Livability index of a city is determined by Infrastructure development in that particular area as it provides a sustainable environment by making the housing and working conditions comfortable.

Infrastructure projects provide a tremendous boost to real estate both in terms of demand and capital values. Viewing its importance, Indian government bodies, both Central and State, are giving emphasis on infrastructure and logistics which is expected to provide a much needed boost to the industrial and logistics segment of the real estate sector.

The Indian economy with its constituent of the real estate sector which is going through a phase of transition which coupled with a time module where the housing sector is in a process of evolution, the Budget for the Financial Year 2015-16 has a set of aspirations and desires which if implemented will help in greater reliability in the sector for all stakeholders. With steps like this, the real estate sector can be highly hopeful of diminishing gap between demand and supply for low-cost housing. Also Government has emphasized the importance of availability of cheap credit to make housing affordable for economically weaker sections (EWS), lower income groups (LIG) and middle income groups (MIG) segments of the population.

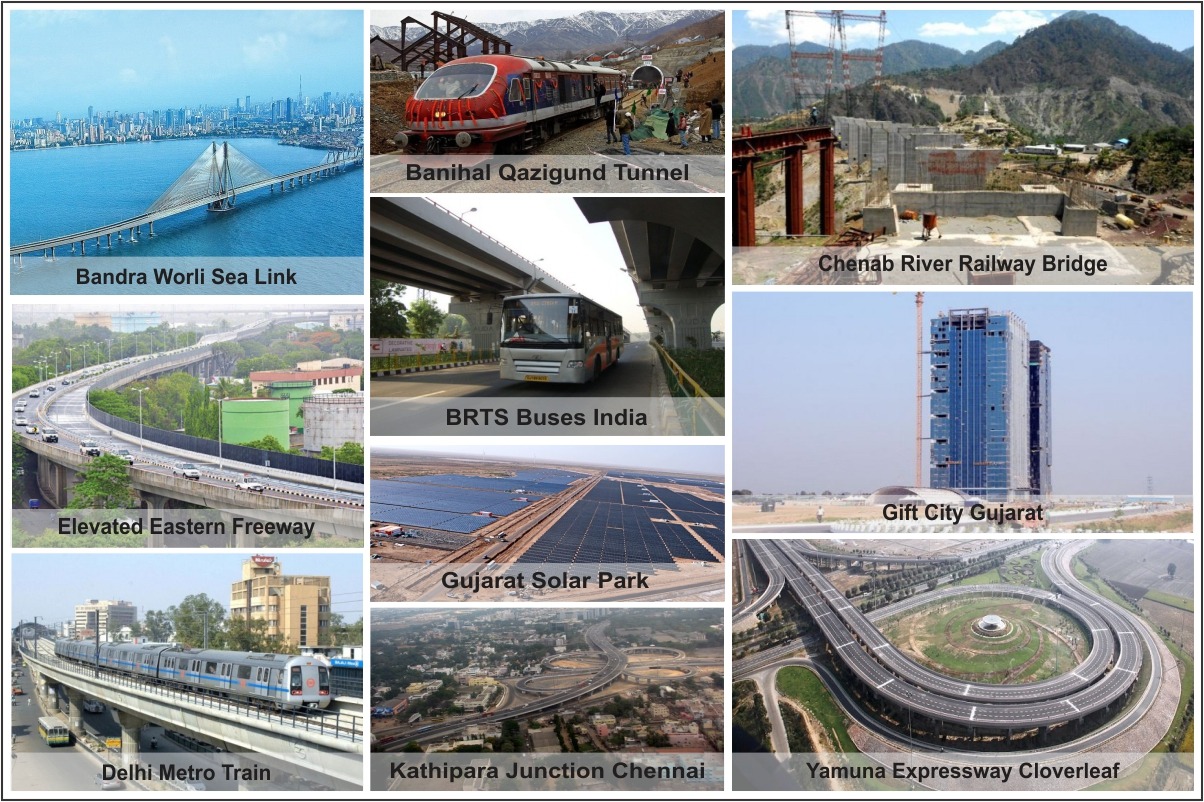

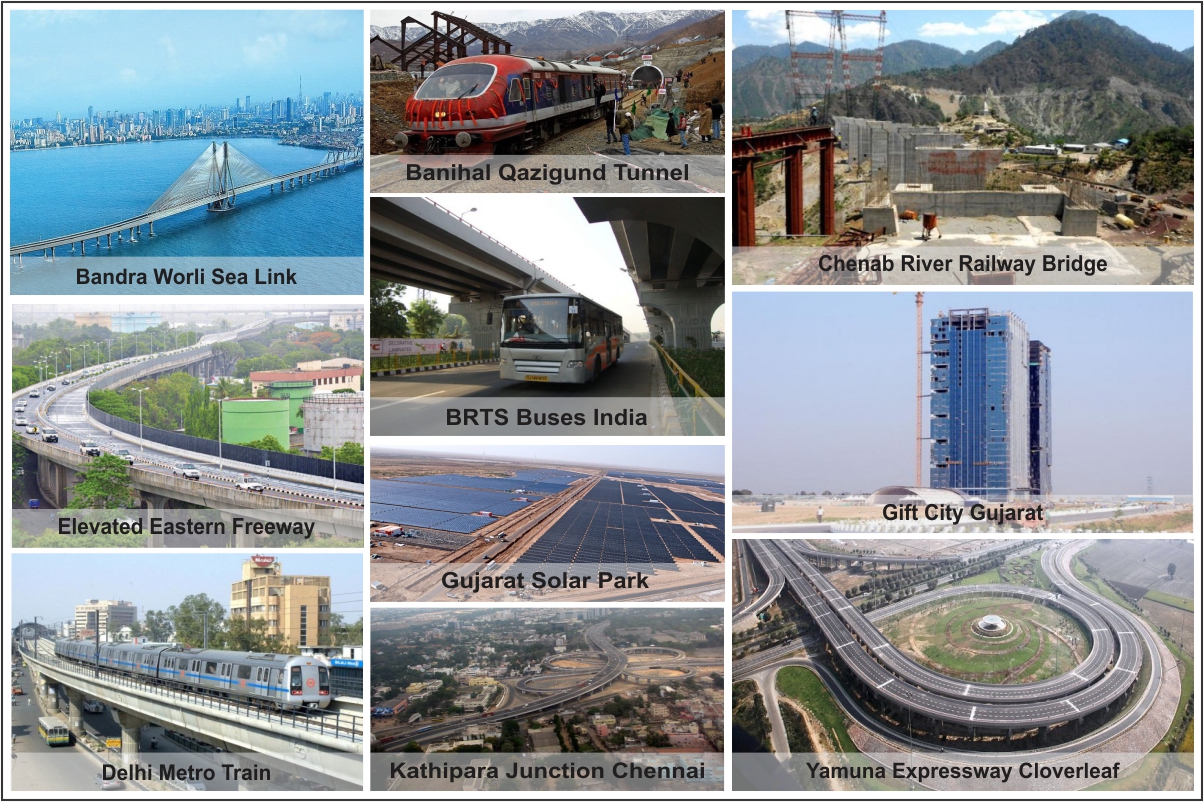

The new Government’s maiden budget focuses on boosting infrastructure through the Publicprivate partnership mode. Schemes for development of airports in tier-I and tier-II cities have also been proposed. Several states, such as Rajasthan, Karnataka, Uttar Pradesh, Maharashtra and Andhra Pradesh have come out with their plans to boost infrastructure and make way for investments in their cities. The Industrial Corridor project predicts a major expansion of infrastructure and industry, including industrial clusters and rail, road, port and air connectivity along the route. The increased spending on the country’s crumbling roads, railways and ports are aimed to attract investment and boost growth and see a spurt in manufacturing.

While infrastructure development had already started in the peripheral region of metros and tier I and tier II cities, the development of industries has boosted the residential activities in those area. As more job opportunities were made available, people from the city opted to move closer to work. People from other cities coming down for work also choose to live here given the proximity to work and well developed social spaces.

The recent move to introduce REITs, or Real Estate Investment Trusts, is quite a progressive one as well. REITs have great potential to tap cash flow into the Indian economy, and help smaller investors to access income-generating real estate assets, without having to invest a large amount. Providing tax incentives to REITs for investment in housing, especially the affordable housing sector, will increase chances of its success.

With the governments eager to develop the cities infrastructure, the real estate industry too is set to receive a significant boost. It seems the good days are here to come for the real estate investors.