“Government of the people, by the people and for the people”

For decades we had been gleaned with this expression but during the ‘Iconic Week Celebrations,’ it came to fruition.

‘Azadi Ka Amrit Mahotsav’, an inimitable way to showcase our veiled heritage, sprouted as a first step on the people-centric governance ladder. Unequivocally dedicated to honouring all that Indians should be gratified by, it gives us a chance to dig into the past and express credits wherever due.

Table of contents

- What is Jan Samarth Portal?

- Significance of Jan Samarth Portal

- Jan Portal: A Perfect Move for Tying the Loose Ends!

- Schemes Integral To The Jan Samarth Portal

- Documents Required to Unlock Benefits of Jan Portal

- Here’s How Jan Samarth Portal Will Work

- Hotspot to Digital Integrations: UIDAI, CBDT, NSDL, LGD

- Partner Banks and Key Stakeholders

- Elimination of Rigmarole to Make Securing Credit Easier than Ever

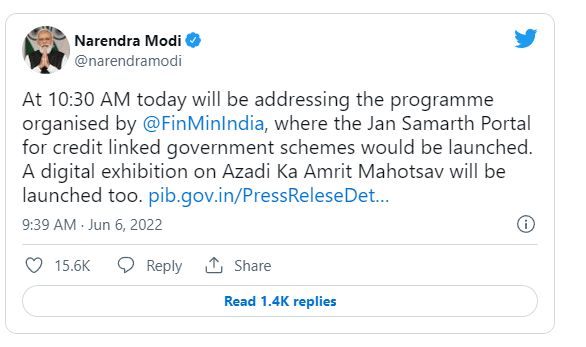

The Azadi Ka Amrit Mahotsav’s Iconic Week was a marvellous jubilation organised by the Ministry of Finance. It highlighted the convergence of the glories of freedom grapples, ground zeroes and hopes of a modern, new and iconic India. It is an opportune moment to rejoice and move forward with new resolutions.

PM Modi expressed to the media that India has progressed in the twenty-first century through people-centric administration. Following the trail of people-centric governance, on Monday, the Jan Samarth Portal was unveiled at Vigyan Bhawan in New Delhi as part of the ‘Iconic Week Celebrations.’

The Prime Minister remarked that earlier, people were obliged to reach out to the government in order to take advantage of the initiatives, but it’s time to recast it. Forthwith, the emphasis is on bestowing governance to the people and setting them free from the rigmarole of visiting several ministries and websites.

The portal will serve as a one-stop-shop for all government credit-related efforts, with a focus on loans for education, agri-infrastructure, business and livelihood development. It will assist everyone, from students, farmers and businessmen to MSME enterprises in achieving their goals.

In simple words, through the Jan Samarth Portal, securing credit has become easier than ever.

What is Jan Samarth Portal?

‘Another milestone on the thoroughfare to digitisation!’

The Jan Samarth Portal is a countrywide portal for government credit-linked programmes. This easily approachable one-stop digital portal connects several government credit initiatives. It’s a first-of-its-kind platform that bridges the gap between lenders and beneficiaries. The primary goal of the Jan Samarth portal is to promote inclusive growth and development of diverse sectors by enlightening and supplying them with the appropriate government benefits. This will be accomplished via a simple and straightforward digital process.

This portal will not only make students’, entrepreneurs’, businessmen’s and farmers’ life easier, but it will also assist them in realising their aspirations. Students will get an idea about available initiatives, the foremost ones to count on and how to take advantage of them. This portal will serve as an end-to-end shop for the youth and middle class. It will be crucial in the field of self-employment.

Consider it a repository of government-sponsored credit programmes. This digital platform connects thirteen credit-linked government initiatives. Every task will be embedded in the Jan Samarth Portal, from credit schemes to grievances and eligibility checks to verification.

Beneficiaries can pin their hopes on checking their eligibility digitally in a couple of facile steps, apply online for approved schemes and can even secure a digital approval. The foremost credit services will be offered to the beneficiaries through four credit categories and more than 125 lenders.

Significance of Jan Samarth Portal

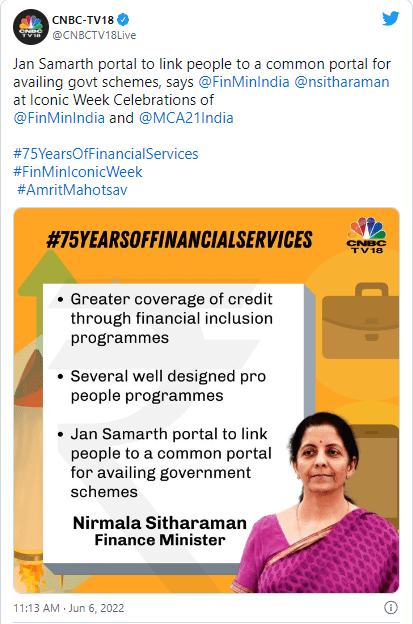

The portal’s major goal is to promote equitable growth and development across multiple sectors by directing and providing them with the appropriate government benefits via straightforward digital methods. The gateway ensures that all linked initiatives are covered from beginning to end.

The Jan Samarth Portal can be used to apply for several startup credit programmes such as the Stand Up India Scheme or the PM Employment Generation Programme, both of which are designed to encourage entrepreneurship in the country.

The Jan Portal’s key objective is to bridge the gap between beneficiaries and lenders, and establish direct communication. The mission is to use a digital platform to make credit more accessible than ever before. Users can check their eligibility for government-aided schemes digitally, apply for eligible schemes online and receive digital approval.

The portal enlists 13 initiatives in four categories aimed at assisting students, farmers, businesses as well as MSME entrepreneurs. A user gets the facility to submit an online loan application to any lending institution listed on the Jan Portal. The portal incorporates more than 125 lending institutions to offer an utmost user convenience.

The main aim is to bring together all of the stakeholders in the financial ecosystem on a single platform to make business development and growth more accessible. It creates a perfect web of applicants (beneficiaries), lenders, Central and State Government Ministries, Nodal Agencies and facilitators, in which everyone is closely linked to one another.

Jan Portal: A Perfect Move for Tying the Loose Ends!

A disjointed financial ecosystem with a significant gap between lender and beneficiary and a lack of direction and a streamlined process. This was how the credit application process looked not too long ago. More of a case study and research project in which you were unaware of what the government has to give you, what you should expect and how to access a government-linked scheme.

That isn’t the case! Furthermore, if the general public could gain access to the required programme, they had to solve the puzzle of visiting departments, presenting paperwork, verifying information and so on.

But, a single move by the government and guess what, all the loose ends were tethered to a single portal. It seems impossible, doesn’t it? But it happened right before the start of Iconic Week. PM Modi took the limelight by announcing the launch of the Jan Samarth Portal.

The general public will no longer approach the designated individual for credit. The offering will be made available to the general public through this one-of-its-kind platform from the comfort of their own homes.

Schemes Integral To The Jan Samarth Portal

Education Loan, Agri Infrastructure Loan, Business Activity Loan and Livelihood Loan. The government has meticulously established every scheme to ensure that all welfare needs are met.

| Category | Credit-Linked Scheme |

| Education Loan | * Central Sector Interest Subsidy (CSIS) * Padho Pardesh * Dr Ambedkar Central Sector Scheme |

| Agri Infrastructure Loan | * Agriclinic and Agribusiness Centres Scheme (ACABC) * Agricultural Marketing Infrastructure (AMI) * Agriculture Infrastructure Fund |

| Business Activity Loan | * Prime Minister’s Employment Generation Programme (PMEGP) * Weaver Mudra Scheme (WMS) * Pradhan Mantri Mudra Yojana (PMMY) * Pradhan Mantri Street Vendor Aatmanirbhar Nidhi Scheme (PM SVANidhi) * Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS) * Stand-Up India Scheme (StandUpIndia) |

| Livelihood Loan | * Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY-NRLM) |

Documents Required to Unlock Benefits of Jan Portal

Document is the key to make the rigmarole a layman’s walk.

Each scheme will require a distinct set of documents for uninterrupted credit approval. Consider the document a key to unlocking the door to government credit-linked programmes. The most admirable aspect of the documentation procedure is that your identification will remain the same regardless of the scheme you choose. In other words, for each scheme, your basic documents proving your residence and identity will remain unaltered. You only need to prepare a few documents ahead of time, such as your Aadhaar card, voter ID, PAN card and bank statement. You will also be required to enter some basic information in addition to uploading these essential documents to unlock the benefits of the Jan Portal.

Here’s How Jan Samarth Portal Will Work

The Jan Samarth portal acts as a unified window for 13 government initiatives, allowing users to apply for loans online from more than 125 MLIs, i.e. Member Lending Institutions, including public banks.

The site determines beneficiaries’ credibility by verifying customers’ credit histories with CBDT, GST, UDYAM, NeSL, UIDAI and CIBIL. All these government-based institutions aggregate customers’ information within their database. Integration of these platforms grants in-principle approval to the credit application. The change is intended to lessen the amount of physical work required to visit banks and correlated ministries.

To begin, a user simply answers a few eligibility questions, after which the platform matches them with the most appropriate subsidy programme. It also recommends the best EMI amount, amortisation period and interest rate. Additionally, the Jan Portal directs the user to institutions that offer loans.

Note: The image describes the process to access the Jan Portal to check eligibility and apply for credit-linked government schemes.

Hotspot to Digital Integrations: UIDAI, CBDT, NSDL, LGD

‘Digital integration acts as a mainstay of digital access for data authentication.’

Consider a time-consuming process in which you must visit many departments to complete the authentication phase. What if we say the Jan Samarth Portal completely obliterated this scenario? Isn’t it incredible? Here’s how!

Jan Samarth Portal is not just a portal but an alliance of digital integrations. An array of connectors, including UIDAI, CBDT, NSDL, LGD and much more, allows the finance provider to evaluate an applicant’s authenticity right away. These integrations provide a foundation for digital access to data authentication, easing the burden on Member Lending Institutes (MLIS) and beneficiaries alike.

Note: The image depicts the digital integration of the Jan Samarth Portal to authenticate the applicant of the credit-linked scheme.

The inclusion of cutting-edge technology along with smart analytics allows beneficiaries to select from a variety of alternatives provided by various MLIS onboarded on the portal. The presence of an automated rule engine at the backend of the Jan Portal makes the entire credit approval procedure a garden walk.

Partner Banks and Key Stakeholders

Achieving goals becomes easier if we move together. Hence Proved!

The ‘Jan Samarth Portal’ could be one of the government’s foremost steps, but would not be possible without partner banks and key stakeholders. An initiative in which various Ministries, Nodal Agencies and Financial Institutions stepped together to create a unified platform. A digital platform that ensures a secure, quick and smooth subsidy availing process is made accessible to the beneficiaries.

Note: The above image lists a few partner banks that stepped forward to make the Jan Samarth Portal a successful move.

The Jan Samarth Portal covers 8+ Ministries and 10+ Nodal Agencies along with more than 125 Lenders. The key finance providers of India, including an array of banking institutions, are listed on the Jan Portal, including ICICI Bank, Axis Bank, IDBI Bank, HDFC Bank, State Bank of India (SBI), SIDBI, National Bank for Agriculture and Rural Development, Bank of India, UCO Bank and many more.

You May Also Like

| Saksham Yuva Yojana | Pradhan Mantri Awas Yojana |

| Pradhan Mantri Gram Sadak Yojana | Pradhan Mantri Suraksha Bima Yojana |

Elimination of Rigmarole to Make Securing Credit Easier than Ever

In the last decade, the government has stepped forward with multifarious initiatives to ensure that Indian enterprises not only develop but also reach new heights. All this was accomplished by decreasing compliances of over 30,000, repealing over a thousand laws, and decriminalising many portions of the Companies Act.

However, the inconvenient nature of interacting with numerous ministries remained. Every job required the people to contact the government and associated departments, which portrayed govt-centric governance. The department was given every vantage while the public had to suffer.

Despite that, citing the notion of a democratic nation as a “government of the people, by the people, and for the people,” the administration chose to provide a vantage point to the people for the nation’s betterment. The Jan Samarth Portal, a single-window portal, serves as a beacon for public-centric governance. A new beginning with new resolutions in the direction of iconic India.