Even though with the growing incidence of COVID 19 property seekers have been gravitating towards on-sale properties with larger configurations, common consumer preferences for rent in 2021 stubbornly stuck to 1-2 BHK units. Square Yards dives deep to understand this trend in detail.

In the pandemic induced atmosphere of uncertainty, demand for larger homes (3 BHK – 4 BHK flats or apartments) has increased. But, on one hand, while 2021 witnessed the growing need for home ownership, it also experienced unprecedented job losses and economic instability.

So, even though the need for a more stable accommodation influenced larger property purchases in 2021, consumer preferences in the rental space seemed unaffected by the pandmeic, not going beyond 1 and 2 BHK units.

Property rent has always been a dominating factor influencing tenants’ preferences. In 2021, Square Yards research observed that online searches for rental properties majorly revolved around the rent range of Rs 10,000 to Rs 20,000 per month capturing a major share of 46 percent.

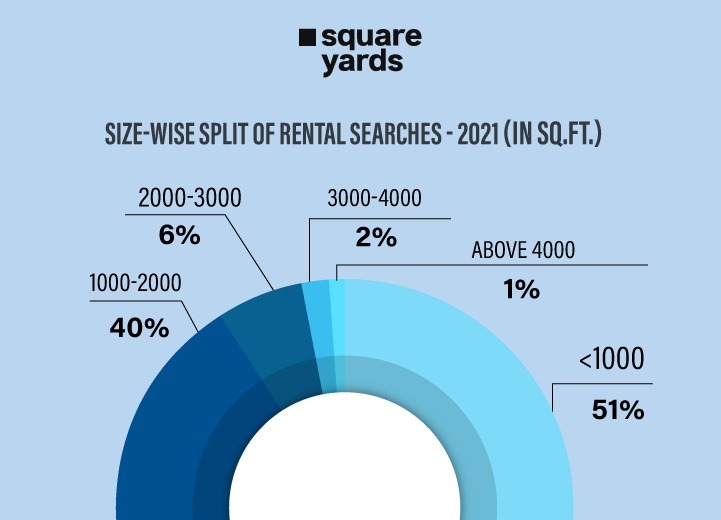

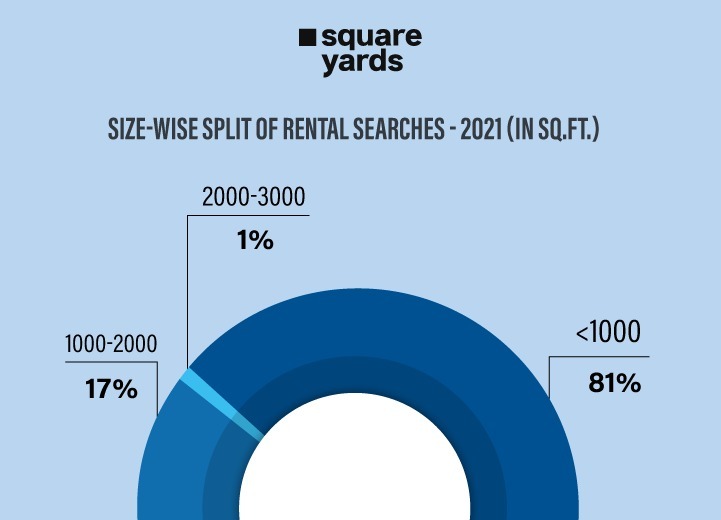

In fact, 70 percent online rental searches across the six major metropolia in India in 2021 were also for home sizes of or less than 1,000 Sq. Ft., which in broad terms would not go beyond a 1 or 2 BHK property. This preference may be fuelled by both affordability and the temporal status of a rental property against the more stable permanency of a property on sale.

This article throws light on the rental property trends of 2021 pan India along with an in-depth city-wise analysis.

Note: This research revolves around the property listings at squareyards.com and includes the six main cities of India: Bangalore, Hyderabad, Gurugram, Noida, MMR and Pune.

Overview of Rental Property Trends in the Six Major Cities

As per Square Yards research, in 2021, out of the top six cities studied, the highest percentage share of online searches for rental properties was taken up by MMR at 31 percent and Bengaluru at 28 percent.

The reason for this can be attributed to two conditions: sky high property prices and heightened influx of the working population. Additionally, being a coastal metropolis with high population density, MMR has a dearth of land to further expand their real estate that could potentially bridge the gap between demand and supply. This is why even property rents had been high in MMR in 2021, making prospective tenants stick to only 1 and 2 BHK flats for rent.

On the other hand, the percentage share of Gurugram (12 percent), Noida (13 percent) and Pune (11 percent) were almost at par with each other in 2021, with Hyderabad capturing the lowest share at 5 percent.

This similarity between the three metropolia can be majorly attributed to the affordable prices for properties on sale as well as on rent in these areas. Gurugram and Noida are both rapidly developing areas with scope for both residential and commercial expansion.

So, even though these NCRs also experience an influx of new working populace every year, the availability of multiple rental properties balanced the demand and supply in 2021. Additionally, native populations in these locations also have their own family property that further nullifies the need for renting.

City-Wise Analysis of Rental Property Trends in 2021

Here is the city-wise analysis of rental property trends in India last year.

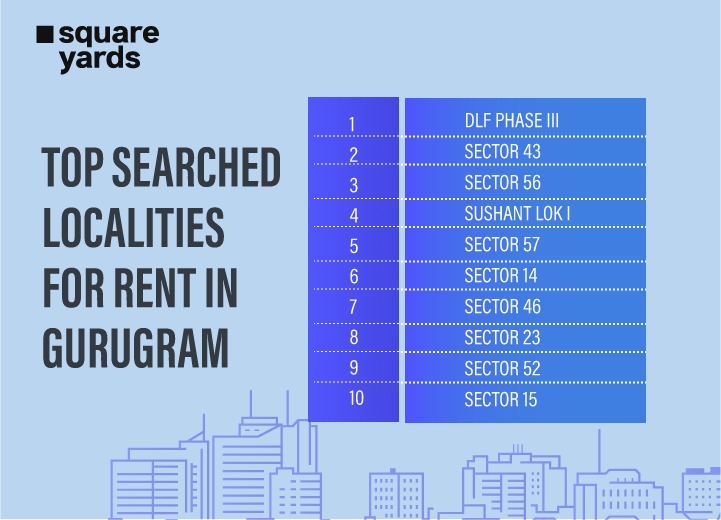

Gurugram

The top ten localities for renting in Gurugram last year were Sectors 43, 56, 57, 14, 46, 23, 52 and 15, DLF Phase III and Sushant Lok I. When we moved deeper with our analysis, Square Yards research discovered that almost all of these localities have common attractive features of excellent connectivity, amenities like marketplaces, shops and leisure spots, and are corporate hubs.

The features of these localities opens us to the tenant demographic of the area – most belonging to the working population, either living by themselves, sharing apartments or nuclear families. This analysis can be further supported by the preference of rental properties in these areas.

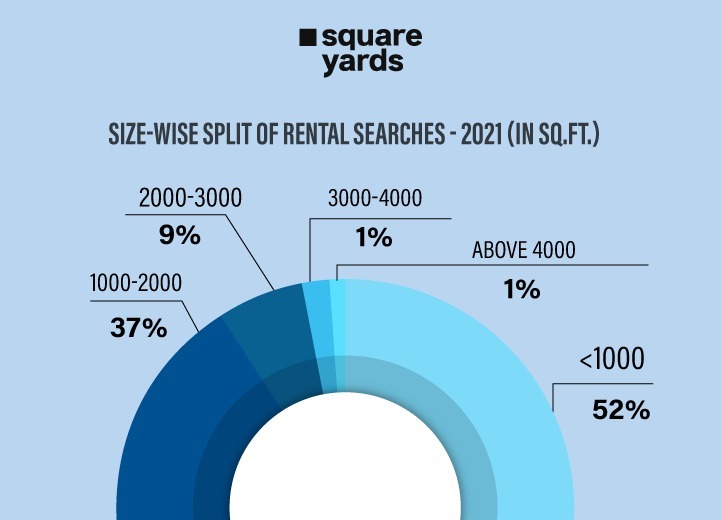

In 2021, about 52 percent of real estate consumers opted for rental properties with a size of 1,000 Sq. Ft. or less whereas 37 percent preferred rental properties between 1,000 Sq. Ft and 2,000 Sq. Ft. These properties can be broadly categorised into 1BHK and 2BHK properties.

While there was a gaping difference of 15 percent even between the tenant preference of these rental property sizes, the trend further dipped to eight percent and then to one percent for bigger rental properties, indicating a lower preference for the latter.

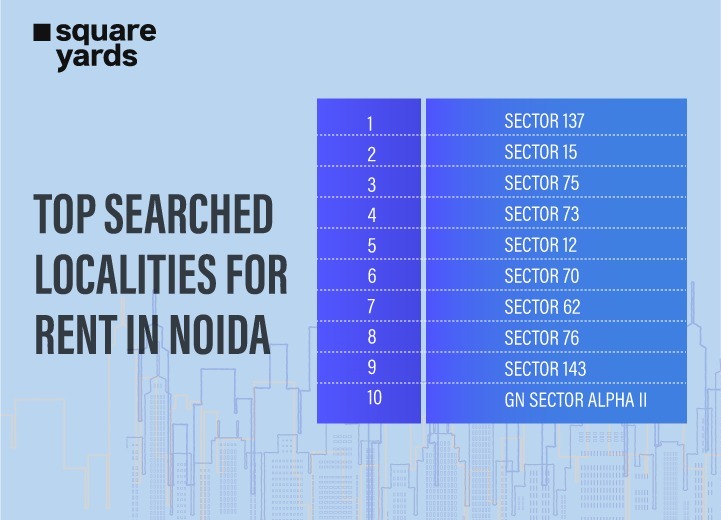

Noida

As per Square Yards research, the popularly preferred localities in Noida in 2021 included Sectors 137, 15, 75, 73, 12, 70, 62, 76, 143 and GN Sector Alpha II.

Like Gurugram, these localities also offer a plethora of amenities. But what makes all these localities stand out are that they are all planned areas offering robust inter and intra city connectivity between Delhi and Noida especially via highways and metro stations. The juxtaposition of planned cities and adjacent developing areas further improve the scope of greenery making way for a peaceful residential environment.

Out of the ten localities in Noida seven of them (Sectors 15, 75, 73, 12, 70, 62, 76) are in Noida Central, two (Sector 137 and 143) are in Noida Expressway and one in Greater Noida (GN Sector Alpha II).

The maximum concentration of rental properties are in Noida Central as it is in close proximity to the DND road offering access to multiple employment hubs catering to software, healthcare, etc. Sectors 75 and 76 even come under the rapidly developing real estate hub comprising Sectors 74 to 79. They also offer robust connectivity to Sectors 50 and 76 metro stations.

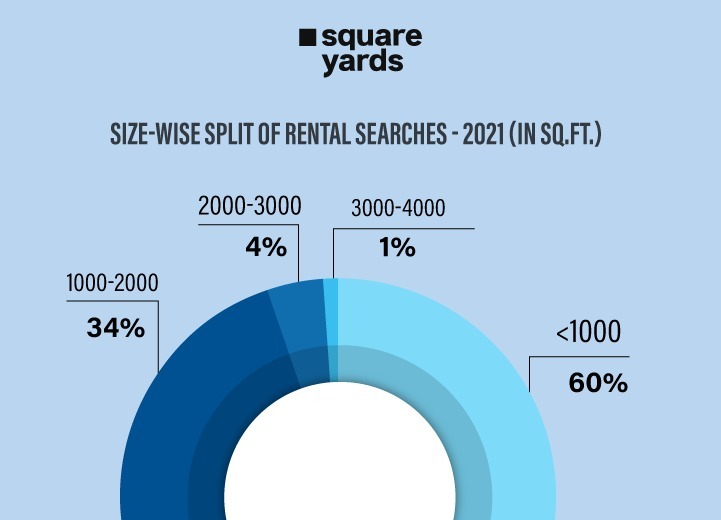

When we looked into the size-wise trends of rental property preferences, we found that about 60 percent opted for rental properties that were of or below 1,000 Sq. Ft. This can be mostly attributed to working populations living by themselves or as couples in the NCR.

On the other hand, nuclear families staying on rent made up about 35 percent of the rental populace that gravitated towards properties between 1,000 Sq. Ft. and 2,000 Sq. Ft. With larger properties this trend descended further to four percent and one percent, finally hitting the abysmal zero for rental property sizes ranging between 4,000 Sq. Ft. and above 5,000 Sq. Ft.

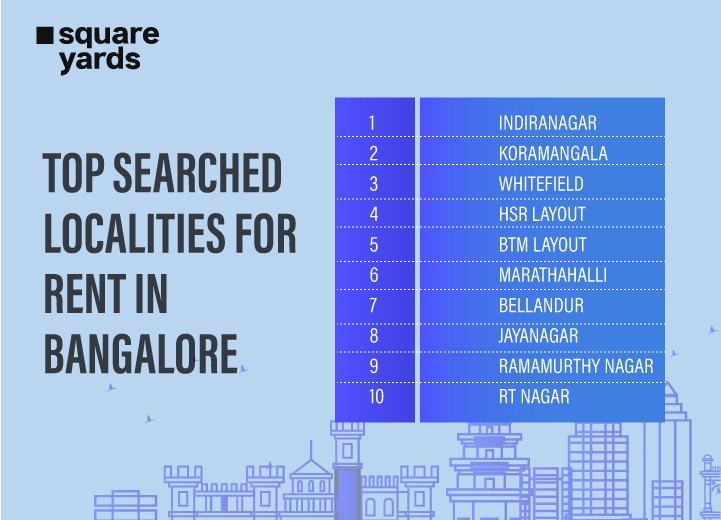

Bangalore

As per Square Yards research, Indiranagar, Koramangala, Whitefield, HSR layout, BTM Layout, Marathahalli, Bellandur, Jayanagar, Ramamurthy Nagar and RT Nagar emerged as the top ten localities in Bangalore for rent in 2021.

Out of these ten localities, five of them are in East Bangalore (Indiranagar, Whitefield, Marathahalli, Bellandur, Ramamurthy Nagar), four in South Bangalore (Koramangala, HSR layout, BTM Layout, Jayanagar) and only one (RT Nagar) in North Bangalore. This distribution indicated that the majority of the tenant density in Bangalore was concentrated in the East and South zones.

East Bangalore comprises the major IT hub of Whitefield and the corporate hub of Marathahalli. The same can be seen in South Bangalore. Localities like Koramangala, HSR Layout and BTM Layout offer extensive amenities and connectivity with neighbouring IT areas. Koramangala and Jayanagar are also two of the developed upscale locations in the city.

With the working population dominating these areas, apart from property rent, what might matter most to the rental populace in Bangalore is the accessibility to their workplaces. This can be the primary reason for growing rental properties in these locations. In fact, IT hubs like Whitefield and Koramangala even have a walk-to-work concept that helps rental residents save their commute time and expenses.

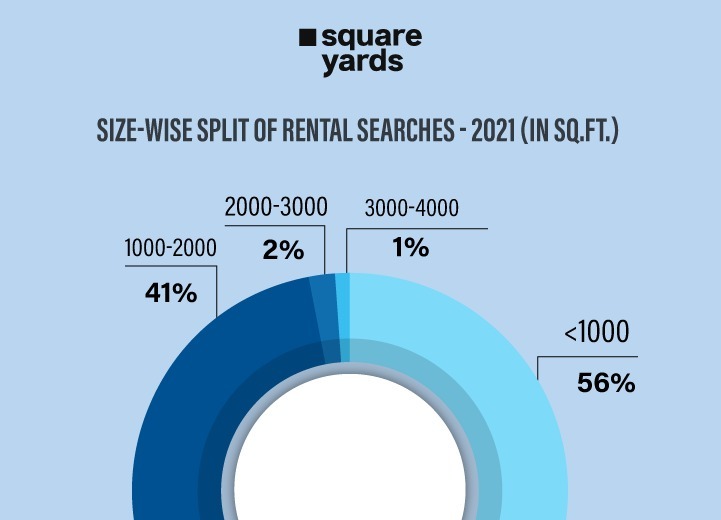

However, when looking into the popular trend of renting properties in Bangalore, Square Yards research indicated that just like Gurugram and Noida, properties of 1,000 Sq. Ft. and less dominated the trend by about 56 percent in 2021.

On the flip side, the city also proved to be an exception as unlike the other metropolitan cities, property sizes ranging from 1,000 Sq. Ft. to 2,000 Sq. Ft. showed a popularity trend of 41 percent, indicating that people were more open to investing in larger properties (2-3 BHK) in 2021.

Hyderabad

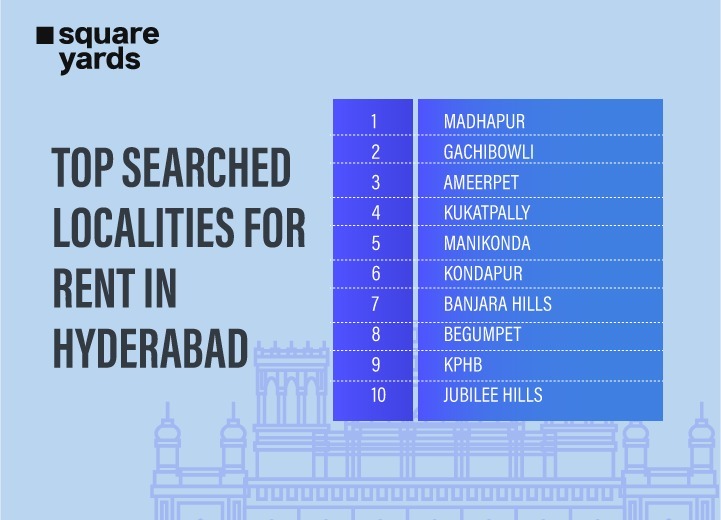

The top ten localities for rent in Hyderabad in 2021 were Madhapur, Gachibowli, Ameerpet, Kukatpally, Manikonda, Kondapur, Banjara Hills, Begumpet, KPHB and Jubilee Hills.

When Square Yards looked deeper, we found that out of the ten, West Hyderabad had the most popularity for rental properties across its five localities (Madhapur, Gachibowli, Manikonda, Kondapur, Jubilee Hills) in 2021 followed by three localities (Ameerpet, Banjara Hills, Begumpet) in Central Hyderabad and two in North Hyderabad (Kukatpally, KPHB).

All the ten localities across the three regions in Hyderabad have one thing in common: they are rapidly expanding IT hubs offering excellent facilities and connectivity to the other neighbouring IT localities. They are also planned areas with sound retail and social infrastructure.

Apart from being an IT hub, Madhapur in West Hyderabad is also known as an educational hub with some of the prominent schools, colleges and institutes present. Additionally, the developing area of Manikonda has also been gaining momentum as the next rental housing hub. The densely populated area of KPHB (Kukatpally Housing Board) is considered one of the largest colony hubs in Asia.

But despite the enhanced infrastructure, road network and amenities, we did not witness any rise in demand for rental properties ranging between 2,000 Sq. Ft. and over 5,000 Sq. Ft. What we observed in the data retrieved by squareyards.com was that 51 percent of the popularity for rental properties were for those with property sizes of 1,000 Sq. Ft. and less. This explains a lot about the affordability and preference of the working populace in these localities in 2021.

Even though professionals may be earning more, they would not prefer to opt for larger properties whose monthly rent exceeds Rs 30,000.

MMR

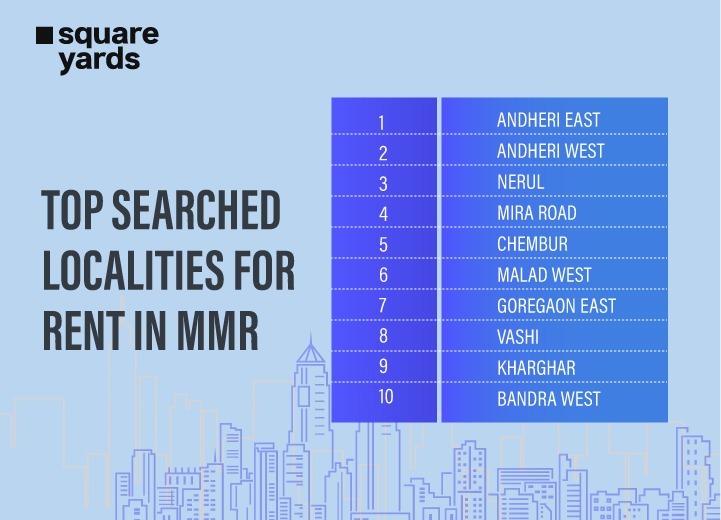

The top ten localities in MMR for rental properties in 2021 were Andheri East and West, Nerul, Mira Road, Chembur, Malad West, Goregaon East, Vashi, Kharghar, Bandra West.

Five localities out of the ten (Bandra West, Andheri East, Andheri West, Malad West, Goregaon East) are located in the Mumbai Western Suburbs, whereas three localities (Kharghar, Nerul, Vashi) are in Central Navi Mumbai and the other two (Mira Road and Chembur) in Mira Road and Beyond and Mumbai Harbour Line, respectively.

The common USPs that make these locations stand out are excellent road and rail connectivity, well-planned infrastructure and a fine blend of residential and commercial areas. While Bandra West and Malad West are two of the poshest areas of the ten, Mira Road gained momentum due to the availability of affordable properties and its connectivity to various business and industrial areas.

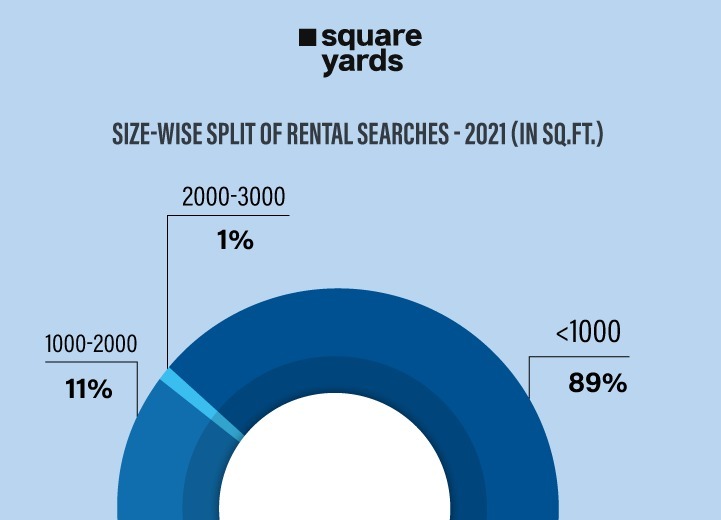

However, when Square Yards looked at the rental property trends, we found that MMR had the highest 89 percent preference for rental properties that were sized at 1,000 Sq. Ft. or less in 2021. With a huge gap of 79 percent, the preference for rental properties between 1,000 Sq. Ft. and 2,000 Sq. Ft. stood at only a meagre 10 percent while the demand for even larger rental properties fizzled out with the increment in its size.

This is mostly because MMR has always been an expensive city for any real estate investment (buying or renting). Owing to limited availability of land, increasing population and regular influx of new working professionals, the city is growing without the possibility of spatial expansion which has been a resonating concern since the 90s.

Pune

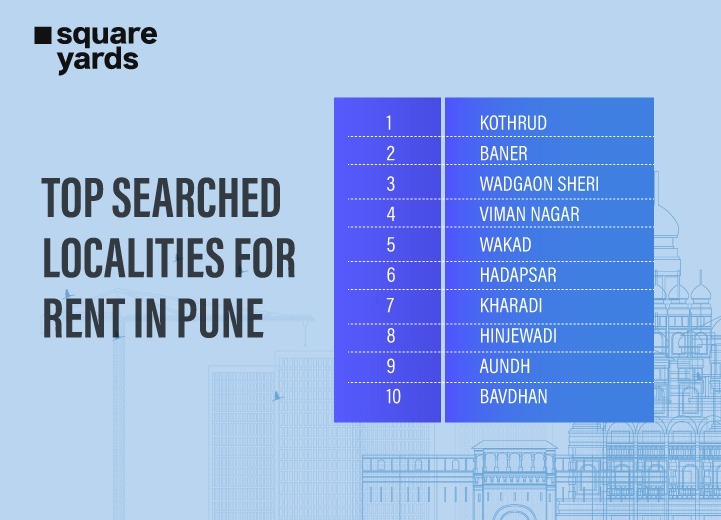

As per Square Yards research, Kothrud, Baner, Wadgaon Sheri, Viman Nagar, Wakad, Hadapsar, Kharadi, Hinjewadi, Aundh and Bavdhan emerged as the top ten localities in Pune for rent in 2021.

Out of the ten localities six are in West Pune (Kothrud, Baner, Wakad, Hinjewadi, Aundh, Bavdhan) whereas four are in East Pune (Wadgaon Sheri, Viman Nagar, Hadapsar, Kharadi). Like Bangalore and Hyderabad, these areas were popular amongst prospective tenants in 2021 as they are primarily a blend of residential, IT and commercial hubs offering excellent connectivity and amenities.

However, like in MMR, rental properties of 1,000 Sq. Ft. or less captured a major chunk of 81 percent of the trend share for rental properties. When compared with property sizes between more than 1,000 Sq. Ft. and 2,000 Sq. Ft., it showed a yawning gap of 63 percent.

Just like in the rest of the metropolises in India, Square Yards data of Pune also indicated the preference of the working population and how rental expenses are perceived by them. Most did not want to go beyond a rent of Rs 30,000.

Bottomline

While the uncertainty of COVID has definitely fuelled the demand for larger on-sale properties across the six cities in India, when it comes to rental properties, consumer preferences did not go beyond 1 BHK or 2 BHK apartments for rent.

While varying rental residential properties were available throughout the six cities in 2021, it was quite surprising to notice that the most popular renting properties were those of or less than 1000 Sq. Ft., with the preferred rent ranges between Rs 10,000 and Rs 20,000 per month.

Apart from affordability, the rental property trend of 2021 indicated the prospective tenants’ need for more economic and functional spaces that required low maintenance and saved their pocket. Their perspective of rental properties as a temporal solution further influenced this rental investment decision.