LIC, India’s largest public insurance company, has nationwide coverage of over 2000 divisions and 1400 geostationary and core departments. Currently, the LIC has a presence in almost all regions of the country. LIC provides a wide range of insurance services, including investment fund plans, term benefits, retirement funds, as well as group insurance coverage. One of the investment portfolio benefits available by LIC.

In this article, we’ll discuss the working of the LIC new user registration, online payment facilities, criteria along with documents required.

Table of contents

- Documents Required for Registration

- Steps for Registration on Portal

- How to Pay LIC Premium Online?

- Policies under Salary Savings Scheme

- Maturity, Survival Benefits, Disability And Death Claims

- Surrender Value

- How and Where to Pay the LIC Premiums?

- How to Link Pan Card with LIC Policy?

- How to Check the Premium Status?

- LIC Branch Address and Contact Number

- LIC Toll-free number

Documents Required for Registration

A list of documents required for LIC new user registration are mentioned below:

- Registration ID of the policy.

- Copy of premiums installment policies.

- Duplicate Scan copy PAN Card/Passport, with the accurate file size (less than 100 KB).

- The scanned zip file must be in .jpg or .jpeg format.

Steps for Registration on Portal

One of the easiest and most efficient uses of the Internet and technology is online registration.. To open an LIC account, you must first determine which policy you want to use and consider your options. Once you’ve decided on your policy plan, proceed to the steps below for LIC new user registration on the portal.

Step 1: Visit the official website of the LIC.

Step 2: Select the ’Customer Portal’ option and click on it.

Step 3: If you are a new user, click on the ‘New user’ option.

Step 4: The next page will appear on your screen, fill out the credentials like User ID and Password and submit it.

Step 5: After Login selects the ‘Basic Services’ tab under the ‘Add Policy’ category.

Step 6: Enter the required documents for your remaining policies.

Registration for Premier Services

There are three steps involved in the registration process for premier services.

Step 1: Enter the required information for the registration form.

- Fill out the basic details such as DOB (Date of Birth), registered mobile number, and valid e-mail id. These are credentials which are required all the time while login into the official portal.

- After logging in, enter the PAN Card/ Passport/ Aadhaar card information.

- Once the login process is complete all the policies will get displayed on the webpage. Select the eligible policy as per your choice.

- Different registration forms are available for spouses. Where theirr information will be required for the registration.

Step 2: Printing of the form

- Select the ‘Save’ option and get the form printed.

- Before submitting the form, verify the information present on the registration form and then sign it.

- Make a copy of all the scanned form pictures along with the copy identity of proof such as PAN Card/ Aadhaar Card/ Passport and more.

- The size of the file scanned pictures must be 100 KB(maximum).

- The scanned images must be in .png,.jpg or .jpeg format.

Step 3: Upload the documents

- Scan and upload required documents such as registration form/ PAN Card/ Passport/ Aadhaar card, etc.

- Once all the documents are uploaded, select the submit button.

- A confirmation email and SMS will be sent to the registered mobile number and email id.

- This application will be forwarded to our Customer Region for verification.

- After verifying by the customer area (within three working days of enrollment), you will receive an affirmation via email and SMS.

How to Pay LIC Premium Online?

Some of the primary online services are listed for LIC policy online payment below:

- The LIC policy online payment facility allows you to pay due payment of renewal premium, loan interest and repayment of a loan via Net Banking/Debit Card/UPI/ Credit Card (Only for Premium Payment).

- Renewal premiums can be reimbursed for all active policies, except those covered by the Salary Saving Scheme and those enrolled for payment via NACH.

- Payment of premiums is permitted beginning one month before the due date and continuing until the policy is cancelled.

- The interest of loans cannot be paid underneath the policies of the Varishtha Pension Bima Yojana (VPBY) and Pradhan Mantri Vaya Vandana Yojana (PMVVY) plans.

- By all approved RBI credit/ debit cards (Only for premium payment).

Policies under Salary Savings Scheme

- You can discover which Branch of LIC will provide your policy document by contacting your advisor or your employer’s payroll division.

- You will need to know which LIC branch serves your policy because you’ll require their assistance in receiving your Maturity/Survival Benefits, making changes such as changing your address and applying for loans, among other things.

- If you are in a transferable job, notify the specified LIC Division of your new posting. This way, the LIC executive can inform you regarding the status of your policy.

- Where your insurance costs are being rebated by your workplace and the LIC Branch that was previously serving you so that your policy documents can be transmitted.

- To prevent additional policy renewals, keep track of insurance premiums. This can be a time-consuming process for someone in an exchangeable job but will benefit you.

- Always mention the permanent address of your house so that the LIC executive can reach out in the future.

Maturity, Survival Benefits, Disability And Death Claims

LIC notify you in advance if your Survival Perks (for Funds Back policies) or maturity advantages are due. With a few exclusions, if the survival payout is less than or equal to ₹ 5 lakhs. It will be delivered to you immediately without any guidelines or release forms.

Surrender Value

During the insurance policy, the plan can be relinquished at any moment. The amount payable for surrender is defined by the number of policy ages and payments made to the deadline. There are 2 ways and amounts are evaluated based on the LIC surrender value calculator.

- Surrendering the plan under three years of outset: If the proposal is agreed to surrender during the initial 3 years, the surrender value will be zero, and the policy owner will receive nothing.

- Surrendering the policy after three years: After completion of the 3 years, the complete premium payment, the term plan may be surrendered for cash. Assured surrender cost for an applicant will be payable within specified years to the policy owner after removal of surrender fee if any.

How and Where to Pay the LIC Premiums?

The latest technology has infused every element of life in today’s era. It has enabled checking, updating, and online payment for LIC policies. Moreover, it has aided in completing online transactions more quickly, providing a more secure and safer user experience, and much more. However, there are two modes present; how to pay LIC premium online and offline.

Offline

You can visit the nearest branch and can pay the premiums by cash, Check, or Demand Draft. While paying the premium make sure that your branch is fully networked. If your premiums are not paid on time then you might have to pay penalty charges.

Online

Some of the steps are mentioned below to pay the LIC policy online payment.

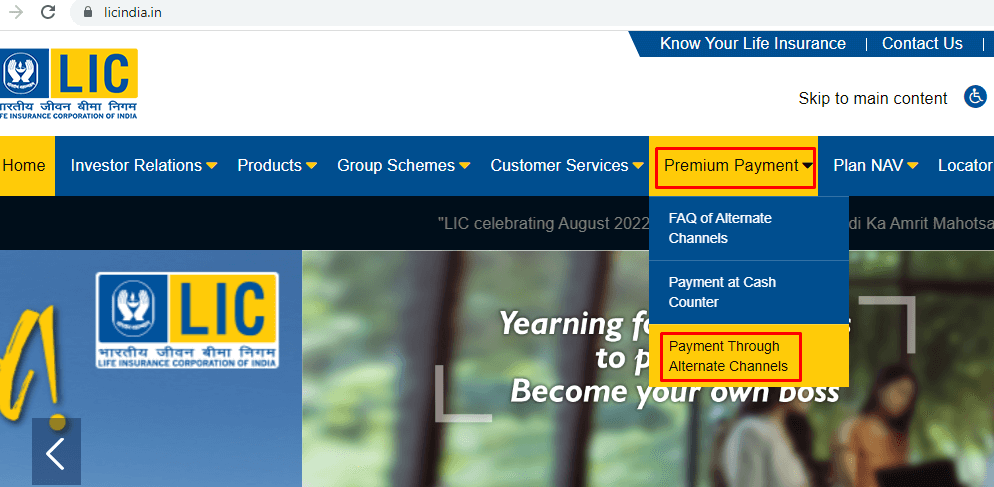

Step 1: Visit the official website of LIC.

Step 2: Under the ‘Premium Payment’ category, select the ‘Payment Through Alternative Channels’ option.

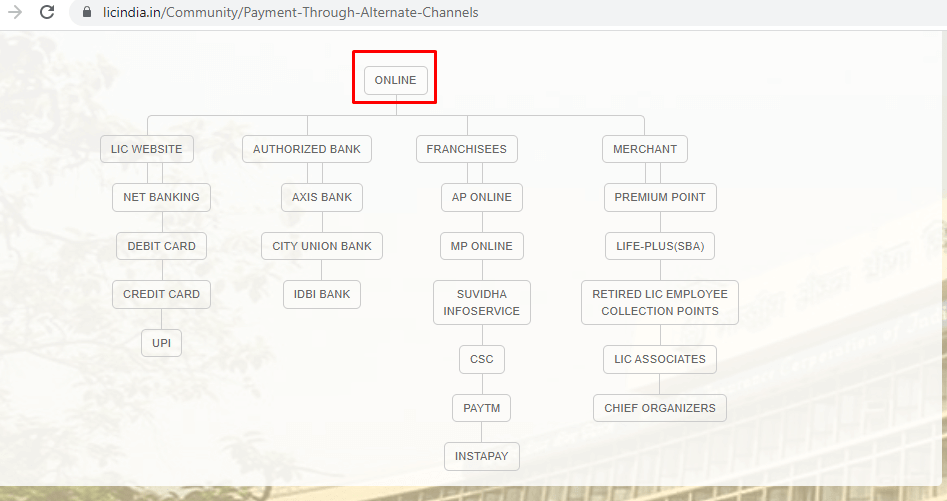

Step 3: You will be redirected to the new page, select the mode as per choice.

How to Link Pan Card with LIC Policy?

Follow the below steps to link the Pan card with LIC Policy.

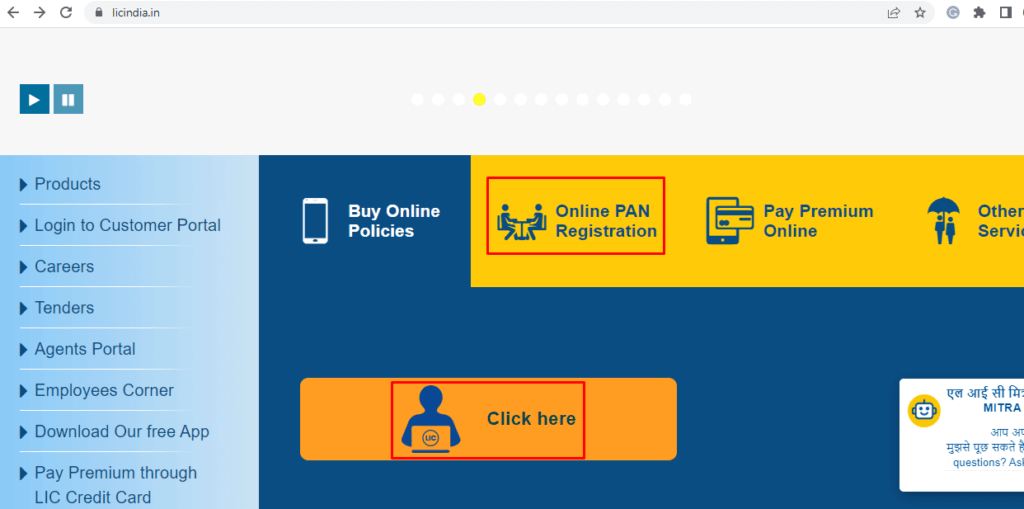

Step 1: Refer to the official portal of the LIC.

Step 2: Scroll down to the webpage, and select the ‘Online PAN Registration’ and ‘Click Here’ tab.

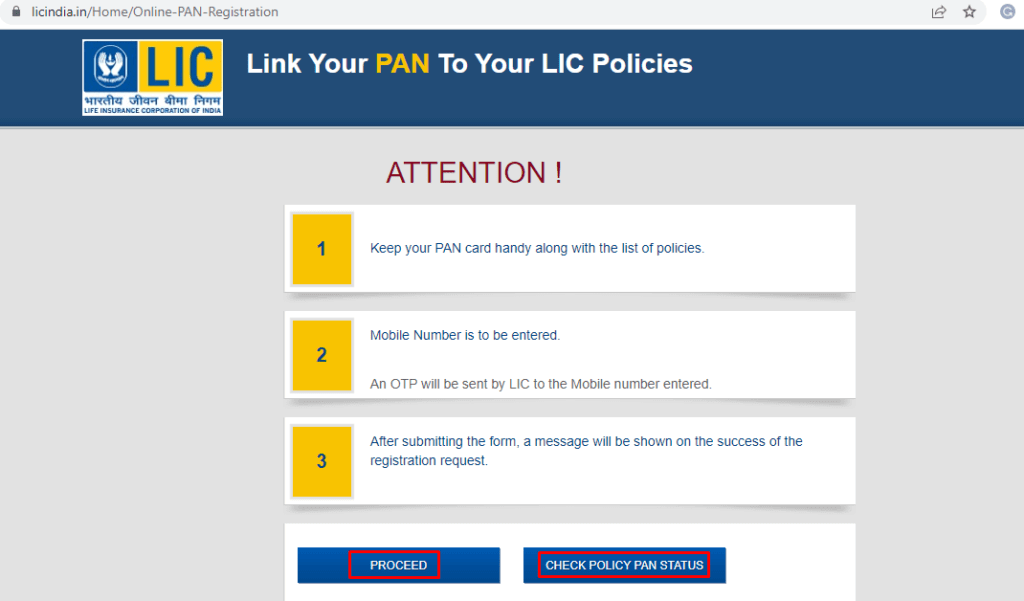

Step 3: After clicking, you will be redirected to the new page consisting of the ‘Proceed’ and ‘ Check policy PAN status’ buttons.

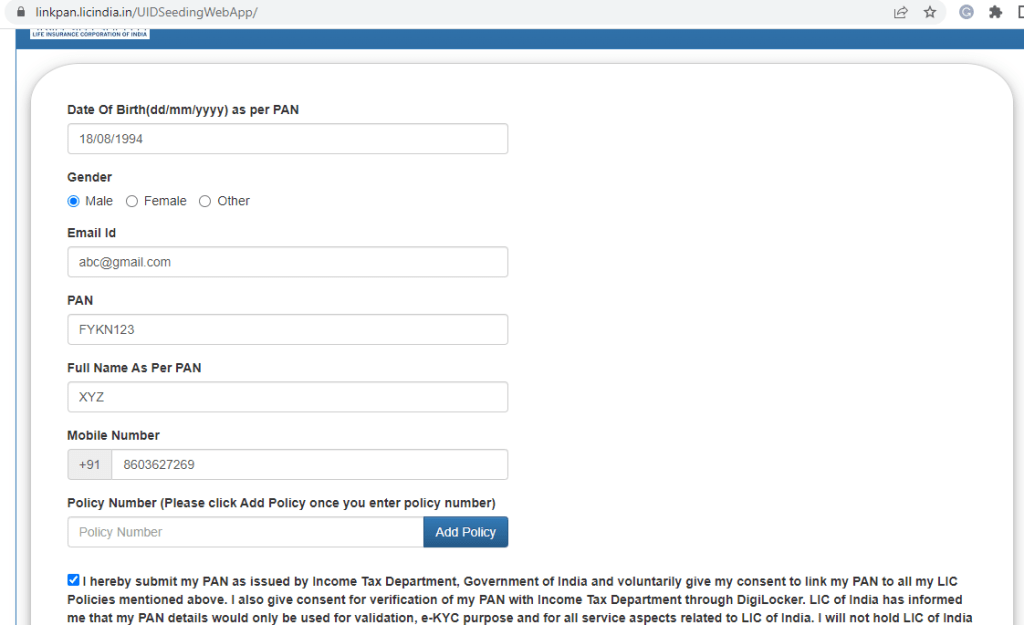

Step 4: Fill out the credentials and submit the form.

Step 5: After submitting the details, you will receive an OTP.

Step 6: Enter the OTP and check the status.

Note: With the same steps, an applicant can check the LIC PAN Update.

How to Check the Premium Status?

To check premium for LIC status follow the following steps:

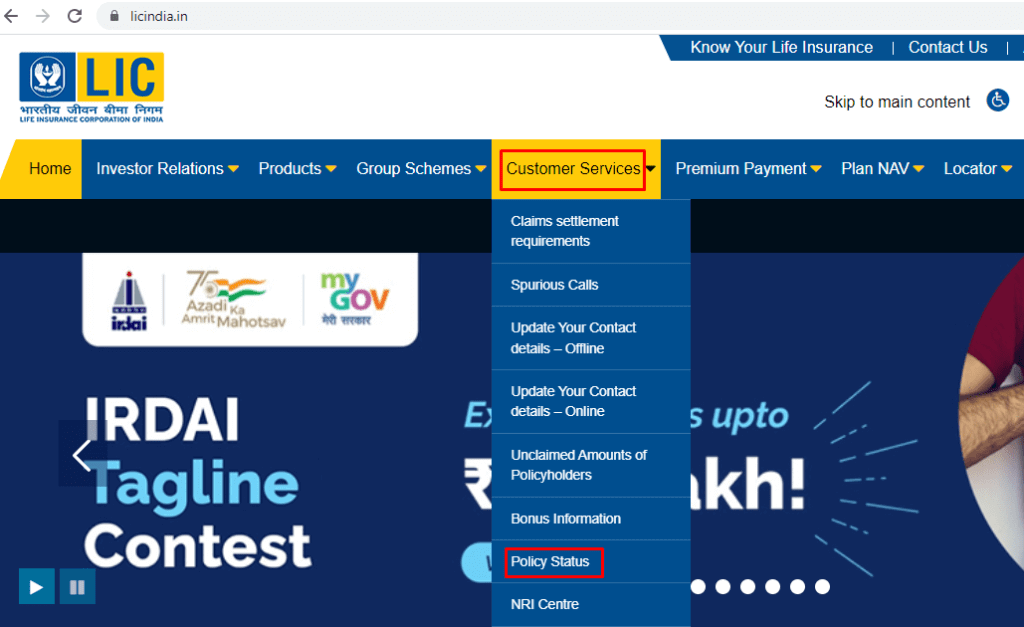

Step 1: Go to the official website of the LIC.

Step 2: Click on the ‘Policy Status’ under the ‘Customer Services’ category.

Step 3: The screen will display the current LIC status of the premium.

LIC Branch Address and Contact Number

Address:

Life Insurance Corporation Of India

Central Office

‘Yogakshema’

Jeevan Bima Marg

Nariman Point

Mumbai 400021

Contact Number:

LIC Call Center at +91-022 6827 6827

LIC Toll-free number

The LIC customer care toll-free number 24*7 is mentioned below:

Toll-Free Number: 8976923091

Senior citizen Toll-Free Number: 8976923092

E-mail ID: helpdesklic@healthindiatpa.com

Website: www.healthindiatpa.com

Frequently Asked Questions (FAQs)

Which policy of LIC gives maximum returns?

LIC provides a large variety of policies for life insurance specially designed to offer a high rate of returns. Some of the plans listed, are LIC is offering maximal perks – Amar Jeevan, New Children’s Money Back Plan, New Endowment policy Plans, New Money Back Plan- 20 years, and New Jeevan Anand Plan.

Is LIC better than mutual funds?

Unlike mutual funds, life insurance is much less unsafe. It does, however, provide guaranteed loss perks. Mutual funds are business assets, which makes them extremely volatile. The returns on LIC schemes are low.

Can I submit a LIC NEFT mandate form online?

Lately, LIC has introduced an online availability at the customer portal for uploading the ‘LIC NEFT Mandate Form. You can do so electronically if you have an LIC policy and have not yet enrolled your NEFT mandate with LIC.

What is the rate of interest for LIC policy?

For regular people, LIC Housing Finance’s fixed deposit rate of interest will range from 5.50% to 5.60%. The rate of interest for senior citizens starts from 5.75% to 5.85% for the term plans vary from 18 months to one year.