Be smart and apply for PAN deactivation of your fake, multiple or duplicate PAN cards before you unknowingly become a part of unwarranted transactions. Yes, if you do not take care of your PAN card, it can be used for several criminal purposes. In this article, we enlist the steps for PAN deactivation for both online and offline methods.

Let’s begin!

Major Reasons Behind PAN Card Deactivation

PAN card deactivation can take place due to numerous reasons. Here we have listed the most common causes because of which the Income Tax Department deactivates PAN cards.

Deceased Person PAN Card

Once the legal heir of the deceased person sends a formal application to the Income Tax Department, they deactivate the PAN card of the departed person. To complete the process of PAN card deactivation, the Income Tax Department requires a death certificate copy of the deceased person apart from a formal application.

One Person With Multiple PAN Cards

Many individuals apply for a new PAN card after misplacing the old one instead of blocking or reprinting the existing one. Due to this, the Income Tax Department deactivates the extra PAN cards allocated in your name.

Owning Fake PAN Cards

Many individuals may use fake documents to own multiple PAN cards. It happens to evade paying taxes to the government. Therefore, the Income Tax Department has to deactivate such fake PAN cards.

Foreigners PAN Card

Foreigners who wish to discontinue their financial transactions have to surrender their PAN to the Indian Income Tax Department. This step helps in avoiding the misuse of their PAN card.

How To Deactivate PAN Card?

There are two ways for PAN deactivation. One is offline and the other one is online. We have written the steps for both procedures.

Steps To Deactivate PAN Card Online

Step 1: Visit the online NSDL portal.

Step 2: Select the PAN Application option from the Services tab.

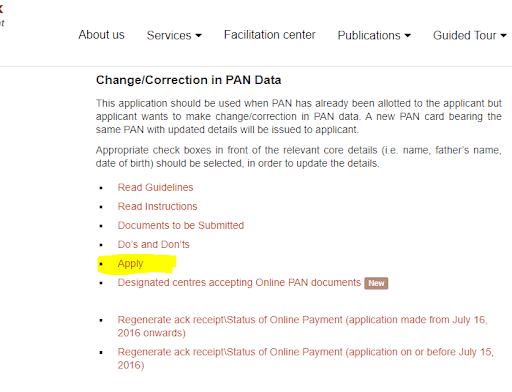

Step 3: In the Application Type, select the Apply option under the heading Changes/Correction in existing PAN Data.

Step 4: Now, fill the online PAN change request form. A token number will come on the screen. You have to write it down for future consideration.

Step 5: Click on the Continue with PAN Application Form option.

Step 6: Fill in every detail but make sure not to select any checkmark.

Step 7: At the bottom of the form you will be given two options:

Physical Acknowledgement, or

Paperless Method

If you choose a paperless method, e-sign using the Aadhaar OTP before submitting the form.

If you choose the physical mode, take the printout of the form and mail it to the NSDL address. Make sure to write the Application for PAN Cancellation on the envelope.

Step 8: Submit the details of the PAN you want to surrender or deactivate. And at the end write the PAN information you wish to use continuously.

Step 9: Submit your application and pay the chargeable amount. Also, download your application for future consideration.

Steps To Deactivate PAN Card Offline

Step 1: You have to fill the Form 49A. Submit the form to the NSDL TIN center.

Step 2: You can write a letter addressing the assessing officer of your area. Make sure to mention the following details:

- Assessee’s Name

- Assessee’s Address

- Information of the PAN to be surrendered

- Information of the PAN you wish to use continuously.

How To Check PAN Card Status?

You have to follow the steps written below to check your PAN card status.

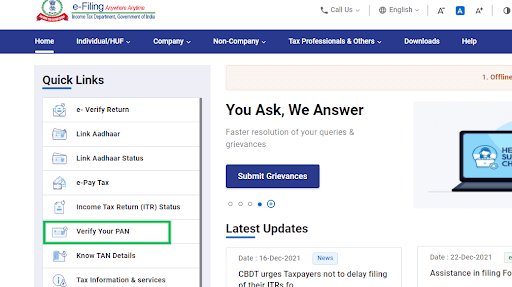

Step 1: Go to the official website of Income Tax India.

https://www_incometax_gov_in/iec/foportal (Remove _ with .).

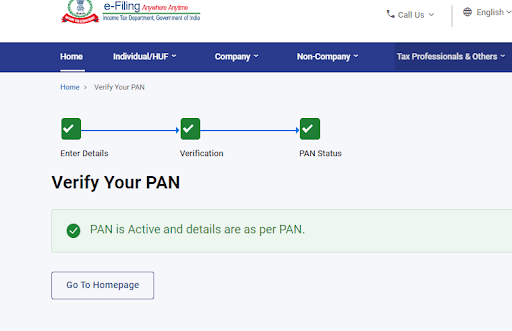

Step 2: Select the option of Verify PAN.

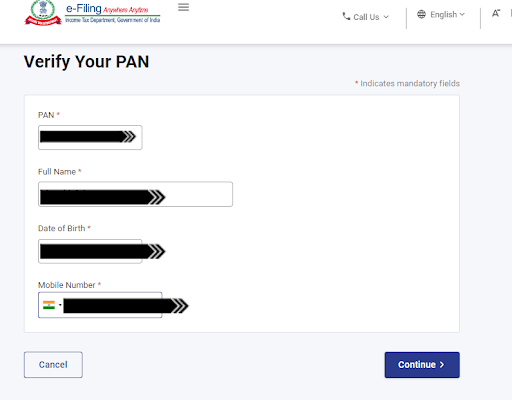

Step 3: Fill in your PAN number, full name, birth date, and registered mobile number.

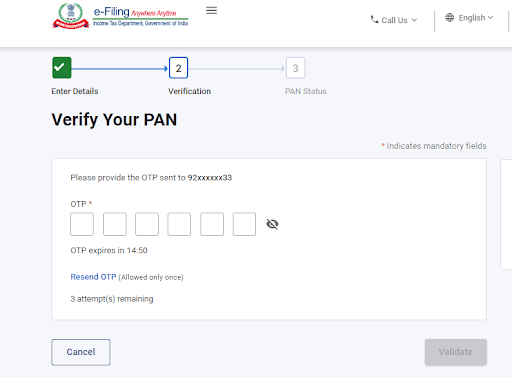

Step 4: An OTP will be sent to your number. You have to write the OTP and validate it.

Step 5: Once you verify the OTP. You can see your PAN status clearly on the screen.

Frequently Asked Questions (FAQ)

How to know if my PAN card is deactivated or not?

You can check the status of your PAN online on the official portal of the Income Tax Department. Select the verify option and enter the details asked. Enter the OTP sent on your registered number. You will be able to see the status of your PAN card.

Is it possible that my PAN card be blocked?

Yes, if you are unable to access your PAN card while filling the return then your PAN card might get deactivated. But if you are not able to log in to the ITR portal, PAN is cancelled.

What if I have 2 PAN cards?

It is illegal to keep two PAN cards at the same time. Therefore, you have to deactivate one of your PAN cards. You can complete the PAN deactivation online and offline.

How to close my PAN card after death?

If you depart your ways from the living world, your legal representative will have to send a formal letter to the AO of your area for PAN deactivation. Also, your representative has to make sure that a death certificate, PAN details, birth certificate is attested along with the formal application. After the clearance of dues and validating your background, the ITD will deactivate your PAN card.

How can I apply for a PAN card a second time?

Every Permanent Account Number is unique and given one time to an individual. However, if you have misplaced your PAN card, you can apply for the duplicate copy of the PAN card to the official website of the Income Tax Department.