the applicants can use composite claim forms.

- To pay EMI from pf balance, the member must provide a letter of authorization.

- The facility can be attached with Pradhan Mantri Awas Yojana to avail housing subsidy.

What is the process to withdraw the Employees’ Provident Fund?

To withdraw the Provident Fund using New Form, follow the steps –

- Go to UAN portal and update your Aadhar number.

- After authenticating the Aadhar number, link it with UAN.

- Enter all the details in the withdrawal form at the EPF member portal.

- Submit the form and the money will be transferred to your account.

To withdraw PF balance via Old Form, follow the steps –

- Obtain Form 19 from the HR team of your previous company or download it from EPFO website.

- Enter all the required details.

- A cancelled cheque leaf may be required for reference.

- Submit the form to your employer.

- Get it attested and send to the regional provident fund office.

This is the offline procedure, it takes a relatively longer period than the previous procedure. Once the processing gets completed the amount gets transferred to your account.

Also Read:

EPFO : Funding home purchase with Employee Provident Fund corpus

Q1. What are the documents required for PF Withdrawal?

Ans.

i. Universal Account Number or UAN

ii. Bank account details. Note: the bank account must be in the name of the PF holder as no fund amount can be transferred to the third party if the real holder is alive.

iii. Valid personal information

iv. The employer must mention to the EPFO the employee’s joining and leaving dates.

Q2. How can you avoid TDS on PF Withdrawal?

Ans.

i. Avoid withdrawing EPF balance while changing job instead, transfer it to the new account.

ii. If you are unemployed try to avoid withdrawing from EPF account. You can earn interest on the amount for three years though taxable, yet no contribution is required.

iii. Withdraw after five years to avoid TDS.