In our previous blogs we have captured the various advantages of taking a home loan & the various factors that are required to get the loan secured.

One more significant aspect that needs to take into consideration is the rate of interest. It is essential that there should be an optimum rate of interest, ensuring maximum benefits for the borrower.

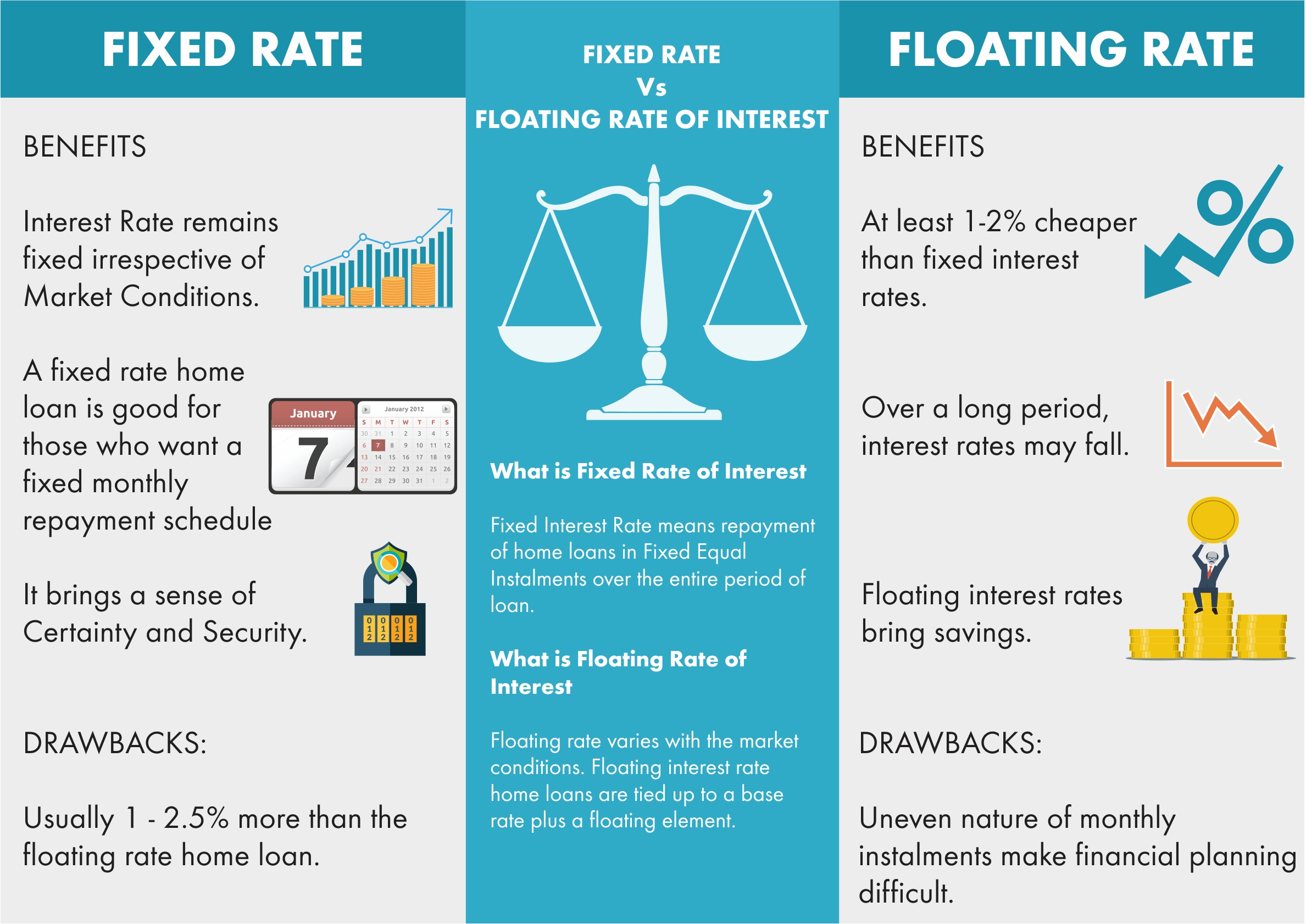

In this regard, there are basically two kinds of interest rates that are available in the market- Fixed Rate & Floating Rate. Both come up with their own pros & cons as discussed below:

Fixed Interest Rate on Home Loan

Fixed Interest Rate means repayment of home loans in Fixed Equal Instalments over the entire period of loan. The interest rate doesn’t change with Market fluctuations.

Benefits of Fixed Rate home loan are:

• Interest Rate remains fixed irrespective of Market Conditions.

• A fixed rate home loan is good for those who are good at budgeting and want a fixed monthly repayment schedule, which is easy to budget and doesn’t fluctuate.

• It brings a sense of Certainty and Security.

Drawbacks of Fixed Rate home loan

The major drawback with fixed rate is that it is usually 1 – 2.5% more than the floating rate home loan. Secondly, if for any reason the market interest rates go down, the fixed interest rate doesn’t get the benefit of reduced rates and the borrower has to repay the same amount every time.

Floating Interest Rate on Home Loan

Floating rate varies with the market conditions. Floating interest rate home loans are tied up to a base rate plus a floating element. So, if the base rate varies, the floating interest rate also changes accordingly.

Benefits of Floating Interest rate on Home loan

The biggest benefit of floating rate home loans are that they are at least 1-2% cheaper than fixed interest rates. Even if the floating rate exceeds the fixed rate, it will be for some period of the loan & not for the entire tenure. The interest rates will surely fall over a long period and thus floating interest rates bring a lot of savings.

Drawbacks of Fixed Rate home loan

The drawback with floating interest rate is the uneven nature of monthly instalments making financial planning slightly difficult.