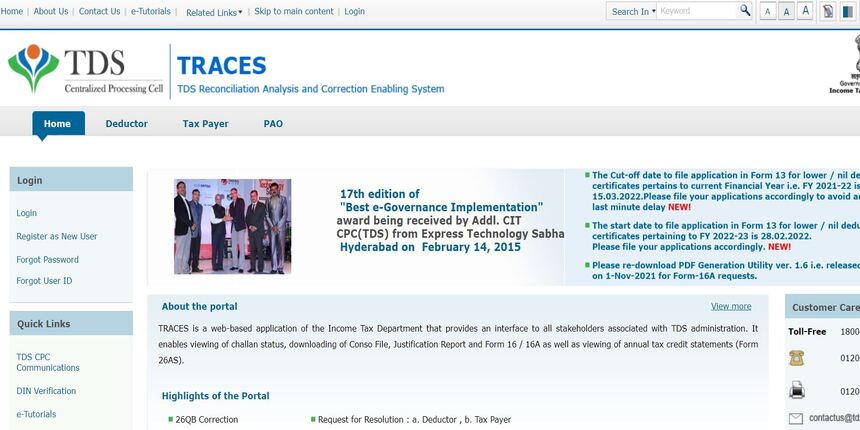

Digitisation has proven to be a benefit for the world. All working sectors, including taxes, have adopted the digital platform to streamline taxation processes. Tax-related activities are made available online via the TDS TRACES portal. This portal aims to make the application and processing of all taxes efficient, easy and fast for both taxpayers and deductors.

The TDS TRACES portal is a product of the Income Tax Department of India, where all the stakeholders can come together who are involved in Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) processes.

Currently, the TDS TRACES login portal is used to view and download all tax-related information and documents, including Form 16, Form 26 AS, Form 16 A, and many more.

Table of contents

- What is TDS TRACES?

- How to Register on TRACES?

- Steps to Register as a Deductor

- Steps to Register as a Taxpayer

- Steps to Register as Pay and Accounts Office (PAO)

- What are the Uses of TDS TRACES?

- Services Offered by TDS TRACES Login Portal

- Services Offered to Deductors by TDS TRACES Portal

- Services Offered to Taxpayers by TDS TRACES Portal

- Services Offered to PAO by TDS TRACES Portal

- TDS TRACES Justification Report

- Steps to Check TDS Challan Status on TRACES

- Form 16/16A Download Process From TDS TRACES Login Portal

- TDS TRACES Login with TAN Number

- How to Download TDS Return Statement/Acknowledgement from TRACES?

- Aggregate TDS Compliance Report

- FAQ’s about TDS Traces Login

What is TDS TRACES?

TDS TRACES, also known as Tax Deducted at Source Reconciliation Analysis and Correction Enabling System, was introduced to collect the tax amount from the source of income of an individual.

According to the concept of TDS, the deductor who has to make payment for a specific nature to the deductee shall deduct the amount at the source. The same tax amount will be transferred to the account of the Central Government of India.

As per the Income Tax of India, the deductee from which the tax has been deducted will be qualified to receive credits for the deducted amount. The entitlement to receive the credits is based upon the TDS certificate or Form 26 AS as furnished by the deductor.

With the portal of TDS TRACES, both the TDS taxpayers and TDS deductors can easily view the tax amount paid online. They can also reconcile the taxes to file income tax returns and seek further refunds.

The TDS tax amount is deducted at the rates described in the different provisions of India according to the Income Tax Act or the Finance Act’s First Schedule. Despite that, in the case of tax payment to any non-resident individual, the retaining rate of tax specified under the Double Taxation Avoidance Agreements will also be considered.

How to Register on TRACES?

The individual taxpayers and deductors need to register on the TDS TRACES official portal to view the tax amount deducted on the income. They need to provide PAN details, mobile number details, and the TDS CPC login to the portal. The steps to register on the TDS TRACES portal are as follows:-

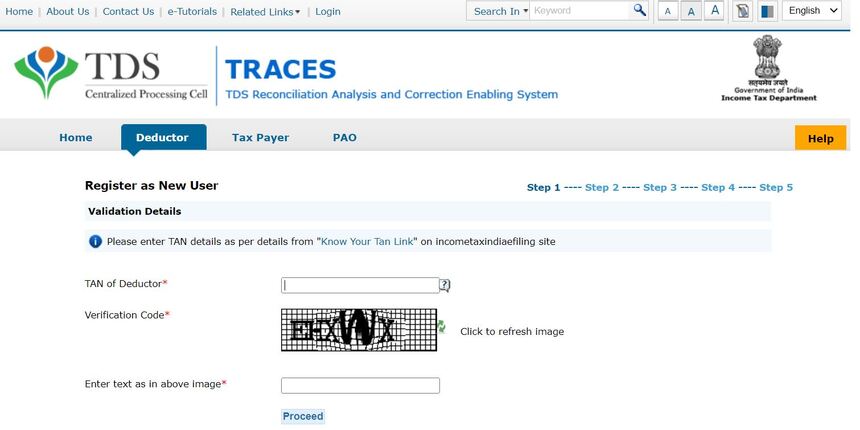

Steps to Register as a Deductor

Step 1: Visit the official portal of TDS TRACES.

Step 2: On the homepage, click on the option of ‘Register as New User’. From the options under this tab, click on ‘Deductor’ or ‘Taxpayer’ to choose the user type. Make sure to pick the type of user that describes you.

Step 3: Click on the option of ‘Proceed’.

Step 4: In the new window, enter the TAN details and verification code to register as a deductor or PAN details, mobile number, name, and verification code to register as a taxpayer.

Step 5: Click on the tab of ‘Proceed’.

Step 6: In the new window, enter the details, such as the token number of the original/regular statement, BIN/CIN number, PAN details that should pertain to the financial year, quarter, as well as the form type as displayed on the screen and the other details as asked by the TDS, TRACES login portal.

Step 7: After all the KYC details have been validated, an authentication code will be generated for the deductor. The KYC details remain the same for the same calendar and type of form, financial year (FY), and quarter.

The deductor details, PAN details and codes will automatically be filled in. All you need to do is update the responsible individual’s details, PAN information, and address.

In the case of proprietorship and an individual, the details of the PAN of both authorised parties will be the same. Whereas in all other situations, the PAN details of both parties will be different.

Step 8: In the new window, provide the details of the username for the new account and password. Then, click on the ‘Create an Account’ tab to successfully create the account.

Step 9: The TDS CPC portal will redirect you to the confirmation page. Check all the submitted details on the confirmation page. If there is any mistake or change, click on the ‘Edit’ option to modify the details.

Step 10: Click on the ‘Confirm’ tab to continue registering on the portal.

After the form is submitted, the message ‘Registration Request Successfully Submitted’ will be displayed on the screen.

Step 11: The activation link will be received on the email ID and mobile number entered for the registration of the account, along with the code. Activate the TDS CPC login account via the activation link and complete the registration.

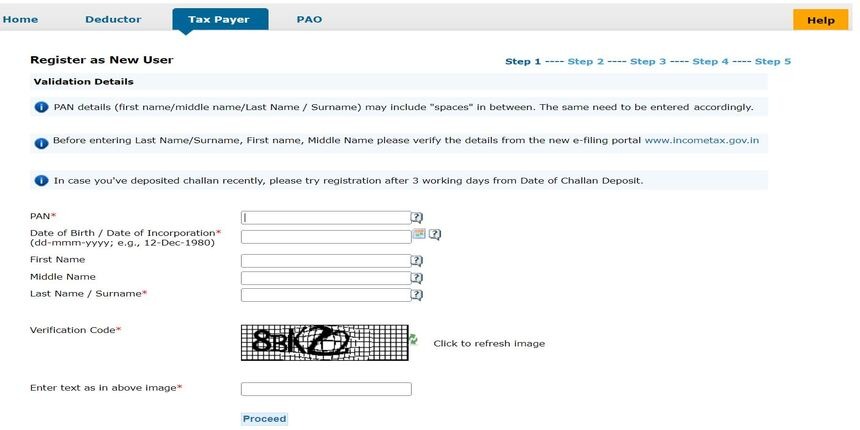

Steps to Register as a Taxpayer

Step 1: Visit the official portal of TDS traces.

Step 2: On the homepage, click on the option of ‘Register as New User’. From the options under this tab, click on ‘Taxpayer’ to choose the user type. Make sure to pick the type of user that describes you.

Step 3: Click on the option of ‘Proceed’.

Step 4: In the new window, enter the PAN details, mobile number, name, and verification code to register as a taxpayer.

Step 5: Click on the tab of ‘Proceed’. The TDS TRACES portal will redirect you to the new window. Enter all the details as asked in this window, such as advance tax details, TCS/TDS details, Form 26QB statement details, and more.

Step 6: After all the details have been entered accurately, click on the ‘Proceed’ option. In the next window, provide the communication details, such as mobile number, email ID, and residential address. Click on ‘Proceed’ to move further with the registration process.

Step 7: In the next window, set up the account password security questions along with the answer and username that will be used to access the TDS TRACES login portal.

Step 8: The TDS TRACES portal will redirect you to the confirmation page. Check all the submitted details to register as a taxpayer on the confirmation page. If there is any mistake or changes needed in the submitted details, click on the ‘Edit’ option to modify the same.

Step 9: Click on the ‘Confirm’ option to continue the registration process on the portal. After the form is submitted, the message ‘Registration Request Successfully Submitted’ will appear on the screen.

Step 10: The activation link for the account will be received on the email ID and mobile number entered for the registration of the account, along with the code. Activate the TDS CPC login account via the activation link and complete the registration.

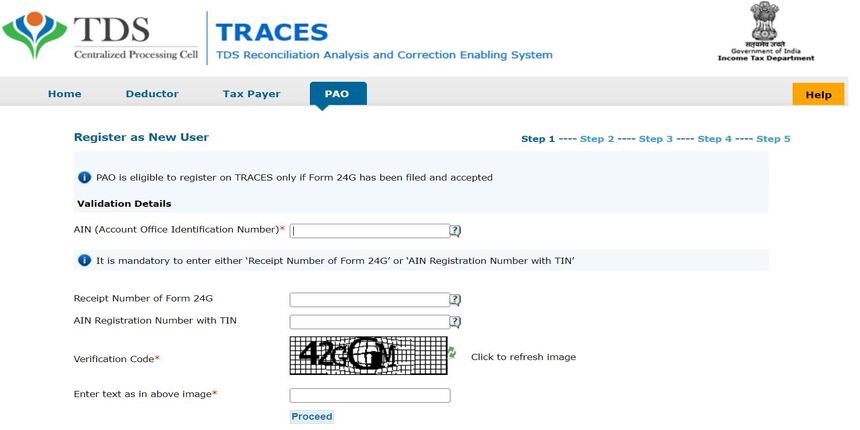

Steps to Register as Pay and Accounts Office (PAO)

Step 1: Visit the official portal of TDS TRACES.

Step 2: On the homepage, click on the option of ‘Register as New User’. From the options under this tab, click on ‘PAO’ to choose the user type. Make sure to pick the type of user that describes you.

Step 3: Click on the option of ‘Proceed’.

Step 4: In the new window, enter the Account Office Identification Number (AIN) details, TIN, and verification code to register as a PAO on the TDS CPC login portal.

Step 5: Confirm the submitted details on the screen in the new window and click on the ‘Submit’ option.

Step 6: After successfully submitting the details, the activation link will be sent to the entered email ID and mobile number.

Step 7: Click on the activation link to activate the TDS TRACES login details of the portal.`

Don’t miss It!

| NPS Login | NPS Login(National Pension Scheme): Karvy & NSDL Login Process |

| Ration Card Types | Different Types of Ration Card in India |

| ESIC | ESIC – Registration, Benefits, Documentation & Eligibility Criteria |

| Post Office Scheme | Post Office Saving Schemes – Overview & Benefits |

What are the Uses of TDS TRACES?

The TDS TRACES portal can be used for the following purposes:

- To download and view Form 26AS.

- To file for correction in TCS/TDS statements.

- For checking the various tax statement status online.

- To submit the request for a refund online.

- For downloading consolidated files, Form 16, Justification Report, Form 16A from the portal.

- To apply for corrections online for the previously filed TDS returns.

- For making corrections in the OLTAS challan online.

The TDS TRACES portal provides hassle-free services so that the visitors can carry out their tax-related work efficiently, smoothly and easily. It is less time consuming, and corrections can be made easily through the portal.

Services Offered by TDS TRACES Login Portal

TDS TRACES portal offers a range of services and facilities. Below-mentioned is the three classifications of services by TDS TRACES:

- Services Offered to Deductors

- Services Offered to Taxpayers

- Services Offered to Pay and Accounts Office (PAO)

Services Offered to Deductors by TDS TRACES Portal

Here is the list of services offered to deductors by TDS TRACES.

- Admin User Registration for a TAN

- Sub-users creation with the help of Admin User

- Can view Challan Status

- Can download Justification Report

- To download Form 16 or 16A

- Can view TCS/TDS credit status for PAN

- Can view PAN Master for any TAN

- View status of statement

- Can provide feedback

- Management of user’s profile and password

- Validating 197 certificates

- Online corrections

- Non-filing statement declaration

- Refund of the TDS

- Offline corrections

Services Offered to Taxpayers by TDS TRACES Portal

Given below is the list of services offered by TDS TRACES to taxpayers.

- Registration for TDS

- Can download Form 26AS

- Can also download Form 16B

- Management of user’s profile and password for TDS TRACES account

- Can easily verify TDS certificate

- Download or view aggregated reports of TDS compliances

Services Offered to PAO by TDS TRACES Portal

Here is the list of services offered by the TDS TRACES portal to PAOs (Pay and Accounts Office).

- TDS TRACES registration.

- Access dashboard through which a summary of DDO details can be accessed.

- View TAN statement status, which is mapped to the Account Office Identification Number (AIN) of the PAO.

TDS TRACES Justification Report

TDS TRACES Justification Report refers to the data that has all the errors/defaults noticed by the Income Tax Department. These defaults are identified during the statement processing that the deductor has filed during a specific financial year quarter.

The justification report of TDS TRACES has the derailed data of the defaults/errors that needs rectification. These rectifications need to be done by the deductor. A correction form statement needs to be submitted to rectify the errors and make the payment of the pertinent fees/interest along with any applicable due amount.

As an alternate method, the deductors can also use the information mentioned in the report to present their clarifications for any defaults/errors identified by the Income Tax Department.

Steps to Check TDS Challan Status on TRACES

The steps to check the TDS challan status on the TDS traces portal are as follows:

Step 1: Visit the official TDS TRACES login portal and log in using the credentials.

Step 2: Go to the ‘Statements/Payments’ option on the homepage after logging in to the portal.

Step 3: Click on the ‘Challan Status’ option.

Step 4: Enter the challan details, and the status of the same will be displayed on the screen.

Also, if there is any balance, the same will be displayed against the details of the challan that it belongs to.

Form 16/16A Download Process From TDS TRACES Login Portal

The TDS TRACES portal allows the deductor registered to access and download Form 16/16A. These documents on the portal contain information about tax deducted at source (TDS) records. It also helps the taxpayers to file the Income Tax Returns (ITR) easily.

As per Income Tax Act, Section 192, Form 16 is issued by ITD to individuals on the tax deduction by the employer in place of the employees (in case it is a salaried income). On the other hand, the department issues Form 16A if the tax amount is deducted under all the provisions, excluding Section 192.

TDS TRACES Login with TAN Number

If the deductor has registered on the TDS CPC login portal using their Tax Deduction and Collection Account Number (TAN Number), follow the steps mentioned below to log in to the TDS TRACES portal.

Step 1: Visit the official portal of the TDS CPC Login portal.

Step 2: On the homepage, click on the ‘Login’ option to redirect to the login page.

Step 3: Enter the login details in the respective fields, i.e., the TIN details and click on the ‘Go’ option.

Step 4: Provide all the details, such as DOB, PAN details, TAN details, etc. and click on the ‘Submit’ option.

Step 5: In the confirmation screen, cross-check all the details submitted on the TDS CPC login portal and click on the ‘Submit’ option.

Step 6: On successfully registering on the portal, an activation link along with a verification code will be sent to the registered email ID and mobile number.

Step 7: Click on the activation link and enter the code to successfully activate the account.

How to Download TDS Return Statement/Acknowledgement from TRACES?

To download the TDS return statement from the TDS TRACES portal, follow the steps mentioned below:

Step 1: Visit the official TDS TRACES portal and log in using the TDS login credential, PAN/TAN details. Click on the login option.

Step 2: After logging in to the portal, you will find the ‘Statements/Payments’ option.

Step 3: Four options will be displayed below, namely Statement Status, Token Number, Statement and During Last 3 Months. Click on the ‘Statement Status’ option.

Step 4: The TDS return details will be displayed in the new window, along with the date-wise status of each TDS filling.

Step 5: Click on the download option to save the details on the device for future use.

Aggregate TDS Compliance Report

In case the PAN details of an individual are registered with multiple TAN details, the aggregated TDS compliance report will help identify any defaults in the TAN that is linked with the PAN of the entity.

These attributes help in the effective working of the TDS TRACES administration, compliance, and control at their level. To generate the Aggregate TDS Compliance Report, follow the steps mentioned below:

Step 1: Visit the official TDS TRACES login portal and log in to the site as a taxpayer.

Step 2: Click on the tab ‘Aggregate TDS Compliance’ to cater for the following option:

- Default Based: Select the specific default type you need to accumulate the TDS compliance report for all the financial years.

- Financial Year Based: Select the specific Financial Year for which the Aggregate TDS Compliance Report is required.

Step 3: Click on the ‘Submit’ option.

Step 4: Once the request is placed on the TDS TRACES portal, the Excel file with the Aggregate TDS Compliance Report can be downloaded via the ‘Requested Download’ option available under ‘Download’.

FAQ’s about TDS Traces Login

Q1. How do I create a login on TRACES?

To create a login on TRACES, visit the official website and create an account. Fill in the details asked by the portal, such as TAN and PAN details verification number, and click on proceed to successfully create your login account.

Q2. What is the user ID in TRACES?

The user ID in TDS TRACES is the PAN/TAN number of the user. To log in to the portal, the user needs to enter their username (PAN) and password.

Q3. How can I check my TDS return on TRACES?

To check the TDS return, visit the official TDS TRACES login portal and log in to the account. Click on the ‘View TDS return’ option under the tab ‘TDS’ to check the TDS return on TRACES.

Q4. How can I download the TDS certificate from TRACES?

Log in to the official TDS TRACES portal and click on the ‘Download 197/206 Certificate’ option under the tab ‘TDS’. In the next window, enter all the necessary details, such as financial year, request number, deductee’s PAN details and more. You will be able to download the TDS certificate thereafter.

Q5. How can I get a TDS summary from TRACES?

After logging in to the official TDS TRACES portal, select Form 26QC. In the new window, enter all the required information asked by the portal and click on the view default summary option to get the TDS summary from TRACES.

Q6. What is Tan of Deductor in TRACES?

TAN refers to the tax collection account number or tax deduction account number of the account holder. It is a 10-digit alphanumeric detail issued to the account holder by the Income Tax Department. The TAN number must be received by every individual whose tax will get deducted at the source or those who have to collect the tax amount at the source.