HDFC Bank offer its customers easy to use and convenient net banking services that can be used to access various account details online. Using this service, customers can access their accounts and carry out various financial transactions with just a click. All the customers have to do is register for this service, and they can use the wide range of features it has to offer. In this blog, we will look at the various ways to register for HDFC netbanking, how to login, and some of the features of this service.

Table of contents

- How to Register for HDFC Netbanking?

- HDFC Netbanking Login Process

- How to Retrieve HDFC Netbanking Login Password?

- How to Check HDFC Balance Via Netbanking?

- How to Transfer Funds Through HDFC Netbanking?

- How to Pay Credit Card Bill Using HDFC Netbanking?

- Features and Benefits of HDFC Netbanking

- HDFC Net Banking Helpline Numbers

- Frequently Asked Questions (FAQs)

How to Register for HDFC Netbanking?

To enjoy the attractive features of HDFC netbanking, the user will be required to register for the service. HDFC account holders can register for netbanking online by ATM, phone banking, or downloading the online form. The process for each of the methods are as follows:-

HDFC Netbanking Registration Online Via Portal

HDFC bank internet banking can be done online in two different ways. Users can register for the service using a phone number/OTP. Follow the below steps to do so:-

Step 1: Visit the official HDFC bank internet banking registration portal.

Step 2: Enter your Customer ID allotted by HDFC bank.

Step 3: Enter the mobile number registered with the bank. This will generate an OTP to the registered number.

Step 4: Enter the OTP you have received on your registered mobile number.

Step 5: Enter your HDFC debit card details.

Step 6: Set a HDFC Netbanking IPIN of your choice.

Step 7: Now login into your netbanking account using your Customer ID and the IPIN you have set.

HDFC Netbanking Registration Via Phone Banking

Given below are the steps for registering for HDFC bank internet banking service via the phone banking facility:

Step 1: The user will be required to call their city’s designated HDFC phone banking number. You will be required to enter the debit card number and the PIN/ telephone identification number.

Step 2: The HDFC phone banking executive will record your registration request and start the process.

Step 3: Once the process is completed, your HDFC netbanking IPIN will be sent to your registered communication address within five working days.

HDFC Netbanking Registration Online Via ATM

Given below is the step-by-step process to register for HDFC netbanking using an HDFC ATM:

Step 1: Visit the nearest HDFC bank ATM.

Step 2: Insert your HDFC bank debit card and enter your PIN.

Step 3: On the main screen, click on the ‘Other Option’ button.

Step 4: Then click on the ‘Net Banking Registration’ option and verify the action when the prompt appears.

Step 5: Your HDFC bank internet banking registration request will be submitted, and the IPIN will be sent to the registered communication address.

HDFC Net Banking Offline Registration

Given below is the step-by-step process to register for HDFC net banking service offline by downloading the form:

Step 1: Visit the official HDFC net banking portal and download the registration form based on the type of user (Corporate or Individual).

Step 2: Fill out the form with all the necessary details and submit it to your closest HDFC bank.

Step 3: Your registration request will then be submitted, and your IPIN will be sent to the registered correspondence address within five working days.

HDFC Netbanking Login Process

HDFC account holders can login to the HDFC netbanking service by following the steps given below:-

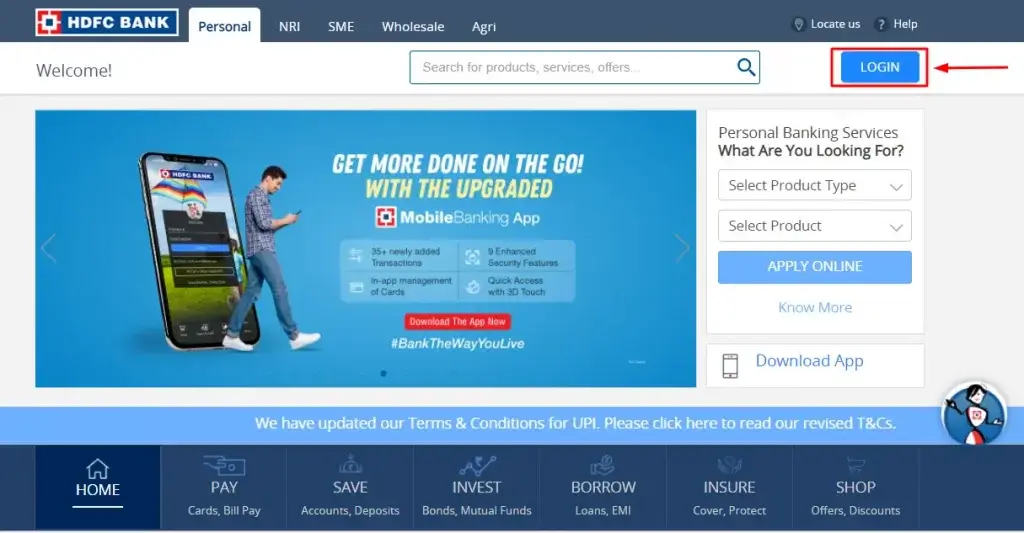

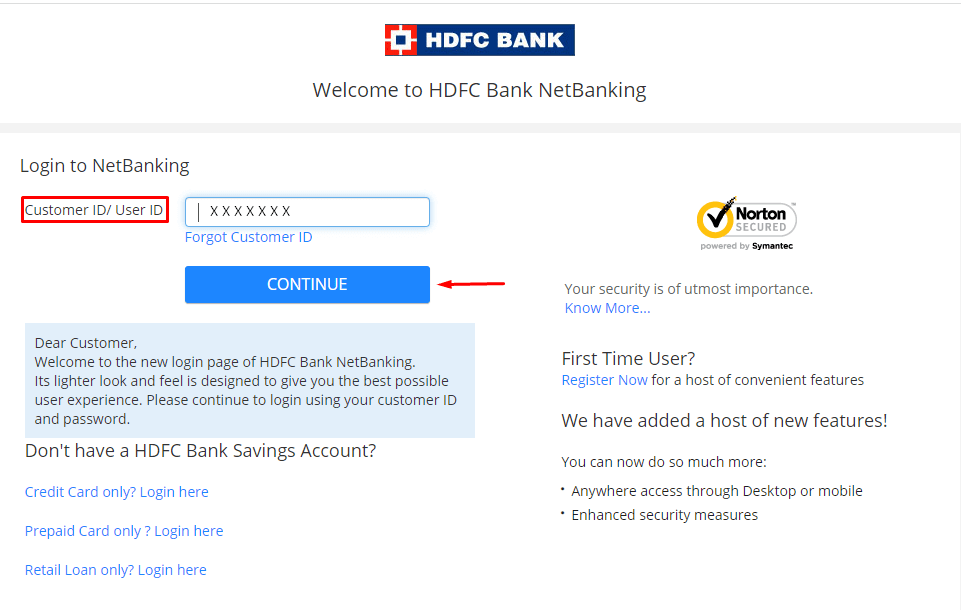

Step 1: Visit the official HDFC Bank website.

Step 2: Click on the ‘Login’ button.

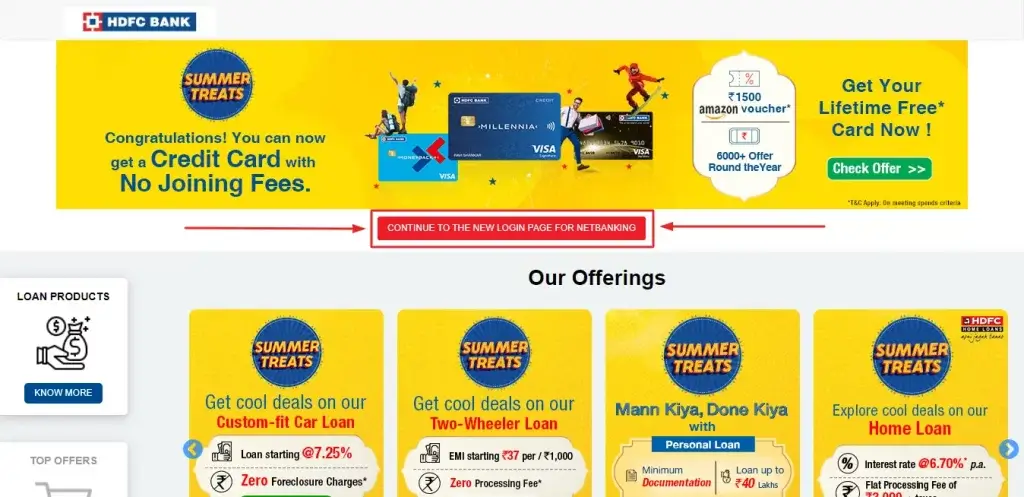

Step 3: On the next page, click on the “Continue to Netbanking” option to be redirected to the HDFC Netbanking login page.

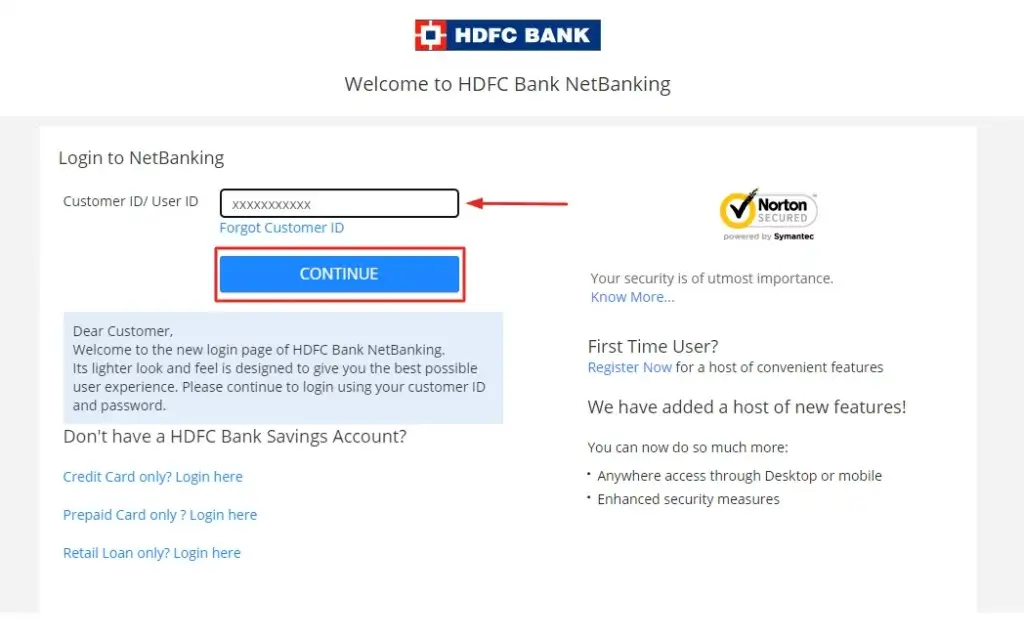

Step 4: Enter the Customer ID and click on the ‘Continue’ button.

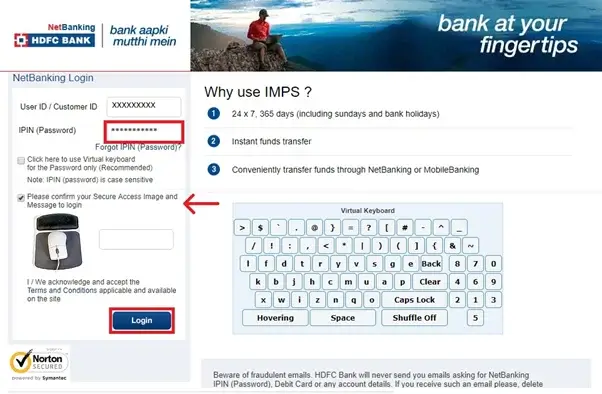

Step 5: Enter the Netbanking password or IPIN and verify the secure access image and message to successful login into your account.

How to Retrieve HDFC Netbanking Login Password?

If you have forgotten your HDFC netbanking login password, it can be easily reset by HDFC online banking using your registered email, phone number, and debit card details. Given below is the step-by-step process to do so:-

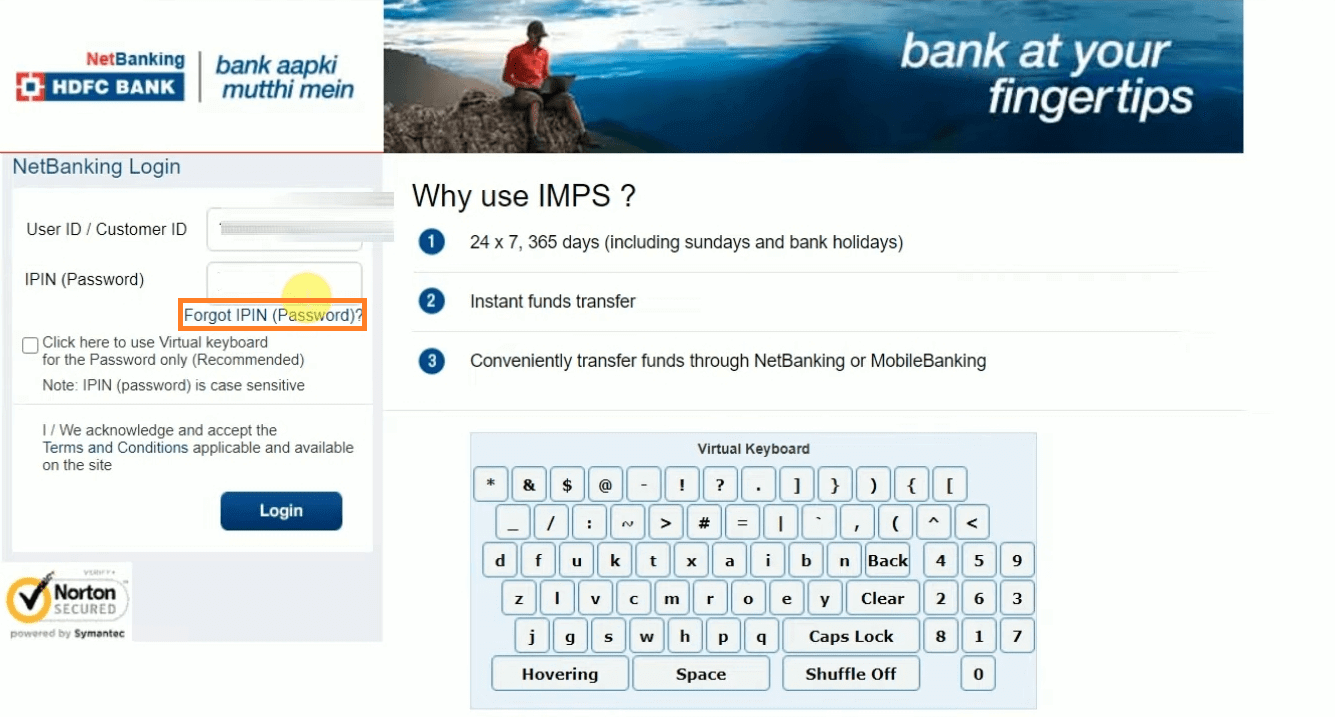

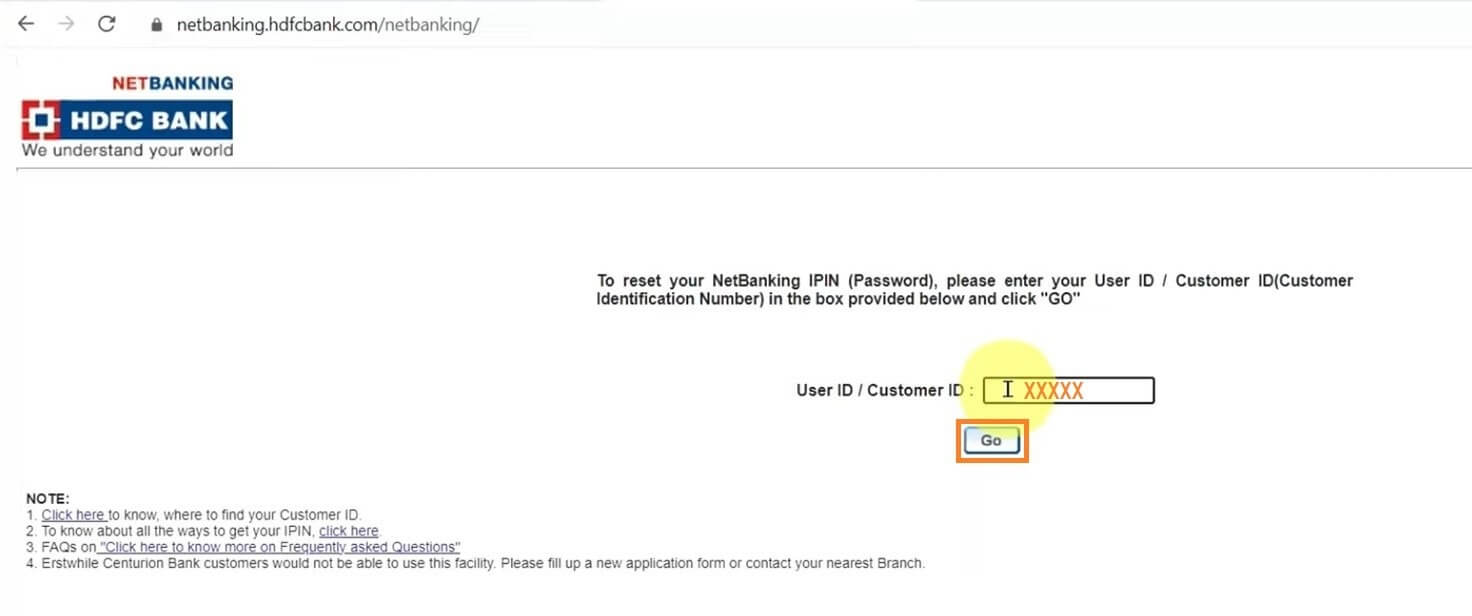

Step 1: Visit the official HDFC netbanking portal.

Step 2: Click on the ‘Forgot IPIN (Password)?’ option.

Step 3: Enter your customer ID and click on the ‘Go’ button.

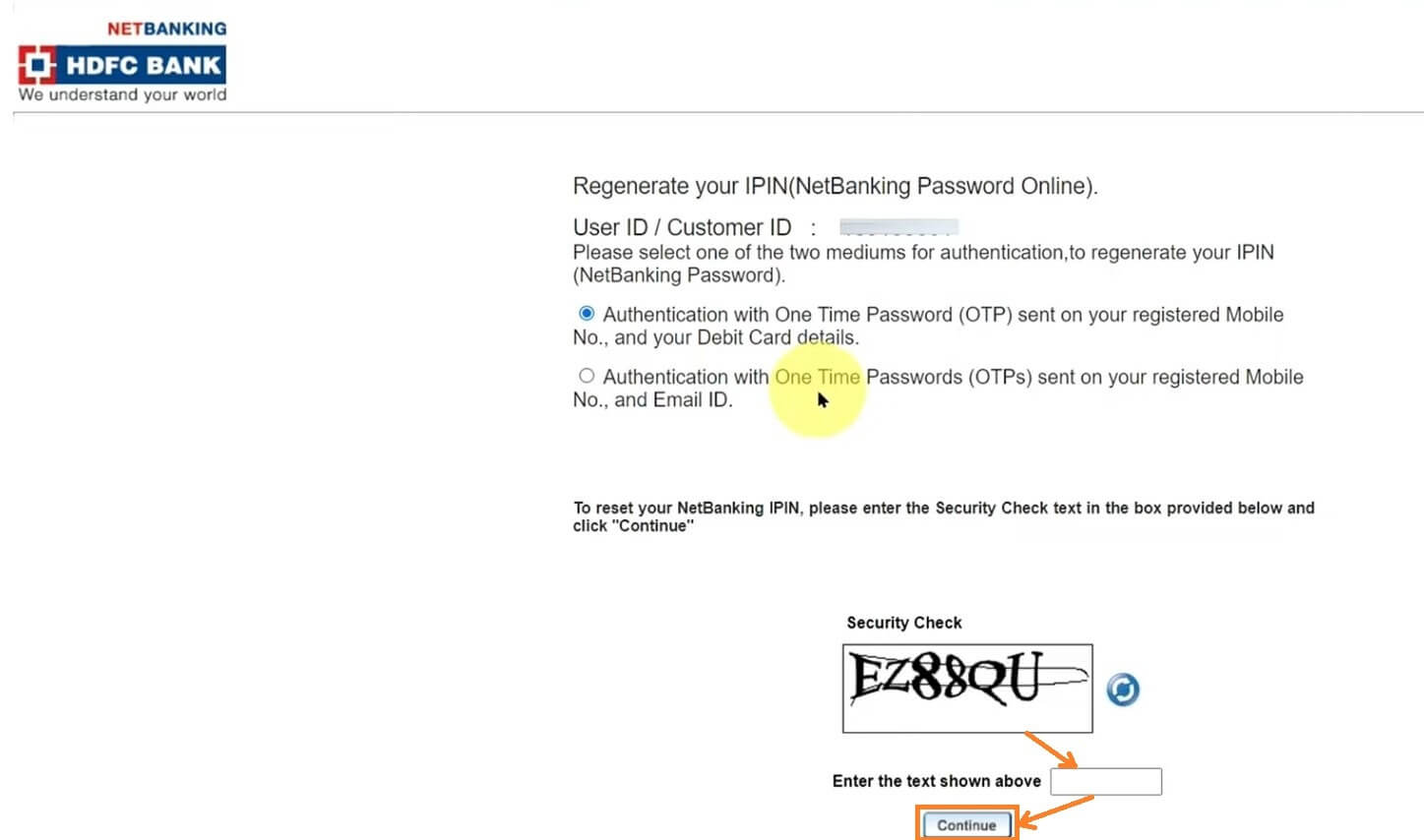

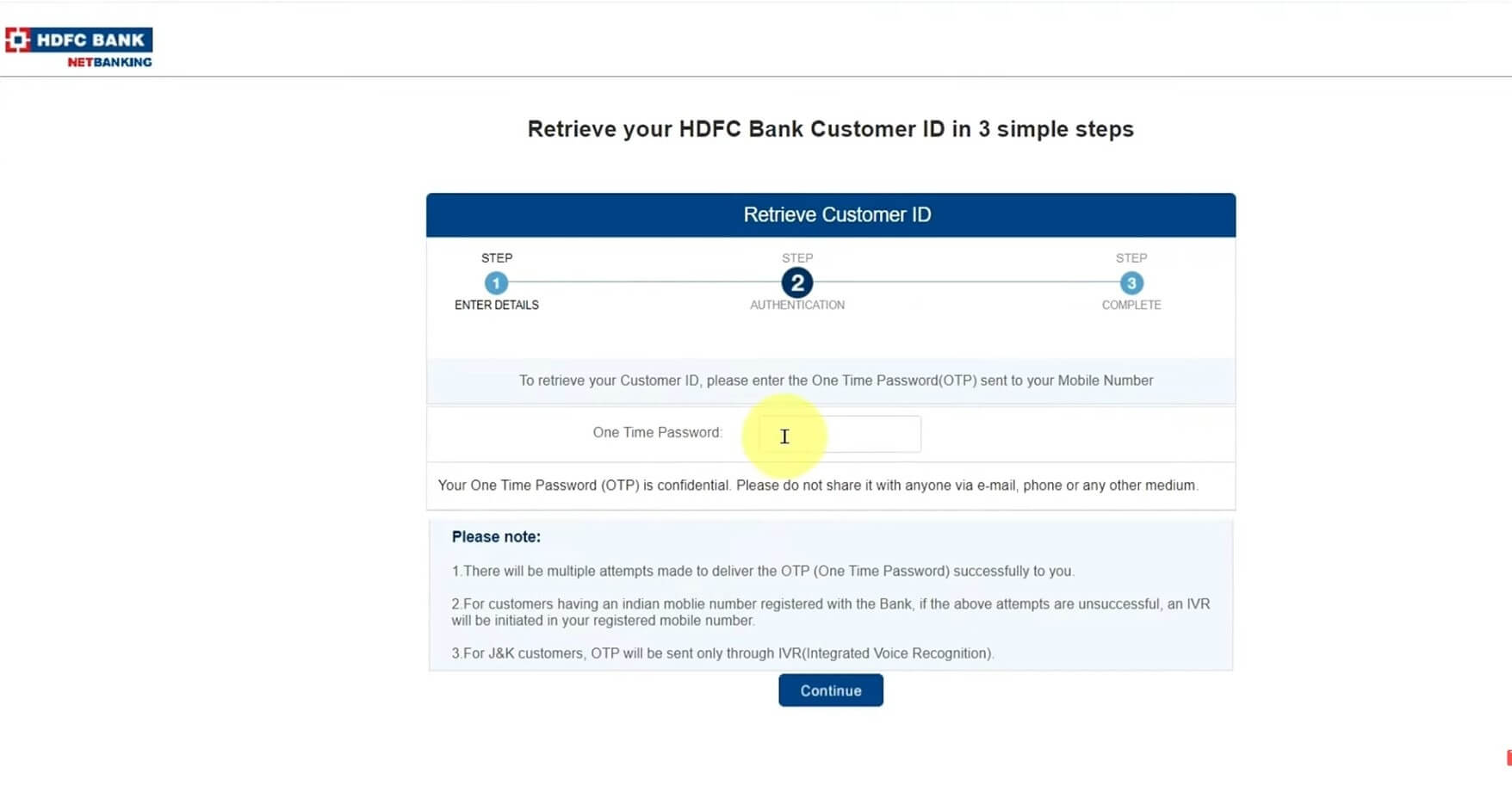

Step 4: Next, you will see an authentication process – select either one or both the options using your registered phone number and your registered email address to generate OTP(One Time Password).

Step 5: Next, you need to enter the OTP which you would have received on your registered mobile number linked to your bank account.

For Domestic Customers need to enter OTP received on their registered mobile number.

For International Customers, they need to enter the OTP received on their registered E-mail address.

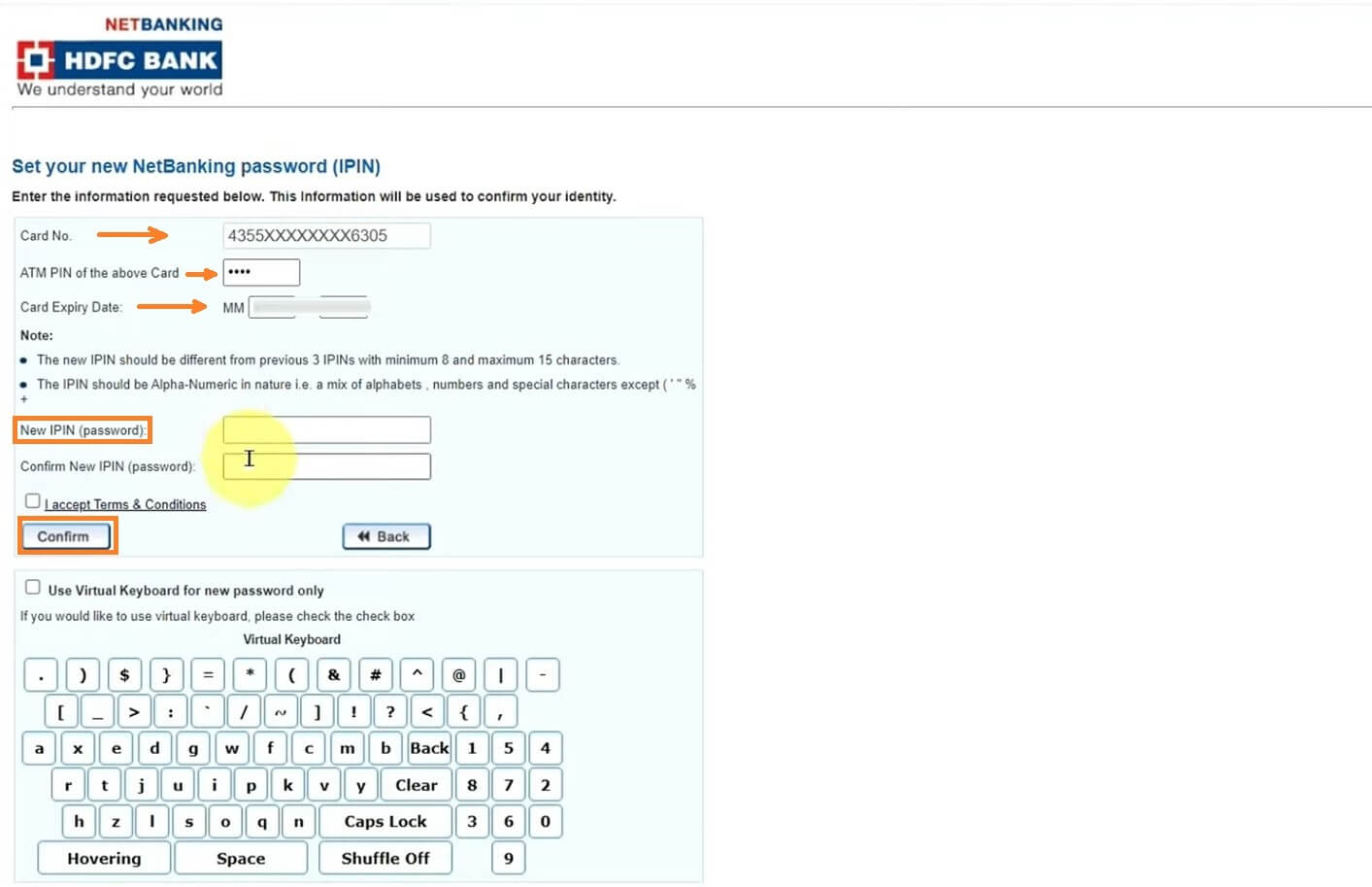

Step 6: Once the above-given step is completed, you must enter all the requested details of debit card and the ‘new IPIN’. Finally, you will now be able to login with your Customer ID and new IPIN..

How to Check HDFC Balance Via Netbanking?

Given below is the step-by-step process to check your HDFC account balance using the netbanking service:-

Step 1: Login to the HDFC netbanking page using your Customer ID and IPIN.

Step 2: Click on the ‘Accounts’ option.

Step 3: Click on the ‘Account Summary’ option on the resulting page.

Step 4: On the next page, various accounts will be displayed.

Step 5: Click on the relevant account, and the account balance and other details will be visible to you.

How to Transfer Funds Through HDFC Netbanking?

HDFC account holders have the facility of transferring funds and making third party transactions using their HDFC netbanking accounts. Such transactions can be made after logging in to the netbanking account and clicking on the ‘Funds Transfer’ option. On the resulting page, you need to select the relevant option as listed below:–

- National Electronic Funds Transfer (NEFT): This facility allows you to transfer funds to other non-HDFC bank accounts. Using this facility, you can transfer funds ranging from Rs 1 lakh to Rs 10 lakh. Please note that the account you wish to transfer the funds should be first added as a beneficiary.

- Real-Time Gross Settlement (RTGS): In this method, the funds will be transferred to the beneficiary account within the stipulated RBI timeline. However, the receiver’s bank account should be added as a beneficiary in your HDFC netbanking account. You can transfer amounts up to Rs. 10 lakhs using this method.

- Immediate Payment Service (IMPS): This service can be used to transfer funds from one bank account to another immediately. Using this method, you can transfer money to HDFC bank accounts and accounts from other banks. Further, this facility can also be used to transfer funds on weekends and bank holidays.

- Visa CardPay: Using this service, you will be able to transfer funds to any Visa Credit Card across the country. The credit card account should be registered as a beneficiary in the netbanking account, and the funds will be transferred within two working days.

- Different customer IDs can also be used from one HDFC account to another. Any money transfer done using this method will be immediate.

- Online transfer of funds can also be done using the online merchant payment option. However, the user cannot make payments for stockbrokers, mutual funds, or taxes using this method.

How to Pay Credit Card Bill Using HDFC Netbanking?

Registered users can also use the HDFC bank internet banking service to make credit card bill payments. Follow the below steps to do so:-

Step 1: You will be required to login into your HDFC netbanking account.

Step 2: Next, you will be required to link your credit card and netbanking account using your card details and PIN.

Step 3: You can find the option to make credit card payments under the ‘Credit Card’ section and the ‘Funds Transfer’ section.

Features and Benefits of HDFC Netbanking

There are tons of services and perks offered to the HDFC customers lately after the release of the HDFC Netbanking system for convenience and time-effective solutions that are discussed below:-

- An HDFC account holder has given the accessibility to check their HDFC bank balance with instant account statement downloading facility in a pdf format for up to 5 years.

- Account holders are given the liberty to access a Recurring Deposit/ Fixed Deposit through online methods.

- Easy transfer of funds through NEFT, RTGS and IMPS are an attractive option through HDFC net banking online system.

- Quick HDFC credit card bill payments or via Debit card or UPI for electricity, water and phone bills.

- Examine the HDFC Credit Card payment and other related information on a real-time basis.

- Accessibility to invest in mutual funds with ease and hustle-free methods.

- Usage allowed for tax-associated payments through HDFC credit card payment or any other Tax credit statement with an easy view option.

- Revise the significant HDFC bank details submit for instance: PAN Card or Aadhar Card linking or updates.

- Manage and monitor various banking transactions for example requesting for a chequebook, demand draft, debit or HDFC credit card bill payment request, or dismissing the cheque proposed for the transaction.

- Customers may check the details on active loans via the HDFC Net banking portal.

HDFC Net Banking Helpline Numbers

In case of any queries or doubts regarding the HDFC internet banking services, users can contact customer service at any of the numbers mentioned below:-

| City | HDFC Customer Care Number |

| Ahmedabad | 079-6160-6161 |

| Bengaluru | 080-6160-6161 |

| Chandigarh | 0172-6160-616 |

| Chennai | 044-6160-6161 |

| Cochin | 0484-6160-616 |

| Delhi & NCR | 011-6160-6161 |

| Hyderabad | 040-6160-6161 |

| Indore | 0731-6160-616 |

| Jaipur | 0141-6160-616 |

| Kolkata | 033-6160-6161 |

| Lucknow | 0522-6160-616 |

| Mumbai | 022-6160-6161 |

| Pune | 020-6160-6161 |

You May Also Like

| HDFC Bank Savings Account | HDFC Bank FD Rates |

| Saving Account | SBI Balance Enquiry |

| Cancelled Cheque Guide | Post Office Savings Account |

| Different Types of Savings Account | Savings Account Interest Rates |

Frequently Asked Questions (FAQs)

How to pay HDFC personal loan EMI through net banking?

You can pay your HDFC loan EMI on the HDFC bank website. Click on ‘Pay’, then click on ‘Loan Repayment’, ‘Pay Overdue EMI Online’, and finally ‘Pay Online’. This will take you to the payment gateway and complete payment using your preferred mode of payment.

How to e-verify ITR through HDFC netbanking?

On the HDFC netbanking portal, click on the ‘Enquire’ option on the ‘Account DashBoard’. Select “Income Tax E-Filing” and agree to the terms and conditions.

Are there any charges associated while using HDFC Netbanking?

There are no charges associated with using HDFC bank’s internet banking service. However, there may be charges for transferring funds or carrying out transactions using this method.

How to pay HDFC credit card bills through net banking?

Through the “Credit Card Payment Option”, one can make payments on HDFC Bank Internet Banking.

How to check ifsc code in hdfc netbanking?

Go to the portal of HDFC net banking and select the “IFSC Codes” option that reflects your branch’s code effortlessly.

Can a customer avail of insurance through the HDFC Bank net banking portal?

Yes, the customers of HDFC net banking online can easily avail of the insurance service via the portal.