GSTR-4 is a simple return that helps small businesses with the relief of the composition scheme. The GSTR-4 is filed only once a financial year. But before FY 2019-2020, the GSTR-4 was a quarterly return to be filed by the 18th of the previous month of the succeeding quarter.

Also, once you file the return it cannot be revised, and if missed you have to pay a penalty fee. And, other important information is also discussed in this blog.

Let’s take a quick glimpse.

What is GSTR-4?

GSTR-4 is simply a GST return form that is necessary to file that too only by a composition dealer. A composition dealer is not like a normal taxpayer that pays 3 monthly returns, a composition dealer furnishes only one return once a year under a composition scheme using GSTR-4 form. The form GSTR-4 is to be filed on the 30th of April of every year following a financial year time period.

Note: A composition dealer has to pay tax at a certain specific rate which depends on its sales. Also, sometimes the dealer has to pay reverse charges for the purchase of a few items.

Who is Required To File Form GSTR 4?

Any taxpayer who selects to work as a composition dealer under the composition scheme is required to file for the form GSTR-4. It also gives perks of a specific composition scheme and notifies for the service providers using the CGST notification number

When is GSTR-4 Due?

GSTR-4 form is used to file the returns annually. The due date is 30th April in the relevant financial year. But sometimes the GSTR due date can be extended further in some specific conditions.

Note: The time frame to file the return using GSTR-4 for the financial year 2020-2021 was extended to 31st May 2021 from 30th April 2021.

How to Revise GSTR-4?

Once a composition dealer pressed on the option of “PREPARE ONLINE.” Then there is nothing he can do to revise or rectify the GSTR-4 form anyhow.

Even if the document and form are submitted offline, the GSTR-4 form will not be able to be rectified.

Therefore, GSTR 4 cannot be amended or altered after filing on the GSTN Portal – https://www(dot)gst(dot)gov(dot)in/

What is The Late Fees Or Penalty For Not Filing GSTR-4 On Time?

If the GSTR-4 due date is gone and you haven’t filed for the form then you have to pay for the GSTR-4 late fee. For every single day, you have to pay Rs. 200. The maximum late fee chargeable cannot exceed the limit of Rs. 5000.

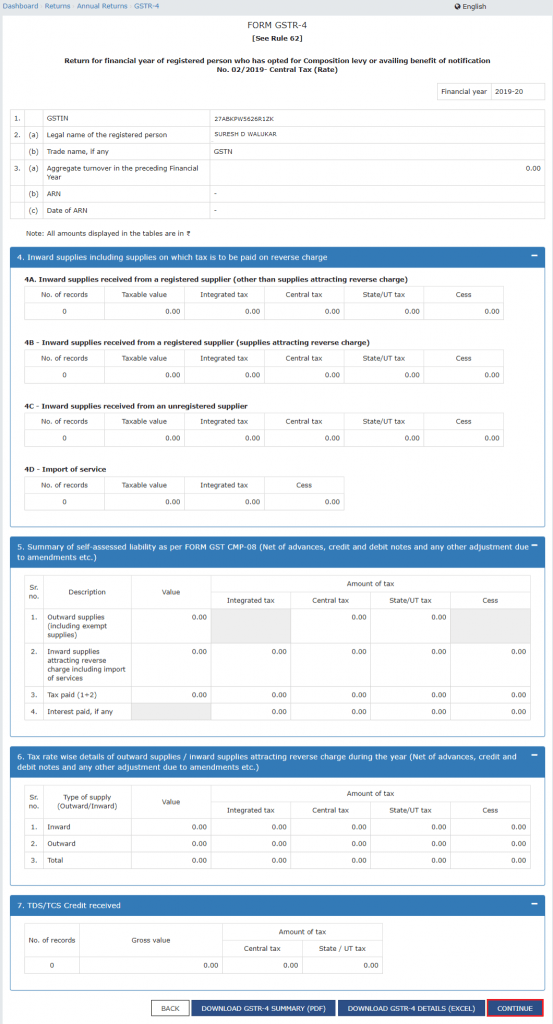

What Details Do Composite Dealers Have to Mention In Form GSTR-4?

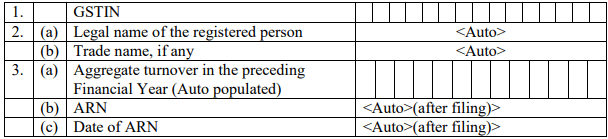

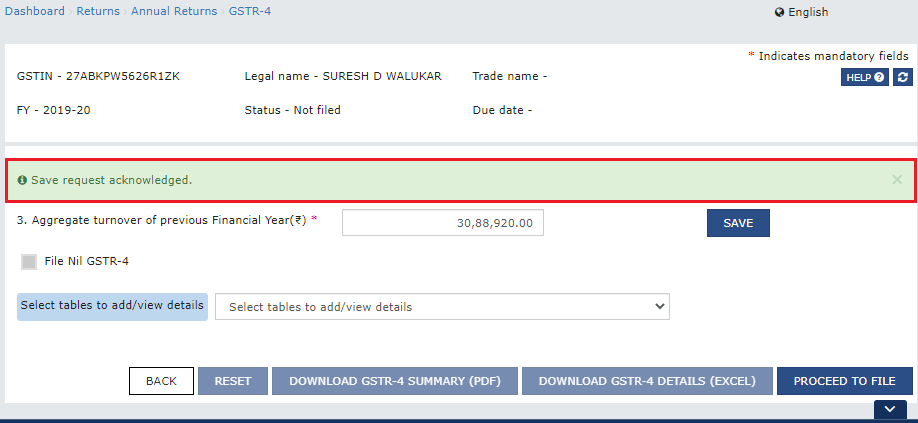

Section 1: GSTIN – The composite taxpayer will get his GSTIN number automatically at the time of filing the return.

Section 2: Name of the Composite Taxpayer – The tax paying person has to enter his or her name (legal) and the name of his or her trade. At the time of return filing, these names will automatically be generated.

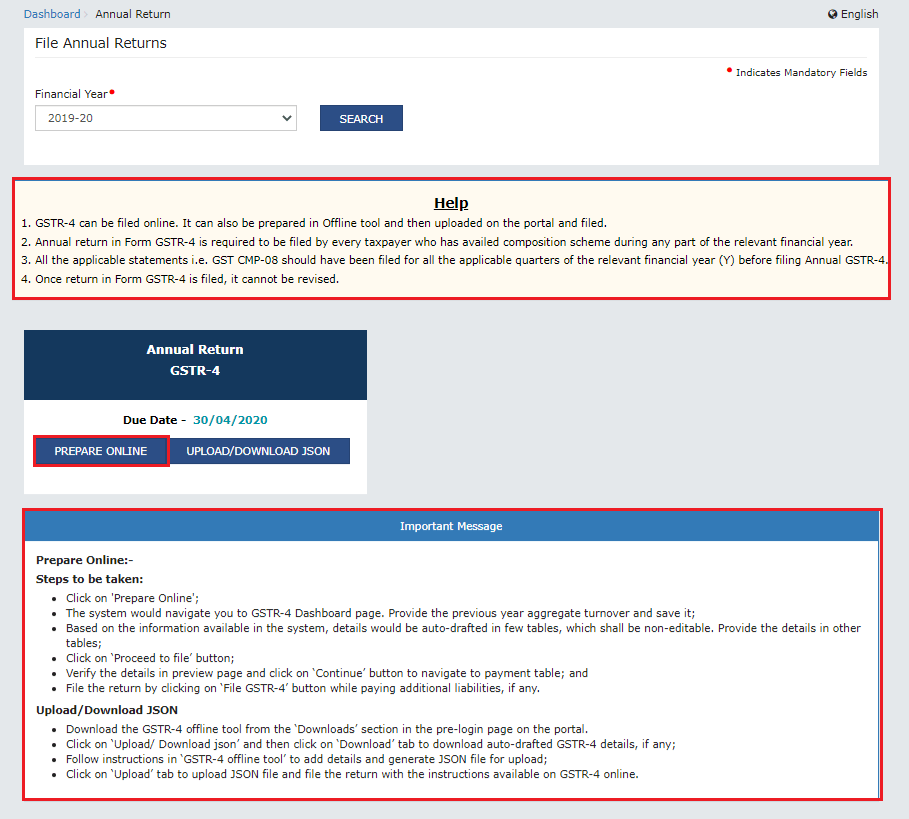

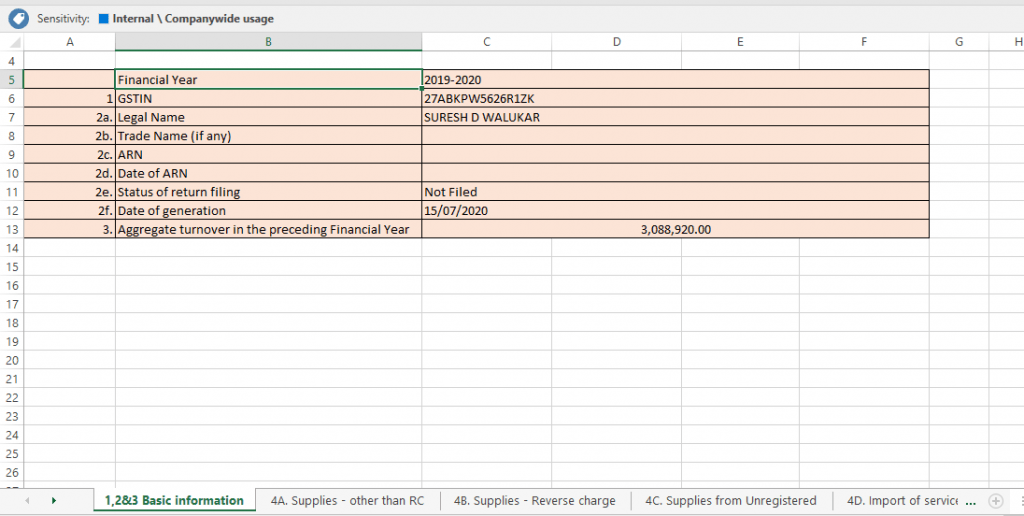

Section 3: Correct Turnover Details – It’s important to write every detail appropriately as the GSTR-4 form is unrevisable. The tax paying person has to enter the exact turnover as the information of the previous financial year always gets auto-populated every year. Also, the date of the ARN and ARN will automatically generate. As you can see in the image below:

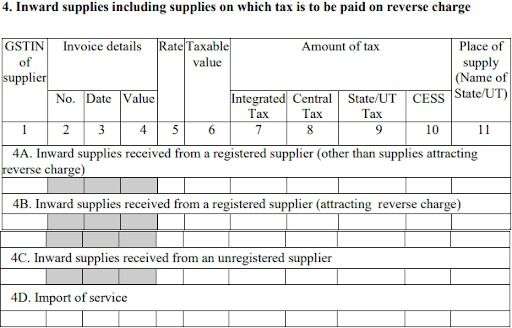

Section 4: Inward Supplies With Reverse Charges (to be paid with tax) –

- When you get supplies from a registered supplier (apart from reverse charges) : An individual needs to offer all the details about the supplies received from the registered suppliers when the reverse charges are not applicable.

- When you get supplies from a registered supplier (drawing reverse charges): One has to offer all the necessary details related to supplies one received from the registered supplier including both inter-state and intra-state. Also, a reverse charge is applicable.

- When the Supplier is unregistered: A tax paying person has to provide all the data about the supplies he or she received from any unregistered supplier both inter or intrastate.

- Importable Services: A tax paying person has to provide information about all the imported services for which one has to pay the taxes due to the reverse charge mechanism applicability.

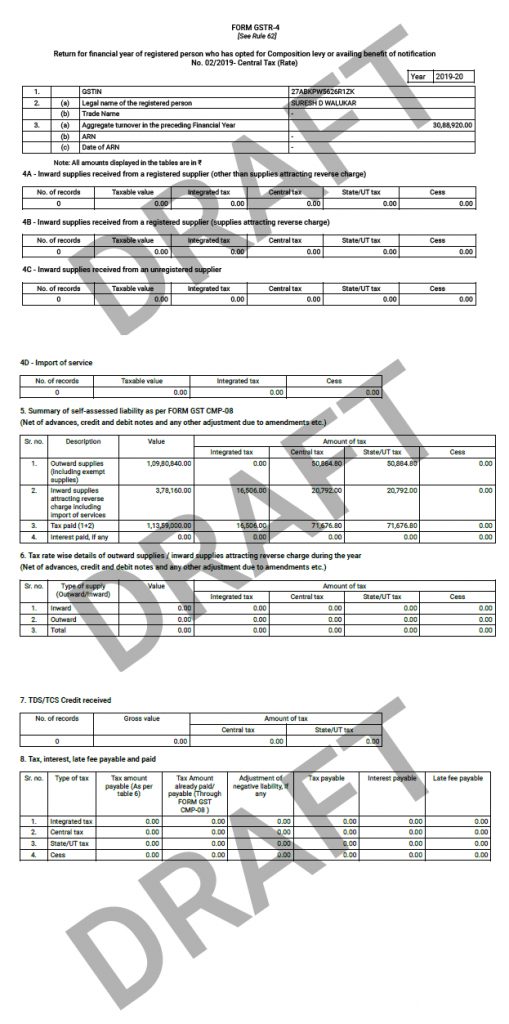

Here is the format of section 4.

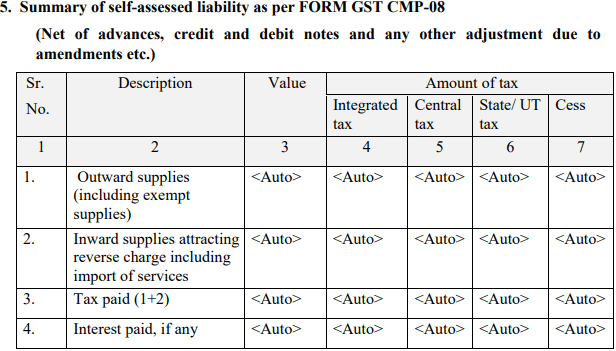

Section 5: The summary of Form GST CMP-08 as a self-responsible liability – All the information in this section will automatically get uploaded directly from GST CMP-08. The GST CMP-08 is used for making the payment on a quarterly basis across the year. This section will also interconnect your payment details from the CMP-08 form filed during the year (it will include outside supplies, inside supplies, reverse charges, and tax & interest paid).

You can clearly see the format of section 5.

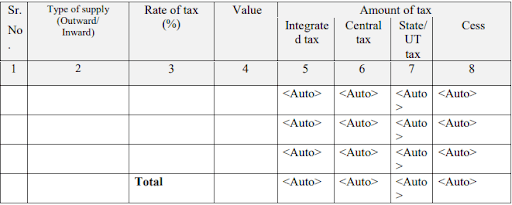

Section 6: Information that displays outside and inner supplies along with reverse charge during that year – A tax paying person has to provide all the information about the outside supplies and inside supplies in the financial year. These supplies attract reverse charges based on the tax rate long with overall taxable value. And the taxes such as – CGST, SGST, IGST, and Cess will get automatically uploaded.

Here check the format of section 6 to understand it better.

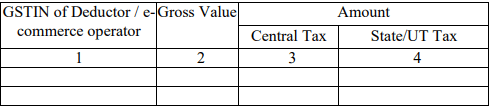

Section 7: Credit received with TDS and TCS – All the TCS/TDS in credit received from the e-commerce operator will be automatically generated in this section. Here the taxpayer will also mention the GSTIN of the deductor, gross invoice, and TDS deduction.

The format and content of section 7.

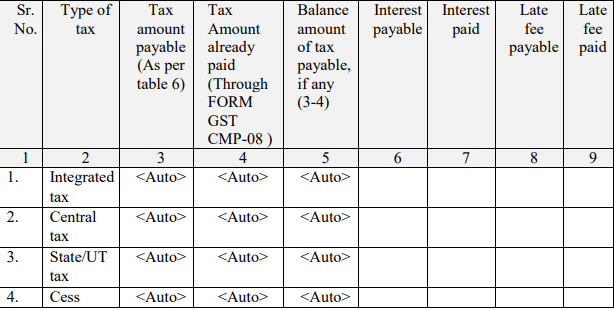

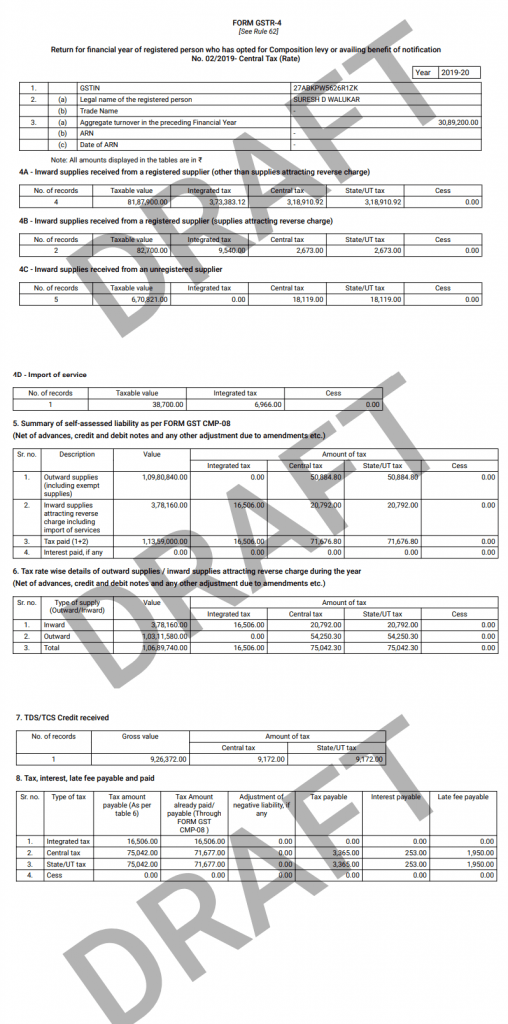

Section 8: Tax, interest, late fee payable and paid –

- PayableTax amount

- Already Paid Tax amount

- Payable Balance tax

- Payable Interest and Paid Interests

- Payable Late fee payable and paid ones

Here is the section 8 format.

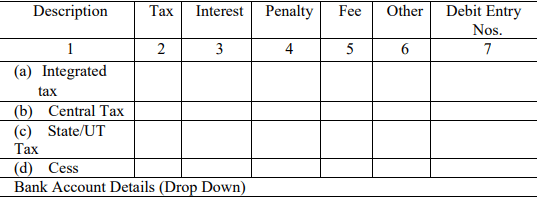

Section 9: Claiming the refund from E-cash ledger – If somehow, someone paid the tax in excess then he or she can claim the refund. Further, the refund amount will be bifurcated into tax, interest, penalty, fee, and other divisions.

The last section format.

Verification –

In the end, the composite tax paying person has to validate that all the information written or automatically generated in the form GSTR-4 is correct and true. Now, finally, they have to sign the form.

Steps to file GSTR-4 online

To file the annual GSTR-4, you have to follow the steps mentioned below:

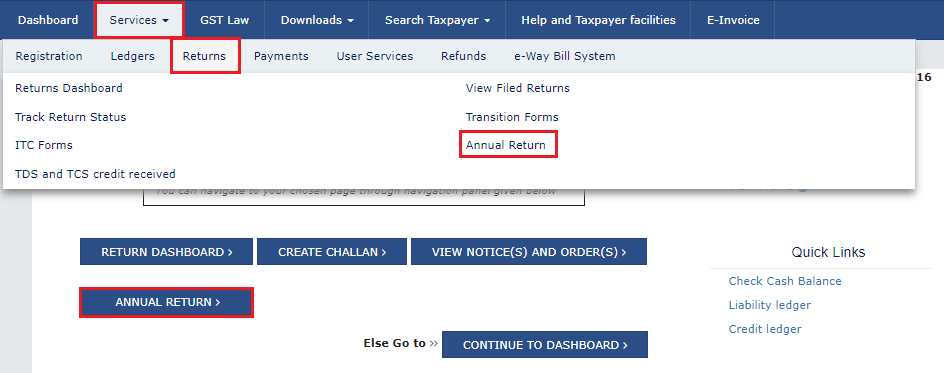

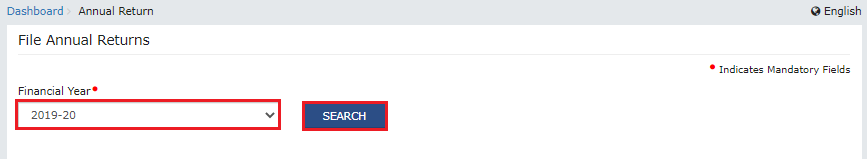

- The first step is to log in to the online GST portal and navigate to the Services > Returns > ‘Annual Return’ option. OR You can also hit on the ‘Annual Return’ option present on the dashboard.

- Now, select the applicable financial year for which you are filing annual GSTR-4 as displayed on the page under the name ‘File Annual Returns’.

- Press on the ‘PREPARE ONLINE’ option. But before that, make sure that you have read the instructions carefully as given on the ‘File Returns’ Page.

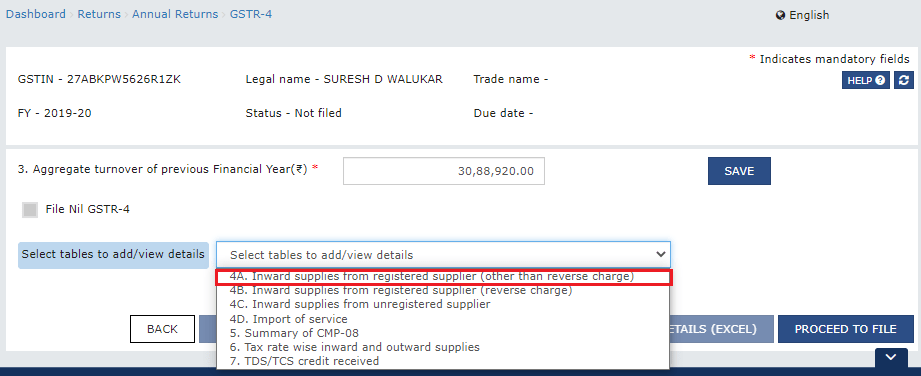

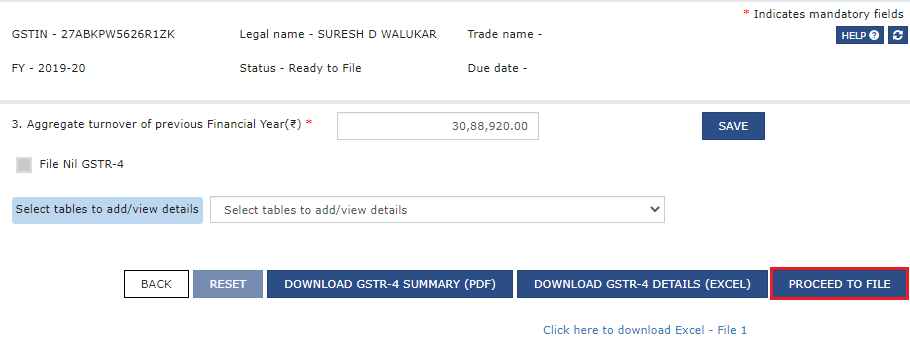

- You have to enter the exact turnover in the previous financial year as it was and then hit the save button. And, in case there is no recorded turnover for the preceding year then you should enter zero. But make sure not to leave it blank.

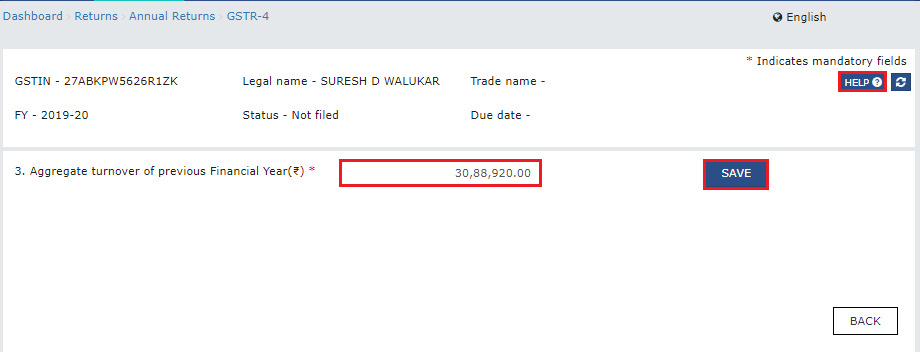

Once you save the file a new page will be displayed as shown in the image below.

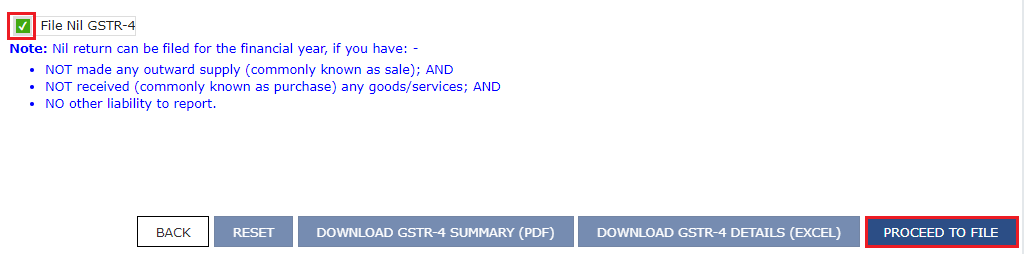

- If you want to file a Nil GSTR-4, then you have to choose the checkbox ‘File Nil GSTR-4’ and tick on the ‘PROCEED TO FILE’. This directly takes you to steps 7 and 9.

- You have to enter the details for various tables of GSTR-4 as explained and listed below. And, every time you select a table against the ‘Select tables to add/view details’ drop-down list. You have to enter details and press the back button.

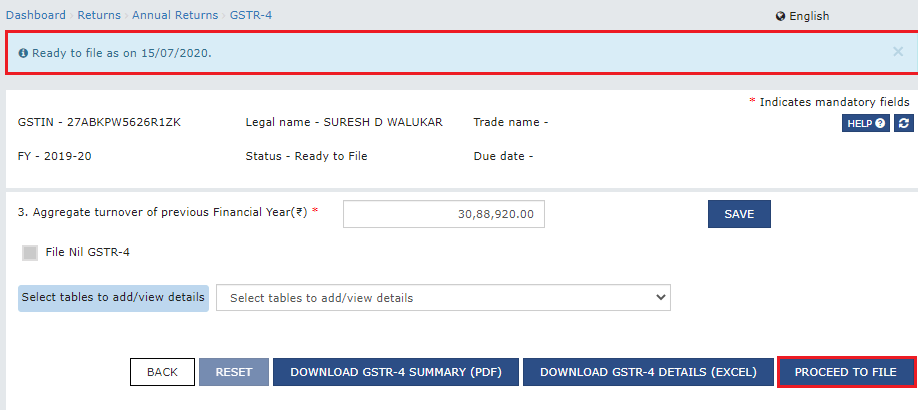

- Hit on the ‘PROCEED TO FILE’ option to see the preview of the saved return.

You will notice that the status of return further changes to ‘Ready to file as on (date)

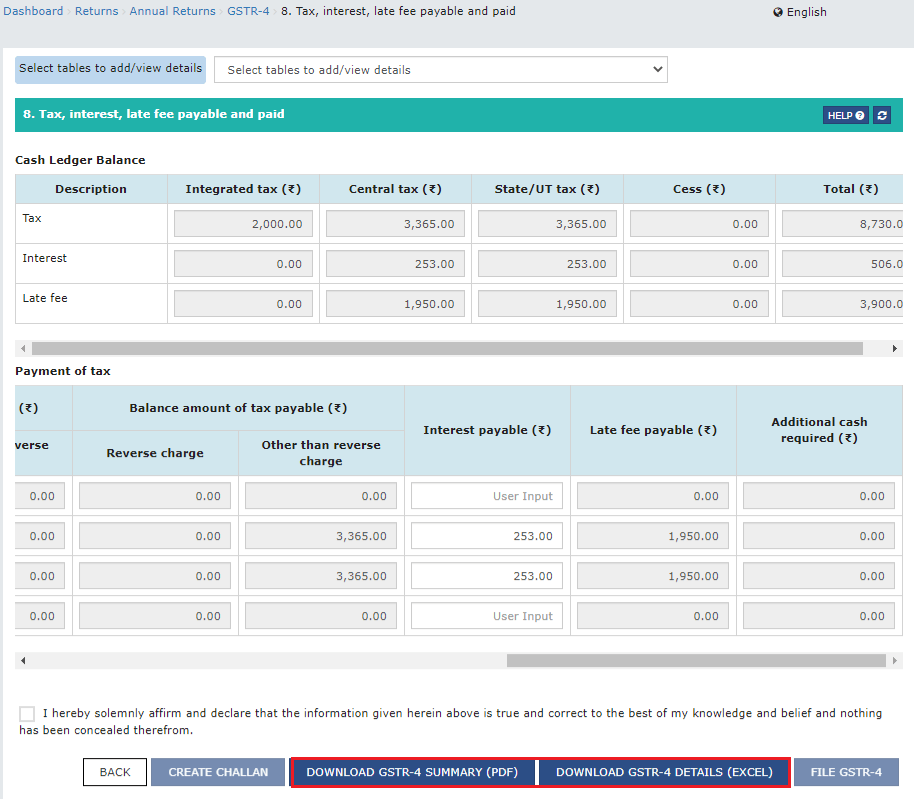

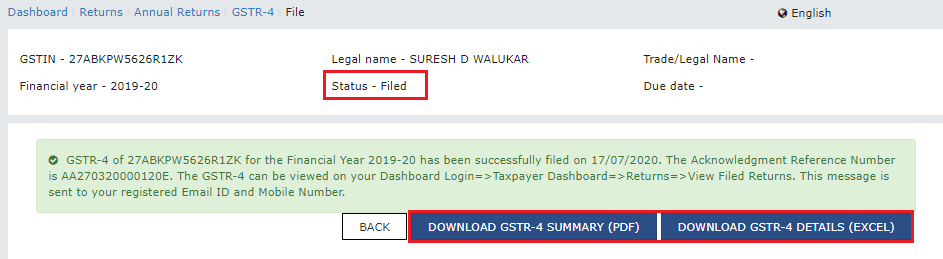

Now, click either on the ‘DOWNLOAD GSTR-4 SUMMARY (PDF)’ or ‘DOWNLOAD GSTR-4 (EXCEL)’ button. This is how you will save a copy of the prepared return.

You can see how the excel or pdf data will be displayed on your screen.

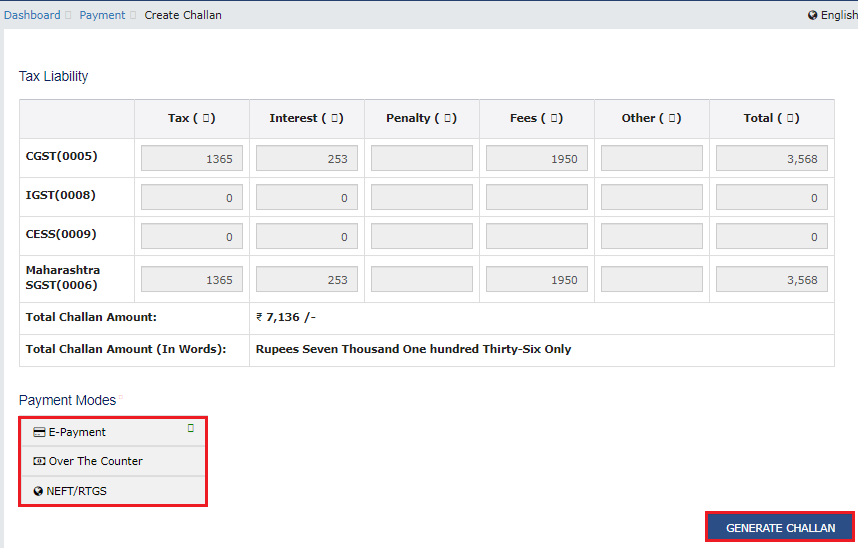

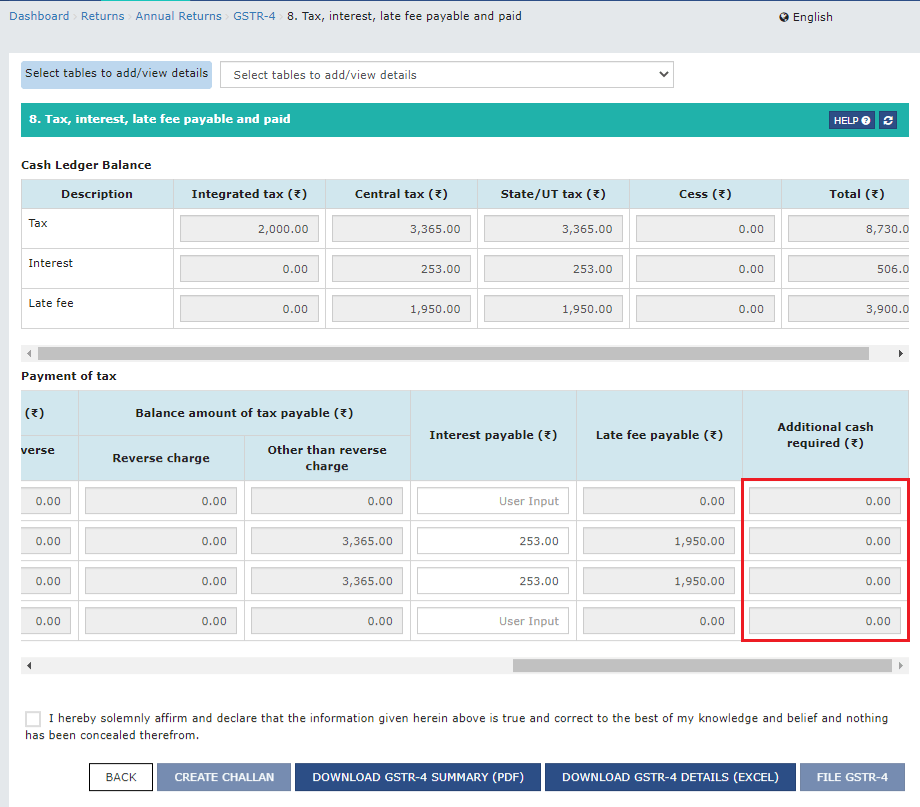

- If there is any penalty for the late filing of the return then it will be displayed in table 8. The balance will also be displayed in the cash ledger as shown in the image below. However, the payment can be done in two ways:

Press on the ‘CREATE CHALLAN’ button if you have insufficient or partial payment in the electronic cash ledger. You have to select the mode of payment as per your wish and create the challan once the payment is done.

And if an e-cash ledger has a enough balance, then the amount will be further adjusted from the records for the payment of tax that too automatically. Also, no amount is represented on the screen in the ‘Additional cash required’ column.

Press on the ‘DOWNLOAD GSTR-4 SUMMARY (PDF)’ or ‘DOWNLOAD GSTR-4 (EXCEL).’

Check the review by pressing on review option as updated GSTR-4 return and continue to the following step

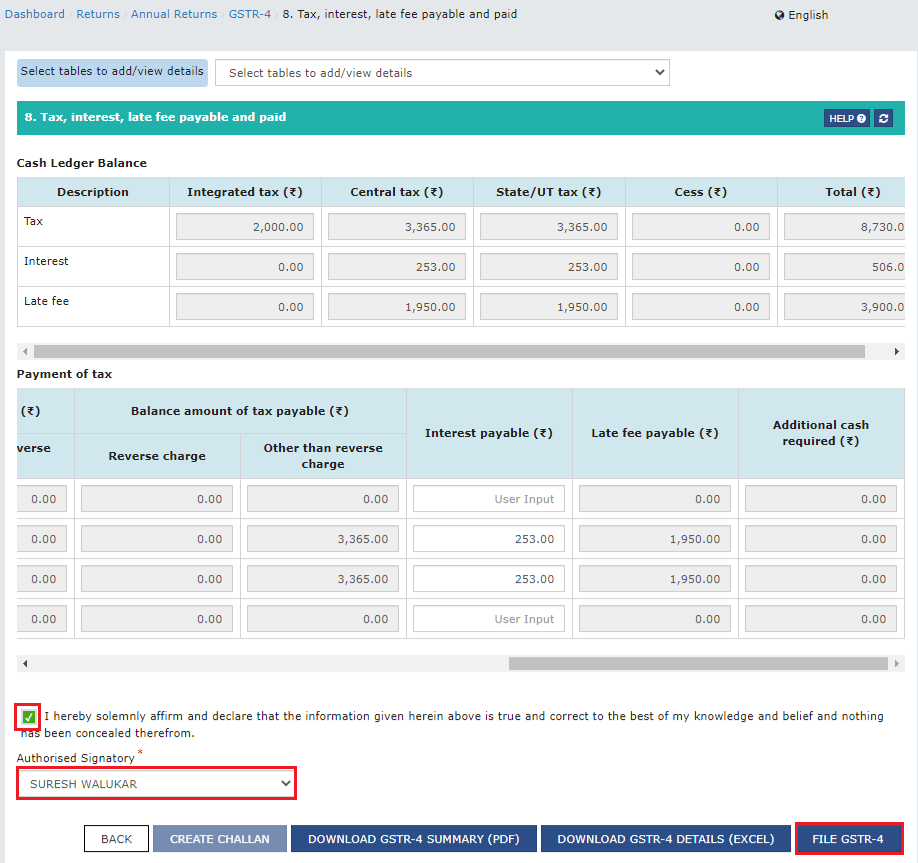

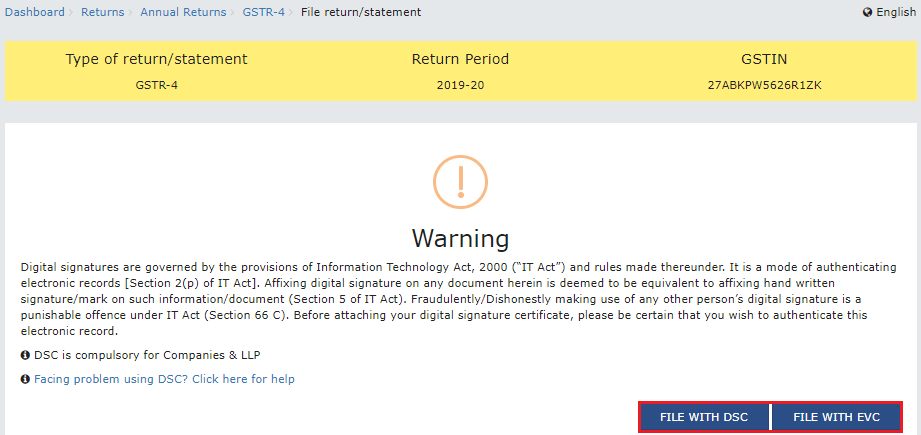

- File your annual GSTR-4 return using the DSC or EVC.

At the end of the page, you have to select the declaration checkbox and the authorised signatory.

Press on the ‘FILE GSTR-4’ button.

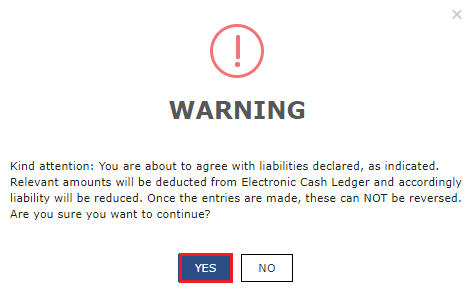

Click on ‘YES’ on an alert message and press either on ‘FILE WITH DSC’ or ‘FILE WITH EVC’ as displayed.

Let’s Summarize –

We hope that now you have understood better – who has to file GSTR-4, how it is filled, what is the eligibility criteria, what is the late return filing penalty fee and so on. But if you still have some confusion you can always comment on your queries and have the answers from our experts.

YOU MAY ALSO LIKE

Frequently Asked Questions (FAQs)

What Are the Conditions To File Form GSTR-4?

The requirements that the composition taxpayer has to fulfil before filing form GSTR-4 are: Registered and opted for composition scheme (one day in a financial year), fill all relevant forms (CMP-08 for quarters in financial year), and note correct turnover (registered in previous financial year.).

When Can an Individual File NIL Returns In Form GSTR-4?

You can fill NIL GSTR-4 only if you do not have any outside supply or haven’t received any goods or services.

Where Can I File GSTR-4?

You can file GSTR-4 on the government website of GST – https://www.gst.gov.in/

Log in to the website, go to services then returns, and then annual return.

Select your year and press prepare online option.

Enter your turnover and other details and then finally click on the submit option.

How To Download the Summary Of Form GSTR 4?

Yes, you can download the summary form GSTR-4. You have to click on navigate to services then click on return, then select annual returns, click on form GSTR-4 prepare online option, and hit the download GSTR-4 summary option. You will get the GSTR-4 summary in PDF format.

Can I File the Returns After the Due Date Without Paying Late Fees?

No, any person cannot file the returns after the due date without paying late fees. They can file the return late but they have to pay the penalty fee.