The Income Tax Department has provided different types of ITR forms for annual IT returns. This has not only been done to help individuals and businesses file their ITRs more conveniently but also to maintain a more streamlined process of tax collection and regulation. One such form is the ITR 4, which is used mostly by individuals, HUFs and businesses whose gross income does not exceed a certain amount.

In this article, let’s get to know in detail about ITR 4, who is eligible to file it, the filing process and why it is important.

Table of contents

- What is ITR 4?

- Who is Eligible to File ITR 4?

- What is the Structure of the ITR 4 Form?

- How to File ITR-4 Form?

- Steps to Submit the ITR 4 Form

- What are the Documents Required to File ITR-4?

- Who is not Eligible to File the ITR 4 for AY 2021-2022?

- Major Changes Made in ITR 4 for AY 2020-21

- Changes Made in ITR 4 for AY 2021-22

- How to Download the ITR-4 Form?

- Frequently Asked Questions (FAQs)

What is ITR 4?

ITR 4 is one of the Indian income tax return forms. It is for those individuals who have selected a presumptive income scheme (PIC) under Sections 44AE, 44ADA, and 44AD of the Income Tax Act and has a business turnover of or less than INR 50 lakh. If the turnover of the taxpayer exceeds INR 2 crore, the taxpayer needs to file ITR 3 form.

Who is Eligible to File ITR 4?

Any taxpayer (individual, HUF or partnership firm) can file ITR 4 if they match the following criteria.

- Income of INR 50 lakh through salary or pension.

- Income of INR 50 lakh generated from One House Property in the form of rent or transfer.

- Your business income comes under Section 44AD or 44AE.

- If your income is earned from a profession listed under Section 44ADA.

- Gross income of up to INR 50 lakh from other sources like freelancing, family pension, interests from savings accounts, unsecured loans, ITR, etc. (excluding horse races and lotteries).

What is the Structure of the ITR 4 Form?

There are two sections of the ITR 4 form. Each section acquires information regarding the different aspects of an individual’s tax declaration. Here is the ITR-4 structure:

- Part A: The first part contains general information like name, date of birth and address.

- Part B: This part holds the income information from five heads of pay, such as house property, salary and income from other sources.

- Part C: This part is for total taxable income and deduction.

- Part D: This part of the ITR-4 form is for tax computation and status.

- SCHEDULE BP: Income details of business/es that come under Section 44AD, 44ADA 44EA. In this section, you will also have to enter information on your annual turnover, gross receipts for GST and other financial information like members, assets, inventories, etc.

- SCHEDULE IT, TCS and TDS 1: It contains particulars of self-assessment, TDS and advances tax payments.

- SCHEDULE TSD-2: It comprises the statement of TDS deducted for income earned from other sources.

How to File ITR-4 Form?

You can file the ITR-4 form online in the official Income Tax e-Filing portal.

Requirements for this service:

- Registration is a must on the e-filing website with a valid user identification and password.

- Active PAN Card.

- Linked Aadhaar and PAN Card.

- Pre-validation with a bank and a nomination for a refund is recommended.

- Linked mobile with the e-Filing website, bank, NSDL, CSDL and Aadhaad for e-Verification.

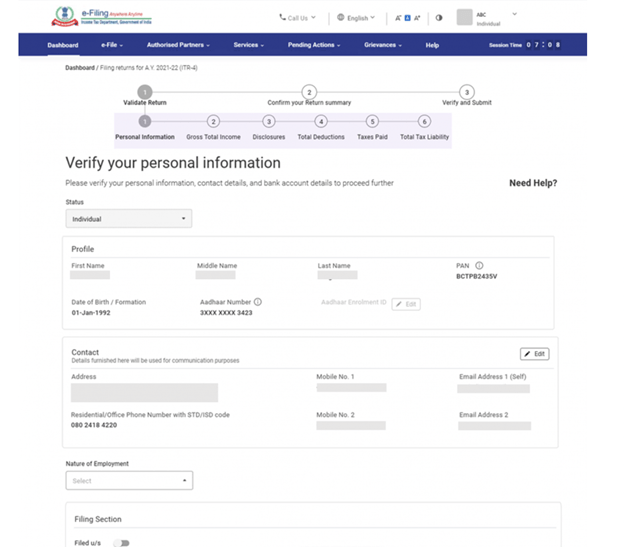

Fill out the six sections in the ITR 4 form. A page for review is also available so that you can verify all entered data before submission. The six sections are mentioned below:

- Personal Information

- Gross Total Income

- Disclosures

- Total Deductions

- Taxes Paid

- Total Tax Liability

Follow these steps to file your ITR 4 form:

Step 1: Personal Information

This section is for verification of the pre-filled data. However, Some of the personal data can’t be edited directly. If you wish to change the data, you need to visit the e-Filing profile. Editing can be done on contact details, authorised representative, details of filing type, your bank details and partner details in the e-Filing profile.

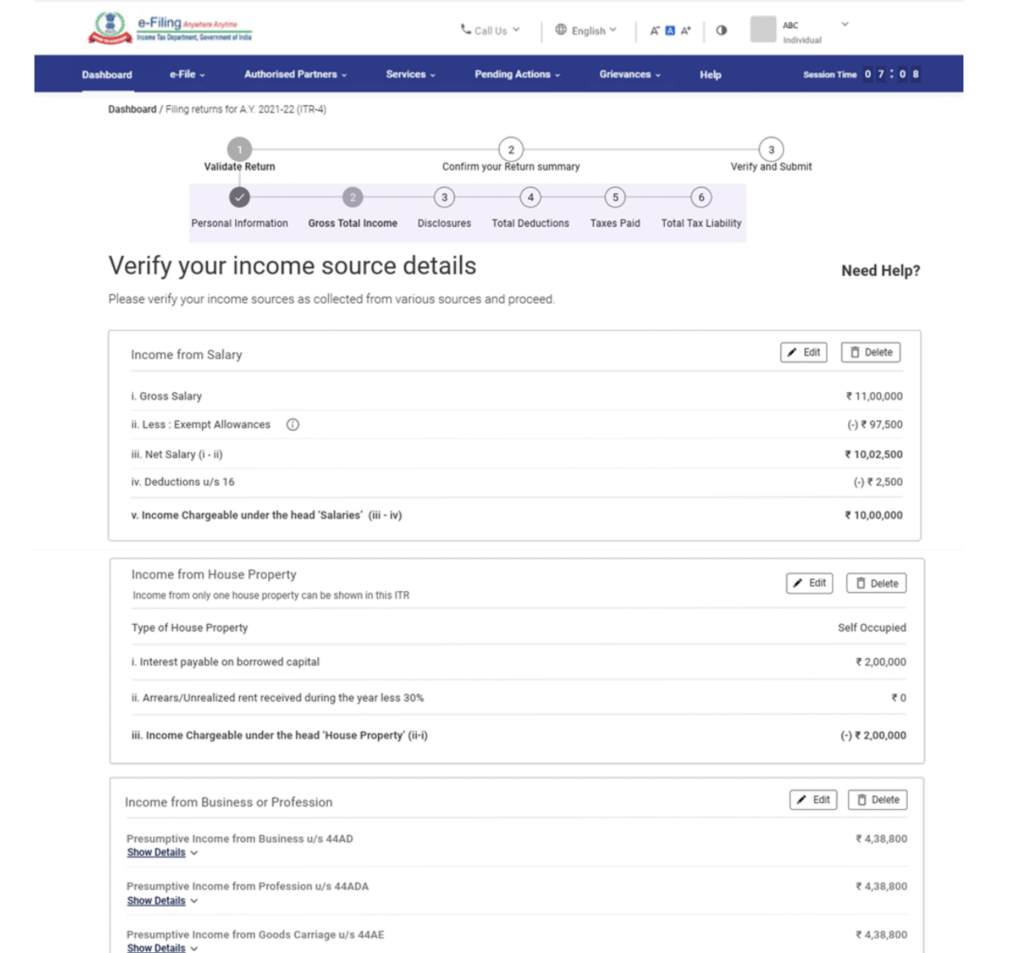

Step 2: Gross Total Income

In this section, the applicant has to verify their income source details and pre-filled information. Enter the additional details of your spare income, if any.

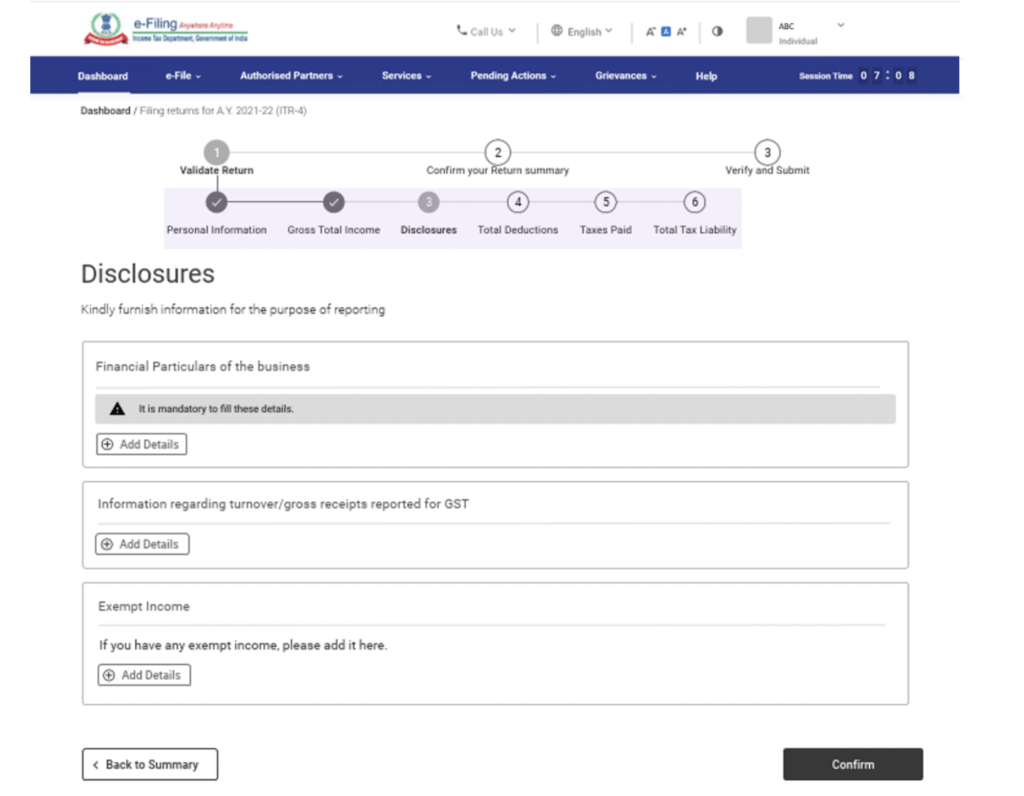

Step 3: Disclosure

In this section, you need to provide your financial particulars, including exempt income and gross receipt reported for GST.

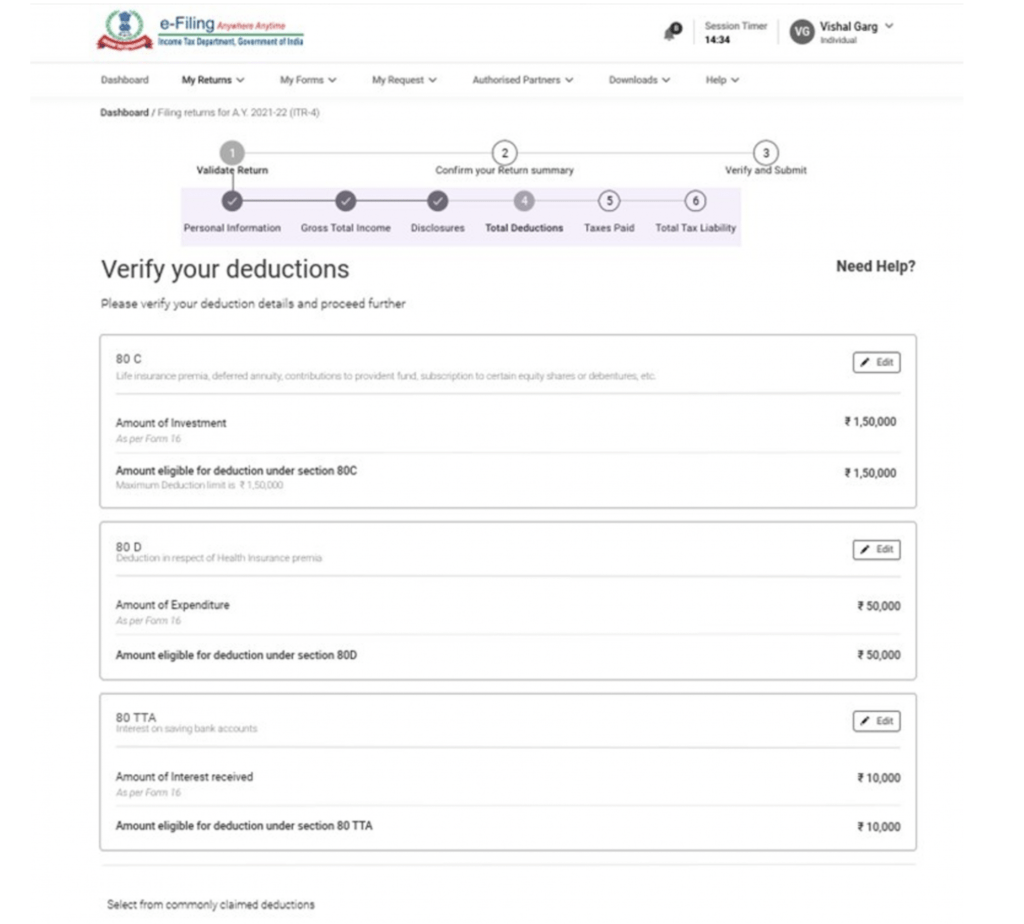

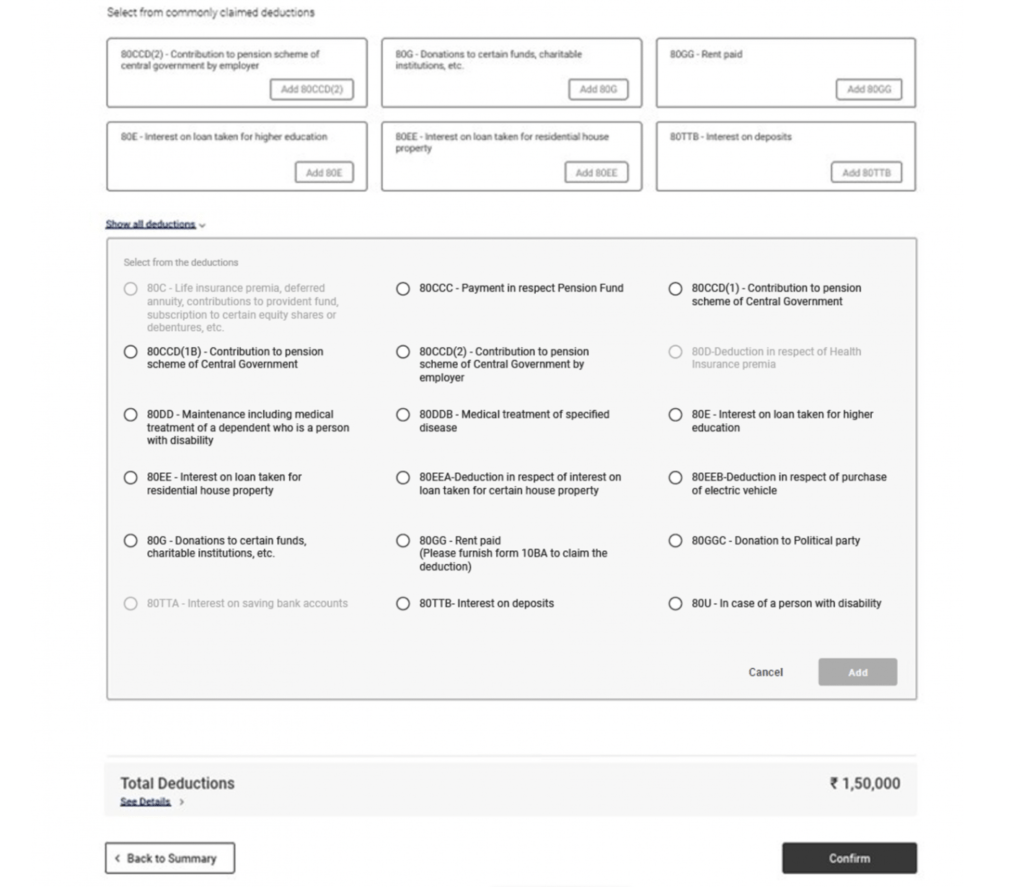

Step 4: Total Deductions

Claim, verify and add any deduction under the Chapter VI-A of the IT Act in this section.

Step 5: Taxes Paid

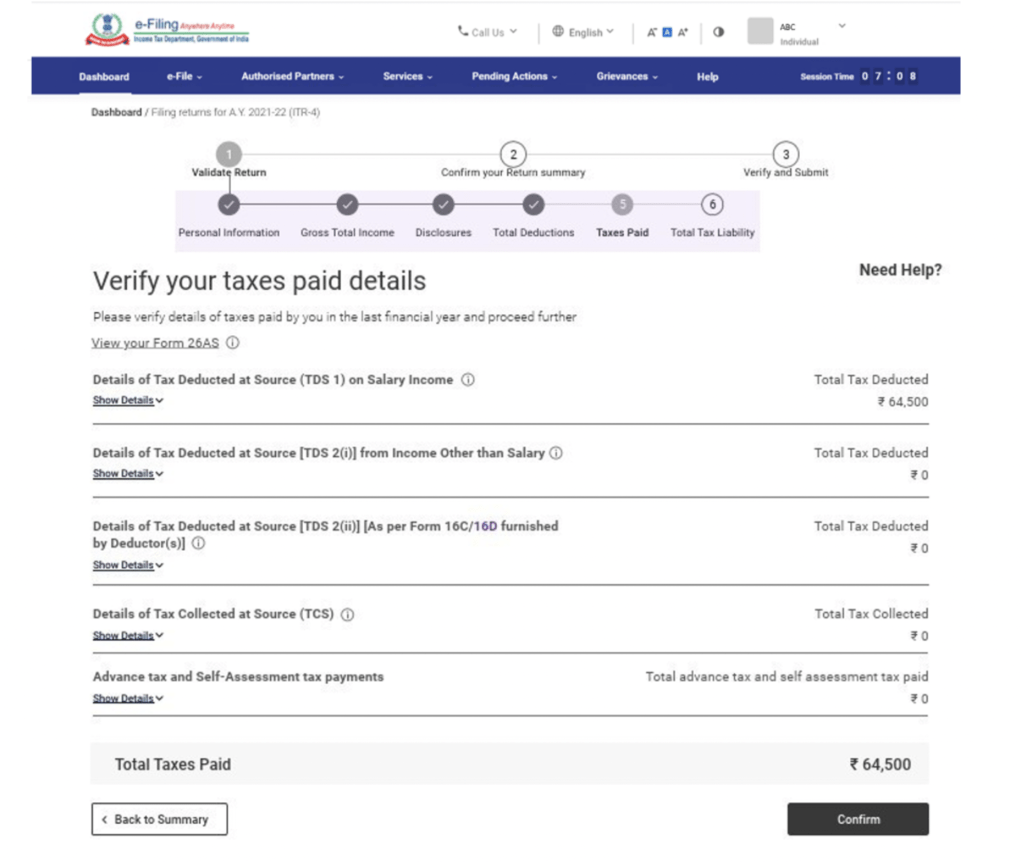

In this section, verify your tax payments for the previous years, including TDS and other furnished salaries by the taxpayer, self-assessment tax, advance tax and TCS.

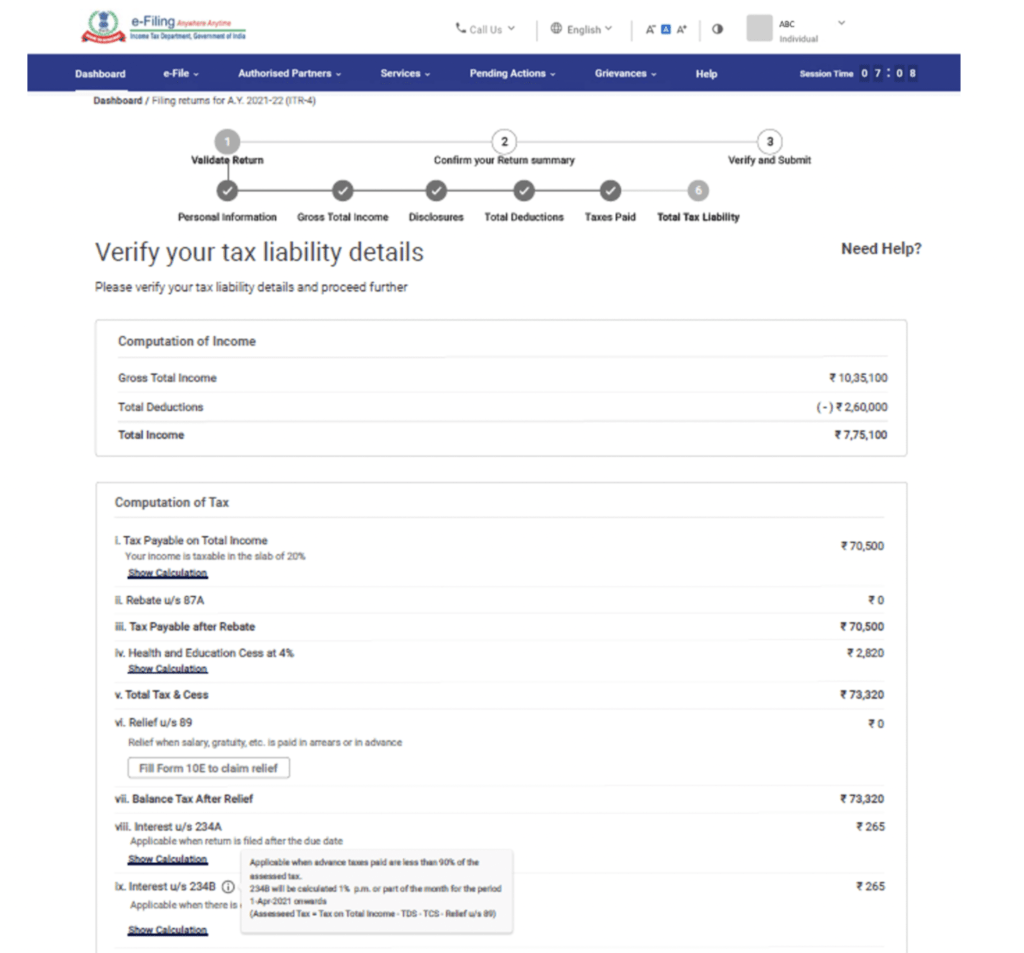

Step 6: Total Tax Liability

This section will give you a preview of the computation of your income, interest, cess and total tax. Check your details of tax liability according to the previously filled sections.

Steps to Submit the ITR 4 Form

Follow the steps mentioned below to file ITR 4 online.

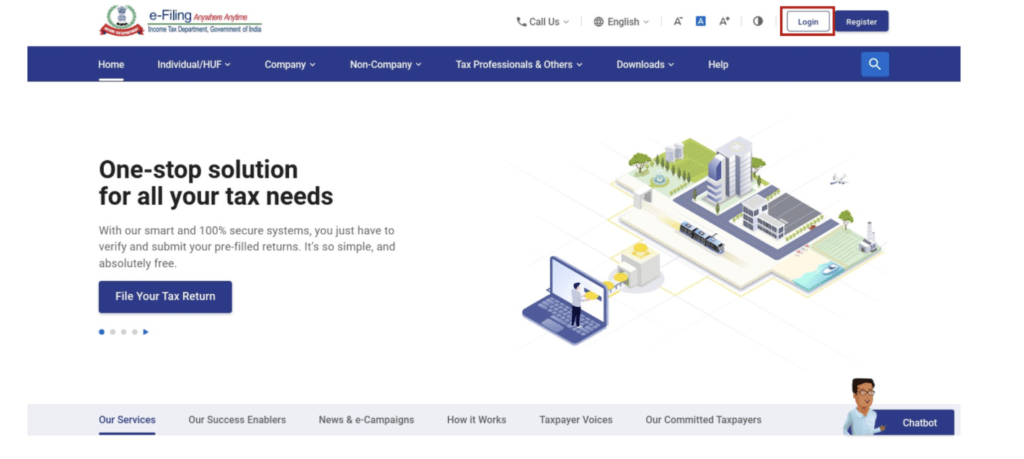

Step 1: Log in to the official e-Filing website with your user identification and password.

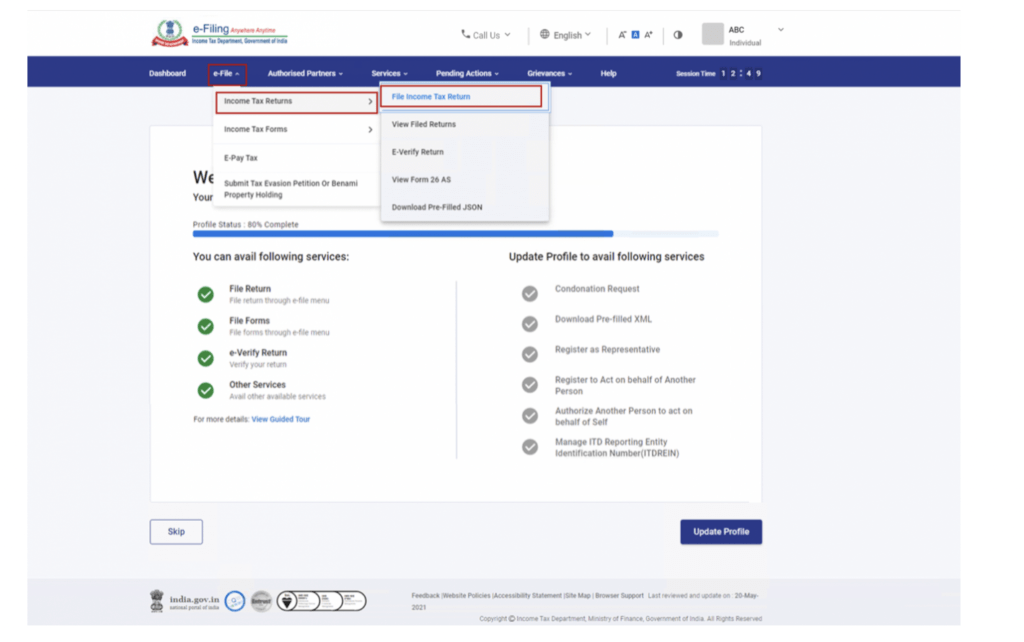

Step 2: Click on the e-File option from the Dashboard. Go to Income Tax Returns and click on File Income Tax Return.

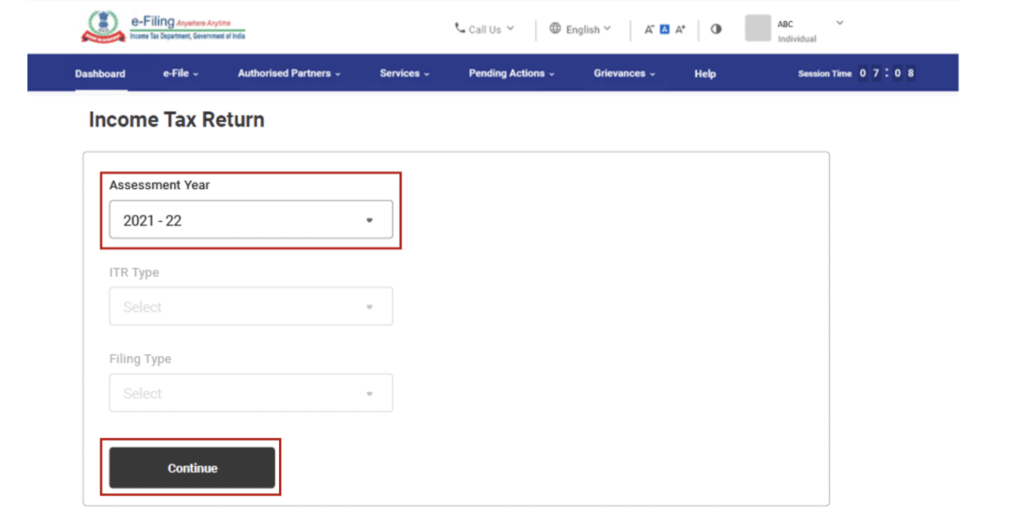

Step 3: Choose the Assessment year and click on Continue.

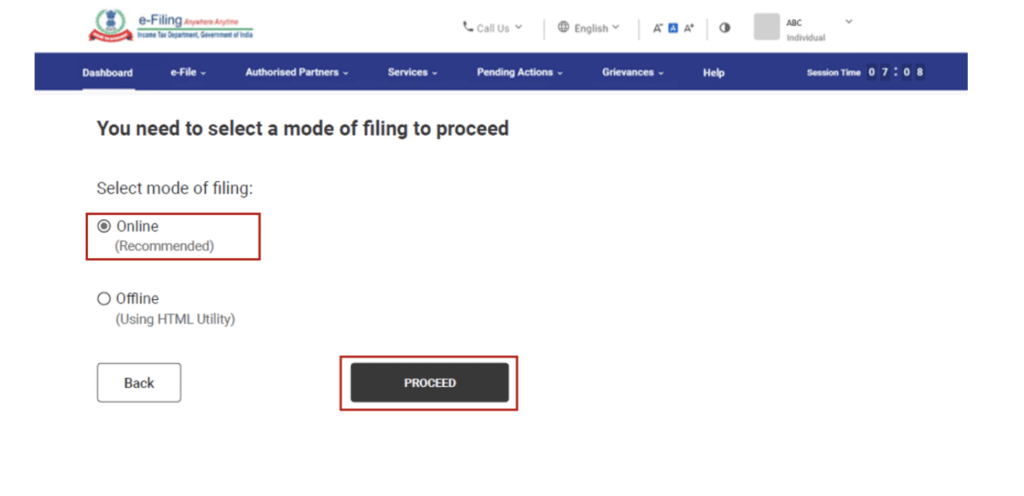

Step 4: Select the “Online” option as the filing mode.

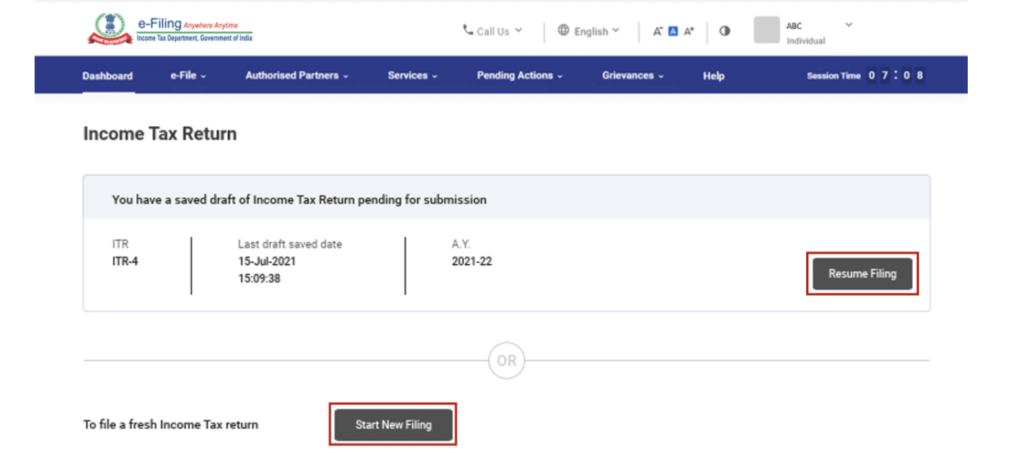

Note: If the previously filed ITR form is pending, then you can continue it by clicking on the “Resume Filing” button. Click on the “Start New Filing” option if you want to discard the current one.

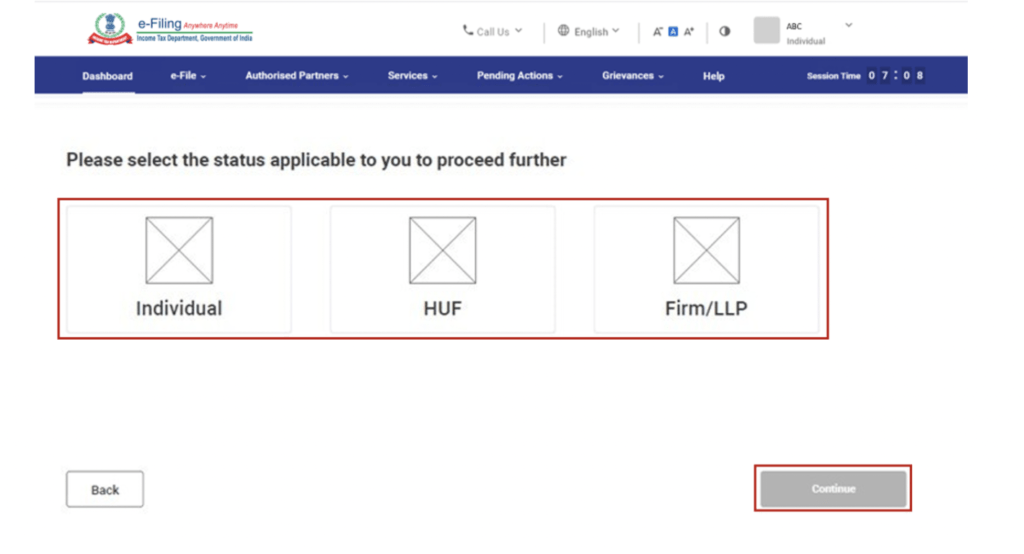

Step 5: Select the status and click on the Continue button to proceed.

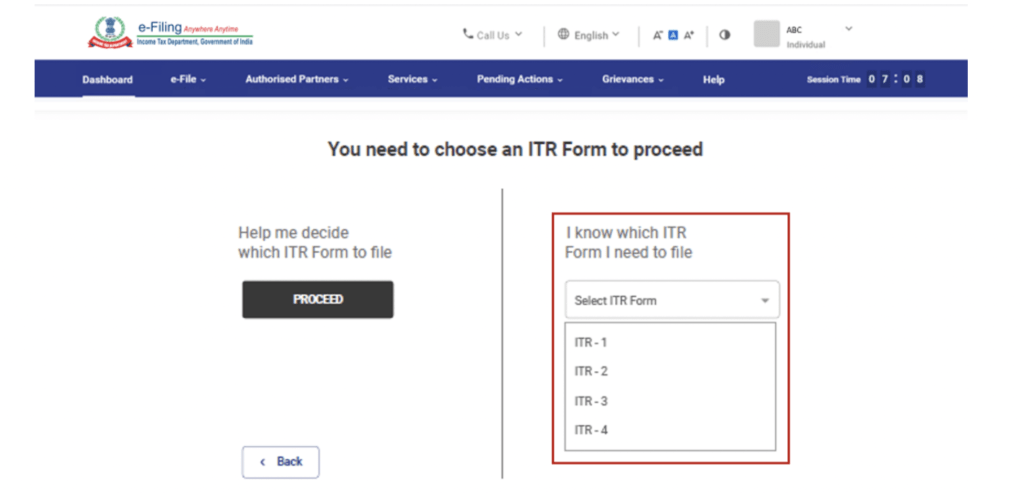

Step 6: You will get two options from the redirected page to choose from:

- Click on the “Proceed” button of the Help Me Decide section if you are unsure about which ITR you should file. The system will help you decide to file the ITR you need to.

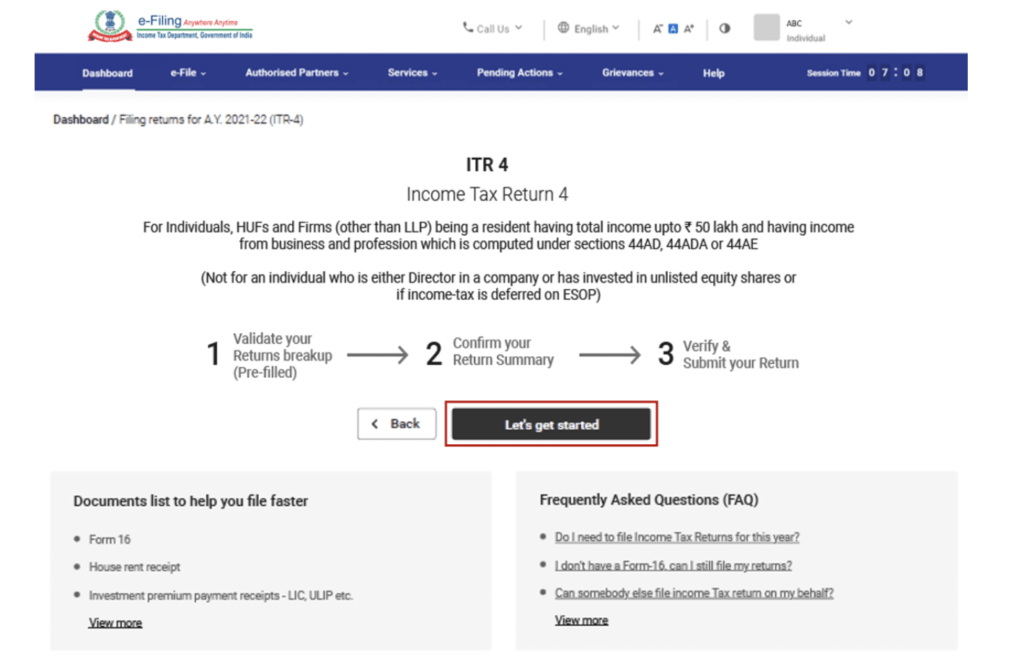

Step 7: Now go through the instructions thoroughly and note down the required document for filing and click on the “Let’s Get Started” button.

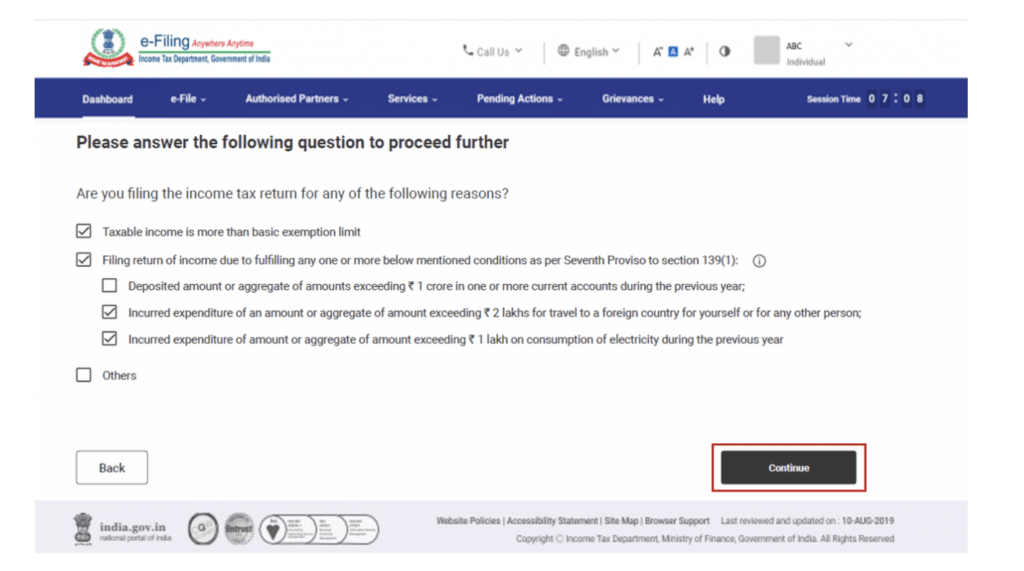

Step 8: Select the applicable checkbox and click on the Continue button.

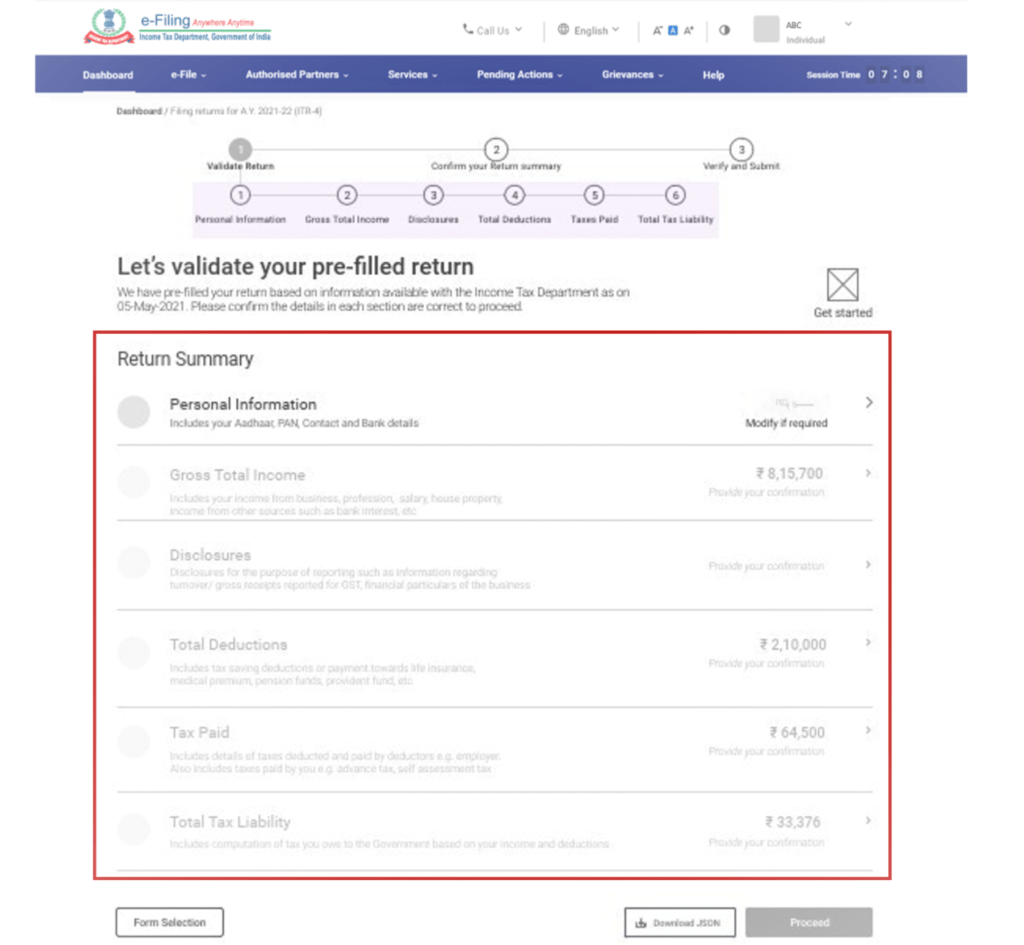

Step 9: On the next page, review the previously-filled data and make edits accordingly. Fill in any remaining information and additional data if needed. Now, click on the Confirm button on the right side of the screen.

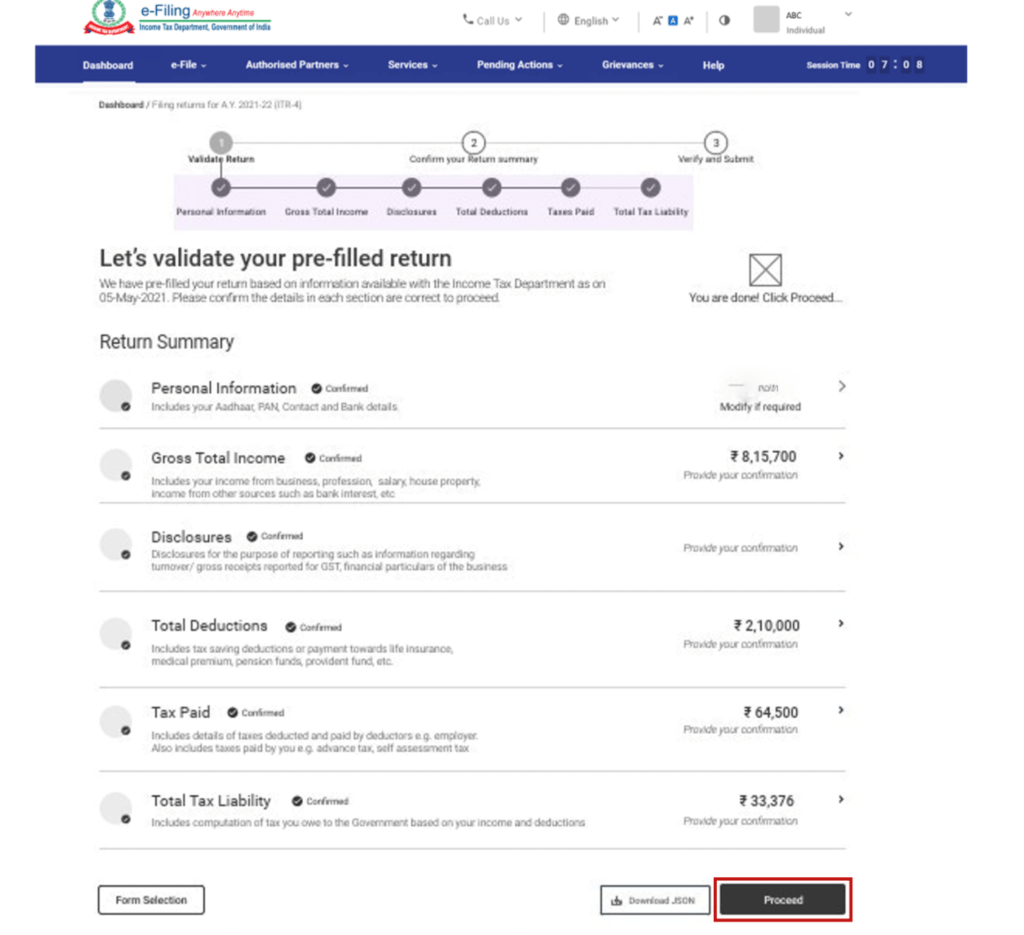

Step 10: Fill in the details of deduction and income in the different sections. Confirm and then click on the “Proceed” button.

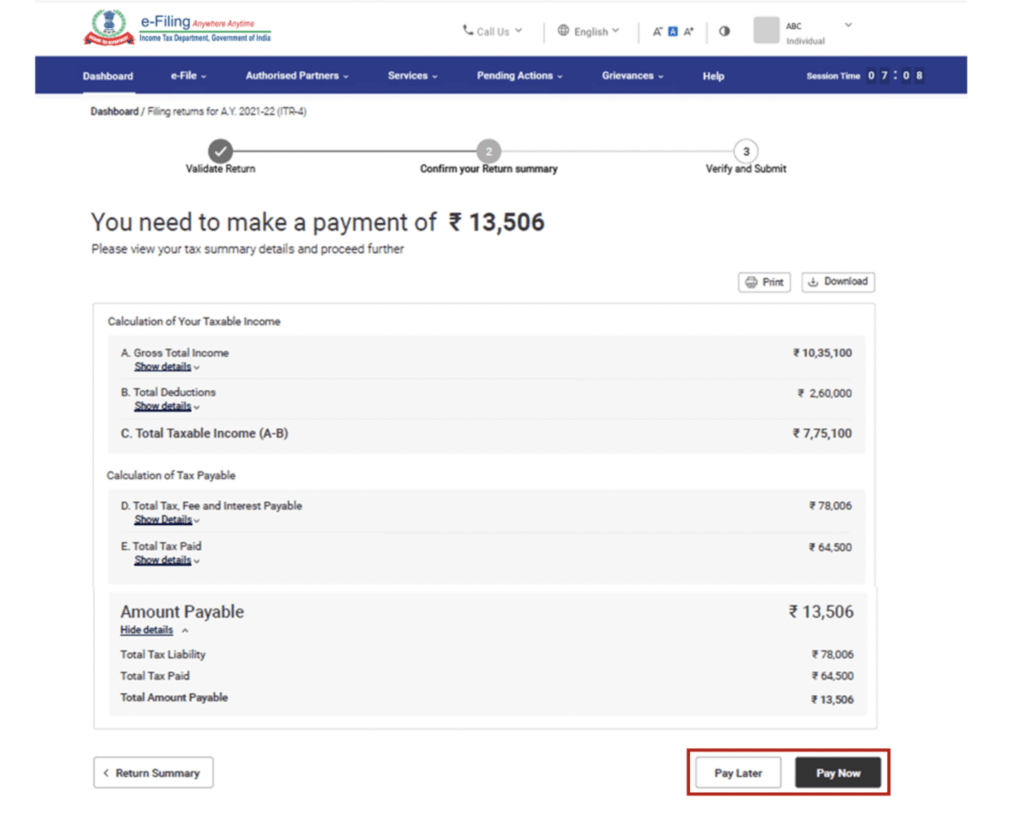

Step 10a: In the case of tax liability, the next page will show you the computation using the provided details. It offers two options: Pay Later and Pay Now.

Note:

- The Pay Now option is recommended in case you have to clear any dues. Enter Challan Serial Number and BSR code in the payment detail correctly.

- You can also pay the same after filing the ITR by choosing the Pay Later option. However, this option is not recommended as you can be considered an assessee by default. The payable interest on tax may rise as well.

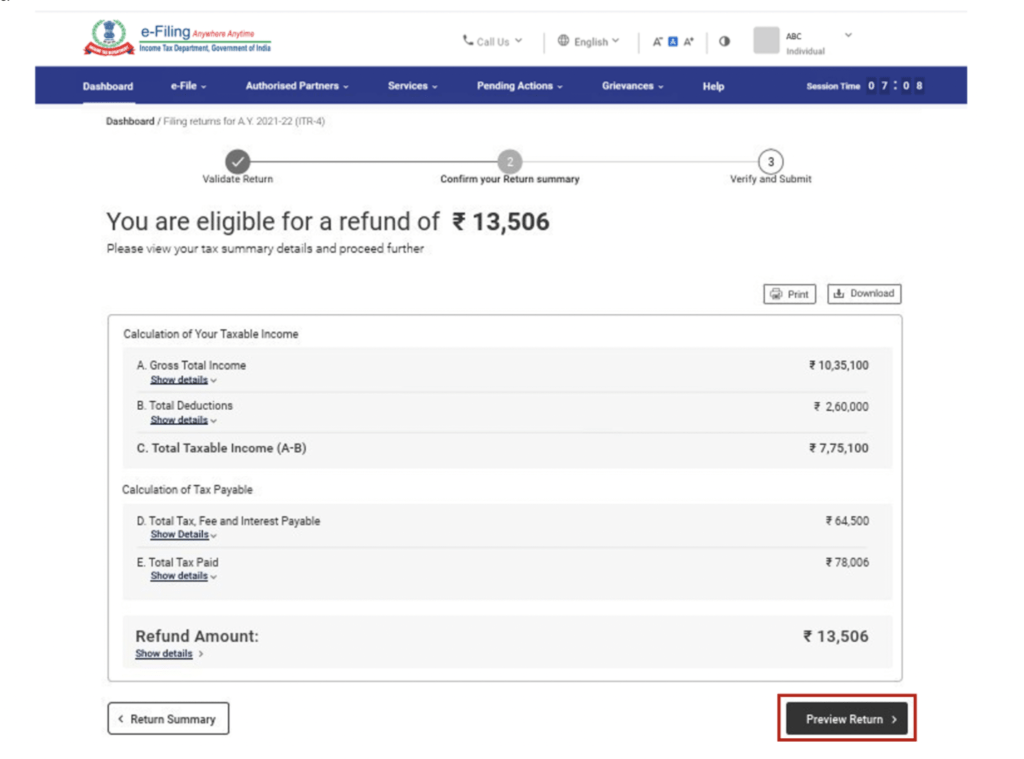

Step 10b: Post paying the tax, click on the Preview Return button in the bottom right corner. If a refund is available after the computation, you will be redirected to the “Preview and Submit Your Return” page. There you will find the eligibility for a refund in case of no tax liability.

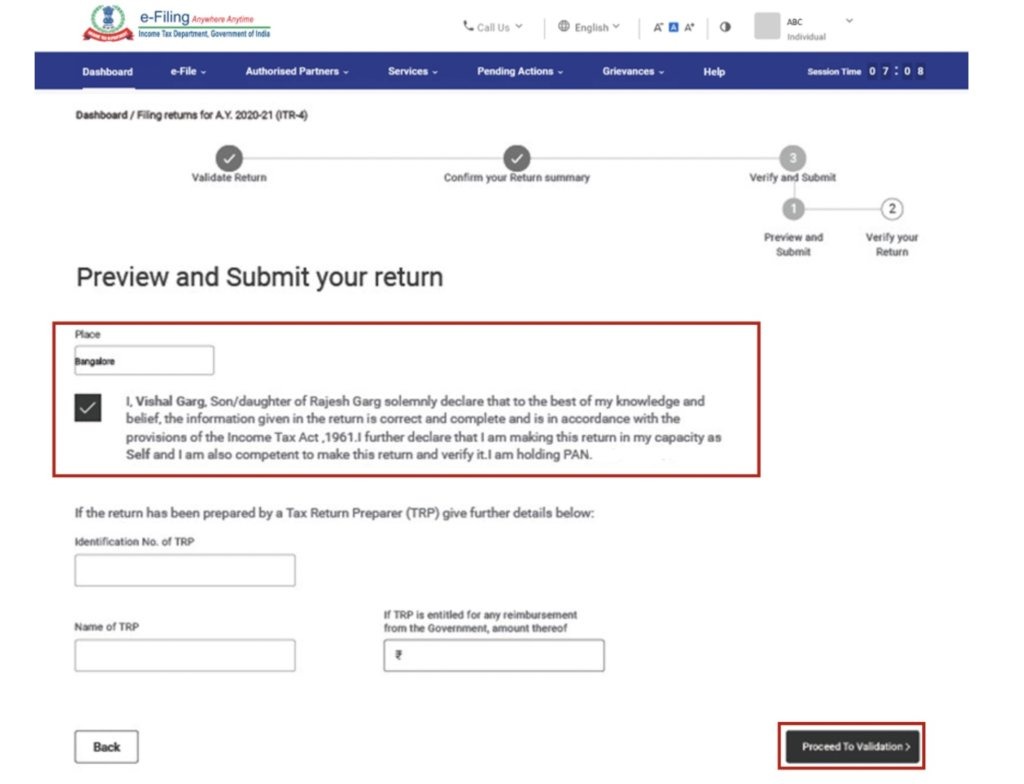

Step 11: On the page Preview and Submit Your Return choose the place, mark check on the declaration checkbox and tap on the Proceed to Validation button.

Note: Leave the text boxes of TRP blank if there is no involvement of a TRP in preparing your return.

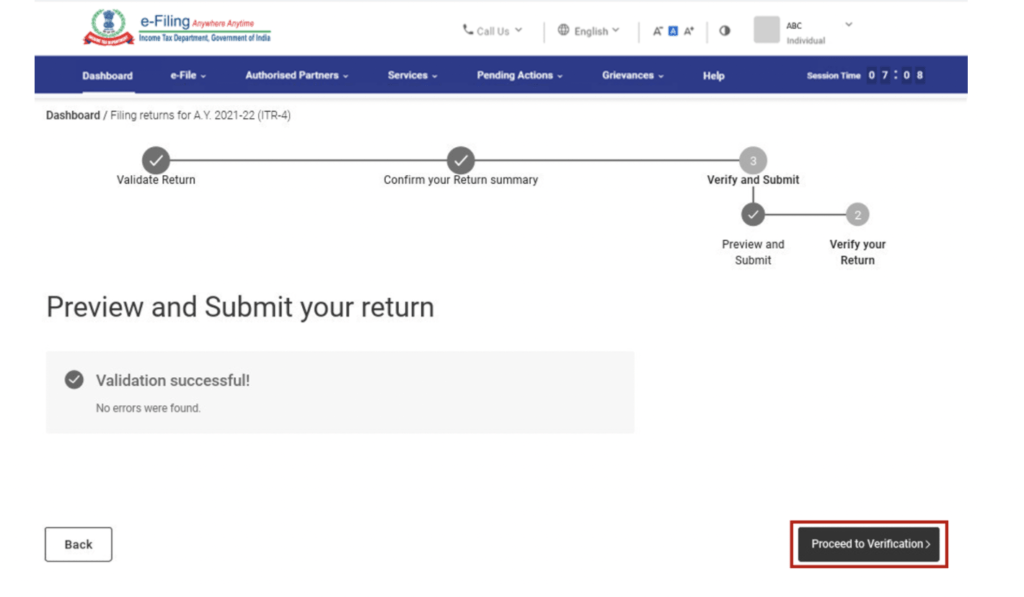

Step 12: Post validation on the page of Preview and Submit your Return, tap on the Proceed to Verification option.

Note: If there are any errors, the user interface will list them out for prompt rectification. It is only when you file the return correctly that you can click on the Proceed to Verification option.

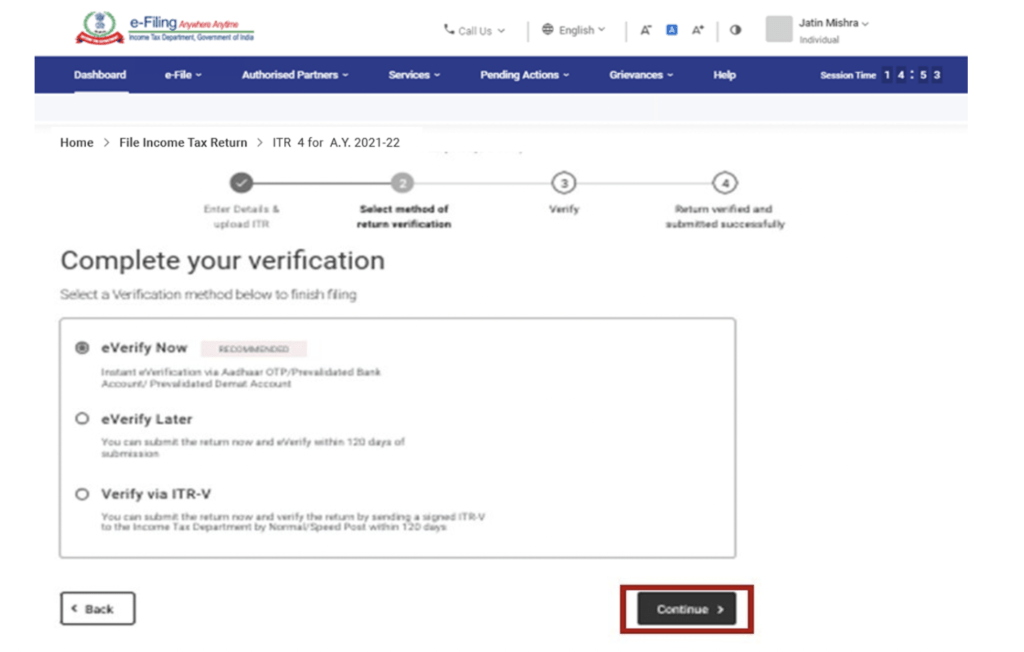

Step 13: Choose from the options of eVerify Now, eVerify Later and Select according to the preference, post completion of verification and click Verify via ITR 5 to initiate the mandated verification process and click on Continue.

Note:

- Verification of your ITR is required within 120 days from the filing if you choose the “e-Verify Later” option.

- If you opt for verification via ITR-V, then you would have to send a physical copy of the ITR-V to the Centralised Processing Centre in the IT Department of Bangalore via post within 120 days.

- Pre-validate your bank account to make sure any due refund gets credited to your bank account.

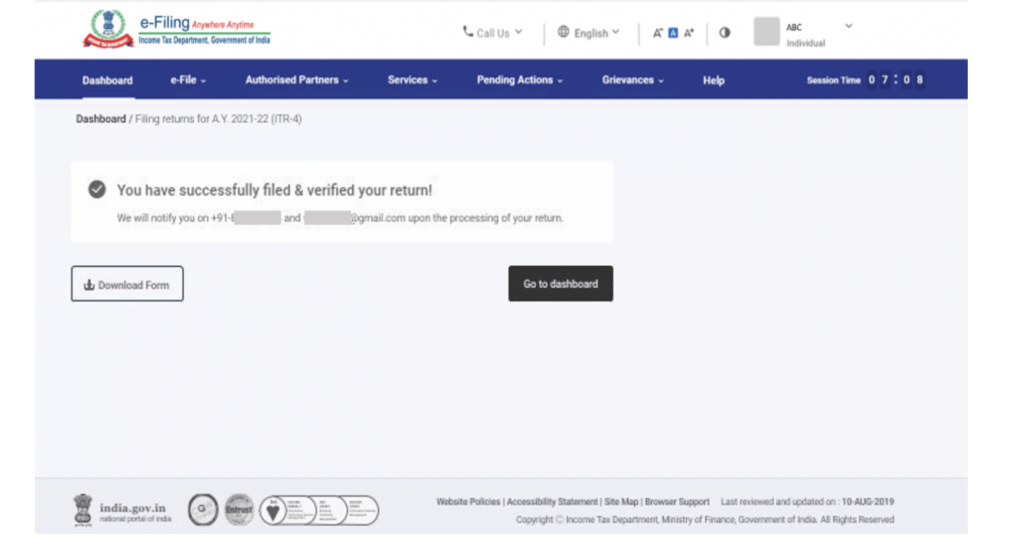

After the e-Verification of the return, you’ll receive a success message along with the Acknowledgement Number and the Transaction ID. You will also receive the confirmation message on your registered email ID and phone number.

What are the Documents Required to File ITR-4?

The required documents to file ITR-4 are as follows:

- Form 16

- Form 26AS

- Form 16A

- Statement of Bank

- Interest Certificates of Housing Loans

- Donation Receipts

- Agreements of Rent

- Receipts of Rent

- Premium receipts of Investments – ULIP, LIC etc.

Related EPF Form

Who is not Eligible to File the ITR 4 for AY 2021-2022?

You are not eligible to file the ITR-4 form if you:

- Have signing authority in account in any foreign country.

- Are a director of any company.

- Have a financial asset in a foreign country.

- Total income exceeds INR 50 Lakh.

- Are an eligible start-up that has received deferred income tax on ESOP from the employer.

- Have unlisted equity shares in the year 2019-20.

As per Section B, you cannot file returns if you have income from the following categories acquired in the last year:

- If your income is from professions and businesses that do not come under Sections 44AD, 44AE, and 44ADE of the IT Act. These include income from commission, brokerage, agency or speculative business.

- Income from several house properties.

- Gains from a lottery.

- Income from racecourses.

- Agricultural income above INR 5,000.

- Capital gains.

Major Changes Made in ITR 4 for AY 2020-21

The major changes made in the ITR-4 for AY 2020-21 are as follows:

- Along with ITR 4, a taxpayer should also file ITR 1 indicating the deposited amount and expenditure if they:

- Make cash deposits of more than INR 1 crore.

- Have expenditures of over INR 1 lakh on electricity.

- Can afford expenses of over INR 2 lakh for foreign travel.

- Under Part A of the form, the ‘Govt’ checkbox is changed to ‘Central Govt’ and ‘State Govt’ along with a Not Applicable checkbox.

- Under the section “Nature of Employment”, a checkbox of ‘Not Applicable’ has been introduced for family pension, etc.

- The Return Filed Under section has been segregated into two heads: Normal Filing and Filed in Response to Notices.

- Schedule VI-A has been amended so that deductions can be incorporated in Sections 80EEA and 80EEB, followed by a drop-down for mentioning donations under Section 80G.

- In ‘Schedule BP’, the gross receipt (also known as gross turnover) will include those revenues that were received from the PEM (Prescribed Electronic Modes) before the specific date.

Changes Made in ITR 4 for AY 2021-22

The changes main in ITR-4 for AY 2021-22 are as follows:

- The declaration for choosing new and old tax regimes has been altered for ITR 4 for AY 2021-22.

- The Schedule DI that was incorporated in AY 2020-21 has been removed this year.

- To specify the nature of income in the e-Filing utility, a drop-down with options of interest from deposit, savings account, etc., has been provided under Income from Other Sources in Part B.

- A quarterly breakup will be provided in case of dividend income that will relieve the applicant from the charge of interest for the payment of advance tax under Section 234C.

How to Download the ITR-4 Form?

Follow the steps to download the ITR-4 form:

Step 1: Log in to the official portal of Income Tax India.

Step 2: Select the e-File, go to Income Tax Returns and click on View Filed Returns to view your e-filed tax returns.

Step 3: Click on the “Download Form” button to download the ITR-4 Form.

Frequently Asked Questions (FAQs)

Can I file ITR 4 all by myself?

Yes, you can file ITR 4 by yourself on the official portal of Income Tax of India.