GST is considerably the top-notch taxation reform that India has encountered since Independence. The key idea was to bring uniformity within the overall taxation structure. Additionally, it caters to the elimination of the cascading taxes levied in the past. Everything in GST orient around GST rates. GST Rates in India are distinct for goods and services based upon the GST slab rate they fall within. Being familiar with GST is vital yet confusing. Thus, to ease up everything for you we have encapsulated the GST rate list for numerous goods and services including the gold GST rate along with the revised information. The GST council keeps revising the GST rates to ensure everything remains seamless. The GST announcement rushed a revolutionary experience into the world of industries and trade departments. The event welcomed swarms of speculations by traders on the long-term ramifications of this structural taxation. We are now going to open our acknowledgement to the current GST rates in India and the tales of GST revision the country has undergone.

Table of contents

- What is GST (Goods and Services Tax)?

- What are the GST Slab Rates?

- GST Rates in India- The Revision into Relaxation

- A Peek into the GST Council Meetings

- Revision of GST Rates in the 47th GST Council Meeting

- Revision of GST Rates in the 44th GST Council Meeting

- Revision of GST Rates in the 43rd GST Council Meeting

- Revision of GST Rates in the 42nd GST Council Meeting

- Revision of GST Rates in the 41st GST Council Meeting

- Revision of GST Rates in the 40th GST Council Meeting

- Revision of GST Rates Declared Within the 39th – GST Council Meeting

- Revision of GST Rates Declared Within the 38th – GST Council Meeting

- Revision of GST Rates announced on the 37th GST Council Meeting

- Revised GST Rates Declared on the 36th GST Council Meeting

- GST Rates Chart for Quotidian Commodities

- Impact of GST Rate on Indian Economy

- In a Nutshell:

- Frequently Asked Questions (FAQs)

What is GST (Goods and Services Tax)?

GST is a multilevel tax system that leads to comprehensive tax practice. This tax is applicable to the sale of goods and services. The major objective of this taxation system is to keep a tight reign over the gush of indirect taxes. GST is applicable throughout India.

The Slabs in GST are detected by the GST Council. The Council performs the revision of the rate slab of goods and services from time to time. Know that the current GST rates are notably high on luxury goods and services and low for basic needs. The GST for various goods and services comes divided into four slabs in India and they are 5% GST, 12% GST, 18% GST, and 28% GST.

Ever since the institution of Goods and Services Tax, the rates on a number of products and services have been undergone modification several times in the past by the GST council. The latest rate revision was performed at the 47th GST Council meeting in June 2022

New GST rates from 18th July

Nine Central Tax notifications were issued by the government which is set to come into effect from 18th July 2022. The new GST rates exhibit a withdrawal on exemptions for some daily essentials. A notification was furnished by the government concerning the updated rates for the items that withstood an inverted tax structure.

What are the GST Slab Rates?

GST has been organized in a unique manner to ensure that all notable services along with the food commodities fall within the low tax brackets, whereas an array of luxury products/ services fall within higher tax brackets.

The GST council made its foremost attempt by fitting about 1300 goods in addition to 500 services into four distinct slab rates. These GST slab rates are categorized as 5%; 12%; 18%; and 28%. Moreover, the levied GST on gold is 3 %. At the same time, only 0.25% of tax is levied on precious and semi-precious stones.

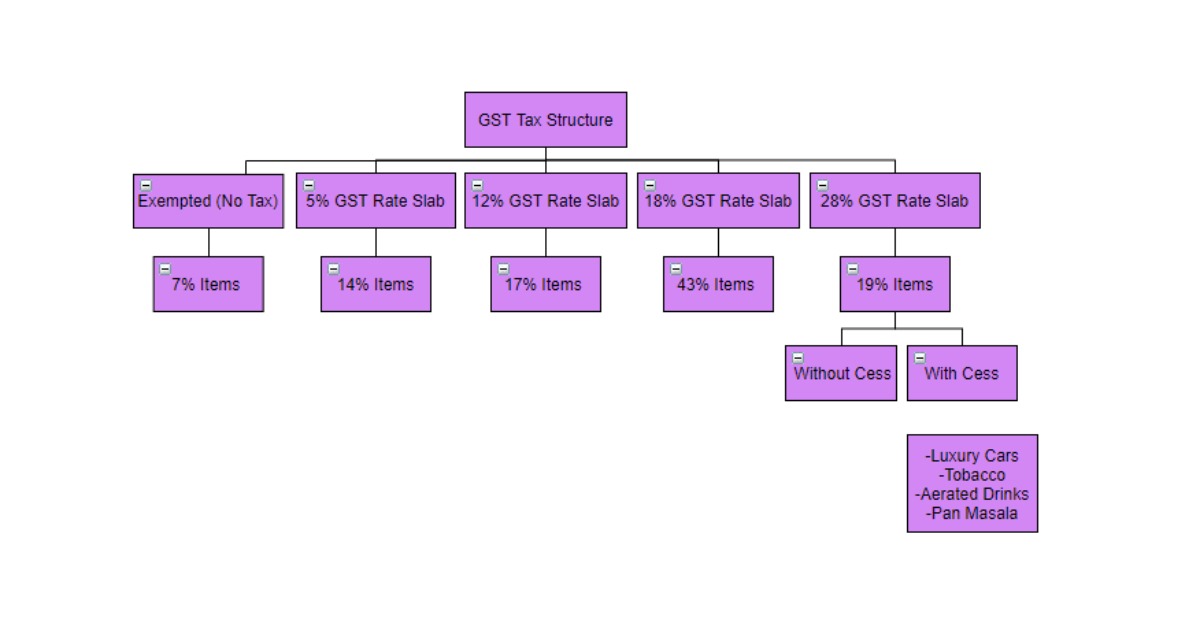

In total 81 percent of the entire range of products & services fits below or under the 18 percent tax slab. This implies just 7 percent of the goods are enlisted within the exempted list. About 14 percent of commodities attract the slab rate of 5%, 17 percent of commodities attract the slab rate of 12% tax. Additionally, 43 percent of the commodities fall under18 % tax slab, whereas just 19% of the commodities attract the highest slab rate that is 28%.

GST Rates Based upon Slab Rate Division for Common Commodities:

| GST Rate list | Common Products |

| 5% | Household requisites including edible oil; sugar; spices; tea along with coffee apart from the instant ones. Additionally, coal, sweets, life-essential drugs also fall in this GST slab. |

| 12% | Items such electronic devices (computers) as well as processed food |

| 18% | Commodities including hair oil; toothpaste; soap; capital goods in addition to industrial intermediaries fall under this slab rate. |

| 28% | This slab rate is specifically designed for luxury commodities including cars; client durables sucha AC; Refrigerators; premium cars; cigar; aerated drinks; and top-notch motorcycles. |

Exempted – GST Rate Slab

This rate slab embraces items that are exempted from GST tax. Here is the list of items that falls in no tax category:

- Fruits and vegetables

- Milk and Dairy Products: buttermilk; curd

- Honey

- Flour and Besan

- Bread

- Salt

- Jaggery

- Hulled cereal grains

- Meat; Fish; Chicken; Eggs

- Drawing books as well as coloring books

- Stamps; Judicial papers

- Printed books; Newspapers

- Jute & Handloom

- Hotels/ lodges charging tariff less than INR 1000

5% – GST Rate Slab

Below depicted items fall in the category of 5% GST rate slab:

- Apparels with printed price less than INR 1000

- Footwear costing less than INR 500

- Packed food products

- Cream; Skimmed Milk (powder); Paneer

- Vegetables (frozen)

- Coffee; Tea; Spices

- Pizza Bread; Rusk

- Sabudana

- Cashew Nuts; Raisin

- Fish Fillet

- Coal

- Ice

- Kerosene

- Revenue Stamps

- Fertilizers

- Railway tickets; Air tickets (economy class)

- Small Restaurants

12% – GST Rate Slab

Following products fall within the category of 12% GST rate slab:

- Edibles including frozen meat items

- Dairy products such as butter; cheese and ghee

- Dry fruits that are available in packed form

- Animal fat

- Sausages

- Fruit juices

- Namkeen

- Ketchup as well as sauces

- Ayurvedic medicines

- Diagnostic kits along with reagents

- Mobile phones

- Steel items such as spoons and forks

- Tooth powder

- Umbrella; sewing machine; spectacles

- Specific indoor games including cards, chess, carrom, ludo

- Apparels with printed price more than INR 1000

- Restaurants ( without air conditioners)

- Air ticket (business class)

- Lottery run by state government

18% – GST Rate Slab

Here is a rundown to notable items thats falls within 18% rate slab:

- Pasta; Biscuits: Cornflakes; Pastries; cakes

- Preserved vegetables

- Jams and soups

- Ice cream

- Mayonnaise

- Mixed condiments along with seasonings

- Mineral water

- Footwear with MRP above INR 500

- Camera; Speakers; Monitors; Printers; Electrical transformer

- Optical fiber

- Tissue paper; Sanitary napkins

- Notebooks

- Steel products

- Headgear along with the associated parts

- Aluminum foil

- Bamboo furniture

- Restaurants (fully air conditioned)

- Restaurants serving liquor

- Telecom services; IT services; Financial services

- Branded garments

28% – GST Rate Slab

Following commodities are clubbed together in 28% slab rate category:

- Chewing gum; chocolates without cocoa; waffles; chocolate coated wafers

- Pan masala

- Aerated water

- Items used for personal care such as Deodorants; Shaving Creams; After shave

- Shampoo; Dye; Sunscreen

- Paint

- Water heater

- Dishwasher

- Electronic devices such as weighing machine; washing machine; vacuum cleaner

- Automobiles and motorcycles

- Stays in 5-star hotel

- Betting in race club

- Private lottery

- Movie tickets having worth more than INR 100

GST Rates on Services Gleaned upon Slab Rate Division:

GST Rates for services are classified into five categories. First is NIL, these services are exempted from taxation.Rest services are categorised in 4 tax slab rates i.e. 5%; 12%; 18% and 28%. Here is a rundown of services as per the categorization of slab rates initiated by the GST council:

Exempted Services:

- Services that are chargeable and accessible while opening a Basic Savings Bank Deposit (BSBD) account in case of PMJDY – Pradhan Mantri Jan Dhan Yojana.

- Hotels offering accommodations with charges equal or less than INR 1000.

5% – Tax Slab

| Serviceable for venture printing newspapers | Goods imported in vessels from abroad to India | Renting a automobile ( cab) excluding fuel cost | Scheduled transport through air medium or airplane travel for pilgrimage purpose ( by relying on chartered flights or through non-scheduled flights) |

| Travel services | Leasing aircrafts for travel and other purposes | Print Media |

12% – Tax Slab

| Transportation of goods through rail containers when performed by third party apart despite Indian Railways | Air travel (business class) | Food and drinks offered at restaurants ( absence of AC or heating and liquor license) | Leasing of accommodation falling within the range of INR 1000 to INR 2500 for one day | Railway carriages; coaches; rolling stock (no refunds correlated with Input Tax Credit (ITC) |

| Building or home constructed with sale purpose | IP rights when applicable for temporary basis | Chit fund services offered by foremen | Hotel accommodation available between INR 1000 to INR 7500 on per day basis |

18% – Tax Slab

| Restaurants that have availed liquor license and offer beverages | Fully air conditioned restaurants offering food items and serving drinks | Outdoor-catering

services | Rent charges on accommodation that costs more than INR 2500 yet less than INR 5000 on per day basis | Hotel accommodation offered at price above INR 7501 on per day basis |

| Activities including Circus; Indian classical; folk; theatre and drama | Supply of works on contract basis | Movie Tickets costing above INR 100 | Food supplies in addition to party arrangement |

28% – Tax Slab

Fun, entertainment and adventure activities fall in this category of slab rate. Additionally, offerings provided by five star hotels are coupled within this slab rate.

| Entertainment services; adventurous events; amusement and water parks; joy rides; casinos; sport events similar to IPL | Race club – Services |

| Beverages offered at 5-star hotels | Gambling |

GST Rates in India- The Revision into Relaxation

GST holds prominence as the biggest tax-based reform in India, inhaling undeviating momentum in the structure of taxation and waving goodbye to the thunderstorm of taxes that were treated to the citizens in the past. In the meeting that is held timely, the GST council performs the revision of current GST rates for a number of products. These periodical meetings also observe the inputs from the part of several states and industries in the concern of GST tax rate reduction for various products.

A Peek into the GST Council Meetings

The first GST Council meeting was conducted on 22 and 23 September 2016. This meeting was dedicated to launching the GST on 1st April 2017. In this meeting, the regulation under the composition scheme, as well as the cap limit for tax payment, was announced. The second meeting which was held on 30th September 2016 decided the rules for taxpayers on the registration, returns and invoices, payment process and other concern.

Revision of GST Rates in the 47th GST Council Meeting

The 47th GST council conducted by the Union Finance Minister Nirmala Sitharaman took place at Chandigarh on 28th and 29th June 2022. The council granted withdrawal on exemptions for various mass consumption products and hiked tax rates on several goods and services with the aim to streamline the tax rate structure.

Changes in GST Exemptions

The 47th GST Council Meeting approved the withdrawal of GST exemptions on several products.

Exemption Withdrawn

| Goods and Service | Previous GST Rate | New GST Rate |

| Atlases, maps, and hydrographic charts of all kinds in printed format | Exempted | 12% |

| Bank charges on cheque issued | Exempted | 18% |

| Hospital beds whose rental charges exceed Rs 5,000 (Excluding ICU) | Exempted | 5% |

| Bio-medical waste treatment Facility | Exempted | 12% |

| Hotel rooms whose tariffs exceed Rs 5,000 per day | Exempted | 12% |

| Coaching centres for recreational activities operated by individuals | Exempted | Applicable Rate |

| Transportation of railway equipment and materials by train or vessel. Warehousing of commodities like copra, nuts, spices, jaggery, cotton, etc. | Exempted | Applicable Rate |

| Fumigation in agri-produce warehouse, GST registered businesses residential dwelling rent | Exempted | Applicable Rate |

| Components of goods featured in 8801 heading | Exempted | 18% |

| Labeled Food Items | Exempted | 5% |

| Tetra Packs | Exempted | 18% |

Products That Witnessed a Hike in GST Exemptions

| Petroleum/CoalBed Methane (CBM) | 5% | 12% |

| Technical and Scientific Instrument to Research Institutes funded by public | 5% | Applicable Rate |

| Electronic waste | 5% | 18% |

Changes in Inverted Tax Structure

The new GST rate change is visible in the below mentioned goods and services.

| Goods and Services | Old GST Rate | New GST Rate |

| Solar Heaters and systems | 5% | 12% |

| Chamois Leather, composition leather, finished leather and prepared leather | 5% | 12% |

| Work concerning with processing of leather, hides, skins. Leather products including footwear | 5% | 12% |

| Contract and Sub-contracts of government regarding the civil constructions | 5% | 12% |

| Air-based atta chakki, grading machines for pulses and seeds, wet grinder, miling and cereal making machines | 5% | 18% |

| Ink used for printing, drawing, and writing | 12% | 18% |

| Cutting blades, pencil sharpeners, paper knives, servers, spoons, forks etc. | 12% | 18% |

| Submersible Pumps, bicycle pumps employed to handle water, centrifugal pumps | 12% | 18% |

| Dairy machinery, cleaning, sorting, and grading machines use for agri produce | 12% | 18% |

| LED lamps, and metal printed circuit boards | 12% | 18% |

| Drawing and Marking Instrument | 12% | 18% |

| Foreman and chit fund services | 12% | 18% |

| Work Contracts and sub-contracts by authorities concerning pipelines, dams, canal, water supply plants, educational institutes and monuments | 12% | 18% |

Revision of GST Rates in the 44th GST Council Meeting

The revision of GST rates announced in the 44th meeting of the GST Council came with the revised rates for Covid-related essentials. Essentials such as hand sanitisers, pulse oximeters, equipment to check body temperature, ambulances, furnaces for cremation and installation now have the 5% rate. The rates on medicines for Covid and testing kits are also under the 5% slab now.

Coming to the current GST rates revision for oxygen and medical devices related to oxygen such as oxygen concentrator/ generator, ventilators, mask, canula or helmet, high flow nasal cannula device, and medical grade oxygen, the rate has been revised to 5%.

The meeting marked no revision on the Covid drugs such as Tocilizumab and Amphotericin. Other drugs like Heparin and other anticoagulants, remdesevir and any drug recommended by the ministry of health was finalised with a 5% rate.

GST Rates Pertinent To Covid-allied Essentials

| Covid-allied essentials | Old GST Rate list | Revised Rate |

| Oximeters | 12 percent | 5 percent |

| Sanitisers | 18 percent | 5 percent |

| Gadgetry to depict body temperature | 18 percent | 5 percent |

| Forge to cremate along with the installation furnaces | 18 percent | 5 percent |

| Ambulance | 28 percent | 12 percent |

GST Rates Applicable on Covid Medicament Along with Testing Kits

| Covid Medicament Along WIth Testing kits | GST Rate List | Revised Rate |

| Testing kits | 12 percent | 5 percent |

| Notable Inflammatory Kits for Diagnosis | 12 percent | 5 percent |

GST Rates Pertinent To Oxygen-Related Devices

| Oxygen and oxygen-related medical devices | GST Rate List | Revised GST rate |

| Medical-Grade-Oxygen | 12 percent | 5 percent |

| Oxygen Concentrators | 12 percent | 5 percent |

| Ventilators | 12 percent | 5 percent |

| Mask/ Canula | 12 percent | 5 percent |

| BiPAP Device | 12 percent | 5 percent |

| Device for Nasal Canula (high flow) | 12 percent | 5 percent |

GST Rates Applicable On Covid-Allied Drugs

| Covid-Allied Drugs | GST Rate List | Revised Rate |

| Tocilizumab | 5 percent | – |

| Amphotericin B | 5 percent | – |

| Heparin and other anti-coagulants | 12 percent | 5 percent |

| Remdesevir | 12 percent | 5 percent |

| Other Required Drugs as per the Recommendation of Health Ministry | Not Applicable | 5 percent |

Revision of GST Rates in the 43rd GST Council Meeting

In the 43rd GST Council meeting, the GST on the export of relief goods was announced exempted which will remain in effect until 31 August 2021. Import of medicine for the black fungus disease was also announced to be in effect under the list of exemptions. Any relief item associated with Covid, in case it is imported as a donation to the government or a relief organisation, was also announced to be exempted till 31 August 2021.

The finance minister announced the Amnesty Scheme which was to reduce late fee returns. Small taxpayers were given the room to file returns under this scheme. Apart from that, the decision to form a group of ministers was taken which will help determine if the rates should be increased or decreased.

Revision of GST Rates in the 42nd GST Council Meeting

In the meeting conducted on 5 October 2020, it was decided that the small taxpayers (turnover of less than Rs.5 crore can file quarterly GSTR-3B as well as GSTR-1 in which the due date for GSTR-1 will be the 13th day of the month following the quarter. The rule was brought into effect on 1 January 2021. As a result of its implementation, the count of returns was reduced from 24 to 8.

Besides that, the quarterly taxpayers were given the option for paying 35% of their net tax liability from the previous quarter through an auto-generated receipt for the first couple of months of the quarter.

Revision of GST Rates in the 41st GST Council Meeting

The 41st GST Council meeting, chaired by the Union Finance Minister Nirmala Sitharaman, was held on 27 August 2020. In this meeting, it was announced that the government will offer an additional relaxation of 0.05% in states with the borrowing limit under the FRBM Act. It was decided that the states can avail more money in case of any injury that has been caused by the COVID-19 outbreak.

Revision of GST Rates in the 40th GST Council Meeting

The 40th GST Council meeting, chaired by the Union Finance Minister Nirmala Sitharaman, was held on 12 June 2020. In this meeting, it was decided to have no late fee levied for taxpayers that belong to the nil tax liability group. If taxpayers file the returns within 1 July 2020 to 30 September 2020, the maximum late fee of Rs 500 can be charged. For small taxpayers who have an aggregate turnover of up to Rs.5 crore, the interest rate has come down from 9% to 18% p.a. on GST returns filed for February to April 2020. The returns are to be filed before 30 September 2020.

Revision of GST Rates Declared Within the 39th – GST Council Meeting

Within the 39th GST Council Meeting notable amendments were made. Below-depicted table contemplates the applicable rate change:

| Commodities | Revised Rate | Existing Rate |

| Handmade Safety Matches | 12 percent | 5 percent |

| Cell Phones | 18 percent | 12 percent |

| Entire Range of Handmade Matches | 12 percent | 18 percent |

| Aircraft MRO-Services | 5 percent together with ITC | 18 percent |

These revised rates were announced 14th March 2020, and will be applicable on mentioned commodities from 1st April 2020.

Revision of GST Rates Declared Within the 38th – GST Council Meeting

The below-depicted table represents the changes as per the revised rates:

| Commodities | Revised Rate | Existing Rate |

| Polythene & polypropylene sacks | 18 percent | 12 percent |

| State Lotteries (owned) | 28 percent | 12 percent |

| State Permitted Lotteries | 28 percent | 28 percent |

| Woven Fabrics and Non-Woven Fabrics | 18 percent | 12 percent |

These revised changes were announced on 18th December 2019. These revised rates were levied on the mentioned goods from 1st March 2020.

Revision of GST Rates announced on the 37th GST Council Meeting

These revised rates were announced on 20th September 2019. Here is a rundown of reflected changes based upon the newly introduced rates. These changes came into action from 1st October 2019 onwards.

| Items | Revised Rate | Old Rate |

| Tree products based items such as plates as well as cups | – | 5 percent |

| Caffeinated-Beverages | 28 percent in addition to 12 percent cess | 18 percent |

| Furnishing of railways wagons along with coaches ( non-presence of ITC) | 12 percent | 5 percent |

| Outdoor Catering (In absence of ITC) | 5 percent | 18 percent |

| Work correlated to Diamond making | 1.50 percent | 5 percent |

| Other job related works | 12 percent | 18 percent |

| Hotels enlisting room tariff of equal or above INR 7501 | 18 percent | 28 percent |

| Hotels enlisting room tariff in the range of INR 1,001 to INR 7,500 | 12 percent | 18 percent |

| Packaging bags prepared from Polyethylene | 12 percent | 18 percent |

| Marine-Fuel | 5 percent | 18 percent |

| Milk (Almond) | 18 percent | – |

| Slide fasteners | 12 percent | 18 percent |

| Grinders (comprising of stone in terms of a grinder) | 5 percent | 12 percent |

| Dried Tamarind | – | 5 percent |

| Semi-precious stones, polished stones | 0.25 percent | 3 percent |

| Specified commodities for petroleum tasks as per the instructions – Hydrocarbon Exploration Licensing Policy | 5 percent | Applicable rate |

| Cess on the Petrol based Vehicles having Capacity range of 10 to 13 passengers) | 15 percent | 1 percent |

| Cess on the Diesel based Vehicles having Capacity range of 10 to 13 passengers) | 15 percent | 3 percent |

Revised GST Rates Declared on the 36th GST Council Meeting

The mentioned table depicts the revised rates on notable commodities and services:

| commodities | Revised Rate | Old Rate |

| Electric-Chargers | 5 percent | 18 percent |

| Electric-Vehicles | 5 percent | 12 percent |

The above-mentioned revised rates were declared on July 27th, 2019 and came into action from 1st August 2019 onwards.

GST Rates Chart for Quotidian Commodities

There is a broad range of products on which GST is levied. You can’t memorize the entire range of products along with the applicable current GST rates. Thus, we have enlisted a GST rates chart for products used on a day-to-day basis.

| Product | Current GST Rate |

| Cement GST rate | 28% |

| Furniture GST rate | 12% |

| Laptop GST rate | 18% |

| Mobile GST rate | 18% |

| AC GST rate | 28% |

| Sanitizer GST rate | 18% |

| Car GST rate | 28% |

| Steel GST rate | 18% |

| TV GST rate | 18% |

| Battery GST rate | 28% |

| Bike GST rate | 18% |

| Petrol GST rate | 28% |

| Washing machine GST rate | 28% |

| Paint GST rate | 18% |

| Rice GST rate | 5% |

GST on Loans and Advances

The GST on loans replaced the Service Tax which was levied on loans in the past. While the rate of Service Tax applied was 15%, GST bears it for 18%. It obviously directs an individual’s attention to the straightforward increase in the overall cost of availing a loan which goes 3% more than what was incurred earlier. Then there is a group of people who is of the opinion that GST would throw a hike in their monthly instalments for a loan, given the increase by 3%.

It must be noted that GST is not applicable on the loan repayment or the interest payment. It is levied on other charges like processing fees, foreclosure fees etc. that are to be paid to the bank or NBFC. The payment of GST charges has nothing to do with the repayment of principal or interest amount. Since the largest portion of loan cost is incurred out of principal repayment and applicable interest, the GST rate is meagre and thus, the chunk it adds to the overall payment would be inconsequential. GST impacts the most important loans such as home loans, car loans and personal loans with an 18% rate.

GST on Cars

In the wake of the GST ritual being brought to cars, the GST rate on cars for personal use has been set to 28% for the vehicles featuring diesel or petrol engines. However, the overall tax payable for the vehicles under GST totals up to the bracket of 29% to 50%, given there is a composition cess on the vehicles over above the GST rate. If it is about the cars with neater technologies such as electric cars and the ones driven by fuel cells claim the relief in taxation with quite a lower rate.

Gold GST Rate

Coming to the impact of GST on items made with gold including, of course, gold jewellery, the applicable gold GST rate is 3%. If the making of jewellery is subcontracted to a worker then a 5% GST rate is levied on its making charges. In this case, the rate can be acknowledged and charged as an input tax credit. It will reflect only a 3% GST charge on the final bill that is to be paid by the buyer.

GST on Food

Mostly, the food items carry a NIL GST rate. This includes fresh food in most cases. When it comes to the packaged food, semi-processed and processed food items, there is a GST rate ranging from 5% up to 18% applicable. The 18% GST slab has food products like chocolates and baked goods, cakes etc. in its group. Currently, there is no food from the 28% slab.

Impact of GST Rate on Indian Economy

There is no second thought in admitting that GST has revolutionized the Indian economy to the best of influence. This taxation reform came out as a transformer for the track of the Indian economy. It is because of its working in bringing forth the net price for various types of goods and services that are acknowledged under a single taxation system. Let us drive our sight to different ways the GST rates have impacted Indian taxation.

Here are the major highlights of GST rates chiselling the Indian economy to a changed structure-

- The Market Witnessed Increase in Competition

Ever since the arrival of GST in the picture, the time has observed a significant fall in the price of goods and services. As a result, the final consumer has achieved relief in the tax regime for goods and services. This event has led to a robust stream of competition in the market because of the increased production.

- Tax Structure Got Easy-Peasy

If GST rates have a kind of impact that everyone found the most comfortable when it arrived, it has to be the simplification of the taxation system in India. Gone are the days of multiple-storeyed taxation structured as it has been demobilized upon the incoming of single taxation with GST. It proved to be a saviour of time as well as money.

- Uniformity in Taxation

GST brought a feel-worthy change in the tiring set of taxes at different stages of the supply chain. Earlier, there used to be the practice of multiple taxes at different levels of a supply chain which created troublesome confusion for taxpayers. Now that we have GST, it has become easy as a pie for a taxpayer to perform stable taxation.

- Boost in Exports

Subsequent to the implementation of GST in India, production has seen a fall in cost. This has resulted in the competence towards the international market leading to an increase in exports.

In a Nutshell:

After going through the afore-mentioned information, you will be able to acknowledge the applicable GST rates on bought and sold products/services. The GST rates in India are revised from time to time to cope with fluctuating international market trends. So, it is better to be updated with the current GST rate by referring to the GST rate list.

You May Also Like

| GST Cancellation | GST Returns | What is GST? | Types of GST |

| GST Registration | GST Invoice | Input Tax Credit | Impact Of GST |

Frequently Asked Questions (FAQs)

What is the GST rate in India?

The GST rates in India for various goods and services are segregated into four different slabs. These slabs are- 5%, 12%, 18% and 28%. These rates have been revised multiple times by the GST Coun

What is the GST rate for bags?

GST rates for bags fall into the bracket of 12% to 18%. While the GST rate applicable to the bags made of jute and cotton is 12%, it is 18% for other categories of bags.

What is the GST rate on mobile phones?

Customers have to pay 18% for the GST rate on mobile phones.

Is there any difference amidst Nil GST and GST Exempt goods and services?

Yes, both the terms Nil GST and GST Exempt goods and services are distinct from one another. Nil GST implies that no GST is applicable or levied on the related products or services. goods and services. Whereas GST exempt goods and services depict that the products or services have been temporarily exempted from the leviable taxation and might fall within higher slab rates.

Who is responsible for deciding current GST rates?

The GST council is responsible for deciding current GST rates. This vital council embraces 33 members, inclusive of State Finance Ministers. The Union Finance Minister heads the council and passes the final decisions including revised GST rates.

What are the different GST rates levied on services?

The GST council has levied four distinct GST rates on services known as GST slab rates for services. These slabs are 5% ( such as tour services); 12% ( such as business class air travel); 18% (such as outdoor catering) & 28% (for instance gambling).