Inflation is the most universal tax of all.

— Thomas Sowell

About 20 years ago, one litre of milk would have cost about ₹15. However, today, it ranges from ₹55 to ₹60. This mechanism is known as inflation. It surges and dips with the fluctuations in demand and supply, production costs, and other factors, ranging from rising fuel prices to a global pandemic. But, it does not completely go away.

Last year, inflation roared the loudest in over a decade. Worldwide, the rate amounted to roughly 4.37% compared to the previous year, which was approximately 3.18%. The state is volatile, and the future is tentative.

But, amidst all this hubbub, the lingering question is, if we cannot eradicate inflation, how can we safeguard ourselves from its influence? This is where the role of investment in real estate comes into play.

To know the real story behind the worldwide issue of inflation, who will benefit from it, and how real estate investment can protect you from its impact, just keep scrolling steadily.

Table of contents

How Does Real Estate Offer Hedge Against Inflation?

As inflation rises, net returns on stocks, bonds, and fixed-rate vehicles are likely to take a hit. On the other hand, real estate managers can reduce the impact of inflation by increasing rents of managed properties.

Obviously, this doesn’t happen uniformly across markets or property types. But can you remember having a landlord who seemed oblivious to rising inflation, leaving you with a jaw-dropping deal on rent? Indeed, it takes a piece of foresightedness to combat inflation efficiently.

Given below are some tactics that professional real estate managers implement to lessen the risk of soaring inflation:

CPI Indexation

Contractually tethered rent grows with the increase in the CPI (Consumer Price Index). While this may appear extremely complicated, it was fairly traditional back in the 70s and 80s when inflation was more prevalent.

Periodic Rent Reviews

These are created into leases. A periodic rent review is specifically essential with longer-term leases and/or when a few tenants occupy the property.

To Shift Operating and Capital Improvement Costs to Tenants

Sponsors or promoters may be able to transfer some of the improving and operating costs of properties to tenants. Specifically, utilities, services, and materials are likely to drive alongside inflation. While this transition may demand reducing gross property rents to stay competitive in leasing, it can significantly impact net operating income (NOI) over longer leases.

Note: This applies to non-residential CRE asset classes, including retail, office, and industries.

Limited Supply of Properties in Urban Areas

While land use and availability of properties are not much of an issue in suburban areas, it is a major factor affecting real estate property prices in the metropolis. This is mostly because there is a limited supply of properties in densely populated urban areas. Plus, the availability of land for building new structures is rare.

So, if you own properties in such urban areas, selling them during inflation could prove to be a win-win deal for you. How? The demand for real estate properties rarely decreases despite inflation. Resulting to which, there is a high possibility that property value will increase, given the increasing cost of labour and materials for building a comparable structure.

See also@ What is in Store for the Housing Market in 2022?

Who Benefits from Inflation?

Assuming that consumers will experience the most benefits of inflation would be unfair. While they do, it’s on a minimal level. On the contrary, investors enjoy the maximum advantages if they possess assets in markets affected by inflation.

For instance, if the economy is functioning well and housing demands are high, the real estate industry or the home-building company may charge higher prices for selling properties and homes.

Some corporations extract the rewards of inflation if they can charge more prices for their goods as an outcome of a spike in demand for their products. Another example could be the energy businesses. If you have invested in energy stocks, you might witness a rise in the companies’ stock prices when the prices increase.

In other terms, inflation can offer businesses pricing power and boost their profit margins. If the profit margin rises, it indicates that the rate of the companies’ products is growing at a faster pace than the growth in the costs of production.

Other Assets that Provides Protection Against Inflation

In the market economy, inflation is a natural phenomenon. Besides real estate, several other elements offer a hedge against inflation. A disciplined and experienced investor can mitigate the risk of inflation by investing in asset classes that transcend the market during inflationary conditions.

Adding inflation-hedged asset classes to your portfolio can help it thrive when the time arises. Below are some of the best ways to hedge against inflation besides real estate.

- Gold

- The S&P 500

- Commodities

- A 60/40 Stock/Bond Portfolio

- TIPS (Treasury inflation-protected securities)

- Real Estate Income

- The Bloomberg Aggregate Bond Index

- Leveraged Loans

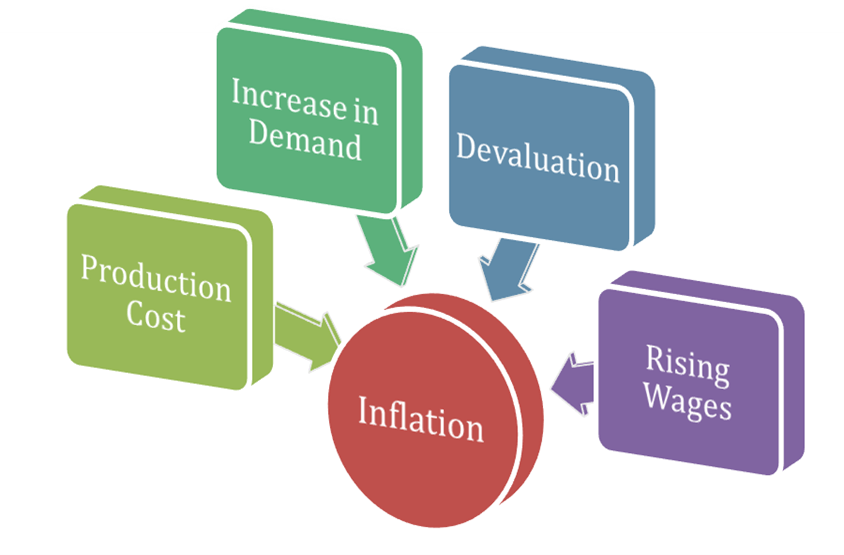

Significant Factors Driving Inflation

A plethora of elements causes inflation or drive prices in an economy. Typically, inflation is the result of the following:

- An increase in production cost

- A rise in demand for products and services

- Devaluation, and

- Rising wages

Production Cost: Cost-push inflation is caused by a hike in production costs such as wages and raw materials. The demand for goods remains constant while their supply reduces due to higher production costs. Eventually, the costs of production are borne by the consumers in the form of higher prices for the finished products.

Increase in Demand: An inflation driven by the strong consumer demand for products and services is demand-pull inflation. When the demand for a wide array of goods across an economy surges, their prices increase.

Devaluation: Devaluation is the aftermath of the soaring costs of imported goods and is one of the primary factors boosting domestic demand.

Rising Wages: The higher the wages, the more will be the firms’ costs. Eventually, this increases the disposable income of the consumers to spend more.

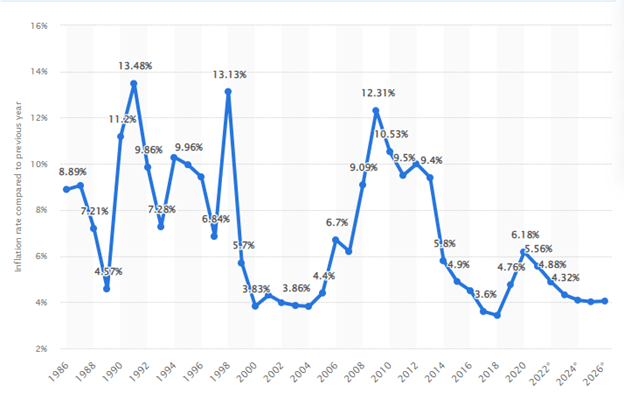

Inflation Rate in India for the Last 10 Years

Inflation acts as a significant indicator of a country’s economy. The inflation rate serves as the percentage at which the level of prices, goods and services in an economy rises, affecting the cost and conditions of living. It further transpires as increased mortgage interest rates and decreased savings, and also influences the levels of benefits and state pensions received.

The statistics below represent India’s inflation rate from 1986 to 2020, with projections up to 2026. In 2020, India’s inflation rate was approximately 6.18% compared to the preceding year. Glance through the country’s economic growth for further information.

Source: Statista

As you can see in the image above, an all-time high inflation rate occurred in 1991, which amounted to about 13.48%. It touched the lowest of approximately 3.6% in 2018, which was two years prior to the pandemic.

Although it rose again and almost doubled at 6.18% in 2021, a positively declining trend of inflation can be witnessed in the upcoming years.

While we can hold the developing stage, high unemployment and poverty rates in the country to be responsible for such heightened inflation in the pre-2000 era, the inflation between 2008 and 2012 can be attributed to Asia-wide hike in oil and commodity prices, which impacted India. At the time, the government, too, fanned the fire of inflation via fuel price hikes in an attempt to reduce subsidies, costing almost 3% of the GDP.

However, with India’s GDP (Gross Domestic Product) steadily climbing over the past years, the country’s economy has been performing well now, resulting in an impressive reduction in the national debt.

But, in the current time, as the state deficit equates to over 9% of GDP, the budget balance associated with it doesn’t seem too remarkable.

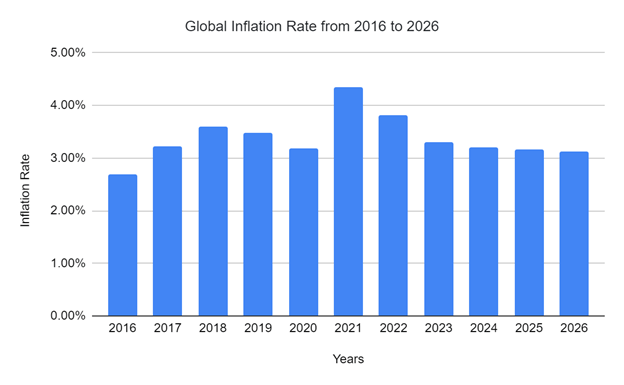

Global Inflation Rate from 2016 to 2026

The statistic given below represents the global inflation rate from 2016 to 2026. As opposed to 2020, the inflation rate in 2021 amounted to about 4.35%, which is the highest in over a decade. Have a look through the image below:

Source: Statista

As you can infer from the above graph, the global inflation rate was at its lowest in 2016, which was about 2.7%.

In 2021, however, due to the global impact of the pandemic, the inflation rate spiked straight to 4.35%. Economists believe the inflation rate may ease up this year as more goods are available now and the lingering pandemic-relation supply chain shortages have been substantially resolved.

As an outcome of the global recession, the shortage of centralised banking systems and the upsurge in interest rates, the cost of living in many Middle East nations, like Syria, Iran, etc., have also increased compared to the industrialised countries.

Additionally, in 2015, industrialised countries had an inflation rate (IR) of just about 0.5%. Meanwhile, in North Africa and the Middle East countries, the inflation rate amounted to beyond 6.2%. Why?

Because inflation rises with the rise in the production cost, increase in demand, wages, devaluation, among others. In developed countries, meeting the increasing demands of goods and services and production costs is easy. Whereas for Middle East countries, it was a hefty job to meet ends and stabilise demand and supply as they were developing nations with weaker economies.

See more@ 5 Reasons Why You Should Invest In Real Estate at a Young Age

To Sum Up

Real estate can be a reliable investment that can shield the investor from the ill effects of inflation. But, this stands true only when it is managed well. If you are a passive investor, you would definitely want to know if the sponsor or the promoter has planned for extending NOI at pace with inflation. This will ensure that the returns aren’t watered down over time.

Amidst inflationary challenges, you can wish that the private real estate in your portfolio will cope better. However, if you don’t have private real estate in your portfolio, it may be the right time to consider rebalancing your portfolio toward the same if you are administering less than 15% of it.