What does the term “Market Capitalization” Mean?

To evaluate the value of a company, there isn’t a better way than Market Capitalization because the reader gets the insights through the analysis of the company’s stocks. The value is essentially put together based on the market value of the company’s outstanding shares. Thus, it can be concluded that only publicly owned companies can be valued by this option of evaluation. For investors, it is crucial to get the concept of market capitalization, as a whole because this will give them the correct insights for investing in stocks.

While using this method of evaluation, unstable market conditions, and variable stock prices are always taken into consideration. Especially for investors planning to create a long investment plan, knowing the company’s market value stands essential. When the investors know about the market value and risks involved with the company, it assists them in making better decisions which includes investment in stocks of different companies. Understanding a company through market cap gives you a dig at how the company is performing in its business venture. This is what the investors should consider while making a relevant investment portfolio.

Market Capitalization Formula

It is an easy process to calculate the market capitalization formula because it only requires the two elements mentioned below:

- The present-time rate of a single share

- Total number of outstanding shares

Market Capitalization = Price of a single share* total number of outstanding shares

Example: The Company 1 share current price is 100 rupees in Stock Market

The company have Total 20 lakh Share

2000000 * 100 = 200000000

Company Total Market Cap = 20 crore Rupees as per Market Value of Stock

Why is Market Cap Important?

The importance of Market Cap stands in comparing the relative size of the company to other companies. Market cap is used as a metric to know the worth of a company in open market along with its future perspective, areas of growth, and extent of growth.

History of Market Cap India

Over the past 8 years, the annual growth rate of GDP for local rates has grown to 5.93%. But, this growth is a by-product of the rise in inflation and not the real growth of GDP and the current GDP is $2,580 billion in US dollars or national currency it is 190,540.

Market Capitalization Indicator or Market Cap to GDP Ratio

Buffet Indicator or what we call the Market Cap to GDP Ratio is the total value of the stocks which are traded publicly in the nation which is divided by the present-time GDP of the country. This method evaluates whether the stock market of a country is overvalued or undervalued in comparison to the average presented historically.

The formula of market cap to GDP is:

Market cap to GDP ratio= value of all public stocks in the country/ the GDP of the country*100

|

Indexes |

Value |

|

Market Capitalization NSE |

US$ 3.1 Trillion |

|

Indian Stock Market Capitalization 2020 |

US$ 2.08 Trillion |

|

Equity Market Capitalization BSE |

US$ 3.6 Trillion |

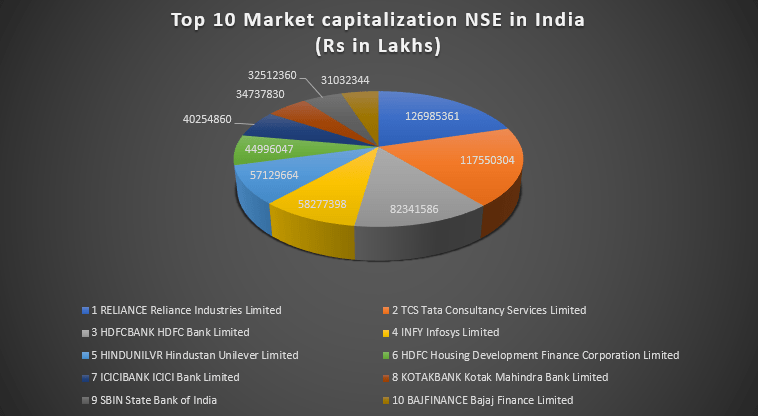

Top 10 Companies Market Capitalization NSE In India ( Pie Chart )

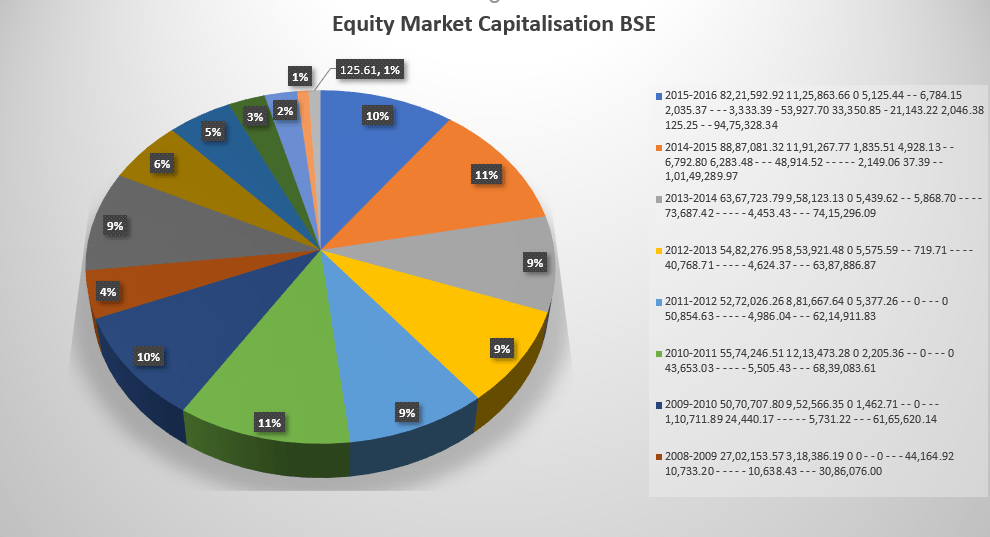

Equity Market Capitalization BSE – Pie Chart Data

The Buffet Indicator

The market cap to GDP ratio popularly came to be known as the Buffet indicator because of a comment that was made by Warren Buffet to Fortune Magazine calling it one of the best ways to measure the value of stocks at present. He says this because this is an easy method to have a look at stock value aggregately and its comparison to the total value of GDP of the country. It is highly relatable to the price-to-sales ratio.

The interpretation of market cap to GDP ratio

This specific indicator works like a price-to-sales ratio for the whole nation. For comparable company analysis, the use of price/sales as a metric to measure the valuation is done. The companies trading on 1.0x or above it is considered to be of high value while companies with less than 0.5x ratio are regarded as cheap. Other factors like the growth and margin of the company should also be considered to properly analyze the valuation of the company. This is the right interpretation done by Warren Buffet and makes absolute sense because it is similar to having a price-to-sales ratio not just for a company but for the entire country.

Loopholes of the Buffet Indicator

Though the Buffet indicator is a good and high metric for valuation, the price-to-sales ratio is also crude. It is so because this ratio does not consider the business’ profitability and relies only on the top revenue value which can at times be misleading. Also, this ratio has been in the market for a long period of which makes the investors question about a relevant and average ratio. Usually, 75% is the average but multiple of them being 100/5 indicates the overvalued market, and some believe that the new normal is the average of 100%. The ratio is influenced by the companies trading publicly and the trends emerging in the IPOs. The market cap to GDP ratio will shot up if a large number of companies become public rather than being private but the valuation will show no changes.

Important Market Capitalization Formulas :

|

Category |

Formula |

|

Market Capitalization formula in Excel |

Total Number of shares allotted by the company* Current value of one share |

|

Market Capitalization Formula Example |

Market Price of single share*Total number of outstanding shares |

|

Market Capitalization Formula Crypto |

Total number of coins mined* Price of a single coin |

|

Market Capitalization Formula to Private companies |

Market Price of single share*Total number of outstanding shares |

|

Market Capitalization Formula CFI |

Stock Price* Total number of outstanding shares |

|

Market Capitalization Formula Enterprise Value |

Share Price* Total number of outstanding shares |

|

Free Float Market Capitalization Formula |

Price of one share* Total number of outstanding shares |

All that you need to know about Outstanding Shares

Outstanding shares can be defined as the shares which are available for the investors because they are traded in the secondary market. The outstanding share of the company is inclusive of the restricted shares which are in the name of the insiders and officers as well as the portion of the equity owned by some financial institutions in the form of hedge funds, mutual funds, or pension funds.

Before making the shares available to the secondary market, the shares are authorized and issued, and the investors purchase them and become one of the shareholders of that company. The prominent shareholder so the company gets to attend the annual stock meetings of the issuing company and at times get the right to participate in electing the company’s Board of Directors.

There is an increase in the number of outstanding shares of the company when the insiders or the employees of the company use the stock options or when the company comes with some additional shares. Huge corporations use IPOs to get the required finance in exchange for portions of equity.

Having a large number of outstanding shares increase the company’s liquidity but also boosts dilution. On the other hand, if the company buys back some of its shares through a share repurchase program, it will decrease the outstanding shares of the company. Alternatively, the total number of outstanding shares can also be calculated by dividing the market capitalization of the company by the current share price.

What are the Diluted and Basic Outstanding Shares?

The total number of outstanding shares can either be fully diluted or basic. The basic outstanding shares are nothing but the total number of shares present in the secondary market and the fully diluted outstanding shares consider the dilution of the convertibles. Thus, if a company has some diluting securities, it can be calculated that the number of outstanding shares of the company will rise in the future.

Treasury Share Vs. Outstanding Shares

The difference between outstanding shares and treasury shares is that treasure shares are only owned by the company and cannot be traded in any of the open markets. The total treasury shares and outstanding shares form up the total number of issued shares.

Floating Shares Vs. Outstanding Shares

To understand floating shares, you need to know about the closely held shares. Closely-held shares are a large chunk of shares owned by a small group, an individual, or the officers of the company. And the total of floating shares is the number of outstanding shares minus the number of closely held shares. The number of floating shares is indicative of the active shares of the company and their reputation in the market among the investor except the people holding some large portions of the equity.

Authorized Shares

The total of authorized shares can be considerably high than the total of the outstanding shares of the company because the authorized shares are the maximum number of shares that can be issued by a company. However, the outstanding shares can be equal to the total number of authorized shares.

What are the Types of Companies Based on the Market Cap?

Based on the famous concept of market capitalization, there are three types of companies and stocks in which one can invest. To minimize the chances of any risk, you make your investment portfolio, a mix of all the types of stocks.

| Type of Company | Market Cap |

| Small-Cap stocks | Is upto ₹500 crore |

| Mid-Cap stocks | From ₹500 crore to ₹7,000 crore |

| Large-Cap stocks | From ₹7,000 crore to ₹20,000 crore |

Large-Cap Stocks

In the market, large-cap companies are one of the most stable companies but investing in these companies could be a risky choice. However, one should know that because these companies have a good brand name and are stable in the market, the return on investments is comparatively low. The reason for this aspect is that they have reached a certain height of growth and there is a minimum chance that the stock price will change immensely. Investing in the large-cap stock is a conservative option with less return and less aggressive growth of the company.

Some of the Best Large Cap Companies to Invest in 2021 (excluding banks)

| Name of the company | Script Code BSE | NSE symbol | CMP (As on 15th June’21) | Rating | Industry |

| Reliance Industries Ltd. | 500325 | RELIANCE | 2249.7 | 1.0 | Integrated Oil and Gas |

| Tata Consultancy Services Ltd. | 532540 | TC S | 3262.5 | 5.0 | Information Technology |

| Hindustan Unilever Ltd. | 500696 | HINDUNI LVR | 2391.21 | 5.0 | FMCG |

| Infosys Ltd. | 500209 | INF | 1472.9 | 4.0 | Information Technology |

| Housing Development Finance Corporation Ltd. | 500010 | HDFC | 2544.4 | 5.0 | Finance Housing |

| Bharti Airtel Ltd. | 532454 | BHARTIA RTL | 542.6 | 5.0 | Telecom |

| ITC Ltd. | 500875 | ITC | 207.1 | 4.0 | FMCG |

| Asian Paints Ltd. | 500820 | ASIANPAINT | 3041.9 | 4.0 | Chemical Paints |

| Nestle India Ltd. | 500790 | NESTLEIND | 17679.5 | 5.0 | FMCG |

| HCL Technologies Ltd. | 532281 | HCLTECH | 985.4 | 4.0 | Information Technology |

The Advantages of Investing in Large Cap Stocks

There are numerous advantages of investing in large-cap stocks. Have a look at some of those:

- The large-cap companies have a stable growth, business plan, consistent income, and revenue which makes them financially sound. Hence, the chances of these companies getting solvent because of some economic crises are fairly low. They do not have a major impact on the fluctuations of the market and give you a stable investment portfolio. Also, these large-cap companies offer dividends which is ideal to increase the money for investors.

- The large-cap companies usually invest in the blue-chip companies which have exemplary performance and stable financial growth, and this is why there is no major impact on the stock prices. And because of this, the companies can offer better capital appreciation to their investors.

- The companies falling in the large-cap category are well-established and have been operating for a long period hence, obtaining any information about the profitability and finance of the company is a facile task. This gives the investors an idea about the growth and helps them to analyze whether the company is worth investing in or not.

- Another advantage is that these companies present their investors with a lot of liquidity. The fund managers can easily sell these stocks when there is a need to maximize the number of returns.

- Large-cap companies offer you chances of protection from the ups and downs of market instability and economic downturns. These stocks can handle market turbulence.

- If you want to diversify your portfolio across the market capitalization, then large-cap stocks are the best option. Since these companies invest in companies of multiple niches, your investment portfolio automatically diversifies. Also, the investors need not monitor the happening in every sector.

The Disadvantages of Investing in Large Cap Stocks

- One of the main drawbacks of large-cap stocks is that they do not have much potential for capital appreciation. During the market fluctuations, these companies do not have much effect, and that is the reason why the stocks of such companies do not go up as much as that of the mid-cap and small-cap companies.

- To invest in a large-cap company, a good amount of capital is required, and this is why individuals with average or low income cannot afford to invest in them.

- After the SEBI categorization, large-cap companies are not present in a huge number in India. Hence, if you have low income and plan for a higher return then opting out of this investment will be the best decision.

Mid-Cap Stocks

Under market capitalization, the companies with considerable growth and some stability along with a vast potential growth are the mid-cap companies. This kind of stock shows that the company has shown an escalating graph of growth in its industry and has a promising future. While investment in these companies could be a little risky but it is still better than investing in small-cap companies. In comparison to large-cap companies, mid-cap companies provide you with a better rate of return on your investment.

Some of the Best Mid Cap Stocks to Invest in 2021

| Name of the company | Script Code

BSE | NSE symbol | CMP (As on 15th June’21) | Rating | Industry |

| Aarti Industries Chemicals | 524208 | AARTIIND | 1710.7 | 0.5 | Specialty Chemicals |

| Amara Raja Batteries Equipment | 500008 | AMARAJABAT | 760.5 | 4 | Auto Parts and Equipment |

| Coforge | 532541 | COFORGE | 3713.4 | 3 | IT Consulting and Software |

| Crisil | 500092 | CRISIL | 2038.65 | 4.5 | Other Financial Services |

| Crompton Greives Consumer Electricals | 539876 | CROMPTON | 407.05 | 4 | Household Appliances |

| Deepak Nitrite Chemicals | 506401 | DEEPAKNTR | 1754.15 | 0.5 | Commodity Chemicals |

| Escorts | 500495 | ESCORTS | 1212.4 | 0.5 | Commercial Vehicles |

| Gujarat Gas | 539336 | GUJGASLTD | 607.55 | 0.5 | Integrated Oil and Gas |

| ICICI Securities | 541179 | ISEC | 607.75 | 0.5 | Other Financial Services |

| JB Chemicals and Pharma | 506943 | JBCHEPHARM | 1582.55 | 0.5 | Pharmaceuticals |

What are the advantages of Mid-cap stocks?

The scope of growth. One of the best stocks to invest is in mid-cap stocks because they have a higher potential of fundraising through credit which in turn increases the company’s potential to expand and grow in their specific industry.

The potential of return. Usually, the mid-cap companies are either in the growth stage or stable development. The values of these stocks have better chances of appreciation and that’s how it delivers high dividends to its investors.

The substantial company’s information. Mid-cap companies have plenty of information about their financial history and also their present financial status. You can easily analyze the mid-cap stocks from the list of stocks. From the information available, the investors can get an idea about the growth and expansion of the company.

What are the disadvantages of mid-cap stocks?

The condition of a value trap. If a company is operating on limited funds for a long period, it is called the condition of a value trap. And the mid-cap companies are vulnerable to fall into the value trap, especially the ones with a low ranking.

Scarcity of resources. In comparison to the large-cap companies, mid-cap companies tend to have fewer resources and inadequate managerial and operational resources. Generally, these companies are not as well-equipped as large-cap companies.

Small-Cap Stocks

Companies that have the least market capitalization are one of the riskiest stocks to invest in. The small-cap companies are the ones who are still functioning to establish their name in the industry. The aspect that makes them a risky choice is that these companies will have a major hike in their stock prices with success and a major downfall in the stock prices with failure. Small-cap companies are called one of the most aggressive sorts of investors.

Some of the best small-cap companies to invest in 2021

| Name of the company | Script Code

BSE | NSE symbol | CMP (As on 15th June’21) | Rating | Industry |

| VST Industries | 509966 | VSTIND | 3464.1 | 5 | Consumer Goods |

| Thyrocare Technologies Ltd | 539871 | THYROCARE | 1249.9 | 3 | Healthcare Services |

| TCNS Clothing Ltd | 541700 | TCNSBRANDS | 552.4 | 0.5 | Textiles |

| Sterlite Technologies Ltd | 532374 | STRTECH | 265.8 | 0.5 | Telecommunications |

| Sobha Ltd | 532784 | SOBHA | 514.8 | 0.5 | Construction |

| NESCO Ltd | 505355 | NESCO | 573.6 | 1 | Services |

| Mishra Dhatu Nigam Ltd | 541195 | MIDHANI | 212.8 | 1 | Metals |

| KEI Industries | 517569 | KEI | 716.9 | 0.5 | Industrial Manufacturing |

| Justdial Ltd | 535648 | JUSTDIAL | 1010.7 | 2 | IT |

| JK Paper Ltd | 532162 | JKPAPER | 178 | 0.5 | Paper |

Why your investment portfolio should be inclusive of small-cap stocks?

As and when the economy revives and demand drop-in, every sector will see a value chain benefit including the small-cap companies. If a company has market capitalization below the 250th stock in the stock exchange, the company is called a small-cap company. Since the economic data is showing improvements, small-cap companies will also see a boom in their corporate profitability. Investors with risk tolerance and search for better returns can plan to invest in small-cap companies. Almost, 4,500 small-cap companies are associated with the stock exchange in India. Though you can expect better returns from these companies, it is advised to make a long-term investment in these companies. During the economic recovery, the small-cap funds which are managed well tend to outperform every other sector.

Micro-Cap Stocks

To define it easily, a micro-cap company has a market capitalization that is greater than that of a nano-cap company but less than that of small-cap, mid-cap, or large-cap companies. The stocks of these companies are known to be risky, but they also have a good reputation for further growth. The funds associated with these companies are at huge risks and these companies have higher risks than the large-cap companies with high market capitalization. Micro-cap companies do not hold a potential track record of performance, growth, and assets. The reason why these companies are vulnerable in the market is because of their small size and low base of shareholders along with the scarcity of liquidity. If you are an investor who invests in stocks with higher risks, can invest in micro-cap companies because the returns are quite high with these stocks.

Why the funds are close-ended to the micro-cap companies?

Close-ended funds are preferred for micro-cap companies because their size is smaller than that of small-cap companies. To state the facts, leaving some exceptions, every micro-cap company has close-ended funds. The restriction of cash inflow and outflow is the reason why asset managers can take some gravitated decisions. Another reason why it is a close-ended fund is that they do not have the required liquidity.

Nano-Cap Stocks

A nano-cap stock is the one with the least market capitalization in the industry. The nano-cap stocks represent the companies that are not taken care of by the traders and the least regulations from the concerned people of the stock market. These types of stocks are eye-candy for investors who regard them as companies with a bright growth future but as alternative investments, these companies come with their special risks. If the stock price of certain nano-cap companies is below a set threshold, the stocks are called penny stocks. Many traders have an interest in these nano-cap stocks because they have a small downside and a large growth potential. But the experts do not advise overbuying of these stocks because a small event of failure will lead to a greater impact on the prices of the stocks.

Now that we have covered the types of stocks, let’s understand what is free-float market capitalization?

In terms of generic market capitalization, the evaluation of the total number of outstanding shares including the ones owned privately as well as publicly. However, in free-float market capitalization, the evaluation of the company’s value is done only based on the outstanding shares that are publicly owned. The total number of these shares is then multiplied by the price of a single stock. IN this process of calculation, every share that is owned privately is excluded which means that the shares held by the promoters, trust, or government bodies are not included. This also concludes that the valuation of market capitalization will always be greater than the value of free-float market capitalization. At times, you can find free-float market capitalization being termed as float-adjusted capitalization.

The advantages of relying on free-float market capitalization

Gives you a practical and clear picture

In the market capitalization evaluation, both the presently owned and currently available shares are included, and free-float market capitalization only takes into account the shares which are present in the market and open for trading. Thus, this method of evaluation is more reliable in getting the true picture of the company.

No discrepancy with the valuation

The evaluation of market capitalization can fool the investors and make them believe that the company’s shares are easily available for trading, but the reality stands different. Some businesses might receive a large-cap but then not all of their shares are open in the market for trading because they are owned privately. But there is a possibility of broad-based indexing with free-float market capitalization. This reduces the confusion of concentrating the large-cap values with these companies.

Methodology is market-driven

With this method, the companies having very few shares available for trading in the market, are eliminated. Thus, the investors get the idea of where they put their extra funds by purchasing the public shares through this method of evaluation.

Free-float Vs Shares Outstanding

Shares outstanding and free-float are two different variants of determining the number of stocks of a company. Generally, every investor looks for these three metrics before deciding about the stock investment of a company, floating shares, outstanding shares, and authorized shares. The total number of shares that a company is allowed to issue is termed as the authorized share. These shares are inclusive of stocks that have already been issued and also the stocks approved by management but not open for trading. And outstanding shares are those which are held by the insiders of the company and shareholders whereas floating shares are the stocks that are open in the market for trading.

Shares Outstanding

Shares outstanding of a company are the stocks that are issued and actively held by the insiders as well as corporate shareholders of the company, but these should only be actual shares. A company is opened to provide stock options to its executives which are convertible to shares. However, these stock benefits are not mentioned in the tally of stocks unless they are completely issued. There are multiple ways of determining the shares outstanding of a company.

For instance, the investors can check for the shareholder’s equity section in the balance sheet of the firm to determine the outstanding shares of the company. Shareholder’s equity has a mention of several floating shares, outstanding shares, and authorized shares. Also, many stock listings provide you with the money market and market capitalization of a company. You can divide the market cap with the share price to get the number of outstanding shares.

Floating Stocks

One of the narrowest numbers of shares in a company is the floating stocks. In this one, the shares held by the company’s insiders or prominent investors like the directors, sponsored foundations, and officers, are not included. Many indexes like the BSE small-cap index, s &p BSE small-cap index use the floating shares of the company to determine its market cap. Such indexes are called the free-float capitalization index.

The difference between free float and market capitalization

Market capitalization meaning is that it is the overall market value of a firm. This is determined by multiplying the number of outstanding shares by the current price of its stocks be it the large caps stocks, mid-cap stocks, or small-caps stocks. It gives value to the company which is open on the Stock Exchange for investors to decide whether they want to invest in the capital markets of the company or not.

Free-float market capitalization on the other hand is only a share or company’s market value but the actual market value. It is so because this market cap meaning is to exclude the shares held by the people controlling the firm. Free float is what indicates the liquidity of the company. Free float is nothing but a certain percentage of market capitalization in the Indian capital markets and otherwise too.

Latest Update of Indian Stock Market Capitalization 2021

As per data, the India Stock Market Capitalization closed at US$3.4055 trillion on September 14th, 2021. It is one of the biggest market cap gain for India by gaining 35% from that of US$ 2.52 trillion on December 30th, 2020.

You May Also Like :

Frequently Asked Questions (FAQ)

How is market capitalization calculated?

Market capitalization is calculated by multiplying the price of one share by the total number of outstanding shares.

What is the current market cap to GDP ratio of India?

The current market cap to GDP ratio of India is 188 percent.

What is the market cap of NIFTY 50?

The base capital is fixed at ₹2.06 trillion.

What is the market capitalization formula?

Market Capitalization= Price of one share* number of shares outstanding.

Is the market cap better high or low?

It depends on what stocks are being taken into consideration.

Are large-cap stocks safe?

Yes, large-cap investments are safer than mid-cap and small-cap investments.

Is market cap a good indicator?

In some aspects market cap can be considered to be a good indicator but because eit only shows a part of the company’s worth, it is not fully reliable.