The Income Tax Department of India has notified seven kinds of ITR forms that fit a specific category and income type. The ITR 5 form is one of those. You need to fill it with correct information to avoid mistakes and ensure a smooth return filing process. But if it’s your first time filing ITR and you’re worried about how to proceed, we’re here to help. This blog covers all the aspects of filing ITR 5, so you don’t have to look anywhere else.

Table of contents

- What is the ITR 5, and Who can File It?

- Who cannot File ITR 5 Form?

- ITR 5 Form – The Complete Structure

- Parts and Schedules Sequence for Filing ITR 5

- Important Documents for Filing ITR 5

- Downloading ITR 5 Form

- How to File ITR 5

- Due Date for Filing ITR 5 Form

- Necessary Instructions for Filing out ITR-5 Form

- Frequently Asked Questions (FAQs)

What is the ITR 5, and Who can File It?

The ITR 5 Form is meant for bodies like firms, LLPs (Limited Liability Partnerships), BOI (Body of Individuals), AJP (Artificial Juridical Person), AOPs (Association of Persons), the estate of deceased, the estate of insolvent, investment fund, cooperative society, and business trust. Any entity or entity belonging to the aforesaid categories is eligible for filing ITR 5.

Who cannot File ITR 5 Form?

Since ITR 5 Form is meant for a specific category of taxpayers, it cannot be filed by the following bodies:

- Any individual who is filing ITR-1

- Anyone filing ITR-7

- HUFs (Hindu Undivided Families)

- Any company

- Applicants earning income from capital gains

ITR 5 Form – The Complete Structure

The form comprises two parts and over 30 schedules.

- Part A: General Details

- Part A-BS: Details related to the Balance Sheet

- Part A: Contains Manufacturing Account details

- Part A: Contains Trading Account details

- Part A-P&L: Contains Profit and Loss Account details

- Part A-OI: Contains Other information

- Part A-QD: Contains Quantitative details

The details of the 31 schedules are as given below:-

- Schedule HP: Income calculation under Income from House Property

- Schedule BP: Income calculation under ‘profit and gains from business or profession.”

- Schedule DPM: Depreciation calculation on plant and machinery as per the Income Tax Act

- Schedule DOA: Depreciation calculation on other assets as per the Income Tax Act

- Schedule DEP: All assets depreciation summary as per the Income-tax Act

- Schedule DCG: Deemed capital gains calculation on depreciable assets sale

- Schedule ESR: Deduction under section 35

- Schedule CG: Income calculation under Capital gains.

- Schedule OS: Income calculation under Income from other sources.

- Schedule CYLA: Income statement after losses of the current year

- Schedule BFLA: Income statement after unabsorbed loss from previous years.

- Schedule CFL: Losses statement to be carried forward to future years.

- Schedule UD: Unabsorbed Depreciation

- Schedule ICDS: Effect of income calculation disclosure standards on profit

- Schedule 10AA:Deduction calculation under section 10AA

- Schedule 80G: Contains donation details under section 80G

- Schedule 80GGA: Scientific research or rural development donation details

- Schedule RA: Research associations donation details etc.

- Schedule 80-IA: Deduction calculation under section 80IA

- Schedule 80-IB: Deduction calculation under section 80IB

- Schedule 80-IC/ 80-IE: Deduction calculation under section 80IC/ 80-IE.

- Schedule 80P: Deductions under section 80P

- Schedule VI-A: Deductions statement (from total income)

- Schedule AMT: Calculation of Alternate Minimum Tax payable

- Schedule AMTC: Calculation of Tax credit

- Schedule SI: Income statement which is a tax chargeable at special rates

- Schedule IF: Information about partnership firms where you are a partner

- Schedule EI: Income statement that is not a part of total income

- Schedule PTI: Pass-Through Income information from an investment fund or business trust

- Schedule- TPSA: Details regarding secondary adjustment to transfer price

- Schedule FSI: Income details from outside India and tax relief

- Schedule TR: Tax relief summary claimed for taxes paid outside India

- Schedule FA: Foreign Assets and Income details from any source outside India

- Schedule GST: Information about turnover/gross receipt reported for GST

- Schedule DI: Schedule of tax-saving investments or deposits or payments to claim deduction or exemption

- Part B – TI: Calculation of Total income

- Part B – TTI: Calculation of Tax liability on total income

- Tax Payments: Advance tax and tax on self-assessment; tax deductions other than salary; details of collected at source.

Parts and Schedules Sequence for Filing ITR 5

As per the guidelines issued by the Income Tax Department, the applicant should follow the below-mentioned sequence while filing the ITR Form:-

- Part A

- Schedules

- Part B

- Part C

- Verification

Important Documents for Filing ITR 5

Applicants require the following documents to file ITR 5:-

- A copy of the previous year’s tax return

- Bank Statement

- TDS certificates

- Savings certificates/deductions

- Interest statement that displays interest paid to you throughout the year.

- Profit and Loss Account Statement, Balance Sheet, and other Audit Reports wherever applicable.

Related ITR Form

Downloading ITR 5 Form

Downloading the ITR 5 form requires you to follow the steps:-

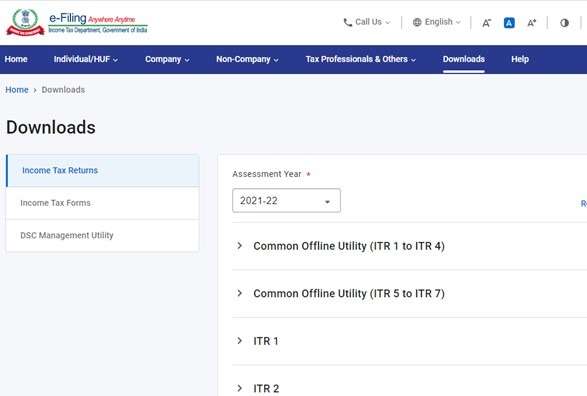

Step 1: Go to the official Income Tax Department website- https://www.incometax.gov.in/iec/foportal

Step 2: From the top menu, click on Downloads and select Income Tax Returns from the left column.

Step 3: Make sure you choose the right assessment year from the dropdown. In this case, it’s 2021-22.

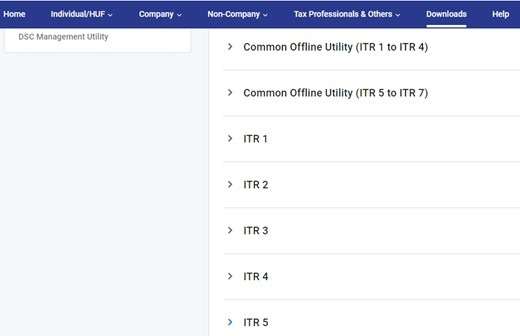

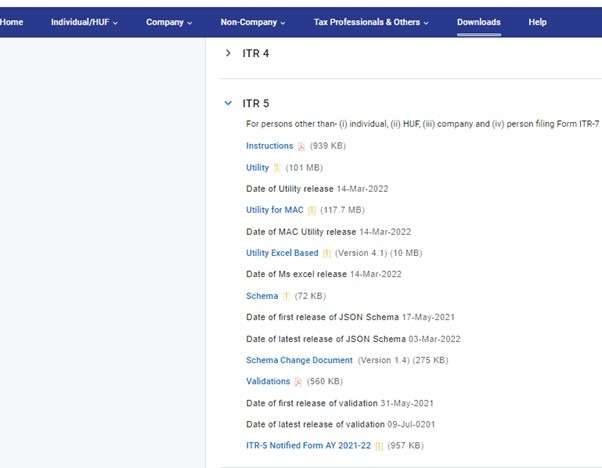

Step 4: Scroll down and select ITR 5.

Step 5: You will find a list of options such as:-

- Instructions

- Utility

- Utility for MAC

- Schema

- Schema Change Document

- Validations

- ITR-5 Notified Form AY 2021-22

Click on the last option – ITR-5 Notified Form AY 2021-22

Step 6: Download the ITR-5 form and fill out all the required fields.

Step 7: You can also download the form by directly using the link – “https://www.incometax.gov.in/iec/foportal/sites/default/files/2021-06/ITR-5%20Notified%20Form%20AY%202021-22_0.pdf”

How to File ITR 5

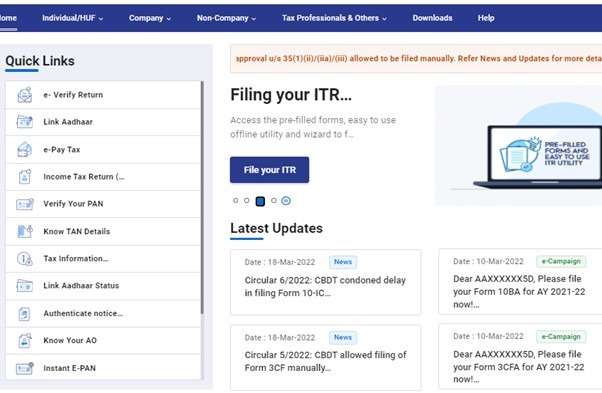

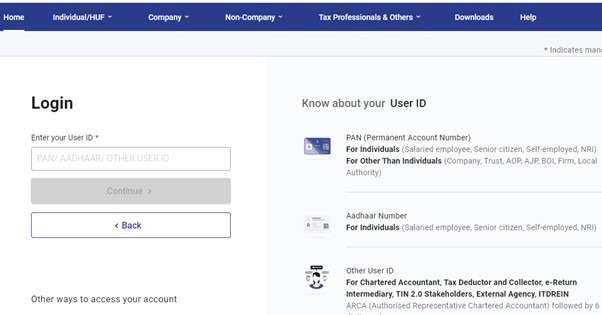

Step 1: For filing the Income Tax Return-5 form, you need to head to the official Income Tax Department website.

Step 2: On the home page, click on the File your ITR button.

Step 3: Login using your User ID (PAN, Aadhaar Number or other User ID)

Step 4: Once logged in, fill out all the general information, audit information, details related to the manufacturing account, trading account, profit, loss account, etc.

Step 5: Make sure the details are correct and keep clicking on the “Save the Draft” button to avoid losing any data.

Step 6: Select the verification option from either of the following choices:-

- digitally signing the verification part (In case the accounts require auditing u/s 44AB, verifying the return online under digital signature is mandatory)

- electronic verification code (EVC)

- Duly sign paper Form ITR-5 (Acknowledgment) and send it by post to CPC, Bengaluru

Due Date for Filing ITR 5 Form

The last date for filing ITR is July 31st of that assessment year and October 31st for taxpayers with accounts that are subject to audit. This date was revised for Financial Year 2020-21 because of the pandemic. The extended due dates are:-

| FY 2020-21 |

| TYPE OF AUDIT | DATE |

| Non-Audit Case | 31st December 2021(REVISED) |

| Audit Case | 15th March 2022 (REVISED) |

Necessary Instructions for Filing out ITR-5 Form

Follow these instructions to successful file the ITR form:-

- If any of the schedules in the form is not applicable, mention it as “NA”.

- Do the same for inappropriate items. Just write “NA” next to the particular item you find inappropriate.

- “NIL” means nil figures. Write NIL whenever you wish to denote figures of zero value in the form.

- In case of a negative figure or loss, use the minus icon, i.e. “-” before that figure.

- All the figures in the form should be written in a round off format.

If you require detailed assistance on filing out ITR-5 Form, you can download its instructions manual from the official Income Tax Department website.

Step 1: On the official Income Tax Department website, click on Downloads from the top menu.

Step 2: Select Income Tax Returns from the column on the left

Step 3: Scroll down and click on the ITR-5 dropdown

Step 4: From the list of available links, click on Instructions

Step 5: A PDF comprising instructions for every field of the ITR 5 form will open. Click on the download icon on the top right corner to download it.

Step 6: You can also directly download the instruction manual using this link – “https://www1.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Instructions_ITR_5_AY_2019-20.pdf”

You May Also Read:

Frequently Asked Questions (FAQs)

Is the ITR 5 form available for e-filing?

Yes, the ITR 5 form is available for e-filing. You just need to visit the official Income Tax Department web portal to file the same.

How can I download ITR 5 utility for AY 2021-22?

Go to the Downloads section on the official Income Tax Department web portal, select

ITR 5 utility for AY 2021-22 to download it.

Is filing Income Tax Return Form compulsory?

Yes, filling ITR form is compulsory to file an income tax return. It comprises taxpayers’ detailed information such as tax liabilities, investment proofs, deductions, etc.

Do I need a CA to file ITR-5?

Yes, you will need assistance from a CA, especially if you are filing ITR-5 for the first time. The CA will guide you through the process, so you don’t have to worry about making errors or missing out on important information.