Authorisation by the government for a business to continue comes under the Goods and Services Tax (GST). Taxes are made systematic and paid at every level of the supply chain. Under the GST rules, it is also compulsory for businesses to get a GST registration certificate from the authorities and display it on their premises. The certificate is an important document that ensures the registration of an entity under the GST Act.

In this article, you will understand the basics of the GST registration certificate, how to download it, its benefits, the procedure to make amendments, components, forms, and more details.

Table of contents

- What is a GST Registration Certificate?

- Components of the GST Registration Certificate

- What is the Validity of a GST Registration Certificate?

- Who issues the GST Registration Certificate?

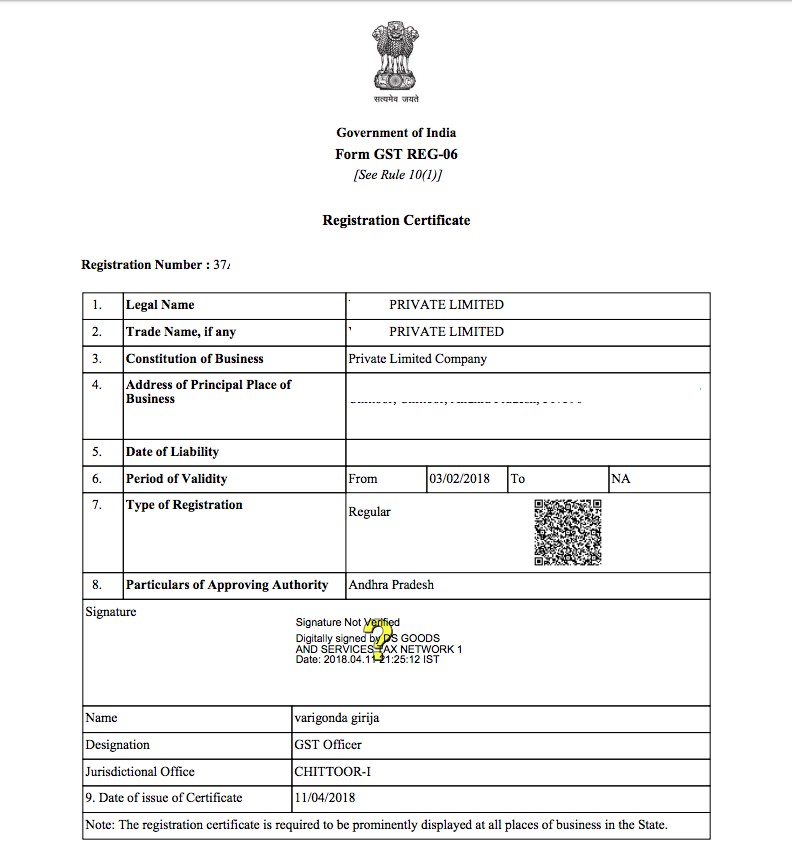

- Sample of GST Registration Certificate

- Ways to Obtain a GST Registration Certificate

- How to Download GST Certificate

- Steps to Make Amendments to GST Certificate

- GST Certificate Verification

- Frequently Asked Questions (FAQ’s)

What is a GST Registration Certificate?

Goods and Services Tax (GST) certificates are legal and authorised documents issued by the Indian Government. They serve as proof of registration under the GST Act.

Here are a few reasons why a GST registration certificate is both compulsory and helpful to taxpayers:

- The certificate is a binding document for businesses in India. Companies whose turnover exceeds the threshold limit (of ₹ 40 lakhs) must have the GST registration certificate, and they are required to display the certificate on their premises. If this is not done, the business will have to pay a penalty under the GST rules.

- Business owners can apply for the GST registration certificate through the official GST site. The Indian government does not issue a physical form of the certificate, and therefore, it can only be downloaded from the website.

- Taxpayers registered through the GST REG-06 Form are issued a registration certificate. The taxpayers included under this form are either GST TCS or GST TDS applicants and are responsible for obtaining a unique identification under section 25 (9) of the Central GST (CGST) Act.

Non-residents of India, the service providers of Online Information Database Access and Retrieval (OIDAR ), and migrant taxpayers come under pre-GST rules.

- A certificate issued to a normal taxpayer in India has no validity and expiry date. Unless the taxpayer or the authorities cancel it, it will remain valid. The GST registration certificate, which is issued to casual taxpayers, has a validity of 90 days. The certification will automatically become invalid after the stipulated period. However, the taxpayer can apply for an extension of the certificate.

Components of the GST Registration Certificate

The components below consist of the GST Registration Certificate:

- Taxpayer’s GSTIN

- Name of the business

- Business type (such as company, partnership, proprietorship, etc.)

- Business place address

- Liability date

- Validity period

- GST registration type

- Particulars as per the approving authority, such as digital signature

What is the Validity of a GST Registration Certificate?

GST registration certificates issued by the GST department to the normal taxpayer do not have an expiry date. If the taxpayer or the department does not cancel the certificate, it will not expire.

Moreover, in the case of non-residents of India or non-taxpayers, the validity of the certificate is 90 days. The certificate holder can extend the validity of the registration certificate by applying it before the expiry date.

Who issues the GST Registration Certificate?

Taxpayers and businesses receive their GST registration certificates electronically from the Goods and Services Tax Network (GSTN). A certificate can only be valid if approved by the GST Act, which is checked by the network to avoid future problems. The department verifies the taxpayer by the information provided in the Form GST REG-06 as mentioned below:

- Business’ Trade Name

- Business’ Legal Name

- Type of GST Registration

- Primary Location of the Business

- Other Business Locations

Sample of GST Registration Certificate

Ways to Obtain a GST Registration Certificate

There are a few ways in which you can obtain a GST certificate issued by the GSTN:

- Apply for a GST registration certificate through the official GST portal, www.gst.gov.in. Once the authority accepts the application, the GST certificate registration will be confirmed.

- The GST registration certification will be effective until the period of accountability. It is only applicable if you have submitted the application within 30 days from the time of eligibility. But if you have applied late, then the GST certificate registration is valid from the period it is issued.

- You can add the bank account details later on. But linking the bank account should be completed within 45 days from the last day of Form GSTR – 3B completion or date of registration.

How to Download GST Certificate

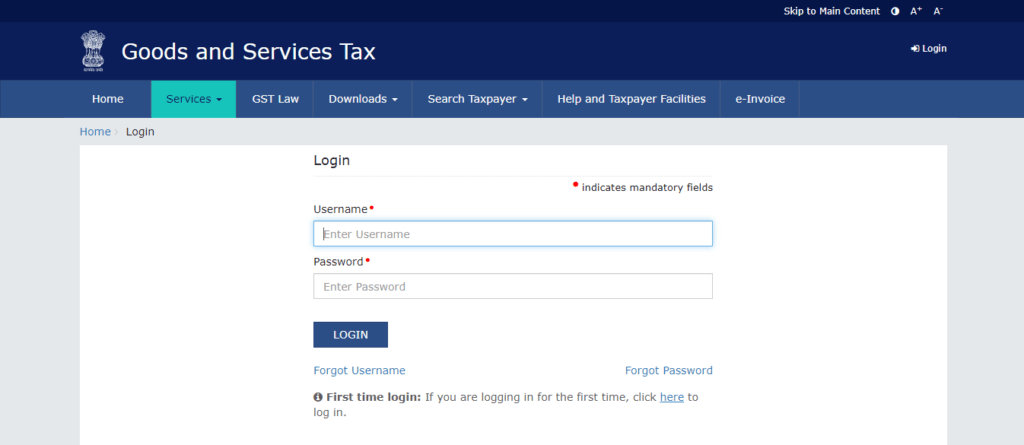

In order to download the GST certificate, you will need to have your account login details ready. You can now follow the steps mentioned below:

Step 1: Visit the official Goods and Services Tax (GST) website, www.gst.gov.in.

Step 2: Click on ‘Login’ and enter the username and password. Enter the captcha code in the field and click on ‘Login’.

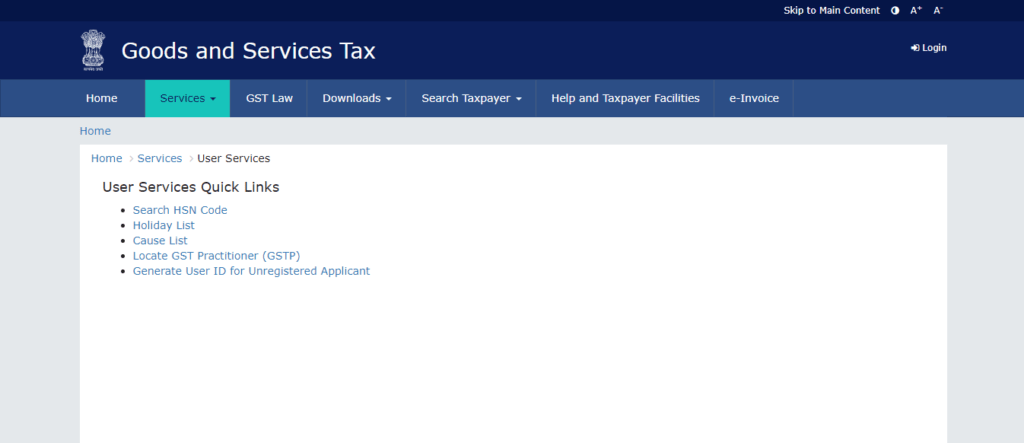

Step 3: After successfully logging in to the site, click on the ‘Services’ tab and select ‘User Services’. In the drop-down menu, select ‘View/Download Certificate’.

Step 4: In the new window, click on the ‘Download’ option to get the certificate downloaded on your device.

Steps to Make Amendments to GST Certificate

The main sections of the GST certificate can be amended in the following way:

Step 1: Visit the official GST portal.

Step 2: Log in to the website to access the GST certifications.

Step 3: Click on the ‘Services’ option. In the further classification, click on ‘Registration’ and then

on ‘Amendment to the Core Fields Registration’.

Step 4: Review the changes that are required in the main fields.

Step 5: In the verification tab of the amendment page, select the verification checkbox.

Step 6: Select the authorised sign from the drop-down menu of authorised names.

Step 7: Enter the current location in the required field.

Once you have completed the GST registration certificate amendment form, digitally sign the application using a digital signature certificate (DSC), EVC, or e-signature.

After successfully submitting the amendment application, you will receive the status soon, i.e., whether the changes are rejected or accepted, on the registered mobile number or e-mail.

After the changes are approved and verified by the authorities, you can view the approval order and download the GST order from the portal. Additionally, the GST portal will also help you download the updated GST registration certificate.

GST Certificate Verification

Follow the steps mentioned to know the status of GST certificate registration and verification:

Step 1: Visit the official portal of Goods and Services Tax.

Step 2: Click on the tab ‘Search Taxpayer’.

Step 3: The status of the GST registration certificate can also be searched via:

- UIN/GSTIN

- With PAN details

- By searching for composition taxpayer

Choose the one that suits you the most and enter the details to know the verification status of the application.

Step 4: Click on the ‘Search’ button after entering the correct details in the field.

Step 5: The new window will show ‘Your GSTIN/UIN Status’. If it shows ‘Active’, then the subscription to GST is active and vice versa.

You May Also Read:

| Impact Of GST | GST E Way Bill |

| GST Refund | GST on Gold |

| GST Portal | GST Rate List |

| GST Login Portal | Goods and Services Tax |

| GST Cancellation | GST Returns |

| GST State Code | GST Return Online |

Frequently Asked Questions (FAQ’s)

Is it possible to make amendments to the GST Registration Certificate?

Yes, it is possible to make amendments to the GST Registration Certificate if the legal name of the business has changed by filing the GST REG -14 Form on the GST portal within 15 days of the varied business name.

Is there any time limit for the GST registration certificate?

The time limit for obtaining a GST certificate is 30 days from when the business becomes eligible to get a GST registration certificate.

How to register for a GST certificate?

Visit the official portal of GST to register for a certificate of registration. Complete the registration process by submitting the required documents.

Who issues the GST certificate?

The Goods and Services Tax Network (GSTN) of India issues the GST registration certificate in the country.

How much does it cost to get a GST Registration Certificate?

A GST registration certificate is free of charge. However, in the case of non-registration, 10% of the due amount will be levied on the entity.

Is GST registration compulsory for small businesses?

If the turnover of a small business exceeds the limit of ₹ 40 lakhs in a particular financial year, then it is compulsory to register for the GST certificate.