The existence of international trade and ecommerce has made the World thrive. The availability of thousands of products across the world made trading daunting. There arose the need for a system that can classify commodities and offer them a unique identity. Considering this, the HSN Code or Harmonized System of Nomenclature was introduced. It offered a common language to understand commodities available worldwide irrespective of the country. HSN Codes are thus considered an integral part of international trade as well as eCommerce.

In this blog, we have encapsulated everything that you should know about HSN code, HSN code list, its format GST HSN code, and much more. Keep scrolling, till the end and grasp every word of the mentioned information.

What is HSN code?

HSN code refers to “Harmonized System of Nomenclature”. The key idea beyond the infusion of this system was to offer a systematic classification of goods around the globe. HSN code is a six-digit static code that embraces more than 5000 products. Countries across the world have accepted this harmonized system to classify numerous products.

The World Customs Organization abbreviated as WCO is the authority behind the infusion of this unique yet effective system. It came into existence in the late 1988s. HSN comprises a specific set of rules for the seamless working of International Trade and eCommerce. It aids in taxation tasks with the adequate identification of liable tax rates.

Additionally, it makes the task of product quantum easier specifically in the event of import and export. HSN is again drilled into chapters that further break down into heading and subheadings. Together all these three categories make a resultant code of 6 Digit termed as HSN Code. More than 200 countries across the world endorse HSN to stagger 98 percent of goods globally.

Understanding the Structure and Bifurcation of HSN Code

After going through the basics of HSN code, it’s time to understand the HSN code in terms of its classification. Going further, if you are not familiar with the HSN full form, then HSN stands for “Harmonized System of Nomenclature.” the HSN Code is classified in for parts i.e.

- 21- Sections

- 99 – Chapters

- 1244 – Headings

- 5224 – Subheadings

The HSN code structure breaks down into 21 groups that are further classified within 99 chapters. These chapters consist of 1244 headings. In total 5224 subheadings form 1244 headings.

To understand how the digits are placed in an HSN code let’s dig deep into the classification of the HSN number.

With a random HSN Code i.e.39 08 90 20 we will understand what these digits stand for:

- The initial two digits of the code i.e. represent the chapter.

- Followed by the next two digits of the code i.e. 08 depicts the headings underlying in chapters.

- The next 2 digits i.e. 90 represent the subheadings of the HSN code. These 6 digits of the HSN code are acceptable by 200+ countries across the world.

- The next two following digits i.e. 20 sub-classify the tariff heading of the product which is considerable for the trading purpose.

The existence of HSN codes allows the individual to save time along with money specifically under the GST taxation system.

Why is HSN Code Important?

Earlier people had to upload a detailed description of the product which got eliminated with an infusion of HSN code. Somehow, it was reflected as a cut down in the GST filing procedure. Additionally, the GST return procedure became fully automated with the existence of HSN code. The key agenda of the arrangement of goods in a systematic and logical manner was successfully accomplished.

The task of assessing and determining data became effortless with the incorporation of the Harmonized System of Nomenclature. The vital reason behind the adoption of HSN codes is the distinct benefits it offers. Refer to the following points to understand the importance of the HSN code:

- It offered systematic categorization of goods and services

- Provision of custom tariffs

- Efficient tracking of data analytics associated with the International trade

- Access to seamless taxation process

- Offers better control over the tax evasion practices

Why HSN Code is Necessary for GST

With the introduction of the Goods and Services Tax Act, the key aim was to bring the taxation system on track. The presence of GST put forward an automated digital module. To take it to the next level the Government decided to infuse HSN codes associated with the product within the taxation system. Thus, when you trade any commodity you need to mention the associated HSN code on the invoice. With the presence of HSN on the GST invoice, the tax returns have become quick and efficient at the same time.

In India, tax fraud doesn’t have any dearth, and the number of people who pay taxes is minuscule. Keeping both the points into consideration the HSN code acted as an adequate step to keep them on the map.

Additionally, the government aims to include local goods within this HSN code-based GST format and further thinking to put these local goods over the international scale.

The key purpose of introducing the HSN code in the taxation system was to make GST more systematic and increase the global acceptance of GST. With its infusion, the need of uploading detailed information got eliminated completely. The trader doesn’t need to provide in-depth information about the goods being traded. Additionally, the automated taxation system has made the GST filing procedure a lot easier.

The trader as well as the service provider is supposed to mention HSN or SAC code along with the sales summary within the GSTR-1.

How Does HSN Code work?

HSN code is a six-digit code that is used to classify 5000+ commodities and offer a legal and logical arrangement of goods. To ensure that the HSN code successfully offers the expected classification it is bound with an array of rules. These rules and the HSN code have got worldwide acceptance to avail seamless international trade.

Additionally, it is used to ease the overall taxation process and helps in identifying the applicable tax rate on a product across the country. This is the reason because of which in India it is well known with the name of GST HSN code. However, it is also used for determining the claim benefits.

Yet this is not it! Apart from the aforementioned things, this classification is also applicable to import and export within and outside the country. The HSN code even helps to determine the quantity in which the goods are imported or exported. In simple words we can say, the presence of HSN code ensures that no ambiguity takes place in International Trade.

For instance, let’s say a trader is exporting “agarbatti” to the UK. There are chances he fails to understand what “agarbatti” stands for. But the associated HSN code “3307 41 00 “ will make him familiar with the product being discussed.

Who Provides HSN Code?

The Directorate General of Foreign Trade (DGFT) is responsible for any sort of formulation, amendment within the existing codes, and infusion of new codes. Although, on a periodic basis, the designated personnel put forward changes in the description of commodities, remove defunct codes if any, add new codes to ensure everything remains up to date.

Is HSN Code Mandatory?

In International Trade or trade within a country, the ITC-HS and HSN Codes are mandatory specifically while exporting commodities. As per the specified rules, it is mandatory to state the associated 8 Digits on the shipping bill or invoice. If you fail to do so, then you won’t be able to avail the associated benefits. Although, in Goods and Service tax GST HSN codes aren’t mandatory especially for ventures having annual turnover below INR 1.5 Cr. The same applies to the dealer who is registered with the GST Composition Scheme.

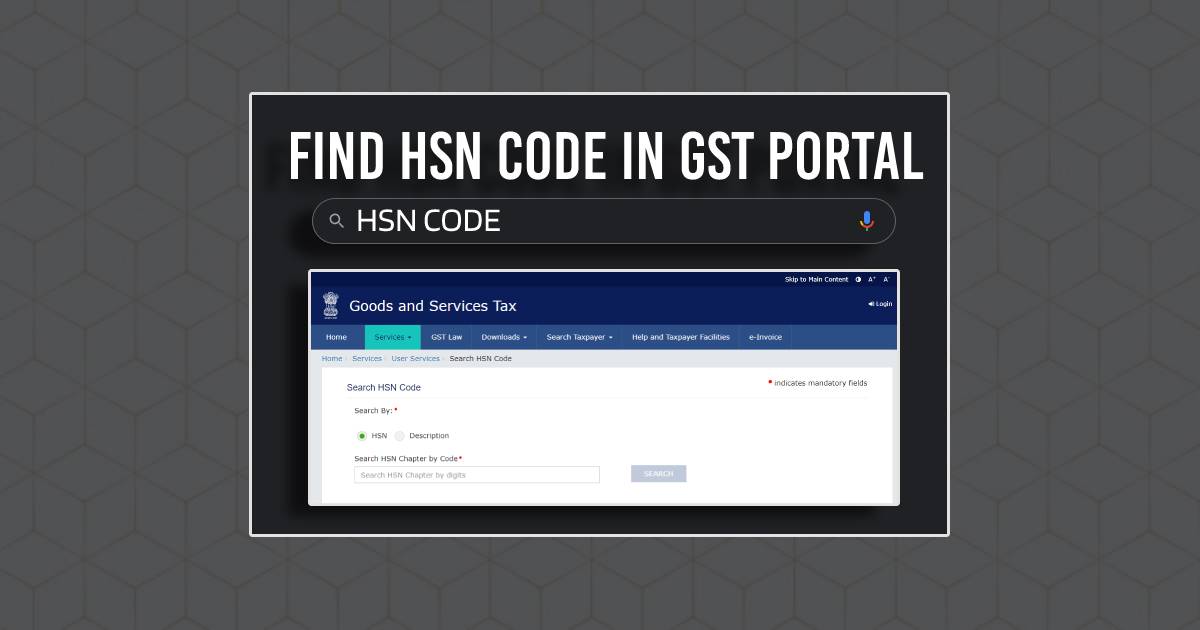

Where to Find HSN Code: HSN Code FInder

If you are looking for an HSN code correlated with a specific product then you can directly look for the same on the official page of the GST council. It specifically comprises the GST HSN code section, where you can find the code or product you are looking for.

Here is the step-by-step procedure to find HSN Code in GST Portal or we can say HSN Code Finder.

- Visit the official portal of the Goods and Service Tax Council.

- On the right side of the screen, you will find a section named “Overview’.

- In the overview section click on ‘HSN/SAC/GST Rate Finder’ i.e. the third subsection of the overview section.

- You will be redirected to another page consisting of the Heading and subheading of each commodity along with GST Rates.

- You can either scroll down the list of items to get the code or can directly enter the product name to get the correlated code.

- You get an array of details about the searched product including heading And subheading of the product, product description, GST Rate, SGST/UTGST Rate, IGST Rate, and Compensation Cess.

For instance, HSN 9954 stands for construction services.

HSN code 9987 represents maintenance, repair as well as installation services apart from the construction ones.

8471 is the HSN code for laptop.

- Search By Product Name:

To find details about the specific product you can type the product name in the search section. After that, you will receive adequate suggestions about the relevant 4 digits of the HSN Codes. If you don’t get the appropriate one, click on search for all results.

After finding the correlated code click on it to get the 4 digit HSN Code; 6 Digit HSN Code and 8 DIgit HSN Code. You will be able to access the minute details relevant for trading together with the applicable GST rates.

- Search by Product’s HSN Code:

To get the details about the product through HSN Code, enter the 2 digits or 4 digits of the product’s HSN Code. You will see the desired result and unlock more information by clicking on it.

Benefits of HSN Code

The HSN code has come with numerous benefits and below listed are the most crucial ones:

- HSN Code classifies commodities around the nation to ease the processing of Customs and Central Excise

- Offers uniform taxation system around the Globe

- International trade became quick and seamless

- It enhances the overall flow of filing returns, preparing invoices, and many other things

Section Wise HSN Code List for GST in India

Refer to the below mentioned HSN Code list to determine in which section-specific product falls within:

| Sections | HSN Code List |

| Section 1 |

|

| Section 2 | Vegetable Commodities |

| Section 3 |

|

| Section 4 |

|

| Section 5 | Mineral Products |

| Section 6 | Products associated with Allied/Chemicals Industries |

| Section 7 |

|

| Section 8 |

|

| Section 9 |

|

| Section 10 |

|

| Section 11 | Textile and Textile Associated Articles |

| Section 12 |

|

| Section 13 |

|

| Section 14 |

|

| Section 15 | Articles together Base Metals |

| Section 16 |

|

| Section 17 |

|

| Section 18 |

|

| Section 19 | Ammunition and Arm parts along with other accessories |

| Section 20 | Miscellaneous Manufactured Materials |

| Section 21 | Work associated with Art, Collectors’ pieces as well as antiques |

HSN Code Worldwide

The HSN Code system has been accepted by 200 plus countries worldwide because of the following reasons:

- To get Uniform classification for a wide range of products

- Offers adequate base for customs tariffs

- Seamless collection of stats associated with International Trade

- Over 98 percent of the trading merchandise is classified through the HSN Code system.

In the Harmonized System of Nomenclature, each commodity has been assigned a unique number to offer distinct identification and is acceptable by most of the nation. The code remains the same for goods from one country to another. Although, in some countries, it may vary based upon the nature of the commodity.

HSN in India

Since 1971, India has been an active member of WCO (World Customs Organization). Initially, India was considering the 6 Digit HSN Code for the classification of commodities. But, lately, the Customs and Central Excise decided to rely on 8 digit code to bring more precise classification.

Approximately all commodities in India are categorized under the HSN classification code. Additionally, it is being used to determine the liable GST and VAT.

Who Should Use HSN Code in India?

HSN codes are generally used by the traders along with the dealers in India. Typically 2,4 and 8 digit codes are taken into consideration especially for the purpose of International Trade. The below-depicted criteria must be followed to use HSN Code in India.

- If the enterprise turnover is below INR 1.5 cr then no HSN code will be used.

- In case the enterprise turnover ranges from INR 1.5 Cr to INR 5 Cr then, 2 digit HSN code should be considered for trading purposes.

- In the event, when enterprise turnover is beyond INR 5 Cr, then 4 digit HSN code should be taken into consideration.

- To deal in Import, Export, and International Trade, you will have to count on 8 digit HSN codes.

Wrapping up:

Infusion of this unique Harmonized System of Nomenclature changed the whole scenario of trading internationally. The HSN Code associated with the product makes it seamless to determine the applicable rates. Additionally, it makes it a bit easier for the trader whether it falls under the category of trading within India or worldwide. The availability of an HSN Code finder makes the whole process quick and uninterrupted. Know the GST HSN Code and trade with the tap of fingers.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQs)

How many digits of the HSN Code are specified on the GST invoice?

6 Digit HSN code is specified on the GST invoice.

How to find HSN Code?

To find a productu2019s HSN code, choose the Chapter, followed by the selection of the section and the subheading. As a result, you will get the product code. For instance, the HSN code for roasted Chana is 19041090 in which the Chapter is 19, Section is 04, and 10 is the subheading. The product is depicted by the number 90.

Is the HSN Code changing?

From 1st April 2021, the GST council has made it mandatory for the traders to mention either 4 digit code or 6 digit code within the Tax Invoice along with the GSTR-1u2019s Table-12. Before this compulsion, the taxpayers were asked to mention the HSN-based invoice value.