Property tax is a tax levied on the value of property owned by an individual and that property may have different usage. These usages depend on the choice of the owner, his occupation or leanings, and whether the property is used for residence or commerce. We call them residential usage or commercial usage. The tax is imposed on this categorization also because tax for residential property will be different from the tax imposed on commercial property.

The government imposes these taxes, and the local municipality of Municipal Corporation executes it. Municipal Corporation Gurgaon imposes property tax Gurgaon on the owners of the property at Gurgaon. These residents are obliged to pay MCG property tax payments to the government through the municipality. It must be noted that MCG property tax is one of the biggest sources of revenue for the MCG.

House tax payable to MCG

House tax is payable which is also property tax to the Municipal Corporation of Gurgaon. As already mentioned, property tax depends on certain factors like the type of property, location of it, etc. a residential property of various sizes attracts property tax of lower value than the ones imposed on the commercial property here. Following are the rates of property tax in Gurgaon which is also known as MCG property tax:

Property tax on Residential properties

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 300 sq. yard | Rs. 1 per square yard |

| 301 to 500 sq. yard | Rs. 4 per square yard |

| 501 to 1000 sq yard | Rs. 6 per square yard |

| 1001 sq. yard to 2 acres | Rs. 7 per square yard |

| More than 2 acres | Rs. 10 per square yard |

Tax Slabs

Commercial Spaces (Office spaces, multiplexes)

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 1000 sq yard | Rs. 12 per sq yard |

| More than 1000 sq yard | Rs. 15 per sq yard |

Commercial property (Shops on the ground floor)

| Area (in square yard) | Rate (in Rs. per square yard) |

| Up to 50 square yard | Rs. 24 per square yard |

| 51 to 100 square yard | Rs. 36 per square yard |

| 101 to 500 square yards | Rs. 48 per square yard |

Vacant land

Residential Properties

| Plot size | Rate (in Rs. per sq yard) |

| Up to 100 sq yard | EXEMPTED |

| 101-500 sq yard | Rs. 0.50 per sq yard |

| 501 and above | Rs. 1 per sq yard |

Vacant land

Commercial/Industrial/Institutional Properties

| Plot size | Rate (in Rs. per sq yard) |

| Up to 500 sq yard | EXEMPTED |

| 101 and above | Rs. 5 per sq yard |

| 501 and above | Rs. 2 per sq yard |

Concessions on property tax

A rebate or concession of 30% is permissible for one time for property owners who pay up their property tax dues within 45 days from the date of notification. A 10% amount is allowed as a concession to those owners who pay within 31st July of a particular year.

There are buildings and lands which are exempted from MCG property tax like any piece of land or building attached to a temple, mosque, or any religious place. And 50 percent exemption is given to government buildings but these buildings are not building by boards, corporations, autonomous bodies, etc.

Steps of payment

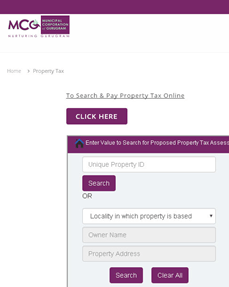

It is possible to pay MCG property tax in Gurgaon online and for that, you have to visit the portal for making the payment. Now, you’ve got to click on the tab mentioned as the ‘property tax tab’. Now you should enter the ID received by you or the name of the locality in which the property is located or the name of the owner and property address. You will find the tax details on the screen.

Now you should check the tax amount and click on the ‘pay tax’ tab and thus make the payment online via credit or debit card or bank online transaction through net banking. Just after the payment, there is a system of receipt generation that can be used for future needs. You may pay your MCG property tax offline too and you can play offline in Gurgaon at the property tax collection office or you may pay at any branch of a bank.

Due date and exemption

The due date for payment of property tax is 31st July of a year. If you pay property tax before the due date then you will be rewarded with an exemption of 10% of the tax amount.

1. How the payment of property tax in Gurgaon can be done?

You can pay your property tax by visiting the corporation website http://www.mcg.gov.in or you may deposit at the property tax deposit center.

2. How to find property tax ID?

You can find the ID number on the tax receipt of the previous assessment year or you may get it after submitting your details on the website.

3. How to pay property tax online?

You have to visit the MCG website. The address is https://www.mcg.gov.in/housetax where you have to click on the tab ‘pay property tax online’. You should now type property ID which you can find on last year’s receipt. If you don’t have it, you can enter your name and address and other details as needed, and the ID is seen on the screen. In case you don’t pay online, you can visit the property tax payment center where you can make the payments.