In accordance with the Income Tax Act of 1961, Form 16 is a certificate that an employer issues to the employees. It acts as a validation of TDS deduction and submission to the tax authorities on behalf of the employee. It also serves as a salary statement of the taxpayer as well as an important document that might even be required for visa or loan applications.

In this blog, we will look at how to download Form 16 and how you can use the same to file your income tax return. So without any further ado, let’s begin!

Table of contents

- What is Form 16?

- What are the Types of Form 16?

- Eligibility Criteria for Form 16

- Downloading Form 16

- Details Required From Income Tax Form 16 While Filing Returns

- Details Required from Form 16 Part B

- Things to Keep in Mind While Checking Form 16

- How to File ITR with Form 16?

- How to Calculate Salary Income Without Form 16

- Benefits of Form 16

- Difference between Form 16, Form 16A, and Form 16B

- Frequently Asked Questions (FAQs)

What is Form 16?

Form 16 contains a lot of relevant information that you will need when filing your income tax returns for the financial year. It is mandatory for the employers to issue Form 16 on or before 15 June of the next year, the year preceding the year of tax deduction. This form comes in handy while calculating your tax liability for the financial year, as it contains all the details of the TDS deducted by your employer.

What are the Types of Form 16?

The two different types of Form 16 available to the taxpayer are as follows:

- Form 16A: This form provides a summary of any tax collected from the salary of the employee by the employer. It also contains the details of the deposit of the same with the income tax authorities. This form is filed by the employer on behalf of the employee.

- Form 16B: This is more like an integrated statement of the information regarding salary, TDS deductions, and other components of the salary.

Details of Part A of Form 16

Part A of Form 16 contains all the information regarding TDS deductions and deposits for each quarter of the financial year. It also contains the employer’s TAN, PAN, and various other information and can be generated by the employer on the official income tax portal. The employer is required to verify and authenticate the information in the Form before issuing it to the employee.

It is important to know that in the case of a job change during the financial year, each employer will issue a different Part A of Form 16. Some of the constituents of Form 16A are as follows:

- Name and address of the employer.

- PAN and TAN of the employer.

- Employee’s PAN.

- Summarized details of the tax deducted and deposited for each quarter.

Details of Part B of Form 16

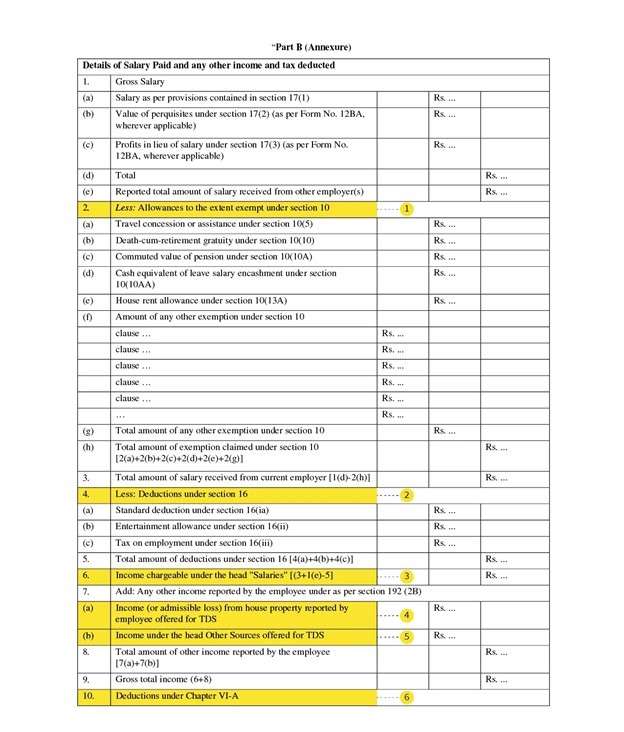

Form 16 Part B is a type of annexure to Part A of the form. This part of the form is generated by the employer for their employees. It contains essential information like salary breakup and deductions as stated under Chapter 6A of the Income Tax Act.

In case of any job change during the financial year, you are required to collect Form 16 from both employers. Some of the constituents of Part B of the form are:

- A detailed breakdown of remuneration.

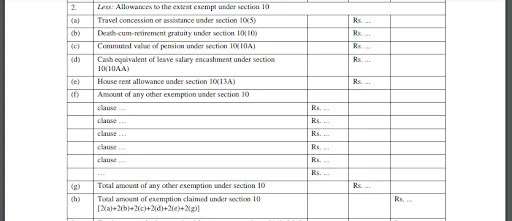

- Details of the applicable exempted allowances, as stated under Section 10.

- Deductions stated under Chapter 6A of the Income Tax Act, including:

- Payments of life insurance premiums, PPF contribution, etc.

- Contribution made to pension funds as stated under Section 80CCC.

- Employees’ payments of pension schemes, as dictated under Section 80CCD(1B).

- Employer’s pension scheme payments as stated under Section 80CCD(2).

- Health insurance premium payments as dictated under Section 80D.

- Interest paid on student loan payments as stated under Section 80E.

- Donations per Section 80G of the Income Tax Act.

- Interest income earned from savings accounts as stated under Section 80TTA.

Eligibility Criteria for Form 16

According to the rules and regulations laid down by the Income Tax authorities, every salaried professional falling in the income tax bracket is eligible for Form 16.

If the employee does not fall in any tax bracket, they have no need for TDS details for the financial year. This means that the employer is not obligated to provide Form 16 in such cases.

However, most organizations nowadays provide Form 16 even in such cases as it contains a detailed summary of all the earnings of a financial year, along with other components of the salary.

Downloading Form 16

Given below is the step-by-step process of downloading Form 16 from the income tax portal:

Step 1: Visit the homepage of the official income tax portal.

Step 2: Click on the ‘Income Tax Forms’ option under the ‘Forms/Download’ tab.

Step 3: Next, click on the ‘PDF’ and ‘Fillable Form’ options under the ‘Form 16’ tab.

Step 4: Choose the relevant option.

Step 5: On the next page, you will be able to download the income tax Form 16.

Details Required From Income Tax Form 16 While Filing Returns

Given below is all the information that you will require from Form 16 while filing returns for FY 2020-21:

- Basic allowances are exempt as under Section 10 of the Income Tax Act.

- Detailed breakup of deductions as under Section 16.

- Total taxable income.

- Income from house property offered for TDS, as reported by the employee.

- Income from other sources offered for TDS.

- Total of all deductions stated under Section 80C.

- Total tax amount or tax refund amount.

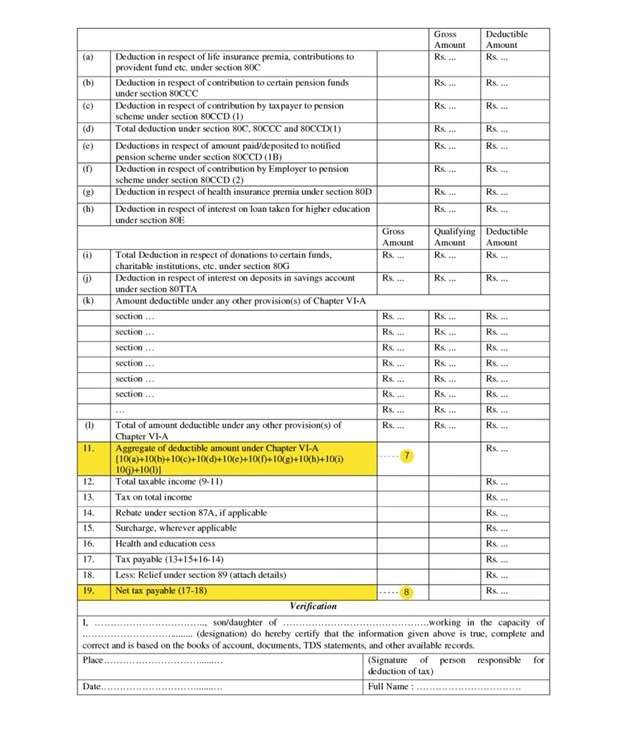

Check out the images below to get a glimpse of how Part B of a Form 16 looks.

Details Required from Form 16 Part B

The following is some other additional information that you will require from Part B of the income tax Form 16, to file your ITR:

- Employer’s TDS deduction.

- Employer’s TAN.

- Employer’s PAN.

- Name and address of employer.

- Assessment year.

- Assessee’s name and address.

- Asseesse’s PAN.

Things to Keep in Mind While Checking Form 16

Be mindful of the below factors when checking the income tax Form 16:

- Ensure all information mentioned in the form is correct.

- Apart from verifying the details of TDS deductions and income, you must also crosscheck if the correct PAN is mentioned on the form.

- In case of any discrepancies, get in touch with the finance department of the organization.

- The employer will issue a corrected Form 16 to the employee. Further, the employer also needs to make rectifications from their end by filing a revised ITR.

How to File ITR with Form 16?

You will require some information from your Form 16 while filing your Income Tax Returns for the financial year. These include:

- Salary allowances exempted from income tax as stated under Section 10.

- Total taxable income.

- Detailed breakdown of any deductions stated under Section 16 of the Income Tax Act.

- Details of income from house property that has been offered for TDS.

- Income from other sources offered for TDS.

- A detailed report of any available deductions as stated under Chapter 6A of the Income Tax Act. This covers all deductions allowed under Section 80C to Section 80E of the Income Tax Act.

- The total amount of deductions is stated under Chapter 6A of the Income Tax Act. This covers all the deductions mentioned in Section 10(a), Section 10(b), Section 10(c), Section 10(d), Section 10(e), Section 10(f), Section 10(g), Section 10(h), Section 10(i), Section 10(j), and Section 10(l).

- Total tax or refund amount due.

How to Calculate Salary Income Without Form 16

In some instances, employers do not provide a Form 16 to employees whose income falls below the taxable slab rates.

If you wish to proceed with your ITR filing without Form 16, you will be required to check your salary slips, bank account statements, loan certificates, Form 26AS, tax-saving investment declaration, etc.

You will need your salary slips for information like basic allowances and salary. Form 26AS will have information about all the tax payments and deductions for the financial year.

Let’s take a look at an example below to illustrate the same:

Basic Pay: Rs. 30,000/month, which amounts to Rs. 3.6 lakh per annum.

Transport Allowance: Rs. 1400/month, which is equal to Rs. 16,800 per year.

Deductions: Rs. 30,000

Since there is a tax exemption of Rs. 1600 per month, the allowance will be tax-exempt.

Total Taxable Amount: (Rs. 3,60,000 – Rs. 40,000) – Rs. 2,50,000 = Rs. 70,000.

Benefits of Form 16

The following are some of the benefits that the taxpayer receives from income tax Form 16:

- It acts as the salary statement of the employee.

- Form 16 is a useful document in the ITR filing process.

- It can be used as a supporting document during visa applications.

- It acts as proof of income and TDS deduction from salary.

- It helps in keeping a check on all the tax-saving investments of a financial year.

- This document might be requested by the bank when you apply for loans.

Difference between Form 16, Form 16A, and Form 16B

The following table shows the difference between Form 16, 16A, and 16B:

| Form 16 | Form 16A | Form 16B |

| Issued by the employer who deducts the tax at source from salary. | Issued by the financial institution authorized to deduct the TDS. | Issued by the buyer to seller for the deduction of TDS for sale of immovable property. |

| Issued for TDS on salary. | Issued for TDS for any other income other than salary. | Issued for tax deducted at source for the sale of immovable property. |

Don’t Miss Out:

|

Income Tax Top Blogs |

Income Tax Related Blogs |

Frequently Asked Questions (FAQs)

How is Form 16 generated?

The TDS CPC (Tax Deducted at Source Centralized Processing Cell) is in charge of generating Form 16 for the financial year. This is done based on the TCS and TDS statements for each quarter. The employer is required to raise a request for the same on the TRACES website.

What are the due dates for issuing Form 16 and Form 16A?

The income tax Form 16 is issued annually before the 31st of May every year. Form 16A is issued every quarter, 15 days before the due date of furnishing the TDS statement according to rule 31A.

I have misplaced my Form 16. How can I get a duplicate?

To get a duplicate of your Form 16, contact the deductor who issued it to you in the first place.

Who issues Form 16 for pensioners?

In the case of pensioners, the bank making the pension payments every month is responsible for issuing Form 16. Previous employers will not be involved in the entire process.

Can I download my Form 16 certificate without registering on the TRACES website?

No. You have to be a registered user to download Form 16 and Form 16A from the TRACES website.

Is the employer required to issue a Form 16 even if there are no TDS?

The TDS certificate in Form 16 is issued in case of TDS deductions. If no TDS has been deducted, the employer is not required to issue a Form 16.

What if the employer deducts TDS and does not issue a certificate?

Any entity responsible for paying out salaries to employees is required to deduct TDS before making payments. The Income Tax Act states that any deductor involved in TDS deduction is required to provide a certificate with the details of TCS and TDS.

If no Form 16 has been issued to me, does it mean I don’t have to file an income tax return?

While the responsibility of deducting TDS from salaries and providing Form 16 lies with the employer. The onus of filing tax returns lies with the taxpayer. If you come under any tax slabs, you are required to file returns regardless of whether your employer has deducted TDS or not. You are required to file a return, even if the employer fails to issue a Form 16.