With GST within reach, it becomes extremely crucial for vendors to count on consistent invoicing as per the GST norms. If as a seller or service provider you don’t want to encounter any roadblocks, then issue the applicable GST invoices on time as it is a true usher for the businesses. Are you new in this field and everything seems to be bewildering? Well, feel free as we got you covered. In this brief guide to GST invoices, you will have a rundown of the GST bill format, GST invoice rules, types of invoices, and much more. Keep scrolling and know everything you were looking for.

Table of contents

- GST Invoice: What Do You Mean by GST Invoice Bill?

- Who Issues the GST Invoice?

- Inescapable Fields of GST Invoice:

- GST Invoice Bill Format:

- What Is the Time Limit to Issue the GST Invoice?

- Essential GST Invoice Rules:

- Minimal Amount for Which an Individual is liable to Raise a GST Invoice:

- URD Based Purchase: Reverse Charge Invoice

- Manage Advance Payments: Receipt Voucher

- Manage Exports Efficiently: Export Invoice

- Manage Special Deliveries: Delivery Challan

- Manage Revisions in the Previously Issued Invoices: Debit Note or Credit Note

- Other Types of GST Invoice:

- Are the Invoices Issued Before GST are Revisable?

- Frequently Asked Questions (FAQ’s)

GST Invoice: What Do You Mean by GST Invoice Bill?

A GST invoice bill is a listicle of provided goods and services together with the pending amount of payment. Supplier of goods and services issues a GST Invoice Bill to the buyer for the offered services. In general, the GST bill format embraces notable contrivances such as the name of the tangled parties in addition to the details of offered goods and services. Apart from the involved parties, it comprises of the following essentials:

- Name of the product

- Product description

- Quantity of offered goods or services

- Details about the involved parties i.e., seller and buyer

- Terms and conditions of the endowed services

- Date of purchase

- Cost of each product or service sold and rendered

- Offred discount

The GST bill orients around these specifics. In general, the GST bill format includes details about particulars of the seller, buyer, goods, and services. After going through what is GST invoice and the basics of the GST invoice bill format, let’s look into who is responsible to issue a GST bill.

Who Issues the GST Invoice?

When a person owns a GST registered business, then he becomes liable to issue a GST invoice in applicable GST invoice format. The seller is supposed to issue the bill in the name of the buyer for every deal done between the two parties. The GST registered trader provides the GST purchase invoices to the buyer for the availed services.

Inescapable Fields of GST Invoice:

Every invoice or bill has its predefined format and the same applies in the case of GST bill. When the trader prepares the invoice, he has to follow the depicted GST invoice bill format.

The below-depicted pointers are inescapable when it comes to GST bill:

- An input distributor is responsible for issuing the bill

- Along with the main bill, all the correlated bills and invoices has to be mentioned

- If the supplier has made any changes in the generated invoice, then that has to be mentioned too.

In addition to the mentioned fields, the GST tax invoice should also comprise certain particulars including:

- GSTIN, seller’s name, and residence address who will issue the GST invoice.

- Date of invoice issuance.

- A 16-digit GST invoice number is unique for every invoice.

- If the buyer is a registered recipient, then the GST bill will also consist of the name, address, and GSTIN of the receiving person too.

- A brief description about the availed services or goods together with the products HSN code.

- Applicable discount, if offered by the seller on these taxes.

- Tax amount.

- Valuation of the bill.

- Imposed rate of CGST, SGST as well as IGST will be mentioned in the GST bill format.

- Address and other information of the seller.

- Address and other information of the buyer.

- Applicable reverse charge/ forward charge based upon the procured goods or services.

- The mandatory part to authenticate this bill is the signature of the issuer/ sole authorized representative.

It might look a bit clumsy after knowing the format in points. It was to portray a rough picture of the GST bill format across your eyes. Now, let’s have a look at how tax invoice GST bill format actually looks like.

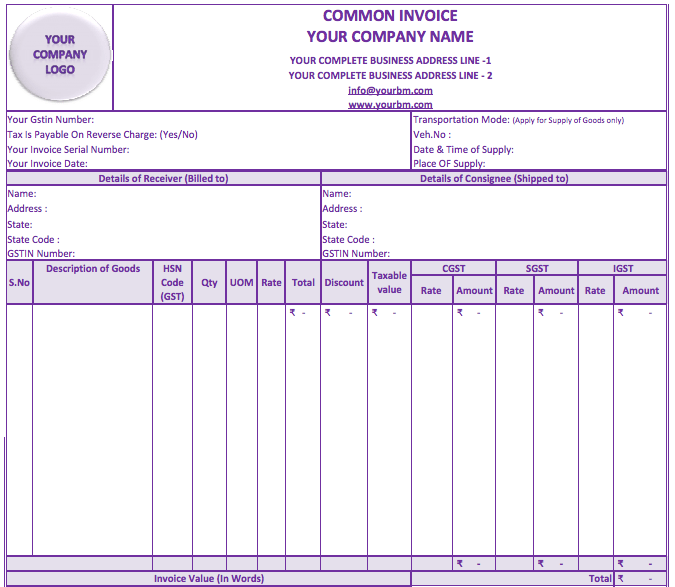

GST Invoice Bill Format:

Although the format may vary from one supplier to the next. So, if you receive a different one don’t consider it as an inappropriate one. Nevertheless, the basic information of all such invoices must match with the depicted details:

| Tax Invoice | Date: | ||||||||

|

Vendor Name: GSTIN: | Address: | ||||||||

| Billing Address: | Shipping Address: | ||||||||

| Serial No. | Item Description | HSN | Quantity | Per Item Rate | Total | Discount | Taxable Amt | CGST (9%) | SGST (9%) |

| 1. | A | 5 | INR 40 | INR 200 | Nil | INR 200 | INR 18 | INR 18 | |

| 2. | B | 7 | INR 25 | INR 175 | Nil | INR 175 | INR 15.75 | INR 15.75 | |

| Total | INR 375 | INR 375 | INR 33.75 | INR 33.75 | |||||

| Tax Invoice Value | INR 442.50 | ||||||||

| Tax Amount Subject to Forward/Reverse Charges |

Regarding this GST invoice sample, you can check if the invoice offered by the seller is appropriate or not. If it comprises all the embraced fields then go with it else check the vendor’s authenticity. After going through the GST bill sample the next mandatory point you must know about is when these invoices should be issued.

How Does the GST Bill Book Format Exactly Look?

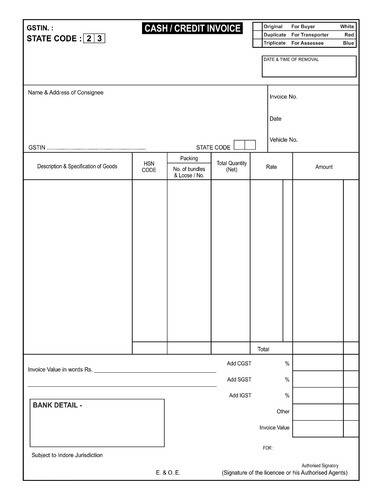

If you are looking for the legitimate GST bill book format then here are some GST bill images which will offer a clear idea about how to make GST bill.

IGST bill format:

Here is a sample of how the IGST bill format usually looks:

After having references about GST bill book format it is clear you can’t generate invoices for buyers without GST bill format. So get your business GST bill book design and issue your buyers required GST invoices for the supply of goods.

When Does the Supplier Issue GST Invoice Bill?

People usually think that they should receive their GST invoice bill as soon as they receive the items at their place. Well, things don’t work this way. It is bewildering to generate GST bills as soon as the goods are shipped. Taking it into consideration and to ease up the matter, the Indian Government has set a time limit for the suppliers to follow.

- On Goods (One Time)

As a goods supplier, you are supposed to generate such a bill on or prior to the day of transfer of mentioned products. Under Section- 2 (96) of the CGST Act, 2017, when we say the transfer of goods or removal of goods, we mean:

- Goods dispatched for the shipment purpose to the buyer/recipient.

- Goods are collected by the buyer from the seller. Any authorized person by the buyer can collect the goods on his behalf.

- On Goods (For Continuous Supply)

If the bill concerns a buyer who maintains continuous business orders from the same supplier, then the supplier is permitted to issue the bill on or prior to the day when the payment is made. This is applicable only in the case of continuous supply.

- On Services

The provider has to issue the GST invoice bill for the services within 30 business days from the day when service is provided.

- On Bank & NBFC Services

If you have availed of financial services from the banks in addition to financial institutions, then you will get your issued invoice within 45 days of the availed services. Unlike other service providers, banks and financial institutions are not liable to issue the GST invoice within 30 days of the service supply.

What Is the Time Limit to Issue the GST Invoice?

Each service provider and goods seller has a time limit within which he has to issue the invoice to the buyer. No matter if you are a seller or buyer you should be familiar with the applicable tenure to receive and provide GST bills on time.

| Supply of Goods | Supply of Services |

The seller is liable to issue tax invoice before/ at the moment of:

|

The seller must issue the tax invoice within:

|

Essential GST Invoice Rules:

There is a specific set of GST invoice rules that the traders should follow to safeguard themselves from any sort of penalties. Here is a rundown of GST invoice terms and conditions India which are inescapable being a GST registered supplier or recipient.

Minimal Amount for Which an Individual is liable to Raise a GST Invoice:

The seller doesn’t need to issue any bill if the overall amount of supplied products and services is less than 200. Additionally:

- The buyer is not a GST registered buyer

- The buyer doesn’t ask for an invoice

In case if the recipient asks for the same then the seller becomes liable to issue the invoice.

Although, the seller has to prepare a consolidated invoice/ aggregate invoice by end of the day for all the supplies for which the tax invoice wasn’t initially issued.

URD Based Purchase: Reverse Charge Invoice

When a GST registered buyer, purchases goods or avail services from an unregistered seller, the buyer becomes liable to pay the imposed tax. Additionally, he is supposed to issue an invoice the same day he receives the said product or service.

Manage Advance Payments: Receipt Voucher

When a GST compliant trader receives payment in advance from the buyer for the promised deal, then the supplier must consider issuing a receipt voucher. This is done to acknowledge the advance payment made by the buyer.

Manage Exports Efficiently: Export Invoice

An export invoice usually comprises certain essentials apart from the one present on the GST invoice. These are:

- Should include must-have words mentioned within the GST bill book.

- Recipient’s name as well as address

- Destination country

- Address of delivery

Manage Special Deliveries: Delivery Challan

Delivery Challan is usually issued by the seller in specific business cases, including:

- Liquid gas supply, especially when the exact quantity is not known during the removal time

- Transportation of products for job purposes

- Transportation of products for other reasons except for supply

- Other notified supplies

Manage Revisions in the Previously Issued Invoices: Debit Note or Credit Note

For revising the aforementioned taxable values, the seller has to issue either a debit note or a credit note based upon the correlated changes.

- Debit Note: Also known by the name of the supplementary invoice, it is used when the seller has to increase the charged taxable value within the original invoice.

- Credit note –Such invoices are issued by the seller when the taxable amount has to be decreased from the original invoice. Although, the seller must issue the credit note prior to or on 30th September. This must be done within the same financial year when the supply was made.

Details that the Debit Notes and Credit Notes must comprise of:

- The applicable nature of the GST invoice as in ‘revised invoice’ and ‘supplementary invoice’ should be prominently indicated.

- Clearly mention the name of the supplier along with the address, and GSTIN.

- Should have a consecutive serial number. It should only contain alphabets, numeric along with the special characters including hyphen and slash. This number is unique for each financial year.

- The date on which the document was issued.

- In the case of GST registered recipient mention the name, residence, and GSTIN in addition to the Unique ID no.

- In case of an unregistered recipient mention the name, residence, and delivery address. Additionally, it must contain the state name and its related code.

- The serial number of the original invoice of supply and date of issuance.

- Taxable value, applicable tax rate, and the value debited or credited by the seller.

- The supplier’s signature or the signature of the authorized representative mentioned by the supplier.

Other Types of GST Invoice:

Apart from the credit note and debit note GST invoices, there are certain more invoices you must be familiar with to enjoy seamless invoice processing. The two crucial types are bill of supply and aggregate invoice.

Bill of Supply:

Usually, the bill of supply is somehow similar to the GST invoice apart from the fact that the tax amount isn’t present on the bill of supply. It is so because the seller isn’t permitted to charge GST to the purchaser.

A bill of supply will be issued in specific cases where the seller cannot charge GST:

- The registered vendor is selling the exempted products and services,

- The registered vendor has availed of the composition scheme

Invoice-cum-bill of supply:

As per the Notification No. 45/2017 posted by the Central Tax on 13th October 2017: If a GST registered compliant supply taxable goods that are exempted to an unregistered buyer, then an “invoice-cum-bill of supply” will be issued for all supplies.

Aggregate Invoice:

In the event of invoices having values less than INR 200 and at the same time if the recipient is non-GST registered, the supplier is liable to issue bulk invoices. The seller can release multiple invoices on a daily basis.

For instance, the seller has issued three invoices in one day of INR 80, INR 90 as well as INR 120. Through aggregate invoice the seller can issue a single invoice, enlisting an overall amount of INR 290. There is no need to issue multiple invoices.

Are the Invoices Issued Before GST are Revisable?

Yes! The seller is permitted to revise the invoices issued prior to GST. As per the GST regime, the dealers are supposed to avail of provisional registration. Then only the suppliers can get their permanent registration certificate.

The vendor should issue the revised invoice for each previously issued invoice. The seller has to reissue the invoice within 30 days from the date when the previous invoice was issued.

Invoice Copies to Be Issued by the Seller:

The number of invoice copies to be issued depends upon the seller. It is different for goods and services. In the case of goods supplied the seller has to prepare three copies of the GST invoice. Whereas, for the provided services the seller only has to prepare two copies of the invoice.

Additional Details about GST Invoice:

- In the event of ceasing the supply of goods or services under an agreed contract prior to the complete supply, the supplier has to issue the invoice at the time of cease. The invoice will comprise of tax amount against the supplied goods or services.

- The seller can generate the GST invoice either electronically via computer or manually through GST bill books.

- If the seller fails to issue an invoice as per the aforementioned rules then he is liable to pay a penalty of INR 25,00.

Bottom Line:

The GST invoice bill is a vital document that makes the deal between buyer and seller more promising. It not only acts as a piece of evidence but at the same time adds to Input Tax Credit benefits. By now you know the exact GST bill format that you should follow to avoid hurdles at later stages. As a supplier knows exactly when the invoice must be issued for a better customer experience. You are all set to crack your deals effortlessly by being stress-free about the GST complaints.

You May Also Like

Frequently Asked Questions (FAQ’s)

What is the GST invoice format?

As per the rules under the GST Act, the seller has to mention certain fields and these are inescapable.

- Date of supply and Invoice number

- Name of seller and buyer

- Billing Address along with the Shipping Address

- GSTIN of seller and buyer( in case of the registered buyer)

- Location of supply

- HSN Code of the product

- Quantity of goods, description along with other relevant details

- Taxable value and offered discount

- GST rates and applicable CGST/SGST/IGST taxes on the purchased items

- A signature or digital signature of the supplier.

Is there any difference between the invoice date and the due date?

Yes, both of them depict distinct values. The invoice date depicts the specific date on which the invoice was created within the bill book whereas the due date refers to the date on which payment is due.

How an invoice is issued under reverse charge?

If the GST is applicable under reverse charge, then the invoice must include the term GST paid against the reverse charge. No matter what type of invoice the supplier issues as per the offered services, all he has to do is mention it specifically.

Is it essential to maintain an invoice serial number?

Yes, the invoice serial number is quite essential as it falls in the mandatory field of the invoice. Although, the seller can change the bill format by filing a written intimating in the favor of the GST department officer. Additionally, you do have to mention a genuine reason for the same.

What is the use of the GST invoice bill?

Under GST, a GST invoice bill is a vital document. It acts as evidence for the supplied goods and provided services. Additionally, it plays a crucial role for the buyer for availing benefits of Input Tax Credit (ITC). However, a registered individual can’t take benefits of ITC until he/she is in the possession of a GST bill or a debit note.

Who can issue a GST invoice?

The supplier is liable to issue the GST invoice for the supplied goods exceeding the amount of INR 200. In case the seller is registered with Goods and Service Tax then regardless of the value of the supplied goods the seller has to provide an invoice to the buyer.