GSTR-8 is basically the monthly return that needs to be filed by the e-commerce operators who have registered themselves under GST. This article will help you understand the importance, classification and provide filing information to make the process of GSTR-8 easier for you.

What is GSTR-8 Return?

GSTR-8 return is filed by e-commerce managers who are requisite to withdraw the Tax Collected at Source or TCS under the GST. The GSTR-8 return holds the details regarding the supply that has been affected by the e-commerce platform & the amount of Tax collected through the source on the supplies.

Who Should file GSTR-8?

Every e-commerce manager who has been registered under the GST requires to file her/himself under the GSTR-8. As per the GST Act an e-commerce manager has been described as an individual who manages or retains any electronic or digital or any other commerce-based electronics like Amazon facilities. It is vital for all the e-commerce managers to obtain him/herself under the GST registration along with registering himself under the Tax Collected at Source.

Who Classifies as an e-Commerce Operator?

As per the GST Act an e-commerce operator has been described as an individual who manages or retains any electronic or digital or any other commerce-based electronics like Amazon or Flipkart facilities. The operator of the e-commerce platform provides the sellers a system wherein they are able to reach out to customers in huge numbers by just getting themselves registered online. This turns out to be beneficial for customers as they are able to access multiple sellers & also compare rates for their desired products.

Why is GSTR-8 Important?

GSTR-8 helps in showcasing details regarding the supply that has been affected through the platform of e-commerce along with the amount that has been collected through Tax Collected at Source on the supplies. But as of now the tax collected at source provisions have been kept on hold, which will be applicable from 1st October 2018. As far as the application of TCS is concerned, a supplier can easily opt for input credit which is deducted from the e-commerce operator once they have filed for GSTR-8 through the e-commerce operator. This amount of TCS is reflected under the Part-C form of GSTR-2A (this form is applicable for the supplier).

For Example, Ram Enterprises has a business of supplying garments that are worth INR 20,000 through the medium of Flipkart. Now that Flipkart is an e-commerce operator, they will now deduct a TCS of 1% & then will deposit an amount of INR 200 will be deposited to the government. So, now the amount of INR 200 will be highlighted under the GSTR-2A of Ram Enterprises after they have filed GSTR-8 by flip kart.

When is GSTR-8 Due?

The due date of filing oneself under the GSTR-8 is due on the 10th of the month that is following for example, if the date of filing GSTR-8 is for the month November then the due date for the same filing will be 10th of December.

What is the Penalty for not Filing GSTR-8 on Time?

In case the GSTR Return is not filed in time, then penalty has been charged of INR 100 under CGST along with INR 100 under the SGST that would be levied each day. The total amount will then be INR 200 per day and the maximum that this amount goes to is INR 5,000 as there is no kind of late fee being charged on IGST in case the filing has been delayed.

With the late fee, there is also an interest of 18% that needs to be paid per annum, which needs to be calculated by the taxpayer on the tax that one needs to pay. The time allotted or the period will be applicable from the next day of when you have filed the D.O.P.

How to Revise GSTR-8?

Once you have filed the GSTR-8 you can then not revise them. In case there is any kind of mistake made under the return can be rectified only in next month’s return. For instance, if you have filed and made a mistake on November GSTR-8, the revision for this month will be done in the month of December GSTR-8 or maybe in other months that follow if any kind of errors or any kind of omission has been found.

DETAILS TO BE PROVIDED IN GSTR-8

In total there are 9 sections under GSTR-8:

1. In case an individual does not have an GSTIN, a provisional id can be obtained instead.

2. Legal Name:

The name of the taxpayer will automatically get filled once you login on the portal of GST.

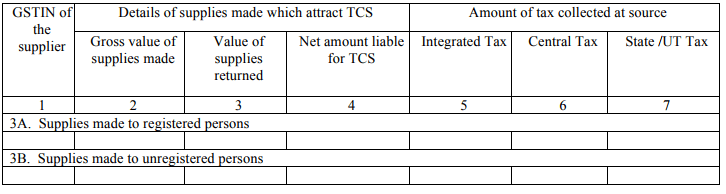

3. Details of supplies made through e-commerce operator

It is mandatory to state the gross value of the supplies that have been made to the registered person & unregistered persons along with the value of supplies that have been returned by the registered & unregistered persons and so the difference b/w the two i.e, the supplies made & the supplies returned will be the final net amount that will be liable as TCS.

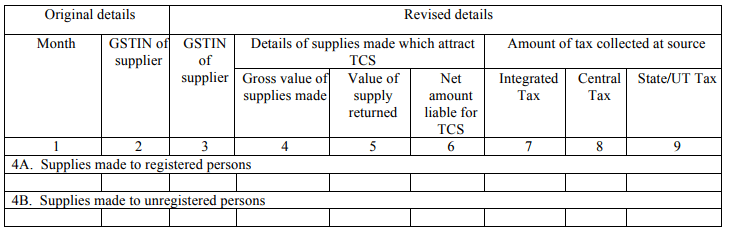

4. Modification in Details of Supplies with respect to earlier statement:

Any kind of modification that needs to be made in the previous month’s return can easily be done under this section.

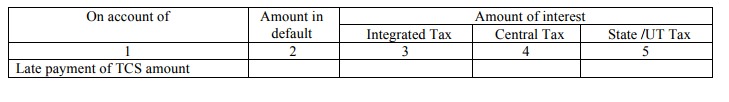

5. Interest Details

In case the e-commerce operator is not able to make his payment on time, then interest will be levied on the same account for late payment for TCS Amount.

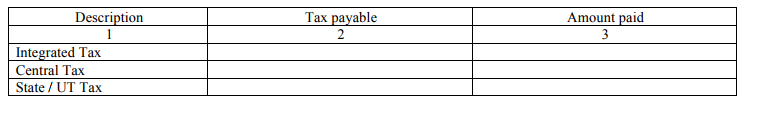

6. Tax Payable & Paid:

Under this section you will be able to find the sum total amount of tax that needs to be paid. This includes SGST, CGST, IGST & the amount of tax that needs to be paid.

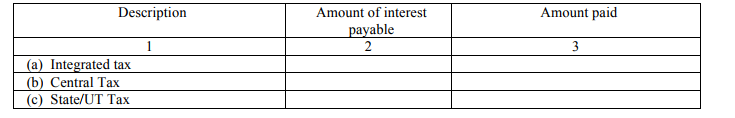

7. Interest Payable & Paid:

The interest is basically calculated according to the outstanding amount for tax. The interest levied on delayed payments is 18 % of GST.

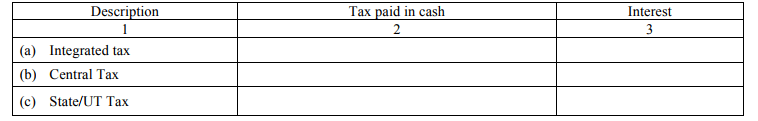

8. Refund Claimed through electronic cash log:

The refund collected through the electronic cash log can be claimed only if the TCS liability is discharged for that particular tax period.

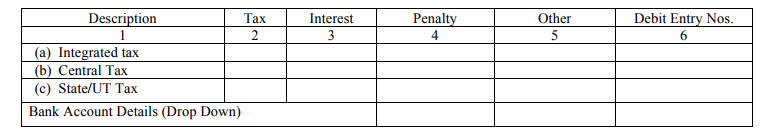

9. Debit entries in cash log for TCS or Interest Payment:

This section is only applicable once the payment has been made for tax & the submission of the return.

The amount that has been collected as tax at source, flows to C Part of the GSTR-2A on the taxpayer once they file for GSTR-8.

How to Fill GSTR-8?

Below are the steps that can easily help you in filing your GSTR-8

Step1: Visit the official website- www.gst.gov.in.

Step2: Once logged in with the help of your credential’s logon yourself to the GST Portal.

Step3: Click on the Service tab which will further take you to the option “Returns” click on the same and you will then be able to find the option “Return Dashboard”.

Step4: Tap on the Financial Year and Return Filing Period.

Step5: Tap on the ‘Search’ button.

Step6: The display that you see on your screen now is the ‘File Return’ Page.

Step7: Go through the displayed message that you see on your screen, it’s important for all the taxpayers to read these messages.

Step8: Next, click on the ‘Prepare Online’ Option which you will be able to find under the GSTR-8 option- this would help in making entry for the prepared return.

Step9: Now, you will be able to find the ‘Return for Tax Collected at Source’ under the same GSTR-8 option.

Requirements for Filing GSTR-8

Following are the requirements that you need to fulfill for filing yourself under GSTR-8:

- Correct User ID & Password.

- TCS Amount that is needed to be collected by the E-commerce operator only.

- The E-commerce operator should have their active GSTIN, who also requires to be the registered person because only then will he be able to submit the tax return.

- Need an absolute correct DSC or Digital Signature.

- Require Registered Mobile Number for the same portal.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

Is it mandatory to file nil GSTR-8?

It is not vital for you to fill the GSTR-8 for every tax period.

What is the due of GSTR-8?

The due date to file the GSTR-8 is 10th of every month for the e-commerce operator.

What is form GSTR-8?

GSTR-8 is considered to be the return that needs to be filed through the e-commerce operator who then further deducts the TCS or the Tax Collected under the GST.

What is GSTR-8 Applicability?

Each E-commerce operator that requires to collect the tax or the TCS that needs to be filed for taxable supplies needs to file the GSTR.

What is the return filing date for GSTR-8?

The return filing date for GSTR-8 is the 10th of every month.