Maintaining the taxation system of a nation like India with 140 crore inhabitants, is a seriously challenging task. Owing to the country’s diverse economic groups, the income Tax tiles were developed by the Indian government to make tax regulation easier and more controllable. Moreover, once a year, the finance minister announces the new tax regime in the Union Budget.

Besides these, new tax slabs are often revised in the yearly budget. The tax slabs help taxpayers by assisting in calculating the payable tax for a given fiscal year. Every individual or enterprise with yearly earnings above a significant limit is liable to pay taxes. Besides salaried, self-employed individuals, companies, etc., freelancers are also liable to pay taxes towards the end of every year. In this article, you will learn about freelance income tax, the new tax regime and its importance.

Table of contents

- How to File an Income Tax Return for a Freelancer?

- Documents Required for ITR Freelancers

- Tax Deduction/Exemption For Freelancers

- What are the expenses a Freelancer can Claim Deductions against?

- Tax Payable for a Freelancer

- How much Taxable is applied for a Freelancer?

- To Sum Up

- Frequently Asked Questions (FAQ’s):-

How to File an Income Tax Return for a Freelancer?

Before filing your tax, you must evaluate your overall gross income from 1st April to 31st March of the said fiscal year for which the tax is to be paid. Moreover, remove the debt assignment like loans since they are not included in income. Determine the expenses incurred in freelancer tax India, and business to claim a tax deduction. The thorough process of filing your freelancer income tax is as follows:

Via Online

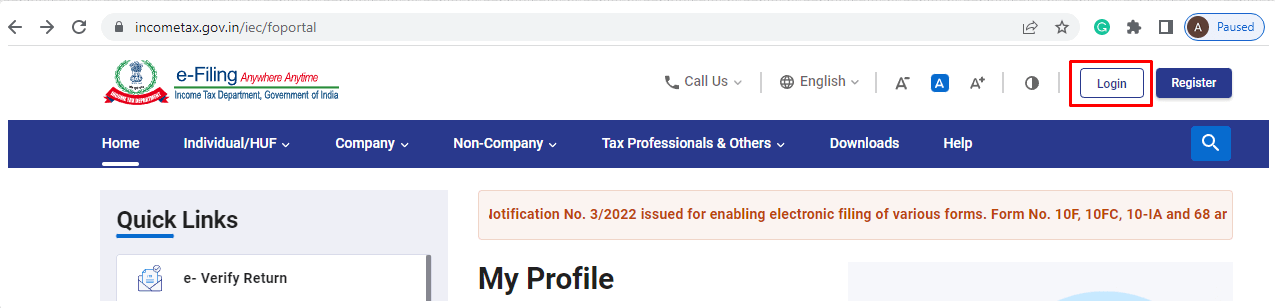

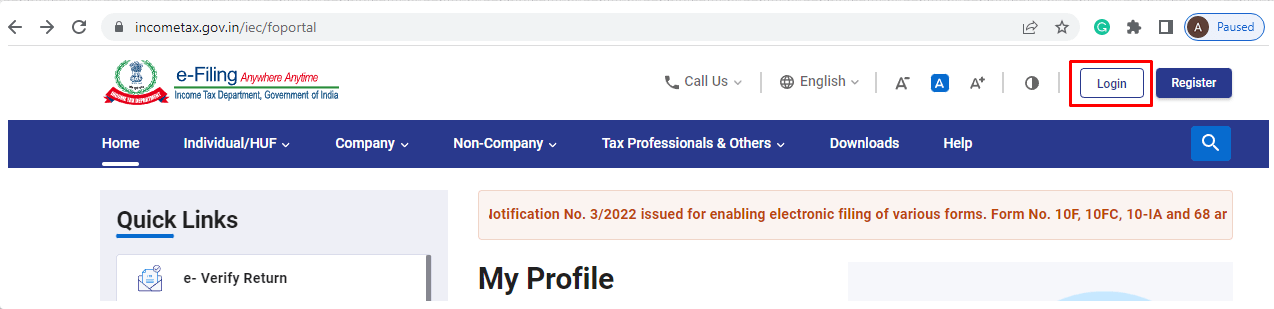

Step 1: Go to the official ITR website and click on the Login button.

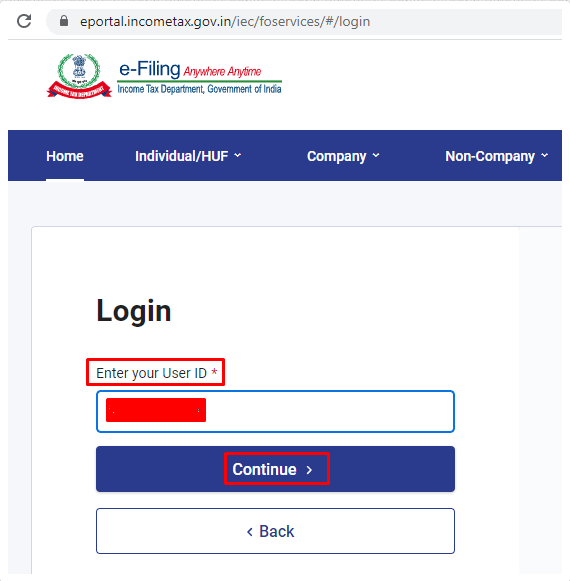

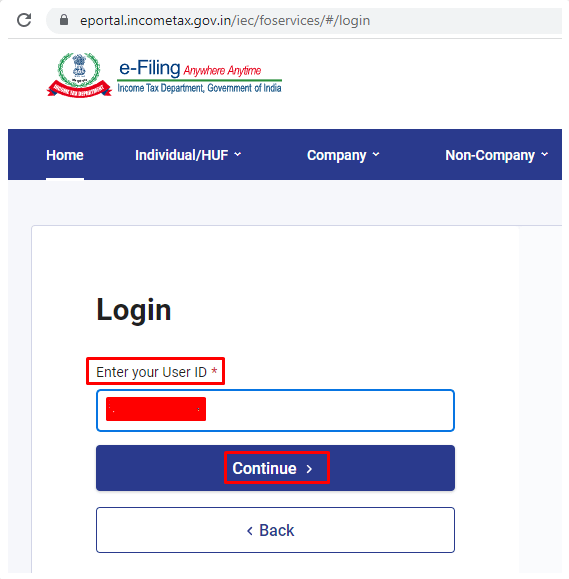

Step 2: Fill out the details like PAN Card number and select the ‘Continue’ button.

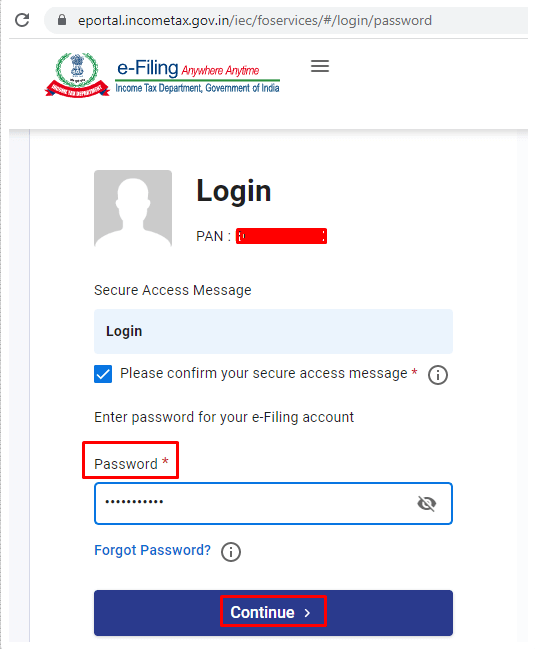

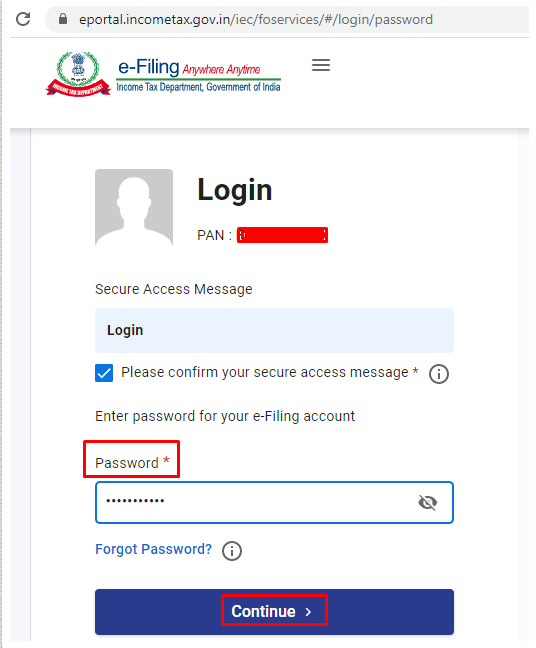

Step 3: Enter the ‘Password’ and click on the ‘Continue’ button.

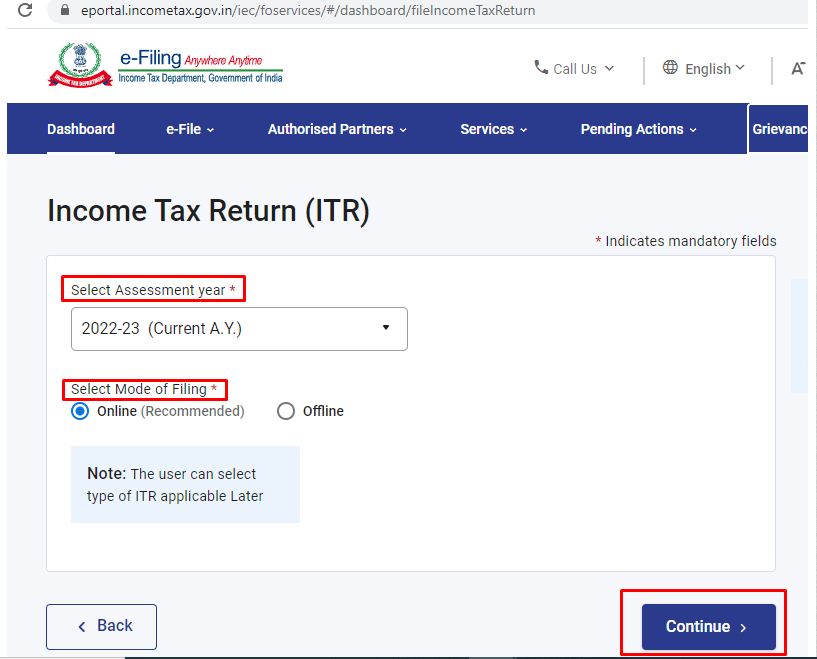

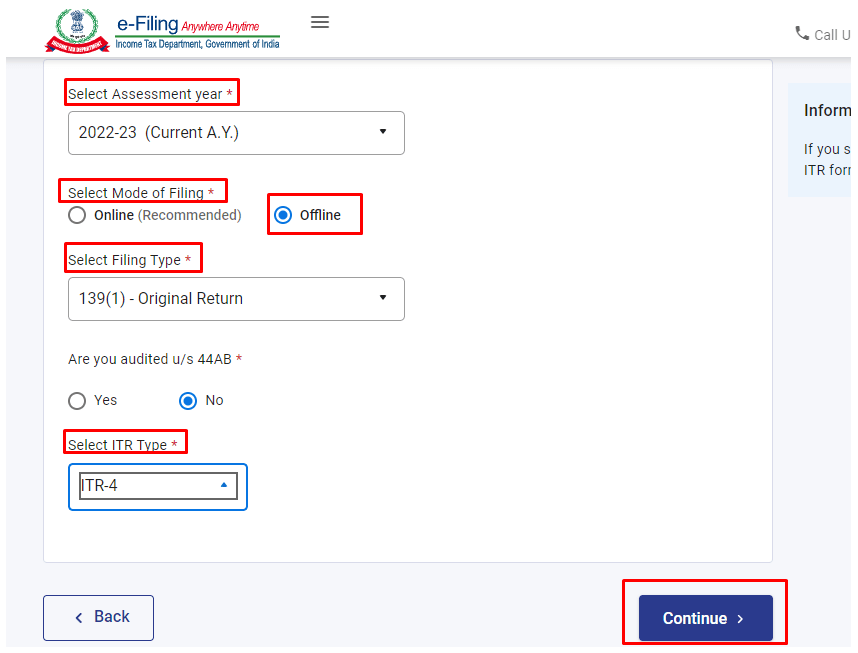

Step 4: ‘Select the Assessment year’, fill ‘mode’ and Choose ‘ Continue’.

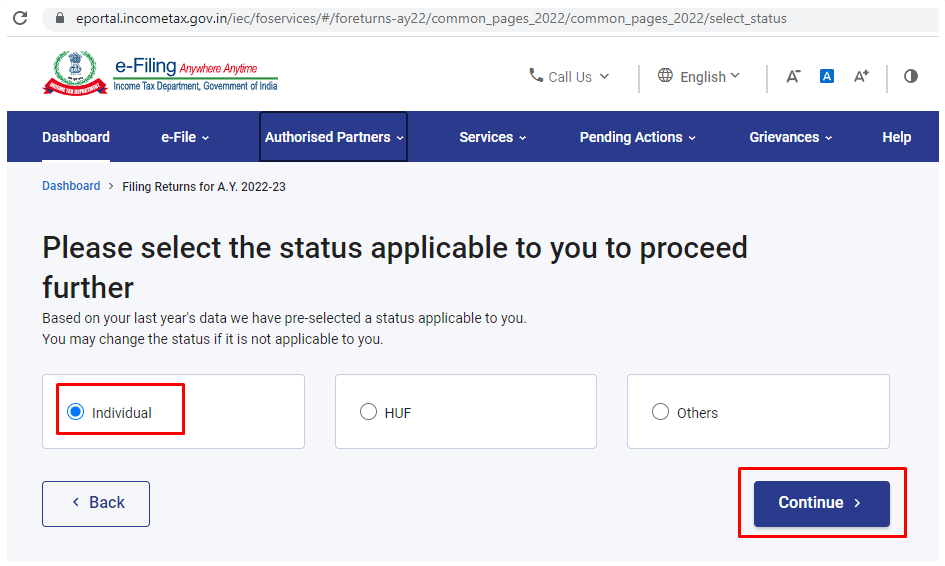

Step 5: Choose the status that applies to you to proceed further, such as Individual, HUF and others.

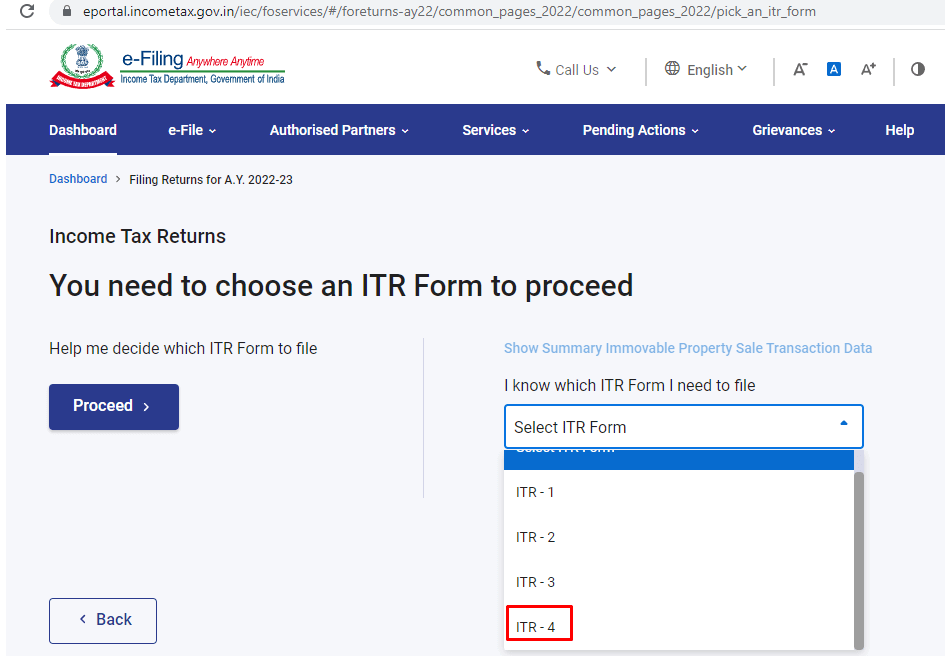

Step 6: Select the ITR form ‘ITR-4’ and click on the ‘Proceed with ITR-4’.

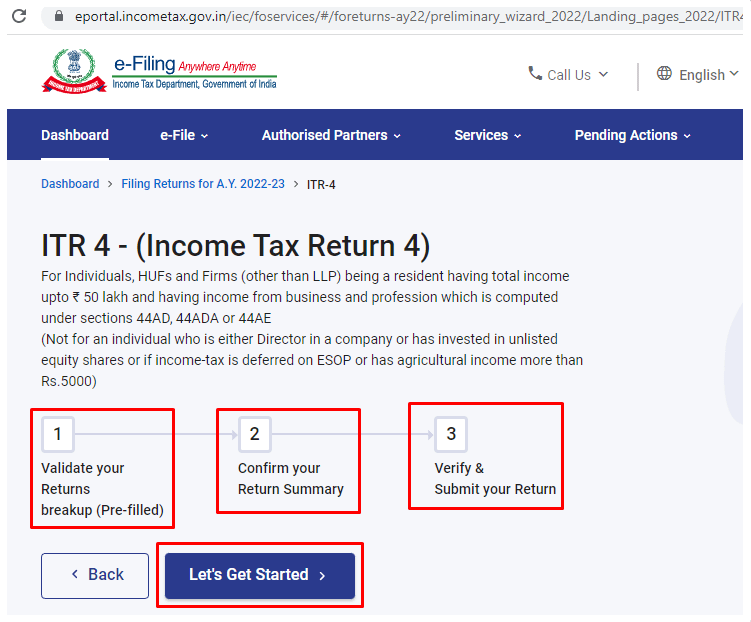

Step 7: You will be redirected to a new page; complete the three basic steps such as

‘validate your Returns breakup (Pre-filled)’, ‘Confirm your Return Summary’, ‘Verify & Submit your Return’ and click on the ‘Let’s get started’ button.

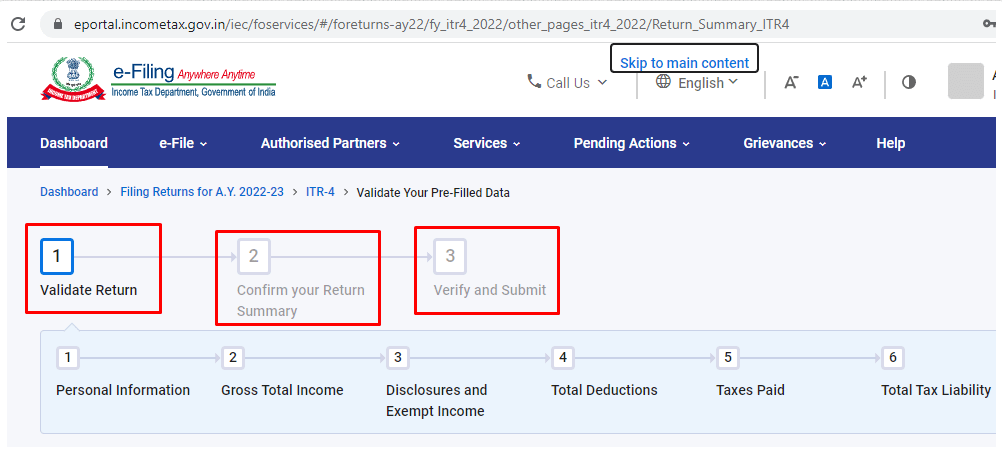

Step 8: Further, you will be asked some questions as per choice. Answer the following questions and click on the ‘Continue’ button.

Step 9: Enter the details to validate your form and submit it.

Via Offline

The steps you need to follow for offline filing of freelancers tax India are as follows:-

Step 1: Visit the official ITR portal and select the Login button.

Step 2: Enter the details like PAN Card number and click on the ‘Continue’ button.

Step 3: Fill out the ‘Password’ and choose the ‘Continue’ button.

Step 4: ‘Select the Assessment year’, fill ‘mode’ and select ‘ Continue’.

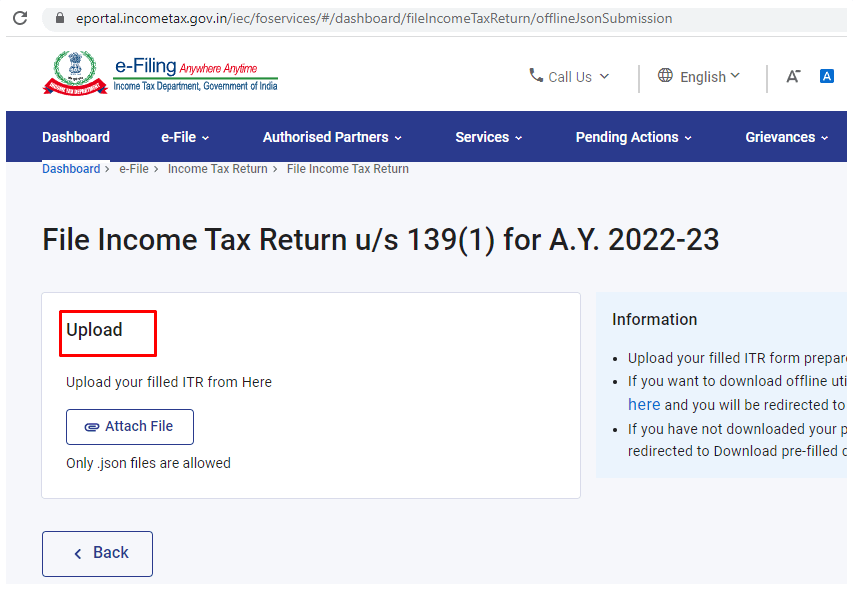

Step 5: ‘Upload’ the required documents and submit them.

Documents Required for ITR Freelancers

To file freelancer tax, you need to keep ready some essential documents for the process. The documents you will need for freelancer tax filing are:-

- Bank statements to identify the type of business.

- Form 264S and Annual Information Statement (AIS) to check TDS deduction and other income.

- Deduction documents such as healthcare, tuition and so on to claim the correct deduction.

Tax Deduction/Exemption For Freelancers

The table represents the tax deduction/exemption for freelancer tax in India.

| Section’s | Deduction/Exemption for Freelancer tax India |

| 80C | It provides deductions up to ₹ 1.5 Lakhs for various schemes such as life insurance, provident fund, tuition fees, a home loan for renovating a house and so on. |

| 80 CCC | Tax deductions for investments made towards pension plans. The maximum exemption limit is Rs 1.5 lakhs. |

| 80 CCD | The exemption will consist of 10% towards investments CGPS (Central Government Pension Schemes). Further, both employers and the taxpayers are exempted from taxation. |

| 80 CCF | The exemptions are provided for investments in infrastructure bonds which is observed by the Indian Government. In addition, the maximum exemption can go up to ₹20,000. |

| 80 CCG | This section offers a maximum deduction of up to ₹ 25,000 toward investments in government schemes. |

| 80 D | Expenses on healthcare insurance schemes are also exempted. In addition, freelancers can also purchase insurance for their spouses or kids and can claim further tax deductions. |

| 80 DD | Tax deductions for treating disabilities (normal and severe) can be claimed for up to ₹1.25 lakhs. |

| 80 DDB | Tax exemptions for treating a certain disease. |

| 80 E | Tax deductions toward an education loan. |

| 80 EE | This section deals with individuals and excuses the payments for home loan or property purposes. |

| Section 80 G | This section provides a 100% tax deduction toward charity funds. Examples are Prime Minister Relief Fund, National Defense Funds and so on. |

What are the expenses a Freelancer can Claim Deductions against?

In India, Freelance income tax can debit work-related expenditures from their earnings. This could range from office equipment to cab fares. These costs should be explicitly associated with the job a freelance taxpayer does. Some of the expenses a freelancer may claim as deductions are:-

- Property Rent

- Expenses of workplace

- Expenses for travelling and so on.

Tax Payable for a Freelancer

If the overall gross tax increased more than ₹10,000 during a fiscal year, then a freelancer taxpayer needs to pay tax quarterly and this method refers to the advance tax. Some of the steps to calculate the advance tax for filing freelancer tax in India are as follows:-

Step 1: Analyse and sum up all your receipts and evaluate your overall gross income.

Step 2: Directly deduct the expenses from your work.

Step 3: Add other sources of income, such as a home or a savings account.

Step 4: Determine your tax slab and evaluate.

Note: Do not forget to deduct the TDS amount from the receipts.

Advance Date Tax for Freelancers

| Date | Tax Percentage |

| Till or before 15th June | 15% (Not less than) |

| Till or before 15th September | 45% (Not less than) because tax is reduced in the previous instalment. |

| Til or before 15th December | 75% (Not less than) because tax is reduced in the previous instalments. |

| Till or before 15th March | 100% (Whole amount) because is reduced in the previous instalments. |

How much Taxable is applied for a Freelancer?

As per Section 194J of the Income Tax Act, a full-time freelancer is equal to 10% of an employee working for a company. Based on the fact, that a freelancer is also eligible for TDS deductions, by auditing the u/s 44AB section, two methods are evaluated to present an applicant’s gross receipts.

Firstly, if the freelancer’s gross income is less than Rs 50 Lakhs, the tax will be calculated as presumptive. Thus, the annual tax amount on gross salary for a freelancer will become equivalent to 50% of his/ her annual income. Secondly, if a freelancer is earning more than Rs 50 lakhs, the annual TDS shall sum up more than 50%.

Furthermore, taxable amounts for business, before 2017, the freelance income tax used to be 12.36% to 14% as VAT and services tax. However, the tax policy has been changed now and they have to pay 18% GST. Therefore, 18% GST is paid based on Central Goods and Services Tax (CGST), State Goods and Services Tax(SGST), and Integrated Goods and Services Tax (IGST) based on service areas.

| Annual Income(₹) | Previous Tax Slap(Percentage) | New Tax Slap (Percentage) |

| Lower than 2.5 Lakhs | NA | NA |

| 2.5 to 5 Lakhs | 10 | 5 |

| 5 to 10 Lakhs | 20 | NA |

| 5 to 7.5 Lakhs | NA | 10 |

| 7.5 to 10 Lakhs | NA | 15 |

| Above 1o Lakhs | 30 | NA |

| 10 to 12.5 Lakhs | NA | 20 |

| 12.5 to 15 Lakhs | NA | 25 |

| Above 15 Lakhs | NA | 30 |

To Sum Up

It is critical to file ITRs on time in order to avoid penalties for late filings. It is the taxable freelancer’s responsibility to submit their documents for an income tax return by the due date. Furthermore, the Freelancer tax India penalty charges can be levied in cases of nonpayment or delays. Every year, you must file your ITR before the deadline, which is July 31st and March 31st of every fiscal year.

You May Also Read:

Frequently Asked Questions (FAQ’s):-

Q1. How much Tax Is Applied to Indian Freelancers?

Ans: The taxation slabs for a freelancer earning less than Rs 2.5 lakhs, then no tax will be deducted. If the annual income lies between 2.5 lakhs to 5 lakhs, the tax deduction will be at 10%, and if the earnings are between 5 to 10 lakhs there will be 20% tax deductions. Finally, above 10 Lakhs, taxes are deducted at 30%.

Q2. Do I need to declare freelance income?

Ans: A freelancer should debit tax or TDS only if he/ she was validated during the last fiscal year.

Q3. Where can freelancers find information related to TDS that has been deducted?

Ans: Freelancers can claim the subtracted TDS when submitting their ITR (Income Tax Return). TDS debited data can be retrieved from Form 26AS.