Since the reinforcement of the PMAY, the MIG housing plan has always been in the air for its diversified network of plans and proposals. For getting a better view of the policy and schemes that are operable under this category of the PMAY, we will provide a detailed discussion on MIG Housing Property meaning and its eligibility criteria along with the associated news and updates below.

Introduction to the Pradhan Mantri Awas Yojana (PMAY)

Before moving forward on the MIG housing scheme, a brief introduction to the Pradhan Mantri Awas Yojana will give you a clearer insight as to how the housing policy functions.

On 1st June 2015, the Government of India launched this policy under the Credit Linked Subsidy Scheme (CLSS) to provide for the ownership of houses for the poor and needy. The CLSS for MIG Schemes allows borrowers of home loans to get subsidized interest rates on their payments of EMIs against the outstanding loan amount for the entire tenure of payment.

The PMAY operates on various levels depending on the income slabs of the households. Even though, we will mainly focus on the MIG housing facility in this article, let us give a brief insight into the other housing facilities provided under this policy.

Besides MIG, the PMAY also provides subsidies to the economically weaker classes (EWS), people belonging to the low-income group (LIG) and the ones dominating the high-income group (HIG).

How does a MIG Housing Property plan operate?

To take a glance at the definition of MIG Housing Property, we may describe it as the facility provided to set up accommodations for the people belonging to the middle-income group. Such as, the people earning a sum which more than rupees six lakhs in a year roughly fall under this category.

Since the majority of the population count falls under the middle-income group with varying income and expenditure, the government of India has further classified the MIG housing programme into two sub-division that is namely MIG I and MIG II. We will give a broader perspective on both the divisions of the MIG scheme at the length of this article below.

Types of MIG plans:

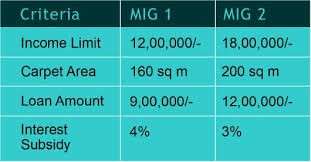

MIG I – For this category, the people earning an annual income of Rupees 6 lakhs to 12 lakhs can apply for an accommodation subsidy.

MIG II – Households with an annual income of Rupees 12 lakhs to 18 lakhs are categorized under the MIG II scheme.

Key pointers and comparison between MIG I and MIG II:

Total area: MIG Flats and area size also varies between its two divisions. Carpet area allotted for MIG I households is 160 sq. m whereas, the carpet area for the build-up of MIG II households is 200 sq. m. This number was initially 90 sq. m for MIG I and 110 sq. m for MIG II on the commencement of the PMAY but gradually was increased to 120 sq. m and 150 sq. m depending on the requirements and earnings of the households.

Do yo Know? Loan Amount and Interest: The MIG I Home Loan caters to provide up to Rupees 9 lakhs with an interest subsidy at a rate of 4% per annum. On the contrary, the MIG II home loan scheme provides a household to be eligible to get up to rupees 12 Lakhs home loan at 3% interest subsidy per year.

Eligibility Criteria to be met for applying in the MIG housing Property scheme:Tenure: The payment of the EMIs against the Home Loans taken under the MIG housing plan can be done in a period of 20 years. The maximum tenure is set to 20 years for both MIG I and II housing scheme.

Here are some of the grounds on which an individual needs to stand firm for being eligible to enjoy the benefits and features provided by the Pradhan Mantri Awas Yojana for owning an urban dwelling at the desired location.

An individual applying for MIG Housing Property loan under the PMAY must not possess a pucca house in his or her name. Also, that individual will not be eligible if his or her family member owns a household in any part of the country.

The persons applying for the benefits of the PMAY must not be assisted under any other scheme or facility for building accommodation by both the state and the central government.

The applicant’s income should not exceed the yearly income slab of rupees 18 lakhs to qualify for the MIG Housing Property plan.

Female applicants for ownership of the households are prioritised over male applicants. Male applicants are only considered when the applicant’s households lack an adult female.

The location of the property for which the applicant claims ownership should be under the planning area as proposed in the 2011 census of the statutory towns laid down by the government of India.

Aadhaar Card is one of the must-possess documents required for filing an application for the PMAY. Aadhar Cards of both the applicant and the co-applicant is required who must be an adult member of the household.

Also Read:

MIG Housing Property: Credit Linked Subsidy Scheme

West Bengal Housing Board

Chandigarh Housing Board

Rajasthan Housing Board

Jaipur Development Authority