IDBI (Industrial Development Bank of India) has set up a convenient and easy to use net banking feature that accounts holders can use to manage their accounts from anywhere safely and securely with just a click of a button. With IDBI net banking, the account holder can tracking account transactions, managing Demat accounts, paying bills, paying loan installments, requesting chequebooks, and renewing existing fixed deposit accounts. With the digitization of various industries now gathering pace and the demonetization of currency, cashless transactions are now under the increased spotlight, making the internet banking facility even more important. Let’s learn how to register for IDBI net banking, log in, and some of the attractive features of this service.

Table of contents

- IDBI Net Banking Registration Process

- How to Login to IDBI Net Banking Portal?

- How to Check the Balance Using IDBI Net Banking?

- Features and Benefits of IDBI Bank Net Banking

- How to Transfer Funds through IDBI Net Banking?

- Transaction Limit in IDBI Bank Netbanking

- IDBI Net Banking Customer Care

- Frequently Asked Questions (FAQ’s):-

Types of IDBI Net Banking

With the introduction of technology in the banking sector, accomplishing banking tasks has become easier. To offer the utmost customer satisfaction, IDBI bank provides two types of net banking, i.e. retail net banking and corporate net banking.

IDBI Retail Net Banking

IDBI bank has initiated retail internet banking specifically for individual account holders. Now they can carry out an array of tasks by login into their account round-the-clock from anywhere. These tasks include:-

- Account balance check

- Transaction tracking and history

- Details of loan instalments

- Bank statements

- Renewal and opening of fixed deposits and recurring deposit

- Mobile and DTH recharge

- Online payment services

- Demat account information

- Bill payments and Presentment

You can easily access IDBI retail net banking service by:-

- Calling customer care executive on 1800-209-4324 and 1800-22-1070.

- Visiting the nearest bank branch and getting in touch with the bank executive.

Corporate Internet Banking of IDBI bank is the foremost channel for providing Corporate Customers with easy access to banking activities. Now, firms, companies, trusts, and partnership firms can access banking services online from anywhere. Everything can be done online from your office, from account information to online instructions to merchant payments.

To access IDBI corporate net banking services, you just need to login to the portal through your login credentials and everything will be readily available on this user-friendly interface.

IDBI Net Banking Registration Process

Given below is the step-by-step process to register for the IDBI internet banking facility:-

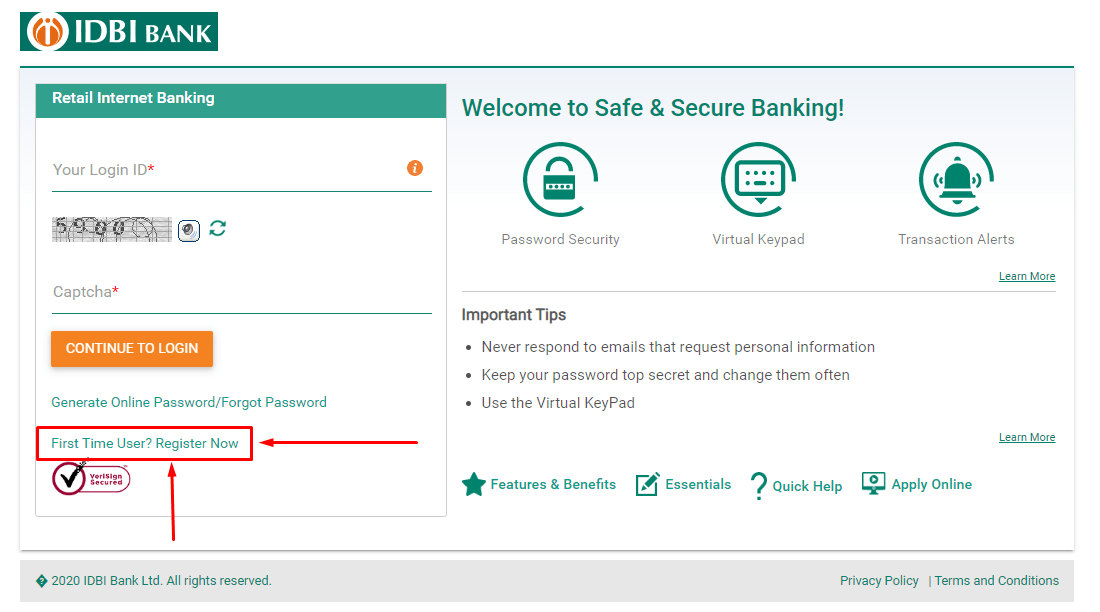

Step 1: You will first be required to visit the official IDBI net banking login page. Click on the ‘First Time User? Register Now’ option.

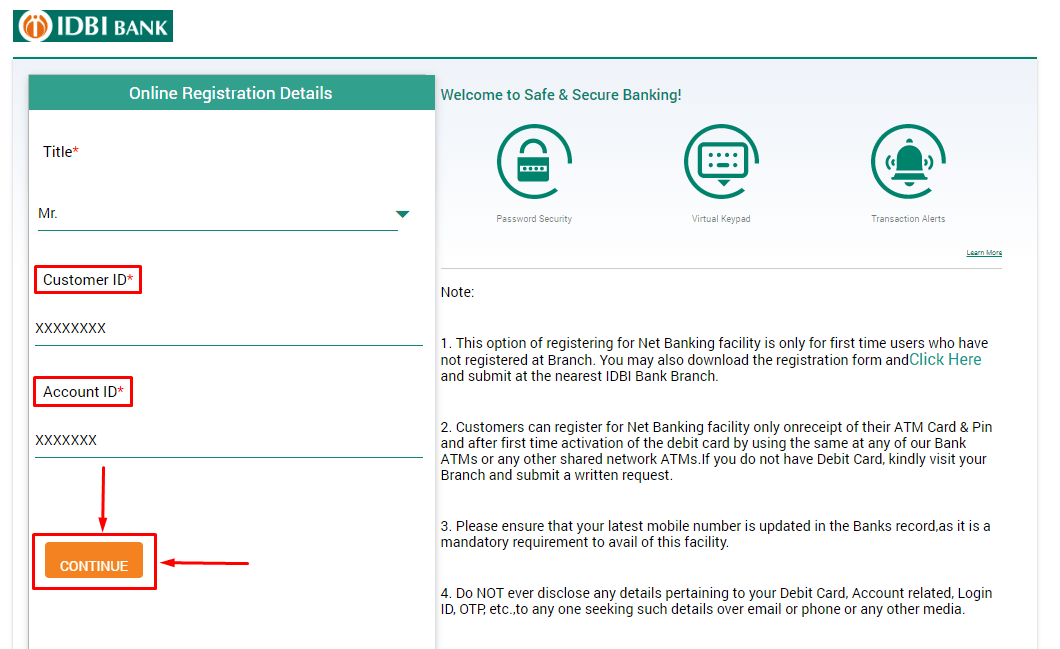

Step 2: You will be redirected to a new page. Enter your ‘Customer ID’ and ‘Account ID’ in the spaces allocated.

Step 3: On the next page, ‘Generate Online Password’ option.

Step 4: On the resulting page, you will need enter your login ID and Account Number.

Step 5: Click on the ‘Submit’ button.

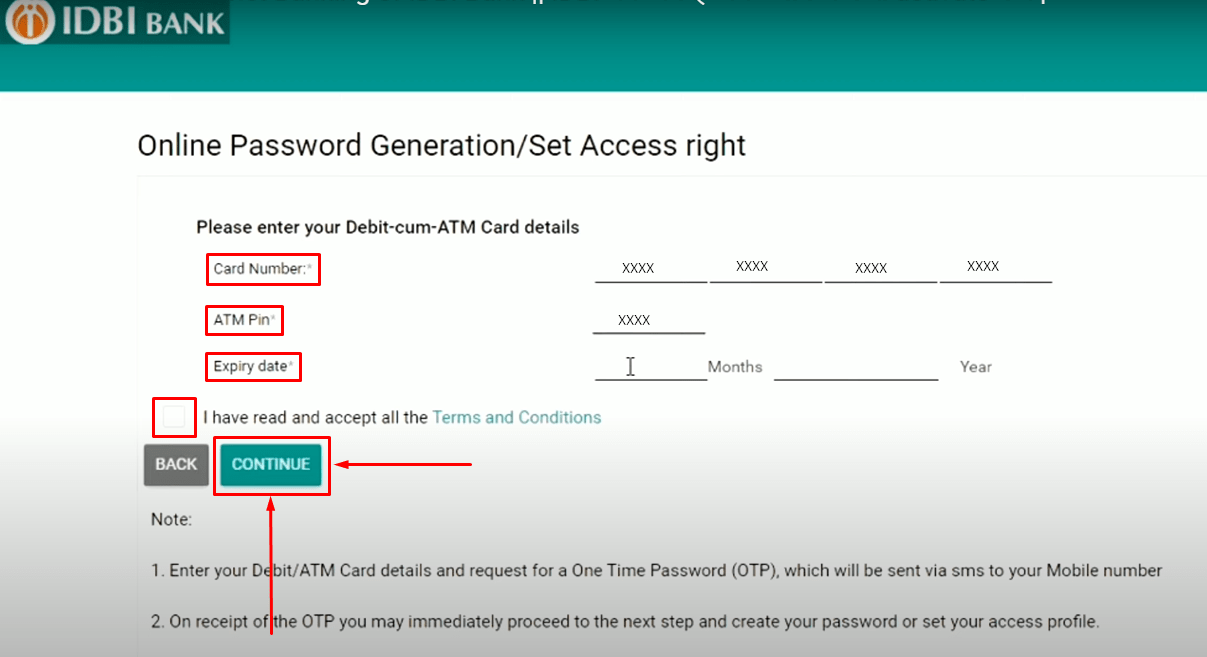

Step 6: Next, enter your debit card number, ATM pin, and the expiration date of your debit card.

Step 7: After accepting the terms and conditions, click on ‘Continue’

Step 8: On the next page, click enter the ‘OTP’ sent to your registered mobile number and click on ‘Continue.’

Step 9: Now you will be redirected to ‘Online Password Generation/Set Access Rights’ page.

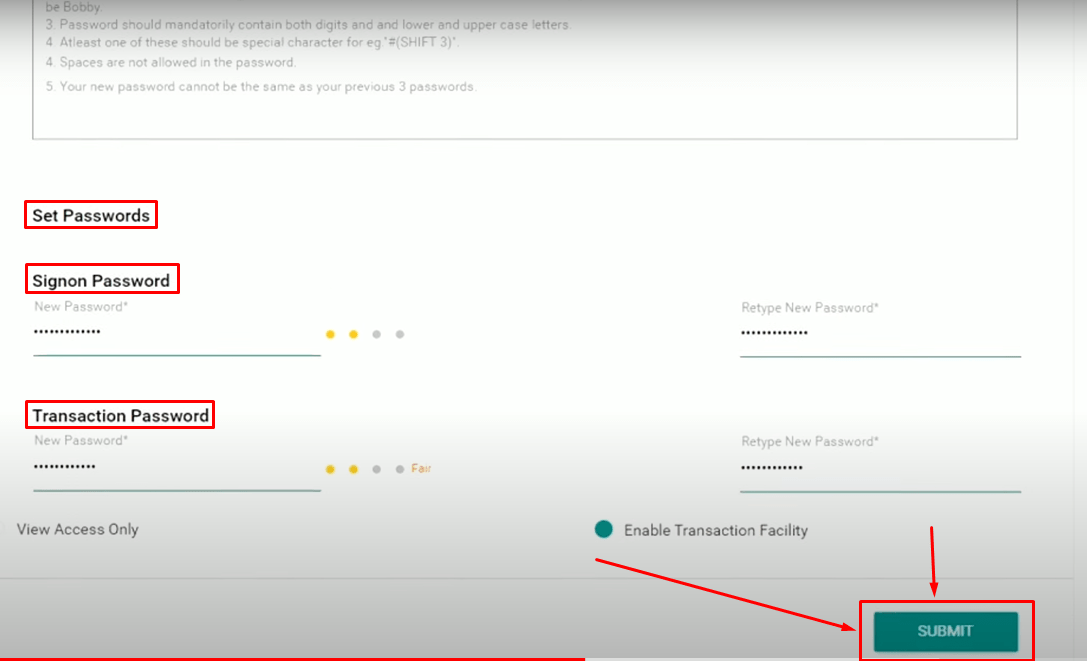

Step 10: Here, carefully read the password guidelines and set your ‘Signon Passwors’ and ‘Transaction Password’ respectively.

Step 11: Set your access rights in accordance with your requirements and click on ‘Submit.’

Step12: An acknowledgement will be displayed on the screen. Click on ‘Go to Login Page’ button.

Step13: You will now be able to login into the account using the credentials you just created.

How to Login to IDBI Net Banking Portal?

Given below is the step-by-step process to login into your IDBI net banking account once you have successfully registered for the same:-

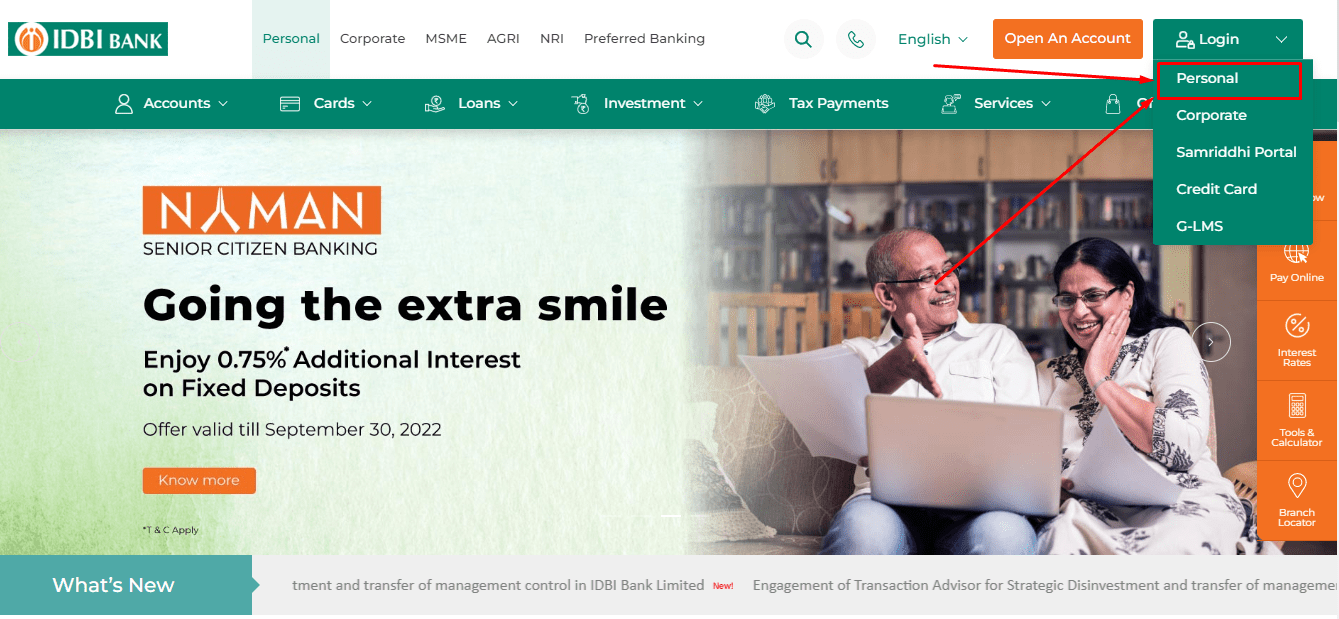

Step 1: Visit the official website of IDBI Bank.

Step 2: Under the ‘Services’ tab, click on ‘Internet Banking’.

Step 3: A new page will be displayed on your screen. Login by clicking on the ‘Login’ button at the top right corner.

Step 4: You will be presented with a drop-down menu, where you can select your account type.

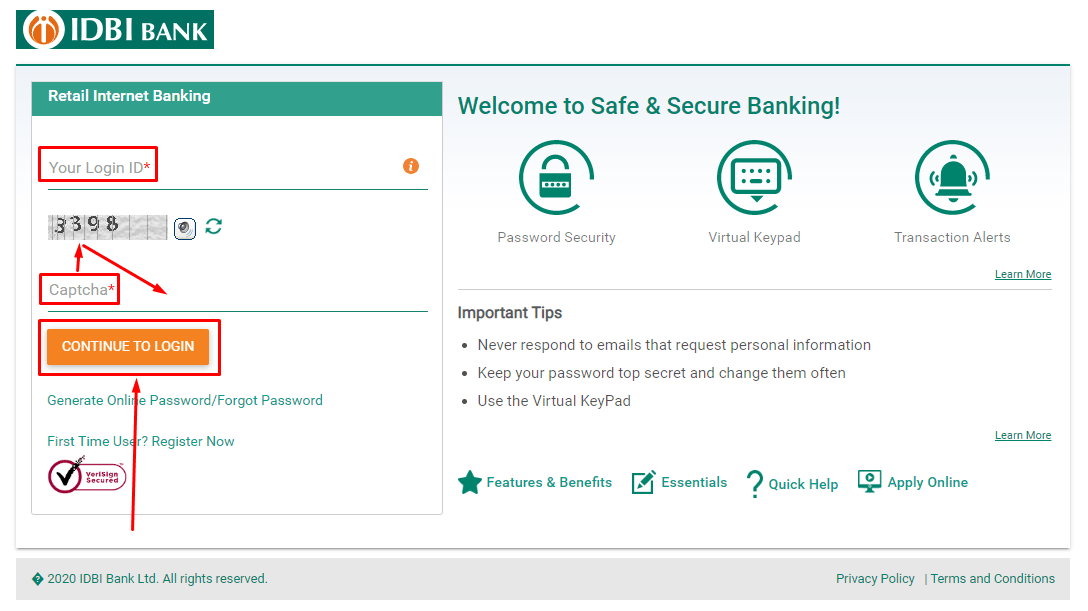

Step 5: Next, enter your ‘Customer ID’ and the captcha displayed on the screen.

Step 6: Click on ‘Continue To Login’

Step 7: On the next page, enter the ‘Password’

Step 8: Click on ‘Generate Online Password/ Forgot Password’ if you are a new user or if you forgot your password.

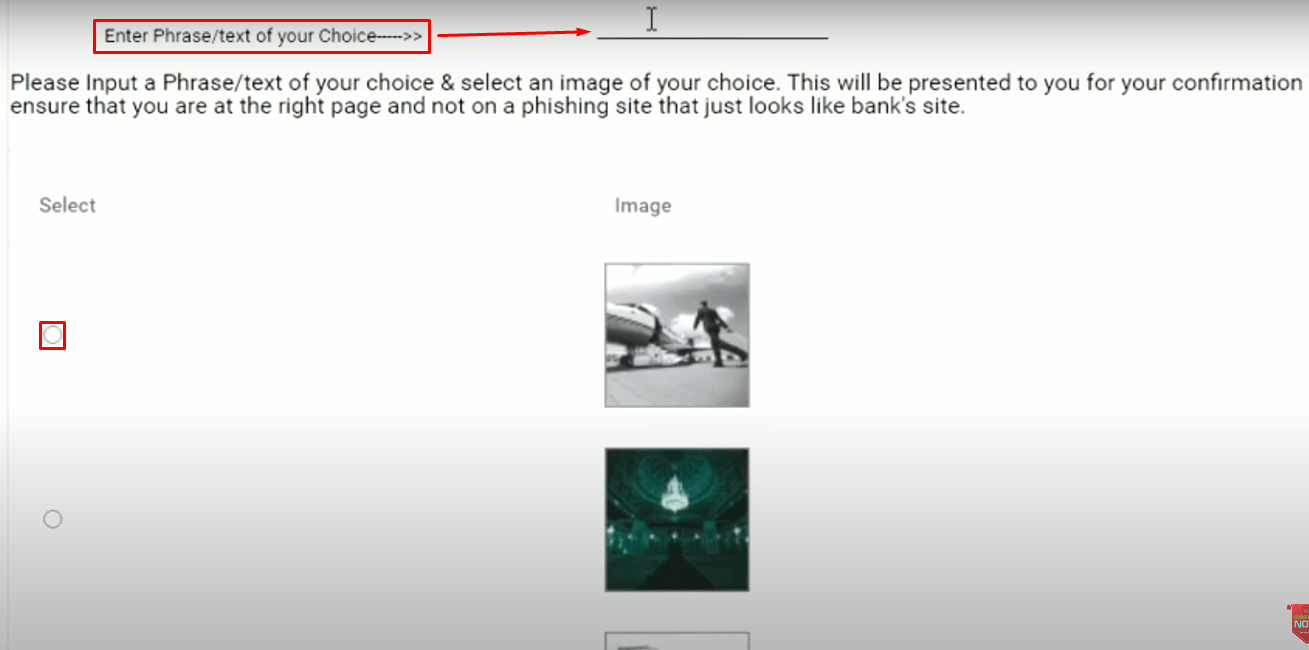

Step 9: Now a new page reflecting the ‘terms and conditions’ will be displayed.

Step 10: Click on ‘Agree’ to proceed.

Step 11: Edit the ‘Phrase Details’ and click on ‘Update’

Step 12: You will then be able to see the homepage of your IDBI net banking login account.

Steps to Reset IDBI Net Banking Login Password

If you have forgotten your IDBI net banking password, you can easily rest it through your IDBI net banking login ID. Here are the steps that you need to follow to reset your IDBI login password:-

Step 1: As you visit the official IDBI portal and select the net banking option.

Step 2: You will be redirected to the login page, where you must select the ‘Forgot Password’ option.

Step 3: Enter asked details, including IDBI net banking login ID, type of user, your registered mobile number, etc.

Step 4: Choose the service for which you want to reset the password, i.e. login or transaction password.

Step 5: Finally, click on ‘Submit’ to finish the password reset procedure.

Next, the password will be updated in the bank’s database, and you can log in with the new login credentials.

How to Check the Balance Using IDBI Net Banking?

Registered users can easily check their balance online using their IDBI online banking profile. Once the registration is complete, they will have to login into their net banking portal. The balance available in the account will be displayed on the account’s homepage. In addition to the balance, users can also check their past transactions and download a detailed bank statement.

Features and Benefits of IDBI Bank Net Banking

Given below are some of the main features and benefits of IDBI Bank Net Banking:

● The users can easily view their account balance from anywhere.

● The users can also track their transactions and view transaction history.

● Account-holders can easily view and download their bank statements.

● Users can also contact customer care and make any queries related to their IDBI accounts.

● The IDBI internet banking profiles can also view the loan statement details.

● You can also check the status of any cheque. You can also use this service to request a new chequebook.

● You can view and manage multiple Demat accounts.

● You can use this service to start a Recurring Deposit or Fixed Deposit.

● You can make bill payments and carry out DTH and mobile recharges.

● Net banking facility makes the funds transfer process very quick and easy.

How to Transfer Funds through IDBI Net Banking?

To transfer funds using IDBI net banking accounts, you will be required to add the recipient’s account details as beneficiary. Given below is the step-by-step process to transfer funds using the netbanking service:-

Step 1: The user will be first required to login into the netbanking profile using the Customer ID and password.

Step 2: Next, click on the ‘Transfers’ options and ‘Start’.

Step 3: Now select the ‘National Electronics Funds Transfer’ option.

Step 4: Next, click on the ‘Make a Payment to a Registered NEFT Beneficiary’ option.

Step 5: The list of beneficiaries will be displayed on the next screen. Select the relevant beneficiary from the list.

Step 6: Once the relevant beneficiary has been selected, click on the ‘Make Hot Payment’ option.

Step 7: On the next screen, the beneficiary account details like name and account number will be displayed.

Step 8: On the next page, enter the desired amount and the money’s bank account to be debited. Click on ‘Pay’.

Step 9: Enter the Customer ID and password, and click on ‘Confirm’ to complete the process.

Transaction Limit in IDBI Bank Netbanking

The table given below mentions all the transaction limits for IDBI net banking for different kinds of transactions:-

| Transfer Mode | Transaction | Charges |

| RTGS (Through Branch Channels) | ₹2 lakh – ₹5 lakh Above ₹5 lakhs | ₹20 ₹40 |

| IMPS | Up to ₹1,000 ₹1,000 – ₹1 lakh Above ₹1 lakh | Free ₹5 ₹15 |

| NEFT (Through Branch Channel) | Up to ₹10,000 ₹10,000 – ₹1 lakh ₹1 lakh – ₹2 lakh Above ₹2 lakh | ₹1 ₹3 ₹9 ₹15 |

| NEFT (via Mobile and Netbanking) | Free | Free |

IDBI Net Banking Customer Care

Given below are the customer care details for IDBI net banking:-

| Toll-Free Number | 1800 425 7600022 4042 60131800 22 6999 |

| E-mail Address | membersupport@idbidelight.com |

| Address | IDBI Bank Ltd.IDBI Tower, WTC Complex,Cuffe Parade,Mumbai – 400 005 |

You May Also Like

| IDBI Bank FD Rates | HDFC NetBanking |

| SBI Mobile Banking | PNB Net Banking Registration |

| Union Bank of India Net Banking | SBI Balance Check Number |

| Savings Account | Savings Account Interest Rates |

Frequently Asked Questions (FAQ’s):-

Q1. What is the process to activate or register for IDBI Net Banking Facilities?

Ans: To register for IDBI net banking, you will have to visit the official website and provide certain details like Customer ID, registered phone number, and create a password.

Q2. What are the services available on IDBI Net Banking?

Ans: Some of the services offered on IDBI netbanking are that you can make easy online transactions, request for cheque book, pay utility bills, make credit card payments, and manage your savings account.

Q3. I have already registered for the browser version of mobile banking. Should I register separately for the Go Mobile+ app?

Ans: No, once you have registered for netbanking on the browser, you are not required to register separately on the mobile application. You can just download and login using the credentials you have set up during registration.

Q4. Are there any charges for internet banking? What is the eligibility?

Ans: No, there are no charges for using IDBI net banking. However, there are various charges associated with carrying out transactions through netbanking.

Q5. How safe is IDBI internet banking?

Ans: Internet banking with IDBI is completely safe and secure. IDBI has employed world-class security measures for its service, and the net banking platform is equipped with 128-bit encryption SSL, verified by VeriSign.

Q6. How to get a login ID for IDBI net banking?

Ans: IDBI net banking login ID is the customer ID present on your bank passbook. If you don’t have your passbook, you can visit the net banking login page and click on ‘get my login ID.’ Followed by entering the asked details such as account number, card details, and OTP sent on your registered mobile number.

Q7. When does the IDBI Net Banking access expire?

Ans: If your IDBI net banking account remains un-operational for more than 180 days, then IDBI Net Banking access will expire.

Q8. What should I do if my IDBI Net Banking Login Password is Disabled?

Ans: If your IDBI Net Banking Login Password gets Disabled, a user needs to regenerate a new Login password.