The introduction of the new income tax portal has made the income tax e filing process easier than ever. Not only is this completely safe, but also quicker than submitting your tax returns offline at the Income Tax Office. As an eligible taxpayer of the country, it is compulsory for you to file your returns for every financial year.

In this blog, we will take a look at how you can do so from the comfort of your own home. We will also talk about what income tax e filing is, the documents required, eligibility, benefits, and dates.

Table of Contents

- What is Income Tax E-Filing?

- What is the Due Date for ITR E-Filing?

- Who is Eligible for E Filing Income?

- Documents Required for Income Tax E-Filing

- 10 Major Benefits of E-Filing Income Tax

- Penalty for Delayed Income Tax E-Filing

- New Rules for Income Tax E-Filing

- Income Tax Department E-Filing Portal Registration Process

- Procedure for Income Tax E-Filing

- How to Check Income Tax E-Filing Status?

- Frequently Asked Questions (FAQs)

What is Income Tax E-Filing?

An income tax return (ITR) is a form that you can use to declare the income for any given financial year. You can file an ITR to claim your income tax refund and deductions, carry forward any losses to the next year, etc.

The new income tax portal provided by the Income Tax Department enables the citizens to electronically file income tax returns. You can file your income tax returns from the safety and comfort of your home. All you need to do is keep all the necessary documents handy for the calculation and reporting of data on the portal.

What is the Due Date for ITR E-Filing?

Every year, the Income Tax Department issues a list of due dates for e filing income. Based on the taxpayer category you fall under, here are the due dates for filing income tax returns for FY 2021-2022:

| Age of the Taxpayer | Total Annual Income |

| Individuals who are below 60 years old | Rs. 2.5 lakh |

| Individuals above the age of 60 years but below the age of 80 years | Rs. 3.0 lakh |

| Individuals who are above the age of 80 years | Rs. 5.0 lakh |

Who is Eligible for E Filing Income?

Given below are the conditions under which it is compulsory for e filing income:

- If you are a business, company, or firm, you will have to file ITR even if there is a loss for the financial year.

- Your earning comes from foreign asset investment.

- You are earning your income from house property.

- If you are claiming a refund from the Income Tax Department.

- If your gross income exceeds the figures mentioned in the below table:

| Age of the Taxpayer | Total Annual Income |

| Individuals who are below 60 years old | Rs. 2.5 lakh |

| Individuals above the age of 60 years but below the age of 80 years | Rs. 3.0 lakh |

| Individuals who are above the age of 80 years | Rs. 5.0 lakh |

Documents Required for Income Tax E-Filing

In case you wish to file the income tax return online, you would require the below-mentioned documents:

- Your PAN details.

- Aadhaar number.

- Bank details.

If you are a salaried employee, you will require the below documents to file your ITR:

- Form 16.

- The rent slips (if claiming House Rent Allowance).

- Salary slips.

When you want to claim deductions, you will require the below documents:

- Proof of income such as gains from capital assets, house property income, etc.

- Details eligible for tax saving deductions.

- Insurance premium and house loan information.

- Interest certificates for deposit and savings accounts.

10 Major Benefits of E-Filing Income Tax

Here are the 10 best benefits of e-filing income tax.

Tracking Refund Status

If you are e-filing income tax online, you can easily track the status of your return filing. Earlier, this whole process was done by post, which made it highly time-consuming. However, now you can use the new income tax portal to check the ITR status.

Refund Processing

Before the introduction of the new portal, the refund process was extremely tricky and time-intensive. However, now when you file your income tax return online, you can receive the refund almost immediately by just updating your bank details online.

Error Reduction

Due to the sheer amount of calculations involved in ITR calculation, it is only human that one would make a mistake. However, while online income tax filing, the tax amount due is auto-calculated on the official portal. This helps in eliminating the possibility of errors.

E-Verification of ITR

Earlier, the ITR had to be sent to the CPC in Bangalore for manual verification. But now, you can e-verify your ITR even when you are filing your income tax returns.

Convenient

The procedure to file the income tax return online is super easy and convenient. Earlier, the whole process was extremely tedious as it involved a long and tiring visit to the income tax office. However, e-filing income tax can now be done easily and quickly from the convenience of your home.

Access to Documents

As the process of IT return e filing requires you to upload a specific document, you can view them anytime you want later on. All documents uploaded by you in the portal are securely saved, nullifying any breach of privacy.

Records Compilation

Earlier, there were a large number of forms associated with income tax filing. The process of correctly filling up these forms was also relatively complex. However, the introduction of the new portal enables seamless income tax e-filing.

Cost Saving

Manual tax filing required a hired or consulted assistance that usually spiked the total cost involved in the e return filing process. IT return e filing, on the other hand, saves such expenses by enabling you to file your income tax return on your own.

Receipt of Proof

When you e-file your income tax returns, you get a receipt confirming the submission of your income tax returns. The same copy is also sent to your registered email address.

Electronic Banking

The payment and refunds process is very easy when it comes to e return filing online. It is done by direct debit for tax payment and direct deposit for receiving refunds. There are also options on the portal through which you can file returns and make payments later. You are free to choose which payments will be made when.

Penalty for Delayed Income Tax E-Filing

Every year, the Income Tax Department releases a list of due dates before which e-filing of income tax returns must be completed. In case you miss this deadline, you are liable to be penalized by the Central Board of Direct Taxes (CBDT). The maximum penalty associated with late income tax e-filing is Rs. 10,000. This is in accordance with Section 234F of the Income Tax Act.

New Rules for Income Tax E-Filing

The Union Budget of 2021 has announced a new income tax structure to be implemented all over the country. The new tax structure does not include many of the tax exemptions that were available in the previous regime. However, the tax rates have been lowered under the new tax plan.

What Happens if I E-file Income Tax Returns With Aadhaar?

If you do not have a PAN, you can file your returns using your Aadhaar Card. The Aadhaar Card is also a mandatory document to be submitted while applying for a PAN card. The new income tax rules state that taxpayers who e-file income tax returns using Aadhaar will be allotted a PAN. This will be done on the basis of data collected by the Unique Identification Authority of India.

Consequences of Not Linking PAN with Aadhaar

The CBDT recently issued a statement that urged the taxpayers to link their Aadhaar to their PAN. Failure to comply with which prevents the taxpayer from filing income tax returns after the deadline. This rule was introduced by the income tax authorities to increase compliance and ease the income tax e-filing process. As it stands, taxpayers must enter their PAN while e-filing income tax returns. In the future, it is expected that it will be necessary to link Aadhaar with PAN to file tax returns.

Income Tax Department E-Filing Portal Registration Process

The following is the step-by-step process to register on the income tax department e-filing portal:

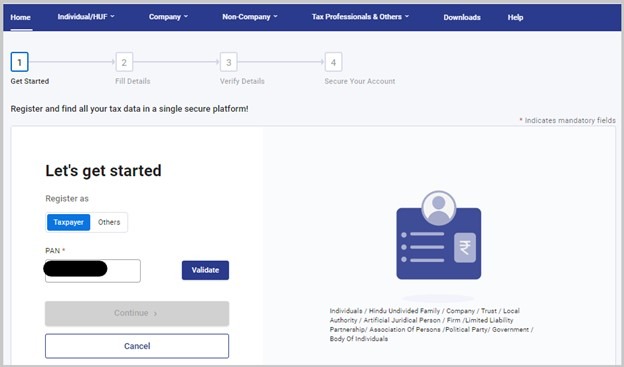

Step 1: Go to the Income Tax Department Homepage

Visit the homepage of the Income Tax Portal to log in to the government portal. Click on the ‘Register’ button present on the right side of the page.

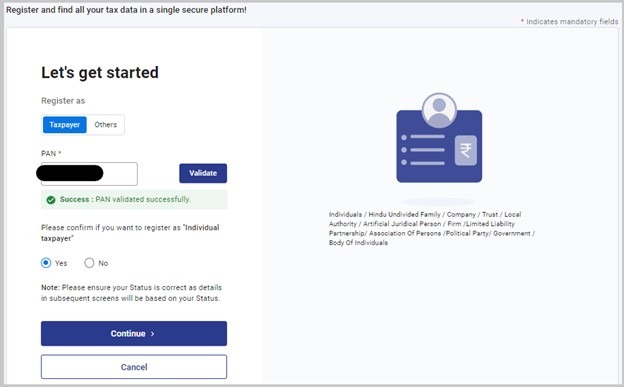

Step 2: Enter Your PAN

Now you need to enter your PAN and click on the ‘Validate’ button. After that, click on ‘Yes’ and select ‘Continue’ to proceed.

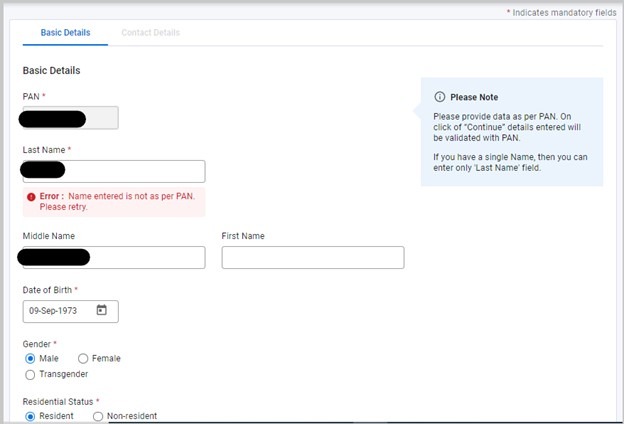

Step 3: Enter Basic Details

Here you need to enter some of your basic details like name, residential status, and gender.

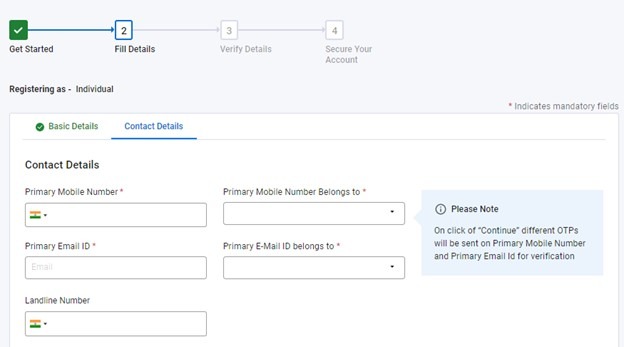

Step 4: Provide Contact Details

Here, you are required to enter some details like mobile number, email address, and postal address details. Click on ‘Continue’ to proceed.

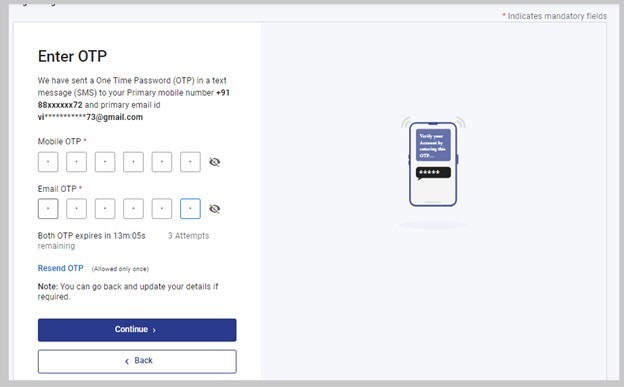

Step 5: Verification

Once you have submitted the form, an OTP will be sent to your registered mobile number and email ID. Enter both the OTPs correctly to finish the verification process.

Note: For non-residents, the OTP is only sent to the registered email address.

Step 6: Details Verification

Once you have verified the OTPs, you will be redirected to a new page to verify the details entered by you. You can make any corrections by navigating to the previous screen. However, you will be required to validate the OTPs again to make any changes.

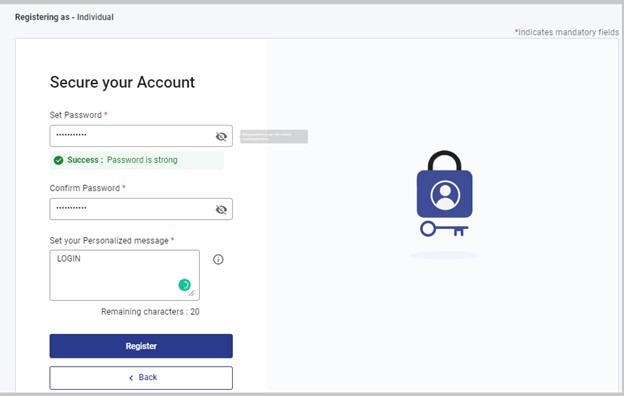

Step 7: Set Up Password

Post verification, you will be required to set up a secure password and login message for your profile. The password needs to be a combination of special characters, upper case letters, and lowercase letters.

Step 8: Click on Register

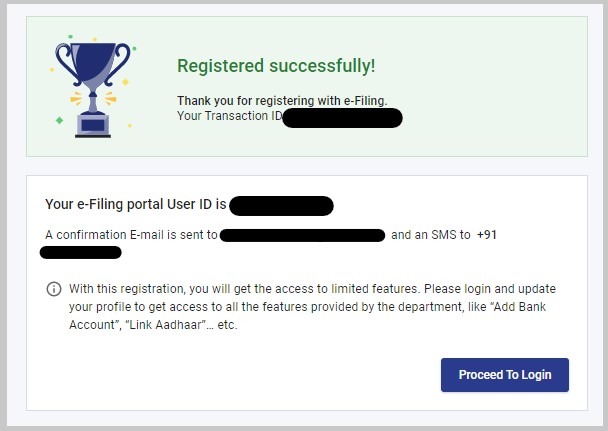

Click on the ‘Register’ tab. You will be able to see a message containing the acknowledgment number for successful registration.

Procedure for Income Tax E-Filing

There are a few things that you will need to prepare before you file your income tax return. Given below are the steps to e-file income tax on the income tax portal:

Step 1: Calculate the income tax amount due based on the provisions stated in the Income Tax Act.

Step 2: Refer to Form 26AS to get the details of the summarized TDS payments for each quarter of the financial year.

Step 3: Visit the home page of the income tax e-filing portal and log in using your credentials.

Step 4: Click on the ‘File Income Tax Return’ option under the ‘e-file’ tab.

Step 5: Choose from Individual, HUF, BOI, etc., based on which category you fall under.

Step 6: Choose the relevant ITR form.

Step 7: Enter your bank details. Pre-validate the details if you have provided them previously.

Step 8: This will redirect you to a new page where you can verify all the details that you have previously provided. Make any required changes. Confirm and validate the same once you are sure that all the details are correct.

Step 9: Verify the income tax returns and mail a hard copy of the same to the Income Tax Department.

How to Check Income Tax E-Filing Status?

You can track the income tax e-filing status by visiting the official income tax website. Given below are two ways of checking the ITR filing status:

- With acknowledgement number.

- Using login details.

Here is how you can track your income tax e-filing status using the acknowledgment number:

Step 1: Visit the official Income Tax Department website.

Step 2: Click on the ‘ITR Status’ tab.

Step 3: Enter the acknowledgment number and PAN, and verify the captcha.

Step 4: Click on ‘Submit’ to continue.

The status will then be displayed on the screen.

If you are using the login credentials for checking the ITR status, you will need to log in to the income tax e-filing website. After logging in, click on the ‘View Returns/Forms’ tab. Select the return and assessment year from the dropdown and click on the ‘Submit’ button. The status will be displayed on the screen.

You May Also Read:

Frequently Asked Questions (FAQs)

How will the ITD refund any excess tax paid by me?

The income tax refund is provided as a cheque or bank transfer once the refund is processed. You can also check the refund status on the income tax e-filing portal.

Who should I contact regarding rectification or any other income tax-related queries?

In case you need any assistance with the income tax return filing process, you can contact the centralized processing center between 8 a.m. and 8 p.m. on weekdays.

What is Form 16?

Form 16 is a form that is issued by an employer for the employee, as per Section 203 of the Income Tax Act. It contains the records of the TDS deducted from the salary.

Who do I contact regarding a query about Form 16?

You can contact the TDS Reconciliation Analysis and Correction Enabling System (TRACES).

Who issues Form 16 for pensioners?

In the case of pensioners, the bank crediting the pension every month will be responsible for issuing Form 16. The previous employer will not be involved in this regard.

How can I get a duplicate Form 16?

If you need a duplicate Form 16, you need to contact your deductor. In the case of salaried professionals, it will be your employer.

Is it compulsory to make tax payments online?

No, the taxpayer doesn’t need to make online tax payments. Offline payments can also be made by visiting the Income Tax Office.

What is Form 26AS?

This form is a credit statement that contains all the details regarding the TDS deducted from your salary by the employer.

What are the different tax filing forms as per the Income Tax Act?

The different forms for submitting tax returns in accordance with the Income Tax Act are ITR1, ITR2. ITR3, ITR4, ITR5, ITR 6, and ITR7.

Do I need to attach any documents while e-filing income tax returns?

No, you are not required to enclose any documents while e-filing your income tax returns.