In today’s world, where uncertainty comes uninvited, savings are your best bet; therefore, a financial strategy is essential. One such scheme is the Mahindra Finance FD account, which offers numerous benefits and is an ideal plan.

By choosing a Mahindra Finance Fixed Deposit, you can ensure a safe retirement for your family. The account was created to offer guaranteed returns at a high interest rate. The best part about opening a Mahindra Finance FD account is that it is risk-free because it has the highest FAAA CRISIL rating.

Do you want to make an FD investment? If so, this article will assist you in selecting the best Mahindra Finance Fixed Deposit Schemes for your needs.

Mahindra Finance Fixed Deposit Rates

The table below depicts the latest Mahindra Finance FD rates for up to Rs. 5 crores:-

| Mahindra Finance FD Interest Rates (p.a.) Highlights 2024 | |

| Highest Slab Rate | 8.05% (for 36, 42, 48 and 60 months) |

| 1 year | 7.60% |

| 2 years | 7.75% |

| 3 years | 8.05% |

| 4 years | 8.05% |

| 5 years | 8.05% |

Note: The interest rates are updated as of 9 February 2024.

Mahindra Finance Tax Saving FD Rates

Mahindra Finance FDs in 2024 offer diverse options for both regular and senior citizens. For guaranteed returns, choose cumulative FDs earning 5.7% to 6.45% based on the 12-month to 5-year term. Senior citizens enjoy an additional 0.25% interest. Their interest compounds for maximum benefit. If you prefer regular income, consider non-cumulative FDs with variable rates (check directly with Mahindra Finance). Enjoy convenient electronic interest transfers to your linked savings account regardless of the scheme. Remember to compare rates and scheme details before investing to find the best fit for your needs.

Mahindra Finance Fixed Deposit Schemes and its Types

Mahindra Finance Term Deposit Interest Rates are divided into two categories:-

- Cumulative Scheme

- Non-Cumulative Scheme

Cumulative Scheme

Further, the CumulIn this scheme, the interest is paid directly at the period of the FD scheme. This strategy is best suited for those people who do not wish to receive interest payments regularly. In addition, the cumulative FD scheme is a fund multiplier.

Further, the Cumulative Scheme embraces three Mahindra Finance term deposit schemes, namely,

- Dhanvruddhi Cumulative Scheme

- Samruddhi Cumulative Scheme

- Bulk Deposit (above 5 crores)

Non-Cumulative Scheme

Pensioners who need periodic interest payments will benefit from a non-cumulative fixed deposit scheme. This is because interest is paid every six months. Further, the Non-Cumulative Scheme holds two Mahindra Finance term deposit schemes are:-

- Dhanvruddhi Cumulative Scheme

- Samruddhi Cumulative Scheme

Mahindra Finance Term Deposit Interest Rates: Up to Rs.5 crores

You can know the latest Mahindra Finance FD deposit interest rates up to ₹ 5 crores.

Dhanvruddhi Cumulative Scheme (Up to ₹ 5 crores)

The table below shows the Dhanvruddhi Cumulative and Non Cumulative scheme for a minimum amount of ₹5000 up to 5 crores.

| Period (Months) | Minimum Amount (Rs.) | Amount Payable (Rs.) | Interest p.a. *(Yearly) | Effective Yield p.a ** |

| 15 | 5,000 | 5492 | 7.75% | 7.86% |

| 30 | 5,000 | 6051 | 7.90% | 8.41% |

| 42 | 5,000 | 6561 | 8.05% | 8.92% |

Dhanvruddhi Non-Cumulative Scheme (Up to ₹ 5 crores)

| Period (Months) | Interest p.a. *#(Monthly) | Interest p.a. *#(Quarterly) | Interest p.a. *#(Half yearly) | Interest p.a. *#(Yearly) |

| 15 | 7.25% | 7.35% | 7.50% | 7.75% |

| 30 | 7.40% | 7.50% | 7.65% | 7.90% |

| 42 | 7.50% | 7.60% | 7.80% | 8.05% |

| Minimum Amount | Rs.50,000 | Rs.25,000 | ||

Samruddhi Cumulative Scheme (Up to ₹ 5 crores)

The below table shows the Samruddhi Cumulative scheme for a minimum amount of ₹5000 up to 5 crores:-

| Period (Months) | Minimum Amount (Rs). | Amount Payable (Rs.) | Interest p.a. *(Yearly) | Effective Yield p.a ** |

| 12 | 5000 | 5380 | 7.60% | 7.60% |

| 24 | 5000 | 5805 | 7.75% | 8.05% |

| 36 | 5000 | 6307 | 8.05% | 8.72% |

| 48 | 5000 | 6815 | 8.05% | 9.08% |

| 60 | 5000 | 7364 | 8.05% | 9.45% |

Note: Fixed deposit rates were recorded on 19 September 2023.

Samruddhi Non- Cumulative Scheme (Up to ₹ 5 crores)

The below table shows the Samruddhi Non-Cumulative scheme for a minimum amount of ₹5000 up to 5 crores:-

| Period (Months) | Interest p.a. *(Monthly) | Interest p.a. *(Quarterly) | Interest p.a. *(Half yearly) | Interest p.a. *(Yearly) |

| 12 | 7.20% | 7.25% | 7.35% | 7.60% |

| 24 | 7.25% | 7.35% | 7.50% | 7.75% |

| 36 | 7.50% | 7.60% | 7.80% | 8.05% |

| 48 | 7.50% | 7.60% | 7.80% | 8.05% |

| 60 | 7.50% | 7.60% | 7.80% | 8.05% |

| Minimum Amount | Rs.50,000 | Rs.25,000 | ||

Note: Fixed Deposit rates were recorded on 19th September 2023.

For Bulk Deposit in Cumulative Scheme (More than 5 crores)

| Period (Months) | Minimum Amount (Rs). | Amount Payable (Rs.) | Interest p.a. *(Yearly) | Effective Yield p.a ** |

| 12 | 5,00,00,001 | 5,39,25,000 | 7.85% | 7.85% |

| 15 | 5,00,00,001 | 5,50,15,513 | 7.90% | 8.02% |

Mahindra Finance Senior Citizen FD Rates

The general public’s Mahindra Finance FD rates vary from 7.60% to 8.05% per year. Senior citizens’ rates range from 7.85% to 8.30% annually. Senior citizens and employees of the Mahindra Group companies are eligible for a higher interest rate on any deposits made into the programme.

Mahindra Finance FD Rates for Deposits Upto Rs. 1 crore

Here is the table with the cumulative FD rates for senior citizens with deposits up to ₹1 crore.

Samruddhi Cumulative Scheme

Tenure (in months) | Interest Rate (% p.a.) | |

| Regular Citizens | Senior Citizens | |

| 12 | 7.60% | 7.85% |

| 24 | 7.75% | 8% |

| 36 | 8.05% | 8.30% |

| 48 | 8.05% | 8.30% |

| 60 | 8.05% | 8.30% |

Dhanvruddhi Cumulative Scheme (Online Mode)

Tenure (in months) | Interest Rates (% p.a.) | |

| Regular Citizens | Senior Citizens | |

| 15 | 7.75 | 7.85 |

| 30 | 7.90 | 8.00 |

| 42 | 8.05 | 8.15 |

Note: These FD rates were recorded as of September 19, 2023, and are variable at the discretion of the issuing company.

How Do You Open a Mahindra Finance FD Deposit Account?

There are two methods for opening a Mahindra Finance deposit account:-

Online

Step 1: Go to the official website of Mahindra Finance.

Step 2: Click on the ‘Regular Investment’ option.

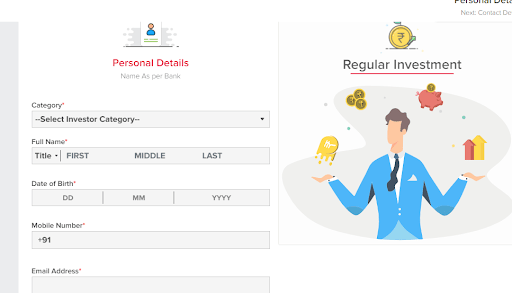

Step 3: Fill out the personal information as shown on the screen.

Step 4: After filling out all the details, enter your configuration details such as FATCA Configuration, KYC details, Repayment bank, and relevant information.

Step 5: Upload the form in the same formatted manner as described.

Step 6: Click on payment request and proceed to the payment option.

Offline

For the offline process, follow the following steps:

Step 1: Visit the closest Mahindra Finance branch.

Step 2: Fill out the form to open an FD account.

Step 3: Submit the application form with required documents.

Mahindra Finance Loan Against Fixed Deposit

- The minimum deposit amount is INR 5,000.

- With a non-cumulative plan, depositors can choose monthly, half-yearly, quarterly, or annual interest payout choices.

- Additionally, depositors may choose to get paid interest when their account matures.

- Every year, cumulative deposits are compounded.

- Additionally, this NBFC offers elderly citizens 0.25% annual interest rates on Samruddhi Fixed Deposits and a 0.10% p.a. extra rate on deposits made with Dhanvruddhi.

- There is an auto-renewal option.

Mahindra Finance Tax Saver Fixed Deposit

Investment in a Mahindra Finance FD does not allow for tax savings under Section 80C of the Income Tax Act 1961. The interest is taxable only if the total return is achieved on a fixed deposit. If it exceeds the limit specified in the Income Tax Act, financial institutions are required to deduct TDS.

Non-senior citizen shareholders are taxed on the interest earned above 40,000, whereas senior citizen investors are taxed on the interest earned above 50,000. Non-assess persons (individuals, HUFs, and trusts) can avoid such tax reduction by submitting a self-declaration on Form 15G/15H.

Features and Benefits of Mahindra Finance

The primary features and benefits of Mahindra Finance are listed below:-

- Adaptable Tenure: Mahindra Finance fixed deposits have tenures varying from 12 to 60 months, which makes them suitable for short- and medium-term investments.

- Regular Payouts: Mahindra Finance’s non-cumulative fixed deposit offers several payout choices. You can receive interest payments monthly, quarterly, semi-annually, or annually depending on your needs.

- Flexible Procedure: You can reserve a Mahindra Finance FD online or offline; the process is quick and easy.

- Senior Citizen Advantage: Mahindra Finance offers senior citizens an extra 0.25% return on their Samruddhi Fixed Deposits.

- Special Interest Rates: When booking Samruddhi Fixed Deposits, Mahindra Contributors and their family and friends are offered a further 0.35% interest rate.

- Secure Option: India Ratings has given the Mahindra Finance Fixed Deposit (MMFSL) the IND AAA/Stable rating. As a result, you can be confident that your earnings are safe and secure.

Eligibility Criteria and Documents Required for Mahindra Finance

| For resident Individuals | For Companies | For NRIs | For Family Trust |

| ID proof & address proof | PAN card | Passport with a valid visa | Proof of identity |

| Valid passport | Proof of Address (Bank statement, Telephone bill) | Letter of Employment Abroad (optional for confirmation of residential status and overseas address) | Registration Certificate Copy |

| Valid driving license | Certificate of incorporation | If you have a foreign passport, you will need a PIO card to prove your Indian origin. | If applicable, acknowledgement of application for registration |

| PAN card | Memorandum of Articles and Association, as well as the most recent Board resolution, with specimen signatures | Required | Required |

| Voter ID card | Authorised Signatory Identify with Signatories’ Photos | A proof of local address if it differs from the passport address, like a bank account statement, an electricity bill, a voter ID, a driver’s licence, and so on. | Proof of Address |

| Aadhar card | Authorised signatories’ identification and proof of address | Tax Residency Document is issued by the country’s Income Tax Department in which the investor resides | All Trustees’ signatories and independent KYC |

How to Close Mahindra Finance FD?

There are two methods for closing or withdrawing from the Mahindra Finance FD account:-

Closing your Mahindra Finance Fixed Deposit Account on Maturity

There are two ways alternative methods when your Mahindra Fixed Deposits get matured:-

- The first option is to request that Mahindra Finance automatically update your Fixed Deposit scheme. The financial institution will renew the FD with the same sum and interest rate in the future.

- In another case, the maturity amount will be transferred to the next savings account.

Closing your Mahindra Finance Fixed Deposit Account Before Maturity

Premature withdrawal is only feasible if your Mahindra FD account is three months old as of the receipt date. Furthermore, suppose your Mahindra FD account is three months old, and you request a premature withdrawal after three months. In that case, the interest rate shown in the table below will apply:-

| Duration | Tenure | Interest Rates |

| 3 Months | 6 Months | NA |

| 6 Months | Deposit Time Period | The payable interest rate is 2% lower than the interest rate applicable on the FD. In case no rate of interest is specified, then a 3% interest rate is lower than the minimum rate. |

Mahindra Finance Fixed Deposit Contact Details

You can contact Mahindra Finance customer care by any of the following modes for filing your queries or complaints.

Customer Care Contact Number

1800 233 1234 (Mon–Sat, 8am to 8pm)

WhatsApp number: +91 7066331234

Email Address

pawar.sunita@mahindra.com or mfinfd@mahindra.com

Official Address

Mahindra & Mahindra Financial Services Ltd. New no. 86, Old no. 827, Second floor, Dhun Building, P.B. No. 2430, Anna Salai, Chennai – 600 002.

Office Telephone Number

044-28411061 or 044-28411016

You May Also Read

FAQ’s:-

Q1. Does Mahindra Finance pay the interest monthly on FD?

Ans: Mahindra Finance pay the interest monthly on FD under non-cumulative Fixed Deposits scheme.

Q2. Can we open a joint account with Mahindra Finance FD?

Ans: Yes, with Mahindra Finance, you can open a joint account.

Q3. Can I open an FD account as a guardian of a minor?

Ans: Yes, you can open a Mahindra Finance FD account on behalf of a minor.

Q4. Does Mahindra Finance pay the interest monthly on FD?

Ans: Mahindra Finance pay the interest monthly on FD under non-cumulative Fixed Deposits scheme.

Q5. Does Mahindra Finance allow premature withdrawal in FD?

Ans: Yes, Mahindra Finance allows the account holder to withdraw money before its maturity on its FD scheme.

Q6. How is the FD interest taxed?

Ans: Interest income from fixed deposits (FDs) is taxed under “Income from Other Sources” at your applicable income tax slab rate. Banks deduct TDS at 10% if annual interest exceeds INR 40,000 (INR. 50,000 for senior citizens). If PAN is not provided, TDS is deducted at 20%. Any deducted TDS can be claimed while filing your Income Tax Return if your total income is below the taxable limit. To avoid TDS, eligible individuals can submit Form 15G and 15H for senior citizens to their bank.

Q7. Can I avail a loan against my FD urgently?

Ans: Yes, you can urgently avail of a loan against your Fixed Deposit (FD) without liquidating your FD prematurely, which often involves penalty fees. Banks offer this secured loan facility and allow you to borrow up to 90% of the FD amount, depending on the bank’s policy. It provides a way to meet your immediate financial needs at an interest rate typically lower than that of personal loans, usually 1% to 2% above the FD interest rate.