To increase tax compliance and streamline the tax structure in the country, the Government of India has classified the taxpayers into different slabs based on their income and source of income. Each taxable person of the country is required to file an income tax return using any of the ITR forms in accordance with what slab they fall in.

ITR 1 form is used by taxpayers whose annual income in the fiscal year does not exceed Rs 50 lakhs. In this blog, we will take a look at the use, structure, and eligibility for filing Income tax Return 1 form.

Table of contents

What is ITR 1 Form?

The ITR 1 form was created for salaried/pensioned individuals to file their income tax returns. This form is also known as the Sahaj form, which means easy, as it makes it very easy for the taxpayer to file income tax returns. In addition to this form, there are ITR 2 Form and new ITR1, which salaried taxpayers can also use according to their needs.

How to File ITR-1 Form?

Any salaried taxpayer can use the ITR 1 form to file their tax returns for the financial year, online as well as offline. Given below is how the taxpayer can do so:-

Offline Method

Only the taxpayers mentioned below are eligible to submit their income tax return in the offline method:-

- Any taxpayer who is over the age of 80 years during any time of the previous fiscal year.

- Any taxpayer whose income does not exceed Rs 5 lakhs and has not claimed any income tax refund during the year.

For offline filing, the ITR 1 form has to be submitted in the paper form to the Income Tax Department of India. The taxpayer will be given an acknowledgement number once the income tax returns have been filed.

Online Method

Given below is how the taxpayer can use ITR 1 form to file their income tax returns online:-

- By submission of data electronically and submitting the verification of the ITR via ITR V to CPC, Bangalore.

- By filing the return form and e-verifying through netbanking/aadhaar/ e-filing portal.

When you complete the ITR 1 filing online, the acknowledgement for the same will be sent to the registered email address. You can also download the same from the website and send it to the CPC office in Bangalore within 120 days of filing the return.

Related ITR Form

Eligibility Criteria to File Income Tax With ITR 1 Form

Given below are some of the criteria that the taxpayer will have to fulfill in order to file their income tax returns using the ITR 1 form:-

- Any taxpayer deriving their income from a pension.

- If a taxpayer who already owns one house is deriving income from another property, they can use ITR 1 form to file their tax return. However, if the taxpayer has incurred a loss from this property during the financial year, then they are not eligible to use this return form.

Who Can Not Use ITR 1 Form?

Given below are some of the sources of income that the taxpayer cannot use to file their income tax return:-

- Any taxpayer deriving income from a business or profession is not eligible to use this tax return form.

- Taxpayers earning income from agricultural activities exceeding Rs 5,000 are not eligible to use this form.

- Income earned from any additional property of the taxpayer.

- Income gained from any lottery winnings.

- If the income is the result of the sale of any capital gain assets.

- Any losses incurred during the fiscal year cannot be filed with the ITR 1 Form.

- Any foreign taxpayer filing returns in accordance with Section 90, 90A, or 91 and claiming income tax relief is not eligible to use this form.

ITR 1 Form Structure

The ITR 1 form is divided into four different sections. Each of these sections will have various fields where you will have to enter and verify the information. Each of these sections also has instructions for filling them. Let’s take a look at the structure of the ITR 1 form in detail:-

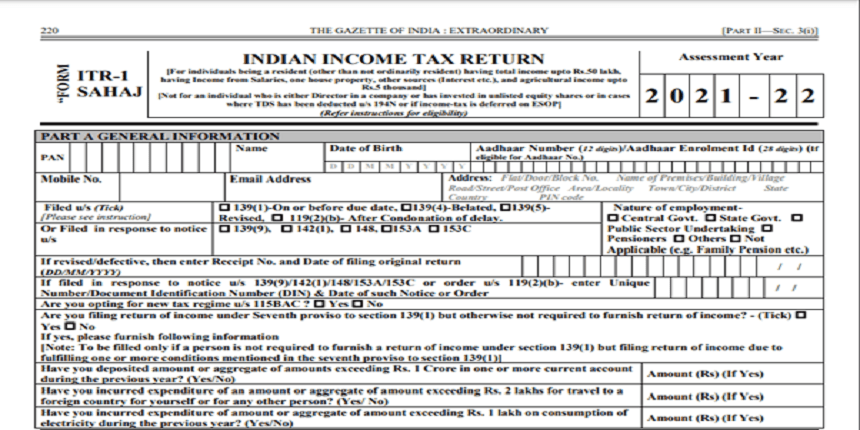

Part A: General Information

This section of the form is divided into different rows starting from A1 to A28. Given below is the information that you will be able to see on this section of the form:-

- First name, middle name and last name

- Permanent Account Number

- Age

- Communication address

- Date of birth and gender as mentioned on the PAN card

- Aadhaar card details

- Return filing date

- City and state of the taxpayer

- Details regarding the taxpayer’s ward and the assessing officer.

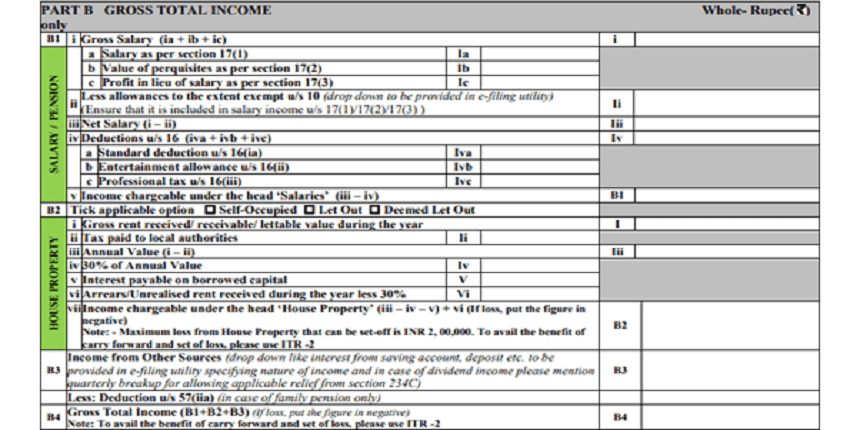

Part B: Gross Total Income

This section of the ITR 1 form contains details regarding the taxpayer’s gross total income. It includes the various components of total gross income like income from salary and income from the property and other sources.

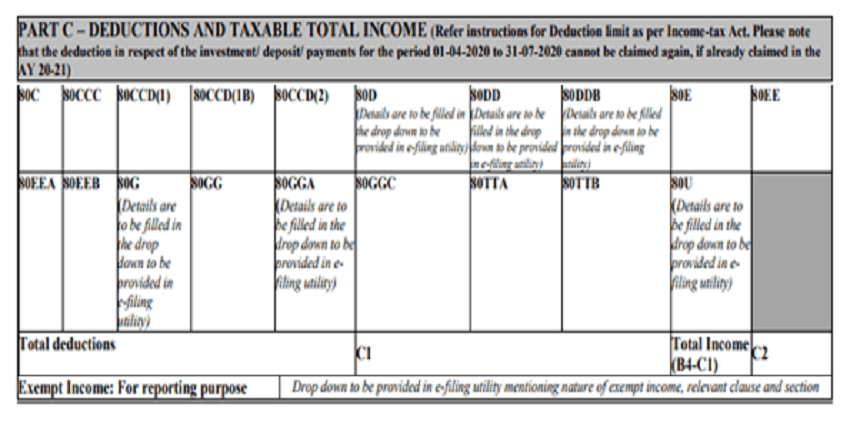

Part C: Total Taxable Income and Deductions

This part of the form has the total taxable income of the taxpayer and the details regarding the deductions from taxable income. Row number C1 to C20 of this section contains the details of deductions according to Section 80C, 80D, 80U, and 80G.

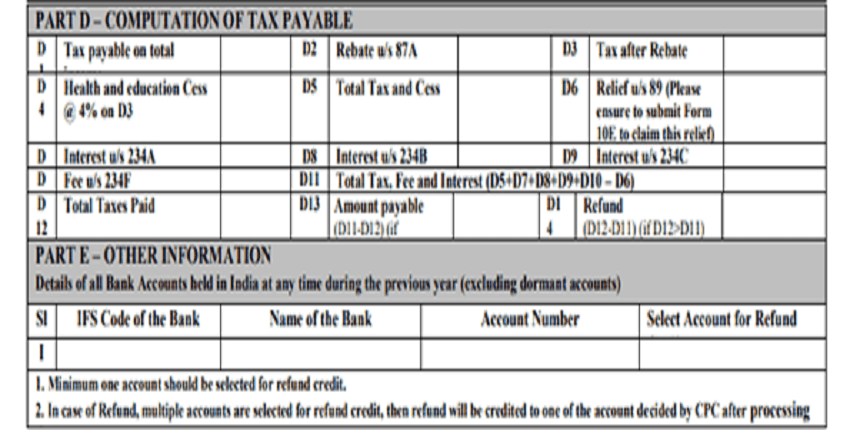

Part D: Tax Payable Calculation

This section of the form is divided into 20 rows. The row numbers D1 to D19 have all the information regarding the tax calculations, status, TDS claims, rebates, etc. The row D20 will have all the information regarding your bank, like bank account number, type of account, IFSC code and name of the bank.

Documents for Filing ITR-1 Form

Given below are some of the documents that the taxpayer should keep in handy while filing their ITR using the ITR 1 form:-

- Form 16 is issued by the employer for the fiscal year.

- Form 26AS: Ensure that the TDS details mentioned in Form 16 match with the details mentioned in Part A of Form 26AS.

- Receipts: If for some reason, you are unable to submit proof for eligible exemptions or deductions to your employer before the deadline, you can use these receipts to claim the ITR directly.

- PAN card

- Investment Proof: FD certificate/details of interest from bank account/passbook.

Major Changes in ITR-1 Form for FY 2021-22

Given below are some of the changes for ITR 1 form filing for the financial year 2021-2022:-

- An individual is not eligible to file ITR 1 form if there has been a tax deduction at the source, according to Section 194N. Section 194N states that TDS should be deducted if income tax non-filers are withdrawing cash exceeding Rs 20 lakhs. For other cases, TDS shall be deducted for cash withdrawals exceeding Rs 1 crore in the financial year.

- There is no provision for carrying forward any TDS under Section 194N. According to Section 194N, TDS credit is only permitted during the financial year when the TDS is deducted.

- Hindu Undivided Families and Individuals have the option to choose between the old tax regime or the new tax regime. If the taxpayer decides to go with the new tax regime, they will have to submit Form 10IE before filing an income tax return in accordance with Section 139(1).

- The income tax return forms for the financial year were amended to include an all new DI. It enabled the taxpayers to avail any eligible deductions made during the extended period of the financial year. This schedule was removed with effect from the fiscal year 2021-22.

Major Changes in ITR-1 Form for FY 2020-21

The following are some of the changes for ITR 1 form filing for the fiscal year 2020-21:-

- The taxpayers meeting the below-mentioned criteria are required to indicate the amount of expenditure or deposit while filing the income tax returns:-

- While making a deposit in a bank exceeding Rs 1 crore.

- In case of expenses exceeding Rs 2 lakh for foreign travel.

- In case of expenditure exceeding Rs 1 lakh for electricity.

- The provision regarding individuals deriving income from salaries, house property, and other sources of income and having a stable income of up to Rs 50 lakh is still in effect.

- Taxpayers who are owners of a single property in joint ownership scenario can also use the ITR 1 form where income is upto Rs 50 lakhs.

Taxpayers are required to separately declare the investment or deposit amount made for tax saving instruments which came in effect from 1 April 2020 to 30 June 2020.

You May Also Read:

Frequently Asked Questions (FAQs)

Can I file ITR-1 without an agricultural income?

Yes, you can file ITR 1 form without agricultural income if the amount does not exceed Rs 50,000. If the income is more than this amount, the taxpayer has to use Rs 50,000.

Can I file ITR 1 form in case of capital gains?

No, you are not required to file ITR 1 form if you earn income from short or long-term capital gains.