Permanent Account Number (PAN) and Aadhaar Card are two essential papers. You might have both. The Indian Government has made it mandatory to link Aadhaar and PAN cards; else, your income tax return will not be filed.

If a person must make a financial transaction worth more than Rs 50,000, they must link the Aadhaar card to the PAN card. Connecting a PAN number to an Aadhar number is a straightforward operation that may be accomplished in various ways.

Table of contents

- Why Link Your Aadhaar to PAN Card?

- Who Needs to Link Aadhaar to PAN Card?

- How to Link Aadhaar to PAN?

- How to Link Aadhaar to PAN Card in Case of Name Mismatch?

- How to Check Whether the Aadhar Card and PAN Card are Linked or Not?

- Why is it Mandatory to Link Aadhaar to PAN Card?

- Drawbacks of Not Linking Aadhaar to PAN Card

- What to Do When Unable to Link Aadhaar to PAN Card?

- Advantages of Linking Your Aadhaar Card to Your PAN Card

- Frequently Asked Questions (FAQs)

Why Link Your Aadhaar to PAN Card?

Without linking the Aadhaar card to the PAN card of an individual/entity, citizens will be barred from performing several activities, especially financial activities. If this process is not completed before the deadline, they will have to pay an amount of ₹1,000, and their PAN card will also become inoperative.

Earlier, there was no penalty provision for not linking Aadhar to PAN cards, but this time, the government has added a penalty for not linking the two identification documents. It is essential to link Aadhar and PAN cards to avoid such circumstances.

Who Needs to Link Aadhaar to PAN Card?

Any entity or an individual who needs to file an income tax return (ITR) or make banking transactions and other services of more than ₹ 50,000 need to link Aadhaar Card with PAN Card. They need to link both to save themselves from any tax evasion frauds.

How to Link Aadhaar to PAN?

There are three ways to link Aadhaar with PAN Card. These ways to link the two are as follows:-

- Through the “Income Tax portal“.

- By sending an “SMS” for linking both documents.

- By filling up a “Form” and submitting it to the respective authority in case of online linking and SMS linking failure or difficulties.

Link Aadhaar Card with PAN Card Online – Income Tax Portal

Given below are the two ways that you can link Aadhaar with PAN card online: –

- By logging into your income tax e-filing account.

- Without logging in.

Method 1: Logging Into Your Account

The steps to link Aadhaar Card with PAN Card via the e-filing portal are mentioned below:

Step 1: Go to the Income Tax e-filing website.

Step 2: On the homepage, click on the ‘Link Aadhaar’ option. The portal will now redirect to a new page.

Step 3: Now, enter the details as mentioned in the PAN card and Aadhaar Card.

Step 4: Then, tick the year you were born if the same is mentioned in the Aadhaar Card.

Step 5: Enter the Captcha as shown on the screen and click on the ‘Link Aadhaar’ button at the bottom.

Now, a message will pop on the screen with the message ‘Aadhaar-PAN linking is completed successfully.’

Method 2: Without Login

Given below is how you can link Aadhaar and PAN without logging in to the income tax portal:-

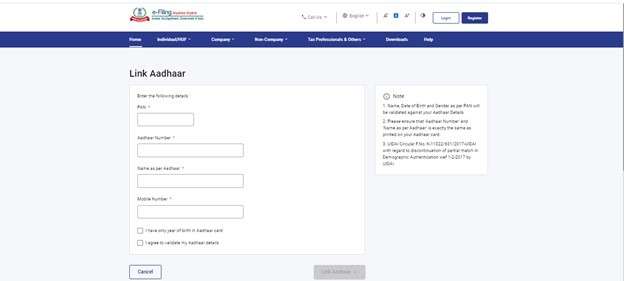

Step 1: Visit the homepage of the income tax e-filing website and click on the option of ‘Link Aadhaar’ on the left side of page.

Step 2: On the resulting page you will have to enter certain information like PAN number, Aadhaar number, name as it is mentioned in Aadhaar card, and mobile number.

If only the holder’s year of birth is mentioned on the Aadhaar card, just click on the “I have only year of birth in Aadhaar card”. Then click on the box that says, “I agree to validate my Aadhaar details”. This step is compulsory to complete the Aadhaar card linking.

This will trigger a 6-digit OTP being sent to the registered mobile number. Verify the OTP and click on the ‘Validate’ button.

How to Link Aadhaar to PAN Card via SMS?

You can also link Aadhaar and PAN Card by sending an SMS following the below-mentioned steps:-

Step 1: Type the message as: UIDPAN <12-Digit Unique Aadhaar Number> <10-Digit Unique PAN number>

Step 2: Then, send the message on 56161 or 567678.

Ensure that the Aadhaar number and PAN numbers are correct to successfully link both documents.

How to Link Aadhaar with PAN Card via Forms?

You can also link the Aadhaar card to the PAN card by visiting National Securities Depository Limited (NSDL). It is an Indian authority that provides all PAN-related services. Fill out the appropriate form by NSDL to link the Aadhaar card to the PAN card. Submit all the required documents and the form to complete the procedure for linking the identification details successfully.

How to Link Aadhaar to PAN Card in Case of Name Mismatch?

The name mentioned on both documents must be correct. Follow the process mentioned below to link the Aadhaar with the PAN Card in case of a name mismatch.

In case of Outright Name Mismatch – In such situations, the entity needs to change either the PAN card or the Aadhaar Card to move further and link both.

In case of Partial Name Mismatch – If the entity has some minor name mismatch in both the documents, then they can resolve the issue in the mentioned manner:

- If there is a partial or minor mismatch in the name, a one-time password (OTP) will be sent to the registered mobile number of the Aadhaar card owner.

- The OTP received by the entity can be used as proof for verification if there is some minor name mismatch.

- Moreover, it is essential for the taxpayers that the date of birth (DOB) and gender details are correct to link the Aadhaar card to the PAN card.

How to Check Whether the Aadhar Card and PAN Card are Linked or Not?

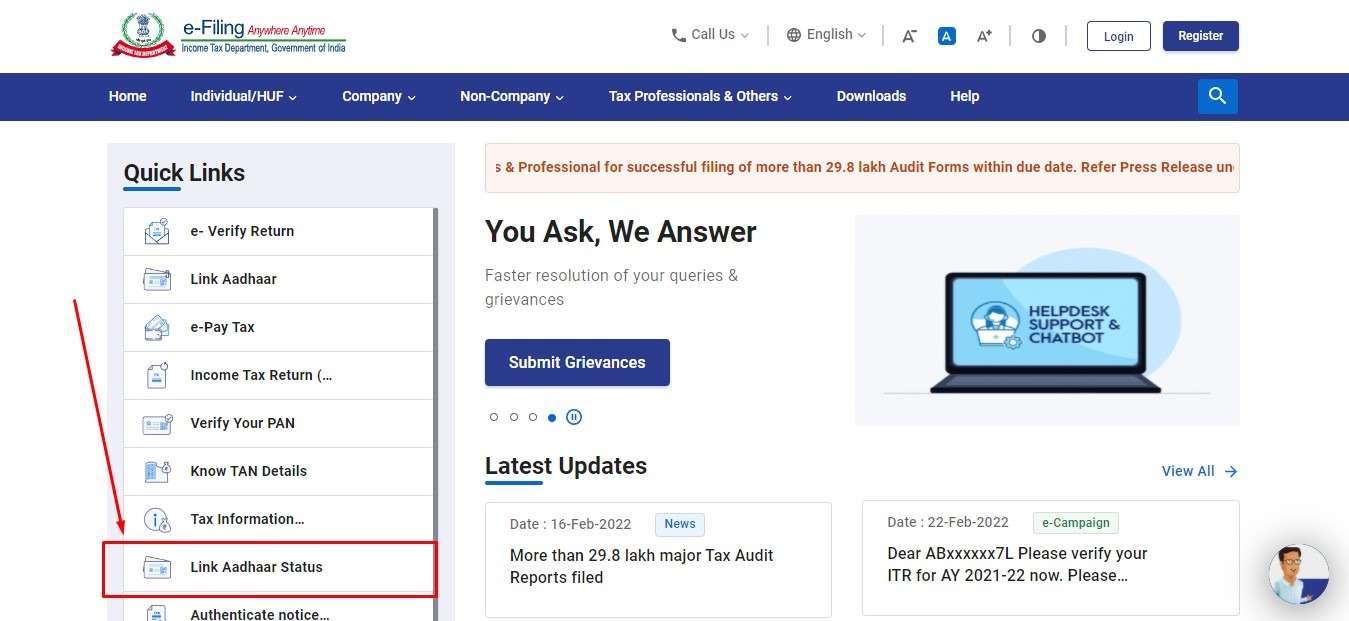

Step 1: Visit the official e-filing Income Tax Department website.

Step 2: Under the ‘Our Services’ section on the homepage, click on the ‘Link Aadhaar Status’ option.

Step 3: Now, enter the PAN Card details and Aadhaar Details and click on the ‘View Link Aadhaar Status’.

The portal will take you to a new window. The new window will have all the link Aadhaar and PAN card status details. You can also send a text message in the format UIDPAN < 12-digit Aadhaar number> < 10-digit Permanent Account Number> to 567678 or 56161 to know the status.

Why is it Mandatory to Link Aadhaar to PAN Card?

Since both documents are identification documents and numbers issued by the Indian Government, it is important to link both for registration and verification procedures.

The urge of the government to link Aadhaar with PAN card is because of the following reasons:-

To Put a Stop to Tax Evasions – The government can keep a tab on all the transactions made by the entity when they link Aadhar cards to PAN cards. After linking the identification details, the identity and address will be verified (through the Aadhaar number and details). Therefore, all the transactions made by them will be recorded by the Indian Government.

Consequently, the government will now have all the details of transactions that they should levy tax on. This will help in controlling the tax evasions.

Stop the Entity from Holding Multiple PAN Cards – Another reason for this initiative is to stop the entities from applying for more than one PAN card. Holding multiple PAN cards leads to tax evasion and is fraught with the government.

By holding multiple PAN cards, the entity might use one to perform precise financial transactions. They may use the other PAN cards for other financial transactions, bank account openings and more to avoid paying tax to the government by concealing it from the Income Tax Department.

Therefore, the government made it necessary to link Aadhaar and PAN cards. This will help them keep a tab on the transactions made by the entity and levy taxes on the relevant transactions. Also, if more than one PAN card is registered under the same entity, they can take the necessary action and put a penalty or punishment on them.

Drawbacks of Not Linking Aadhaar to PAN Card

In case the PAN card of an individual or entity is not linked with the Aadhaar card before the set deadline, the PAN of that entity or individual will automatically become inoperative. Hence, whenever they need to make a financial quotation, they will not do so.

The individual/entity will be unable to open a bank account, buy or sell any property, make any investments, pay higher TDS, and get locked from performing financial transactions.

What to Do When Unable to Link Aadhaar to PAN Card?

If you fail to link Aadhaar with PAN Card, you must submit an Aadhaar seeding form to link both to the nearest PAN centre. Along with the Aadhaar seeding form, you must carry your Aadhaar Card and PAN Card (and other relevant documents if asked).

The physical submission to link Aadhaar and PAN cards via the seeding form is a chargeable service.

Advantages of Linking Your Aadhaar Card to Your PAN Card

Linking Aadhar with the PAN card proffers numerous advantages by the Government. These benefits are as follows:-

- Linking both documents is crucial to file ITR under the identification of a PAN card.

- The authentication of ITR will be automatically completed via the Aadhaar Card itself. This makes the authentication task easier and faster.

- The verification of clients can also be easily verified through the linking of PAN and Aadhaar card for the trading accounts.

- The opening of electronic bank account becomes easily accessible and faster, especially for zero balance accounts.

- By linking Aadhaar and PAN card, the entities can establish their PAN’s uniqueness.

- It removes the chances of availing more than one PAN card for the entity.

- By linking Aadhaar and PAN card, the latter document’s chances are reduced.

PAN Card Linking Related Articles

Frequently Asked Questions (FAQs)

I don’t have Aadhaar. Can I still E-File my Tax Return?

Yes, it is possible to file tax returns but it will only be processed after PAN Card link aadhar. For e filing aadhar link you can visit the official website of Income Tax. But if you have the enrolment number then you can link your PAN with it.

Is there Any other Process to Link the Two?

There are two methods of linking the Aadhar with the PAN card- e filing PAN Card and SMS. But apart from these two, it is essential to know how to link PAN Card with Aadhar Card. A person can physically visit the Income Tax office with the relevant documents to get the two documents linked. Linking the two via the e filing pan website and SMS is free of cost whereas you will be charged a fee on visiting the office physically.

How Can I Check if my Aadhar Card is Linked to the PAN?

The steps to check PAN Aadhar link status is given as follows: Step 1: You will have to visit the link www.incometaxindiaefiling.gov.in/Aadhaar status. Step 2: Enter your PAN and Aadhar numbers. Step 3: Select the “View Aadhar Link Status” option. Step 4: The Aadhar link Status will be displayed in a new window.

Is it necessary to link Aadhaar with PAN for non-taxpayers?

In Union Budget 2017, the Government of India made linking Aadhaar Card to PAN card an essential step to avoid tax evasions in the country.

My name is different in Aadhaar and PAN, and it is not allowing me to link both. What to do?

If your name is different, you need to change either in the Aadhaar card or PAN card. But if it is partially mismatched, an OTP will be sent to the mobile number linked with the Aadhaar Card. Just make sure that the date of birth and gender is correct on both the identification documents.

How Can I know my Mobile Number Link on my PAN Card?

The steps to know your mobile number link in PAN Card is as follows:

Step 1: You will have to visit the telecom operator.

Step 2: Give your mobile number to the telecom operator after which you will receive an OTP.

Step 3: You will have to give the OTP to your operator.

Step 4: For biometric validation, your fingerprints will be taken by the operator. Step 5: After successful completion of the process, an SMS about the linkage will be sent to your registered number.