To understand the system of taxation you should also be aware of the products that are exempted and the products which are taxed under GST. The range of products has widened under the scope of GST and hence there has been a clear distinction with the GST exempted goods. For a better understanding of the concept only the knowledge of the list of exempted goods under GST is not enough, you should also have the awareness about the implications of the products and services exempted from GST. Additionally, the goods which are rated NIL today might also be charged at a much higher rate of tax in the future.

Increase your knowledge by clearly understanding the different terms like NIL rated, Zero-rated, Exempt & Non-GST supplies which are some of the important concepts of GST. It will help you get a greater insight into the GST exempted goods.

What is an exempt supply?

The following 3 supply types come under the exempt supply:

- Supplies that are taxable at 0% (which is called the NIL rate of tax*).

- By the amendment of Section 11 under CGST (Act)/the 6th Section of the IGST Act, the supplies are partially or wholly exempted from IGST or CGST.

- The supplies which are listed under Section 2(78) are non-taxable – these are the supplies that are included in the list of exempted goods under GST under the provisions of the Act (like the alcoholic liquor which is used for consumption by humans).

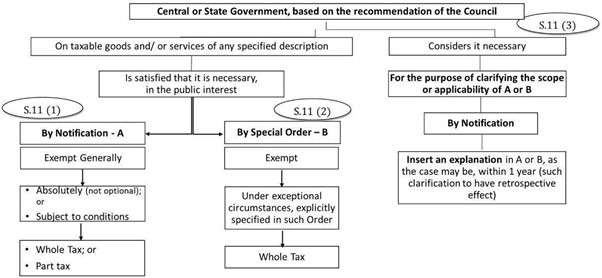

You do not have to pay taxes on the above supplies. The tax credit input related to exempt supplies is not available for setoff/utilization. *The zero-rated supplies (like exports) will not be considered as the supplies which are taxable at the ‘NIL’ rate. Only the Government of India and the State Government are in power to grant the exemptions of GST. The conditions applicable are:

- The exemptions granted must be in the interest of the public.

- Must be in the form of a notification issued.

- It must come as a recommendation from the Council of GST.

- Any conditional or absolute exemption can be possible for any type of good or service.

- Under some exceptional circumstances, the exemptions can be granted through special order (it does not have to be a notification).

- The registered person who supplies the goods or services does not have the right to collect a higher tax than the rate, which is effective, especially when the supply has an absolute exemption.

Classification of Exemptions

Exemption to the supplier – There is a provision in the Act to make an exemption for the person who is producing the supplies (which is the supplier); the category of the outward supply is not considered. For example, the SEBI services, and the services provided by the charitable entities.

Exemption to certain supplies – The supplies of a particular type and nature are also exempted from GST. Provided, all the supplies which are mentioned in the notification will be entitled to exemption. It does not matter who the supplier is, the exemption is provided. For example, the services which are provided by the sponsorship of the sports events or public conveniences.

Types of exemptions

There are three types of exemptions in GST:

- Absolute – when the exemptions are made without any condition then it is an absolute exemption. The RBI services come under this category.

- Conditional – when certain conditions are levied on some exemptions. For example, the services provided by clubs, hotels, etc., provided the statement of an accommodation unit which is less than ₹1000 per day.

- Partial: when there are some unregistered persons who supply the goods within different states to any registered person. Such persons can enjoy the exemption of tax under the reverse charge, provided the total value of the supply should not be more than ₹5000 a day.

Exemption under one GST Law and the effect on another GST Law

| Exemption under the CGST Act | Deemed to be exempted under the UTGST/SGST Act |

| No provision for automatic application of the exemption under the IGST Act | |

| Exemption under the IGST Act | No provision for automatic application of the exemption under the CGST Act |

Important Notifications issued for exemption from payment of GST

|

Notification No. |

Particulars |

| 02/2017 Central Tax (Rate) dated 28.06.2017 | Exempted supplies of around 149 items of goods in terms of Section 11(1) of the CGST Act, 2017. Ex. Electricity, Salt, fresh fruits, plastic bangles, passenger baggage, etc. Amended vide Notification No.28/2017, 35/2017,42/2017, 7/2018, 19/2018 – Central Tax (Rate) |

| 12/2017 Central Tax (Rate) dated 28.06.2017 | Exemption to supply specified services under the CGST Act. More or less, all the exemptions were available earlier under the erstwhile service tax law Amended vide Notification No.21/2017, 25/2017, 32/2017 and 47/2017, 2/2018 – Central Tax (Rate) |

List of Goods Exempt

Services, goods, businesses, individuals, and supplies are required to register under GST, but it is necessary that they are able to fulfill some conditions. However, as everything is there are a few exceptions to this act. Find below a complete list of the businesses, items & taxpayers who are eligible to avail of the exemption of tax in the GST Act.

These categories of taxpayers do not have to register for GST:

- Individuals who belong to the threshold exemption limit.

- Exempt suppliers of goods and services.

- Any person who is supplying non-GST services and goods.

- Taxpayers who are engaging in activities that are not related to the supply of goods and services.

- Those who are supplying the goods are covered under the reverse charge.

If you are a taxpayer and you come under the above list, then you are completely exempted from the GST tax.

GST exemption for small businesses and start-ups

Individuals who want to start a new business can avail of benefits under the GST scheme. Read the following points regarding the GST exemption for emerging start-ups.

- A business that has a turnover of fewer than ₹40 lakhs will be eligible to be a GST-exempted business.

- A composition scheme can be availed under the GST act by the businesses which have an annual turnover of less than ₹1.5 crores. This scheme allows these individuals to pay their taxes at a rate that is fixed. The taxes depend on the amount of turnover. This rate varies between 1 – 6%.

- Small businesses also do not have to e-invoice under GST. However, it is mandatory for businesses who have a turnover of ₹50 crores or more to actively apply for e-invoicing.

- The small businesses which have an income that is below the slap of ₹5 crores can choose the filing system which is quarterly.

It is quite visible from the above-stated points that small & new businesses can receive numerous benefits under the GST scheme.

List of exempted goods under GST

Find below the list of GSTS exempted goods in India:

- Dry and fresh vegetables like onions, potatoes, and leguminous vegetables.

- Fresh products like milk, egg, fish, etc.

- Ginger, melons, grapes, unroasted coffee, garlic, unprocessed green tea leaves, etc.

- Food items that are not packed in containers that are branded like wheat, rice, corn, cereal grains, etc.

- Human blood

- Unspun fibers like jute, khadi fiber, raw silk, etc.

- Handloom, chalks, slates, hearing aid manufacturing parts, etc.

Please note that certain items after being processed are bound to attract GST on them.

Exempted Services Under GST

There are several services exempted from GST. Have a look at the list of exempted services under GST:

- Services related to agriculture like packaging, harvesting, warehouse, lease of machinery, supply, cultivation, etc., are exempted from GST. Horse rearing is not included in these services.

- Metro, auto-rickshaws, metered cabs, and other public transportation are the services that are exempted from GST.

- Transporting/Exporting goods and agricultural products from India.

- The supply of labor for farms.

- Transportation of goods in which the charges levied is not more than ₹1500.

- Waxing, pre-conditioning, retail packing, and other services.

- Government, diplomatic and foreign services.

- Educational and healthcare services like VET clinics, mid-day meal services, paramedics, etc. Charity and other ambulance services are also exempted under GST.

- The services which are offered by the IRDAI, RBI, State, and Central Government, NPS, etc.

- Basic Saving Bank Deposit (BSBD) account and other banking services are included under the Pradhan Mantri Jan-Dhan Yojana (PMJDY).

Additionally, services like sports organizations, religious ceremonies, libraries, and tour guides also come under the list of exempted goods under GST. But you might be wondering why these services and goods are exempted from the GST registration? In addition to knowing the list of these services and goods, you should also be aware of the reasons for which these are exempted. We have already mentioned above the various circumstances and reasons for which the GST is exempted in certain cases.

If you are aware of these conditions and you know that you qualify for the exempted services under GST, then you will be able to get yourself registered under GST without it being a task.

Treatment of ITC if supply is exempted

In the case of exempt supplies, the credit amount related to the exempt supplies will be reversed.

What is a non-taxable supply?

The supply of services or goods or both on which the tax is not levied under the IGST Act or the CGST Act. A transaction must be a ‘supply’ by the definition of the GST law to be able to qualify as a supply that is non-taxable under the provisions of the GST.

Please note that in this definition only the supplies which are not included in the arena of taxation under the provisions of GST are covered. The supplies like alcoholic liquor used for human consumption, articles which are listed in Section9(2) or in the schedule III.

Also, keep in mind that these items are not completely out of the scope of the provisions of the GST Act. This means that their GST Rate is not announced, or the notification is not sent.

- Petroleum crude

- High-speed diesel

- Petrol or motor spirit

- Natural gas

- Turbine fuel for aviation

Negative list under GST

- Services provided by the employee to the employer while employment

- Services of burial, funeral, mortuary, or crematorium

- Sale of the land

- Sale of the completed buildings

- Actionable claims (except betting, lottery, and gambling)

- Services by Tribunal or a court

- Functions performed by MLAs, MPs, etc.

- Any duty performed by a person who holds a post in the pursuance of the provision provided by the Constitution.

Difference between Nil Rated, Exempt, Zero Rated, and Non-GST supplies

| Supplies | Meaning |

| Nil-rated | Supplies that have a 0% GST tax rate. For example jaggery, salt, etc. |

| Non-GST | The supplies that do not come under the jurisdiction of the GST law (alcohol for human consumption) |

| Zero-rated | The export supplies made to SEZ/SEZ developers (Special Economic Zones) |

| Exempt | The supplies which are taxable but do not attract GST. Fresh foods like fruits, curds, etc. |

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

Which is the GST exempted Goods?

GST is not applicable on products like bread, curd, fresh fruits, milk, etc. Supplies and exports made to SEZ or the SEZ developers include both services and goods. Jaggery, salt, grains, etc. Natural gas, alcohol consumed by humans, electricity, petrol, and its various products, etc.

What are the 3 types of GST?

These are the 4 types of GST that are applicable in India

• CGST (Central Goods & Services Tax)

• SGST (State Goods & Services Tax)

• UGST (Union Territory Goods & Services Tax)

• IGST (Integrated Goods and Services Tax)

Is rice exempted from GST?

The rice manufacturers who sell rice under a registered brand name must pay a GST at the rate of 5% on the sale of rice. But if they sell the rice in the name of the registered brand then they will be exempted to pay the GST. It comes under exempted goods under GST.

On which goods is GST applicable?

GST is only applicable on processed, packaged, and semi-processed food items. The GST levied ranges from 5% to 18%. Fresh food comes under GST exempted goods. Currently, no food items are listed in the 28% tax slab, and products like cakes, chocolate are listed in the 18% tax slab.

Who has the powers to grant exemption from payment of taxes?

Only the Government of India has the authority to provide an exemption from the GST. By producing a notification, the government can grant the exemption from the GST on the recommendations of the GST council.