Currently the realty market is more inclined towards buyers owing to stable prices, low interest rates and multiple available housing options. However, experts feel that tax sops in the 2022 Budget may further help in scaling up home purchase demand. Many experts feel that the threshold of Rs.1.5 lakh under Section 80C, which also applies for home loan principal repayment, should be increased in order to spur demand, with the last increase coming in 2014.

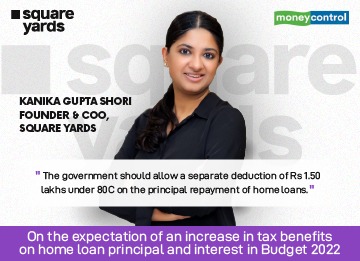

Kanika Gupta Shori, COO and Co-Founder at Square Yards, states that the Government should enable separate deductions of Rs. 1.5 lakhs under Section 80C for home loan principal repayment. Since this section covers multiple investments like PPF, PF, life insurance and others, middle-class citizens often end up exhausting a major amount on the same before investing in any property, giving limited room for availing of benefits on principal repayment on home loans. Separate deductions will spark home purchase interest while giving some relief to borrowers according to her. She also feels that the tax deduction threshold of Rs. 2 lakh on home loan interest repayments under Section 24 should be increased in the Budget for ensuring relief to buyers who have already been tackling higher increases in the prices of essential commodities. This should go up to Rs. 5 lakh to enable more home ownership according to her.

Experts also feel that the affordable housing definition should be reconsidered with the price threshold increased from Rs. 45 lakh to Rs. 85 lakh in Mumbai and up to Rs. 60-65 lakh in other major cities. This will help more buyers get benefits like a lower GST rate of 1%, additional deductions on interest repayment and other Government subsidies. These measures will help in putting more money in the hands of taxpaying citizens who are grappling with a tough last couple of years where their salary increments were also lower or negligible according to many experts.

For a detailed report on this read the articles we were featured in:

Money Control : https://bit.ly/332jiyT

Published Date: Dec 09, 2021