With the instigation of the GST Act, the nation noticed drastic changes across the trading sector. It emerged as the foremost tax reform benefiting buyers, suppliers, manufacturers, and agents. With passing time Input tax credit was introduced based upon feedback and changing market requirements. The new regime of GST input tax credit changed the way of dealing completely. Sellers got the opportunity to get the paid input tax credit under GST by following a specific set of GST input tax credit rules. Feeling confused? Well, you don’t need to worry as Square Yards got you covered through this distinct input tax guide. Keep scrolling and know an array of inescapable things about ITC, who can claim ITC, the time limit to claim ITC, and much more.

Table of contents

- What Is the Input Tax Credit?

- Essential GST Input Tax Credit Rules:

- Who Can Claim the Input Tax Credit?

- Conditions For Taking ITC

- What Can Be Claimed as ITC?

- How To Claim GST Input Tax Credit:

- Reversal of Input Tax Credit

- Reconciliation of GST Input Tax Credit

- Documents Required for ITC Claim

- Special Case Scenarios of ITC

- YOU MAY ALSO LIKE

What Is the Input Tax Credit?

Input Tax Credit is accessible to manufacturers, suppliers, agents in addition to e-commerce operators. It will be available for the mentioned ones if and only if they are covered or registered applicants under the GST Act. Notable individuals are eligible to claim the tax paid for the purchase of goods and services.

In simple words input credit allows you to reduce the amount of tax that has been already paid at the time of purchase. While selling the product you are liable to deduct the already paid amount i.e., the amount paid on input. All you will have to pay is the balance amount after deducting the paid input tax.

Here’s how:

When an individual purchases any good/avail service from the registered vendor, he is supposed to pay applicable taxes levied on the products and services. On selling the product further, you pay collective tax. You have to adjust the taxes you paid at the time of purchase with the applicable amount on output tax (liable tax on goods sale) along with the balance liability. It is determined by deducting tax on sales from the tax paid on purchase. This tax has to be paid to the state government. The whole mechanism from input credit to output credit is termed as utilization of input tax credit.

Let us go through an example to understand how it works:

Person A is a manufacturer.

He pays tax of amount INR 450 on the output i.e., final product.

He initially paid an amount of INR 300 as input tax i.e., for the purchase.

In the end, Person A can claim an amount of INR 300 as INPUT CREDIT and the payable amount will be INR 150.

Essential GST Input Tax Credit Rules:

To claim the input tax credit, you must be familiar with notable GST input tax credit rules. These rules will help you to get a better understanding of how input tax works.

28th May 2021

CGST Rule 36(4) is progressively put in for the months of April, May as well as June 2021 to file GSTR-3B for June 2021.

1st May 2021

The CGST Rule 36(4) limits the provisional ITC claims up to 5 percent of the GSTR-2B. GSTR-3B sees relaxation for the month of April 2021. The taxpayers are liable to apply CGST Rule 36(4) cumulatively for April & May whereas the GSTR-3B has to be followed for May 2021.

1st February 2021

Budget update for 202:

Certain amendments were made in Section 16, allowing taxpayers to file a claim for the input tax credit. It is thoroughly based upon GSTR-2A & GSTR-2B. Furthermore, the input tax credit applicable on the invoice note can be availed only under specific conditions. One such condition is that invoice notes must be precisely filled by the supplier mentioning every minute detail.

Update as of 22nd December 2020

Under this update, certain amendments were made in Rule 36(4). These changes were reflected from 1st January 2021:

- The ITC will be available based upon the supplier’s uploaded invoices. It has to be done either via GSTR-1 or through IFF (Invoice Furnishing Facility).

- The tax recipients can claim a refund through GSTR-3B at a maximum of 5 percent. Earlier this amount was limited to 10 percent of the total ITC claim amount mentioned in GSTR-2B.

As per the newly added rule 86B, certain taxpayers are eligible to make only 99% of payment through the credit ledger from the overall tax liability.

Update as of 3rd April 2020

The CBIC notified that all taxpayers can take ITC as per the GSTR-3B from February onwards till August 2020. It is free from the previous rule consisting of provisional ITC claims set at 10 percent of the input tax against the GSTR-2A. The taxpayers need to adjust their ITC based upon the December update to file GSTR-3B for the month of September 2020.

Update as of 1st Jan 2020

The CBIC amended the existing extent of the claim to 20 percent of a provisional input tax credit. It is revised to 10 percent of provisional ITC claims.

Update as of 9th October 2019

The CBIC notified that the taxpayers can avail up to 20 percent of the input tax credit paid by the registered person against the invoices/debit notes. It will purely orient around the details uploaded by the supplier.

Who Can Claim the Input Tax Credit?

The specific person who qualifies the criteria is permitted to claim Input Tax Credit. You have to qualify predefined parameters to file this claim. Following are the essentials to claim ITC.

- All registered individuals are authorized to profess ITC. Although, the person paying tax under the composition scheme is exempted from the same.

- The dealer has to be in proprietorship of the tax invoice

- The said products and services must have been received by the buyer

- Must have filed GST Returns

- The supplier has paid the liable tax to the government

- In case if the said products are received in multiple partitions and not as a whole, then claim for input tax after receiving the last loss of the goods.

- No claim will be disbursed if the seller has claimed depreciation on the tax component

Individuals who apply for the registration within the tenure of thirty days from the liable registration date can claim ITC for the stocked inputs, semi-finished and finished goods. You have to make sure that all these goods were stocked on the preceding day of the date on which you are liable to pay the applicable tax.

Moreover, the input tax credit is permitted only at most for the stock purchased within the last year of the afore-mentioned date. The responsible person has to file a claim through Form GST ITC-01 in thirty days from the day he becomes eligible to avail of ITC. Additionally, the filled details have to be verified by the chartered accountant specifically if the filed claim is above INR 2 lakhs.

Who is Not Permitted to Claim Take Input Tax Credit

- Individuals not registered under GST

- Individuals who have registered themselves under the composition scheme

Time Limit to Claim ITC

The time limit to claim ITC is within 180 days of the date when the invoice was released. If an individual fails to supply the goods and services within 180 days of invoice note, then the tax credit claimed by the buyer will also be added to the output tax. Additionally, you will become liable to pay an applicable interest amount.

- The due date to file the returns is the September month of the forthcoming financial year.

- The annual return must be filed for the previous financial year.

Conditions For Taking ITC

As a registered person you will be applicable to claim ITC if you satisfy below-mentioned conditions:

- The individual must be in possession of – tax invoice/ debit note. The same has to be issued by a GST registered supplier

- Must have secured the said product and services

- The liable tax for the received goods and services has been paid to the Government

- Have filed the return under – section 39

- ITC will not be applicable if the due date that is September passes. You have to file it before the due date.

- If the goods are received in multiple segments, then you are entitled to file the claim after receiving the final segment of the said goods.

- In case the individual has already claimed for the depreciation under income tax liable for GST, then he will be exempted to file a claim for an input tax invoice. In simple words, either you can claim ITC or depreciation upon the overall tax component.

What Can Be Claimed as ITC?

You can claim ITC scarcely for business purposes. It is not accessible for products and services purely used for personal use. Additionally, ITC claims aren’t applicable for exempted supplies. Certain supplies are exempted from the ITC claim category.

How To Claim GST Input Tax Credit:

To claim a GST input tax credit, you have to follow a specific set of criteria. If you are a newbie to claim an input tax credit under GST then here is a rundown to avail it with utmost ease.

Initially to claim GST Input Tax Credit:

- The individual should have the tax invoice for the purchased good or debit note. A registered dealer has to issue a tax invoice or debit note.

- The buyer must have secured the said products/service.

- You have to deposit the taxable amount to the government officials through claiming input credit or via cash deposits.

- As a supplier, you need to file GST returns.

- If you want to claim ITC as a buyer, you need to make sure that your seller is registered compliant under GST.

- There are possibilities that you encounter unclaimed input credit. Such situations encounter when your purchase tax is higher than the sales tax. For this case scenario, the buyer/seller is permitted to carry forward their claim. Whereas if the output tax is greater than the input tax then you have to pay the balance amount to the government.

- You cannot claim for the input tax if your purchase invoice is older than the previous financial year.

- Goods and services both are GST taxable; thus, you can file the claim for both the cases apart from the exempted products or services.

- You can claim an input tax credit for capital goods.

- It isn’t applicable for goods purchased for personal use.

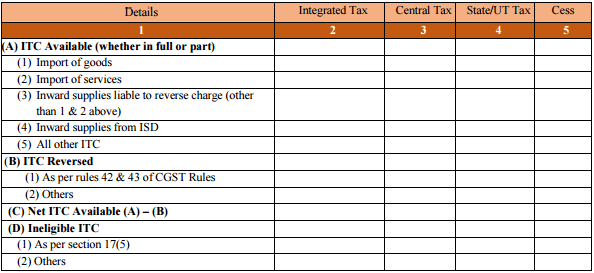

As a regular taxpayer, it is crucial for you to report the input tax credit amount within your monthly – GST returns through Form GSTR-3B. Table 4 of this form is inescapable and comprises a summary figure of (a) eligible ITC, (b) Ineligible ITC, and (c) ITC reversed of the payable tax tenure. The pic depicts the format of Table 4:

You can easily claim applicable ITC on an interim basis within the GSTR-3B. At max, 20 percent of the entitled ITC is auto-generated through GSTR-2A return. Thus, it is recommended to cross-check the figures mentioned within the GSTR-2A figure and then proceed further for filing GSTR-3B.

Earlier the claimed amount of the provisional ITC wasn’t fixed. This was applicable till 9th October 2019. After this, certain amendments were made, and the claim amount was restricted to 20% of the amount eligible for ITC. In simple words, the figures mentioned within the GSTR-3B will be computed from the overall amount mentioned in GSTR-2A. However, after this, the buyers and suppliers have to precisely match their purchase register with the GSTR-2A for seamless claim ITC.

Reversal of Input Tax Credit

The reversal of input credit tax can be benefitted only on products and services that are purchased for business purposes. If you invest in products and services for non-business purposes, or to make exempt supplies then you cannot claim for ITC. Following are certain scenarios in which tax credit is usually reversed.

1) Fail to make payment of invoices within 180 days: ITC is reversed specifically for invoices that are not paid within 180-day tenure from the issue date.

2) Credit note is issued against the ISD by the seller: It applies in the event of ISD. In case the seller issues the credit note in favor of HO, then the ITC will be reversed.

3) Partial inputs and outputs of goods for business purposes or for exempted supplies: It is applicable for enterprises that count on both business as well as non-business purposes. The ITC considered for personal purposes has to be reversed proportionately.

4) Capital goods dedicated partly for business purpose and partly for the exempted supplies: It is quite similar to the previous point except that it was for products and services and it is applicable on capital goods.

5) ITC reversed amount is below the required amount: It will be computed after furnishing the annual return. When your overall ITC claimed on the inputs for personal use is above the reversed ITC for that specific year, the differing amount is added within the output liability. However, notable interest is applicable on this amount.

Reconciliation of GST Input Tax Credit

The ITC claimed by the taxpayer must match with the specifics mentioned in the GST return by the supplier. If any discrepancies occur in terms of mismatch of provided information, then the seller, as well as the buyer, will be communicated. This usually happens when the seller proceeds with the GSTR-3B.

In the event of a mismatch of mentioned figures, you have to count on GST reconciliation. It is the process of matching the sellers’ uploaded data with the buyers’ purchased data. For this process, the GSTR-2A is compared with the buyers’ received supplies. Additionally, it ensures that the transactions are recorded precisely for that specific time frame. Match the values and then apply for an ITC re-claim with similar values at both ends, i.e., buyer and seller.

Documents Required for ITC Claim

To file an ITC claim the taxpayer needs to be prepared with a specific set of documents. These documents are crucial, and you can’t file a claim if any of these isn’t available. Here is a list of documents that are necessary for the input tax credit claim:

- Invoice for the purchased goods issued by the seller

- Supplier issued a debit note in favor of the recipient

- Bill of entry

- An invoice that is issued by the seller for notable circumstances such as a bill of supply in place of a tax invoice when the amount is below INR 200. Invoice issued in case of reverse charge

- ISD issued invoice/credit note based upon the liable invoice rules applicable under GST

- Supplier issued bill of supply applicable for both products and services

Special Case Scenarios of ITC

- Input Tax Credit for Capital Goods

The ITC is applicable for capital goods in case of normal taxable sales and partly for the goods purchased for personal use and normal sales. Although, ITC isn’t applicable for capital goods that are meant only for personal use or for capital goods exempted from sale. In other words, if your capital goods are thoroughly meant to make exempted goods in addition to goods used exclusively used for non-business purposes then you can’t avail of ITC claim. Additionally, you cant file a claim if you have already claimed depreciation on the taxable component.

- Input Tax on Job Work

As a principal manufacturer, you have the authority to send products for further processing directed towards a job worker. For instance, XYX shoe manufacturing enterprise is sending partially made shoes to job workers. These job workers add soles to the partially prepared shoes. In such a scenario, XYZ principal manufacturer is permitted to claim paid tax. The manufacturer can claim ITC for the goods he purchased for the making of partially prepared shoes.

ITC is accessible when the products are to the job worker for both case scenarios:

- From the place of principal business

- Directly from the supply place i.e. from where the supplier sells such goods

Moreover, to enjoy the benefits of input tax, sent products have to be received back at the principal place in one year. This tenure is 3 years in the case of capital goods).

- ITC Provided by the ISD

An input service distributor is generally the head office and can be a branch office in certain cases. Both belong to the GST registered person. ISD is responsible for collecting the input tax credit for overall purchases and distributing the same to applicable recipients. This amount is distributed amongst various correlated bodies including CGST; SGST/UTGST; IGST.

- Input Tax credit on Transfer of Business

It is applicable for the case scenarios consisting of merge and business transfers. The designated transferor needs to be available for ITC, which is further passed towards the applicable transferee. All this is done while transferring the business.

Key Points Associated with GST Input Tax Credit

- Only a registered person is eligible to avail of Input Tax Credit that too after satisfying certain parameters as mentioned within the Invoice Rules.

- If the amount paid as input tax is greater than the amount paid for output tax, then you can rely on carrying forward the amount or can count on a refund.

- The balance amount of tax that is left after deducting the input tax from the output tax is the amount you are liable to pay to the government.

- Claiming ITC is permissible in the month of September for the following Financial Year. You can file the Annual Return in the September month of the preceding year.

- A taxpayer who switches from composition scheme to normal scheme – under Section 10 is applicable for ITC claims against the stocked goods and capital goods. The key point is the same has to be done immediately on the preceding day from becoming a liable taxpayer.

- In the event that the exempted supply of products/services / or both becomes liable to taxation, the seller becomes accessible to avail the benefits of ITC for the stocked goods. These goods must fall within the category of exempt supplies.

- In the event of a transfer of business, the registered individual seller, the merger is allowed to transfer the ITC to the transferee.

- The taxpayer is allowed to claim the tax paid within the Reverse Charge Mechanism through an input tax credit.

- Input Tax Credit is well-known as a GST paid on Capital Goods.

- The taxpayer is not eligible to claim ITC if he has already claimed depreciation on the tax component.

- The specifics about the tax paid for inputs are auto-populated within the form GSTR 2. Although, the details of Reverse Charge are not auto-populated on the applicable form. You have to manually enter the details in the GSTR 2.

Wrapping Up:

After going through the afore-mentioned things it is clear that Input Tax Credit plays a critical role for both the parties i.e. seller as well as the buyer. It is essential to maintain the records precisely to avoid future discrepancies. By being familiar with GST input tax credit rules, you will be all set to deal with unforeseen conditions. Make sure you know the maximum amount you can get and the right time to carry out the claim procedure. Additionally, you need to make sure that you deal with GST registered applicants to avail of the maximum possible benefits.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQ’s)

What is the maximum time limit to avail input tax credit?

The maximum time limit to avail of the input tax credit is 180 days from the invoice date.

Who can claim an input tax credit?

An individual can claim a credit for the paid GST against the goods purchased for business purposes. It is termed input tax credit. The key condition is you need to register yourself under GST to avail the benefits of ITC. Additionally, the purchase must be made for business activities either solely or partly.

How much GST refund can be claimed?

For the financial year 2020-2021 whose payment period is 2021-2022, the taxpayer can claim an amount up to $456 as an individual. Whereas, if you are married then you can claim an amount up to $598.Additionally, if you have a child who is 18 or less then you can take $157 on his behalf.

How to get a GST refund?

If you are a regular taxpayer, then you can file your claim for a refund by filing and submitting the application form GST RFD-01. You can file the same through an online medium via the GST common portal. For offline submission, you will need to visit a GST Facilitation Centre.