The history of Indian currency is a fascinating tale spanning centuries. From ancient coins like punch-marked silver to the introduction of paper money by the British, the Indian rupee has evolved. Post-independence, the Reserve Bank of India took charge, issuing various denominations. Today, it stands as a symbol of India’s economic power.

As the Indian currency landscape transforms, an intricate symphony of economic dynamics is set into motion, shaping the fate of trade relations, investment flows, and entrepreneurial aspirations.

Talking about current trends, from the shiny new Rs. 75 coin to the ban on the Rs. 2000 note, India’s currency landscape has radically transformed. So, currency enthusiasts, get ready to be blown away by our buzzworthy topic for you today: The Latest Changes in Indian Currency.

We’re here to give you the inside scoop on all the exciting updates that have shaken up our wallets and purses.

Table of contents

Indian Currency’s Position on the Global Stage

The position of the Indian currency in the global market tells an interesting story. With its rich history and strong economy, India has become an important player on the world stage. The Indian rupee, as our currency is known, interacts with other currencies, influencing and being influenced by global events. Its value goes up and down based on various factors, reflecting how India’s economy is doing.

As more people look at India’s market, the rupee’s position shows that India is becoming more influential. It works alongside the US dollar, the euro, and other currencies, showcasing India’s potential and power. Every time money is exchanged, the Indian rupee leaves its mark, reminding us that it has found its place in the global economy.

Unveiling the Diverse Phases of the Indian Monetary System

Embark on a captivating journey as we delve into the fascinating tapestry of India’s monetary system, unveiling its myriad phases and illuminating the rich history it beholds.

Phase 1: Colonial Legacy and Early Independence (Pre-1947)

‘Currency in the Shadows of Empires’

Source: Wikipedia

In this challenging and changing phase, the exchange of goods and wealth in the Indian subcontinent was a tapestry woven with threads from diverse indigenous currencies. However, as colonial powers cast their gaze upon the land, the arrival of European coins began to shape the monetary landscape.

| DO YOU KNOW? The first 1 Rupee note was issued on November 30th, 1917, bearing a photo of King George V. |

The East India Company introduced the Rupee, which gained prominence under British rule. This period witnessed the standardization of Indian currency and the birth of paper money, forever altering the course of trade and commerce.

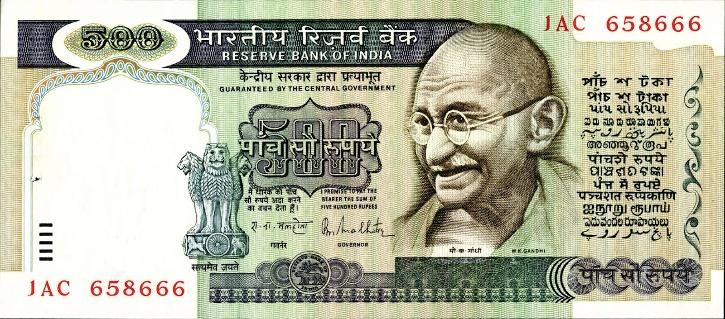

Phase 2: Post-Independence Reforms and Modernization (1947-1991)

‘Winds of Change and the Progressive Rupee’

Source: Wikipedia

With the dawn of independence, India embarked on a transformative journey in currency. The Indian Rupee emerged as a symbol of a sovereign nation, marking the transition to a modern monetary system. Decimalization brought forth the introduction of the Paisa, adding a touch of mathematical finesse to everyday transactions.

| DO YOU KNOW? Rs. 10,000 rupee-note was in circulation from 1954-1978. |

The Mahatma Gandhi Series was introduced on banknotes, paying tribute to the nation’s revered leader. Economic reforms and liberalization brought the winds of change, while robust security measures aimed to combat the persistent threat of counterfeit currency.

Phase 3: Technological Advancements and Financial Inclusion (1991-Present)

‘The Dance of Digital Rupees and Inclusive Prosperity’

As the world ventured into the digital age, Indian currency donned its virtual attire. The dance of the digital revolution enveloped the nation, ushering in a cashless economy. Demonetization acted as a catalyst for embracing electronic payments, propelling the Indian Rupee into the realm of virtual transactions. With the introduction of new denominations, the vibrant Rs. 2000 and Rs. 500 notes, India made its mark on the global stage.

Financial inclusion initiatives such as Jan Dhan Yojana and Pradhan Mantri Mudra Yojana paved the path toward empowering the unbanked population. The future holds the potential for further advancements, including the exploration of cryptocurrencies and the continued evolution of digital currency.

| DO YOU KNOW? There are more than 12,000 cryptocurrencies in existence. |

Indian Currency Takes a Leap Forward: Explore the Latest Transformations

Get ready to witness the captivating evolution of Indian currency as it leaps forward, leaving us in awe of its modern advancements and endless possibilities.

Rs. 2000 Note Ban

Have you heard about the Rs. 2000 note ban?

Well, back in November 2016, when the government withdrew the legal tender status of Rs 500 and Rs 1000 notes, the RBI introduced the Rs 2000 note to meet the country’s currency needs quickly. It was like a sudden change in our wallets!

But here’s the catch: the printing of these notes stopped in 2018-19 once an adequate supply of other denominations became available.

Now, fast forward to today. The RBI has decided to pull the plug on the Rs 2000 note. But don’t panic just yet! The existing Rs 2000 notes will still be accepted as legal tender, so you won’t be stuck with worthless paper. However, in line with their ‘Clean Note Policy,’ the RBI wants us to deposit these notes into our bank accounts or exchange them for other denominations at any bank branch.

| DO YOU KNOW? Individuals can exchange up to 10 notes of 2,000 rupees each, totaling a value of 20,000 rupees, at a time. |

It’s a smart move considering that the Rs 2000 note isn’t commonly used for day-to-day transactions anymore. Plus, we have enough banknotes of other denominations floating around to meet our currency needs.

So, it’s time to bid farewell to the Rs 2000 note and make way for a smoother currency system.

Launch of Rs. 75 Coin

Guess what? PM Narendra Modi has just introduced a brand new coin, and it’s not your typical denomination.

Say hello to the cool and shiny Rs. 75 coin ! This unique addition to our currency lineup has made quite a splash. The Reserve Bank of India (RBI) released this special coin to commemorate a significant milestone in our nation’s history.

Why Rs. 75 coin, you might ask? Well, it’s all about celebrating 75 years of India’s independence i.e. Azadi ka Amrit Mahotsav. As we reach this momentous occasion, the RBI wanted to create something memorable, a tangible symbol of our progress and unity. And what better way to do that than with a new coin?

| DO YOU KNOW? Besides the Rs. 75 coin, the Indian government has introduced over 150 commemorative coins since 1964. |

Just picture it – a gleaming disc, adorned with intricate designs and engraved with the proud Lion Capital of the Ashoka Pillar. It’s a small but powerful reminder of our journey as a country, the struggles we’ve overcome, and the achievements we’ve made. Holding this coin in your hands, you can’t help but feel a surge of patriotism and pride.

But here’s the catch – this Rs. 75 coin isn’t just for collecting dust in your piggy bank. Unlike your everyday currency, Rs. 75 coin is not released for general circulation. Instead, it will serve as a tribute to significant events or renowned individuals, allowing us to honour and remember their contributions.

So, the next time you come across this shiny Rs. 75 coin, take a moment to appreciate its significance. It’s not just money; it’s a symbol of our heritage, resilience, and the unwavering spirit of India. Let’s embrace this new addition to our currency family and continue to make history together.

What Does the Future Hold?

We have witnessed the rich history and evolution of Indian currency, from its ancient roots to the modern digital age. The latest changes, such as the introduction of the Rs. 75 coin and the discontinuation of the Rs. 2000 note, have showcased the dynamic nature of India’s monetary system. As we embrace these advancements, it is clear that the Indian currency continues to adapt and innovate, reflecting the nation’s economic growth and aspirations. The future holds exciting possibilities for further transformations, ensuring that our currency remains at the forefront of global trends.