Gratuity is the amount an employee receives when they leave the organisation after five or more years of continuous service. This can be defined as a financial component an organisation gives to an employee in return for the services rendered. This amount is meant to aid the employee in the case of retirement. However, this amount is also paid out to employees in case of death, disablement, or voluntary retirement due to health issues. In this blog, we will see what is gratuity? , how to calculate gratuity amount and the eligibility criteria. Let’s begin!

What is Gratuity?

Gratuity can be defined as an amount of gratitude that the employer pays to the employees upon the resignation or retirement of the employee. However, the organisation can also pay the gratuity amount even if the employee in question has not completed five years of service, given that such circumstances fulfil certain conditions.

The process of gratuity payment is regulated by The Payment of Gratuity Act of 1972. This Act was introduced as a reference point for activities relating to the payment of gratuity to the employees. However, the gratuity itself is decided at the organisation’s discretion.

In short, the organisation must pay gratuity when the employee resigns or retires before completing five years of uninterrupted service. However, the employer must follow no specific set of rules or laws while calculating the gratuity amount.

Eligibility for Gratuity Payment

Given below are some of the eligibility criteria that govern the payment of gratuity amounts in India:

- The employee is required to have completed five or more years of uninterrupted service before resigning or retiring from service.

- This amount is to be paid by any employer that employs at least ten employees in the 12 months before the gratuity amount calculation.

- Any employee who passes away or suffers disablement before completing five years of service is also entitled to receive gratuity.

- Any employee who has suffered disablement due to onedisease before completing five years of service can also receive the gratuity amount.

Note: Please note that any contractual employee is not entitled by law to receive gratuity from the employer. Nevertheless, the employer can choose to pay gratuity at their discretion.

What is Uninterrupted Service?

By the Payment of Gratuity Act, an employee is deemed to be uninterrupted service when they meet the below-given eligibility criteria:

- The scope of ‘uninterrupted service’ includes several circumstances in which the services had been discontinued. If the employee does not mark such situations as a break from service, these circumstances include absence without leave, sickness, leave, etc.

- In case the employee does not meet the criteria mentioned above for a period of 6 months to 1 year, then said employee is considered to be in uninterrupted service only if:

○ The employee has worked in the company for a minimum of 191 days if the organisation has a five-day work-week.

○ In the case of other companies, the employee should have worked for a minimum of 240 days.

- Suppose an employee of a seasonal organisation does not meet the criteria mentioned above. In that case, the employee should have worked for a minimum of 75% of the company’s period.

How to Calculate Gratuity Amount?

As discussed above, employers are not legally bound by a fixed gratuity percentage that they should follow while calculating gratuity. However, the Payment of Gratuity Act lays down certain formulas to help the employer calculate the gratuity amount. By the Act, non-government organisations can be classified into:

- Establishments covered by the Act.

- Establishment not covered by the Act.

Gratuity Amount Calculation for Employers Covered Under the Act

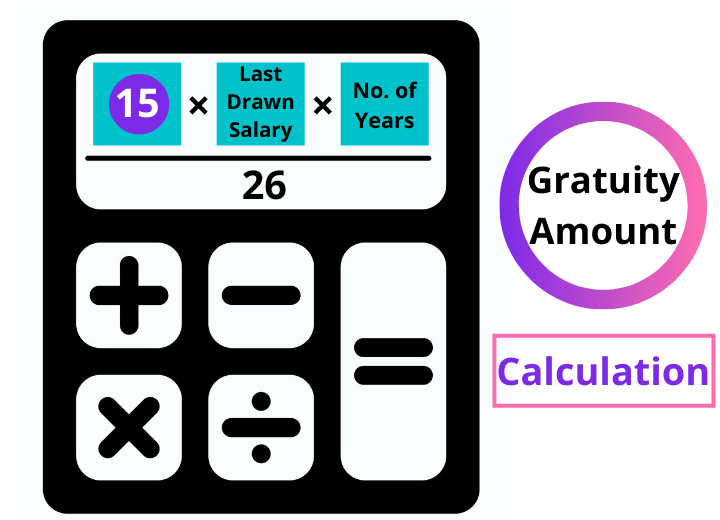

The formula for gratuity amount calculation for employers covered under the Act is as follows:

Gratuity = (15 x last drawn salary x years completed in-service)/26

In this case, basic pay, dearness allowance, and sales commission are some of the factors considered while calculating the last drawn salary. Further, the salary considered for the calculation of gratuity will be the salary received for the previous ten months before the date of gratuity calculation.

Let’s take an example for the calculation of gratuity.

Example: Akhil has been an employee of Company ABC for ten years. The company has more than 200 employees. Akhil’s last drawn salary amounts to Rs. 65000. This is what the gratuity calculation will look like:

Gratuity = Rs ( 15 x 65,000 x 12)/ 26

= Rs. 450,000

Gratuity Amount Calculation for Employers Not Covered Under the Act

Employers who are not covered by the Act can also pay a gratuity amount to their employees. Given below is the formula for calculation of gratuity amount for the same:

Gratuity = (15 x last drawn salary x years completed in-service)/30

The dearness allowance and basic pay are included in calculating the last drawn salary.

Example: Nikhil was employed in Shop X for 16 years. The shop employed over eight people. Nikhil’s last drawn salary during this period was Rs. 30,000. This is what the gratuity amount calculation will look like:

Gratuity = Rs ( 15 x 30,000 x 15)/ 30

= Rs. 225,000

Gratuity Amount Calculation for Deceased Employees

As discussed above, an employee who passed away during their period of employment is eligible to receive the gratuity amount from their employer. The table is given below how the gratuity will be paid out based on the years of service:

| Years of Service | Gratuity Amount |

| Below 1 year of service | 2 x Basic Pay |

| Between 1 to 5 years of service | 6 x Basic Pay |

| Between 5 years to 11 years of service | 12 x Basic Pay |

| Between 11 years to 20 years of service | 20 x Basic Pay |

| More than 20 years of service | 50% of the salary for every six months of service up to an upper limit of 33 x emoluments |

Example: Nitin used to work in Company ABC for 22 years and six months before he passed away due to medical complications. His salary was Rs. 70,000 per month. This is what the gratuity calculation would like:

Gratuity = (70,000/2) x 45

= Rs. 15,75,000

Gratuity Amount Calculation for Retired Employees

According to the official government pensioner’s website, the gratuity amount for retired individuals is calculated based on 1/4th of the last drawn salary for every six months of service. It is limited to a maximum of Rs. 20 lakhs.

Tax Exemptions on Gratuity

According to the policy amendments announced in the 2016 Union Budget, this is what the taxation structure for the gratuity amount looks like:

- Article 10(10) of the Income Tax Act states that the gratuity amount by government employees is exempt from income tax.

- Article 10(10)ii of the Income Tax Act dictates that any gratuity received with respect to death and retirement received by an employee is the lower of the following that is exempt from income tax:

○ (15/26) x Last drawn salary x years of service.

○ Rs. 20 lakhs.

○ Gratuity amount received.

FAQ’s About Gratuity Amount:

Q1. If I resign from a company after 4.5 years, am I eligible for gratuity?

Ans: No, you must complete five years of uninterrupted service to be eligible for gratuity from the organisation. However, a Madras High Court ruling stated that you could claim gratuity if you have completed 240 days in your 5th year of service.

Q2. I am a contractual employee; am I eligible for gratuity after five years of service?

Ans: You will be eligible for gratuity if you are considered an employee and are on the company’s payroll. However, if you are not on the company’s payroll, the contractor should pay the gratuity.

Q3. What is the maximum gratuity amount I can get?

Ans: The maximum gratuity you can receive from a company is Rs. 10 lakhs, irrespective of the number of years in service. If the company wishes to pay more money, it can be titled under bonus or ex-gratia.

Q4. How to elect a nominee for gratuity?

Ans: You can select a nominee for gratuity by filling out Form F while joining the company.