Kanpur Property Tax is a tax imposed by the Kanpur Municipal Corporation (KMC) on properties within its jurisdiction. This tax is levied annually on residential, commercial, and industrial property owners based on the property’s area, location, and usage. KMC uses the revenue from property taxes for various civic amenities and infrastructure development projects.

The amount of property tax payable is calculated based on the annual value of the property, which is determined by KMC based on various factors such as the age and condition of the property, its location, and the prevailing market rates. The tax rate is fixed by KMC and is subject to revision occasionally.

Property owners in Kanpur must pay their property tax on time to avoid penalties and legal action. KMC offers various modes of payment, such as online payment, payment through banks, and payment through designated centres, to make the process convenient for property owners.

Kanpur Nagar Nigam (KNN) is a local government organisation that provides Kanpur residents access to civic and infrastructure facilities. Kanpur Nagar Nigam has developed several initiatives to enhance services and close the gap between supply and demand, including property tax payments.

Table of contents

- Kanpur Property Tax Due Dates, Penalties and Rebates

- Documents Required for Kanpur Municipal Corporation House Tax Payment

- How to Pay Kanpur Property Tax Online?

- Steps to Pay Kanpur Property Tax Offline

- How to check the Kanpur Property Tax Payment Status?

- How to Calculate Property Tax in Kanpur?

- Conclusion

Kanpur Property Tax Due Dates, Penalties and Rebates

Kanpur Nagar Nigam is responsible for collecting property tax from property owners in Kanpur. Here are the details regarding Kanpur Property Tax due dates, penalties, and rebates –

Due Dates

The due date for payment of property tax in Kanpur is March 31 every year. Property owners can pay their property tax online or offline by visiting the designated office.

Penalties

If property tax is not paid by the due date, a 10% per annum penalty is imposed on the outstanding amount. This penalty is levied on a monthly basis. Therefore, if you do not pay the tax by the due date, you will be charged a 10% penalty per month on the outstanding amount until it is paid.

Rebates

In Kanpur, property owners are eligible for a rebate of 10% if they pay their entire property tax for the year by March 31. This rebate is only applicable if the total tax for the year is paid in a single installment.

Additionally, senior citizens (above 60 years) and physically challenged persons are eligible for a 10% rebate on their property tax. However, to claim this rebate, they must submit a request to the Kanpur Nagar Nigam with proof of age or physical disability.

Furthermore, property owners who have installed rainwater harvesting systems on their premises are eligible for a 5% rebate on their property tax. This rebate is applicable for a period of three years.

It is important to note that property tax is a crucial source of revenue for the Kanpur Nagar Nigam, and non-payment of property tax can result in legal action, including seizure of the property. Therefore, it is advisable to pay the property tax on time and take advantage of the available rebates.

Documents Required for Kanpur Municipal Corporation House Tax Payment

Depending on the mode of payment, the documents required for online and offline payment of Kanpur Property Tax will vary.

To pay Kanpur property tax online, you only need your Property Identification Number (PIN) to complete the payment.

However, when paying at the Kanpur Municipal Corporation office, all you need is your ID proof and the online-downloaded receipt.

How to Pay Kanpur Property Tax Online?

Citizens have access to pay the Kanpur Property Tax online to avoid any hassle. The following steps will help you to make Kanpur property tax online payments –

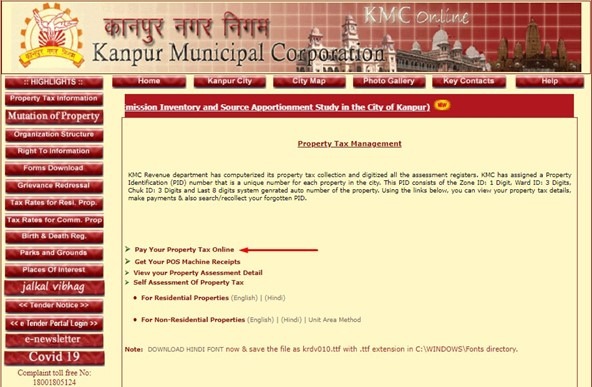

Step 1 – Visit the official website of Kanpur Municipal website – https://kmc.up.nic.in/#

Step 2 – On the homepage, click on Property Tax Information.

Step 3 – This will direct you to the Property Tax Management page. Click ‘Pay Your Property Tax Online’ to direct you to the Kanpur Nagar Nigam website.

Step 4 – The website will display options to search for property tax. You can search your property by adding details such as Zone, Corporate Ward, Mohalla, and House Number.

You can search by Property Number, Receipt Number, or CHK Number/Name. Choose either one and fill in the required details.

Step 5 – After entering the required details, click ‘Submit’.

Step 6 – The screen will display your tax details. To make the payment ‘Click on Online Payment’.

Step 7 – Use the various modes of payment and click on submit. The screen will display your payment receipt.

Steps to Pay Kanpur Property Tax Offline

You can pay the Kanpur Nagar Nigam House Tax bill payment offline by visiting the Kanpur Nagar Nigam municipal office. The office address is –ḥ

Moti Jheel, Moti Jheel Ave, Harsh Nagar, Kanpur, Uttar Pradesh – 208002

The office timings are 10 am to 5 pm, Monday to Saturday. The office is closed on Sundays.

Step 1 – Provide the current bill with your ID proof.

Step 2 – Fill in the Kanpur property tax form with all the required details given in the form.

Step 3 – Once the designated officer at the office verifies the form, make the payment in cash or by Demand Draft (DD).

Step 4 – Make sure to collect the Kanpur property tax receipt from the officer.

How to check the Kanpur Property Tax Payment Status?

There are two ways to check the Kanpur property tax payment status.

- You can check your online payment status by downloading your tax receipt from the official website.

- Visit the Kanpur Nagar Nigam website – https://knnpropertytax.com/index.php.

- On the homepage taskbar, click on ‘Download Receipt’.

- Add in your receipt number and click on download. The receipt will display your payment status.

- If the property tax is paid offline at the Kanpur Municipal Corporation office, you will receive a payment confirmation slip from the designated official.

How to Calculate Property Tax in Kanpur?

The Kanpur property tax can be calculated two ways based on different variables such as –

- Base value of the land

- Occupancy – owned or rented

- Property type – residential or commercial

- Kanpur property age or construction year

- Type of construction – multiple or single floor

- Annual Rental Value

The Kanpur property tax calculation formula is given below –

Kanpur Property Tax = Built-up Area × Property Age × Base Value × Property type × Category Use × Floor Type

The other alternative way to calculate Kanpur property tax is calculated based on the property’s Annual Rental Value (ARV). The ARV is determined by the Municipal Corporation of Kanpur based on factors such as the location, size, and condition of the property.

The formula for calculating property tax in Kanpur is as follows –

Property Tax = ARV x Rate of Tax x Age Factor – Rebate (if applicable)

Where:

- ARV – Annual Rental Value of the property

- Tax Rate – The tax rate is determined based on the use of the property – residential or commercial and the property’s location within the city. It ranges from 10% to 30%.

- Age Factor – The age factor considers the property’s age and ranges from 0.5 to 1.5 years.

- Rebate – A rebate may be available for timely property tax payment.

To illustrate the calculation, let’s consider an example –

If the Annual Rental Value of a residential property in Kanpur is Rs. 50,000. The tax rate for residential properties is 10%, and the age factor is 1.0. There is no rebate applicable in this case. The property tax for this property would be –

Property Tax = 50,000 x 0.10 x 1.0 – 0 = Rs. 5,000.

Therefore, the property owner would be required to pay Rs. 5,000 as property tax for the year.

The annual rental value and the year of construction keep changing, and as a result, the property tax value also marks a difference year on year.

Conclusion

Online services have reduced the difficulty of filing tax returns, paying property taxes and bills, and other official duties. The website of the Kanpur Nagar Nigam offers all the required relevant information to the users. It’s simple to pay the Kanpur property tax online without visiting the municipal offices. Everything you could need to know about Kanpur’s property taxes is readily obtainable.

Can Kanpur property tax be paid online?

Kanpur property tax can be paid online on the Kanpur Nagar Nigam official website. You only need the PIN and property details to complete the required page.

What are the exemptions for payment of Kanpur property tax?

The properties excluded from paying property taxes in Kanpur include those used as cemeteries or for the disposition of the dead, institutions used for charitable organisations or public worship places, schools and secondary institutions, and historic structures.

What are the due dates and penalties for non-payment of property tax in Kanpur?

The annual property tax is required, and the payment deadline is March 31. The property’s size determines the penalty amount, ranging from Rs. 100 to Rs. 25000.