Mysore, located in the southern state of Karnataka, is a popular tourist destination known for its rich cultural heritage and magnificent architecture. The city has many historical palaces, temples, and landmarks that attract visitors worldwide. However, with growth comes the responsibility of maintaining civic infrastructure, and the Mysore City Corporation levies a property tax on all properties within its jurisdiction to fund these services.

The Mysore City Corporation Property Tax is a yearly tax levied on residential and commercial properties in Mysore. The tax is calculated based on the property’s Annual Rental Value (ARV) and rental value for a year. The ARV is determined by the Mysore City Corporation based on various factors, including location, age, size, and type of property.

In this article, learn how to pay the Mysore property tax online, offline, and more.

Table of contents

- Online Payment Guide for Mysore City Corporation Property Tax

- Offline Payment Methods for Mysore City Corporation Property Tax

- Hassle-Free Payment of Mysore City Corporation Property Tax through Karnataka One Portal.

- Mysore City Corporation Property Tax Exemption Categories

- Frequently Asked Questions (FAQs)

Online Payment Guide for Mysore City Corporation Property Tax

Paying Mysore City Corporation Property Tax online is a simple and convenient process that can be completed from the comfort of your home or office. Here’s how:

Step 1 – Visit the official website of Mysore City Corporation Property Tax and select the “Online Services” tab.

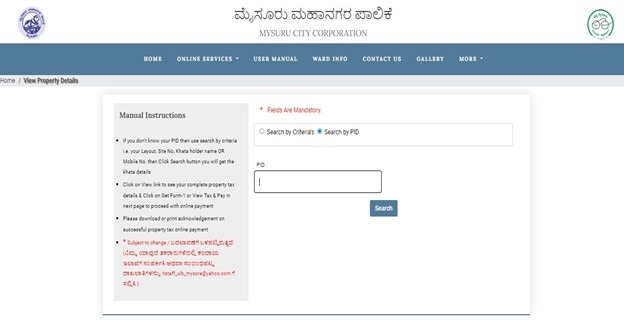

Step 2 – Click on the “View Property Details and Pay Online” option and enter your Property Identification Number (PID), a unique number assigned to your property.

Step 3 – Once you enter your PID, your property details will be displayed on the screen. Check the details and click on the “Pay Now” button.

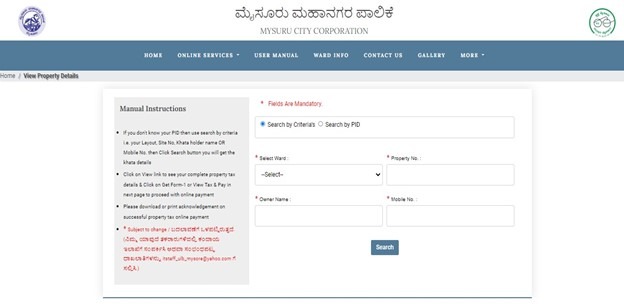

Step 4 – You can also pay Mysore property tax using the ‘Search by Criteria’ option if you do not have a PID number.

Step 5 – Provide and fill in the details such as the Ward Number, Property Number, Owner Name and Mobile Number. Click on Search, and the screen will display all your details.

Step 6 – Select the mode of payment to complete the process.

Step 7 – A receipt will be generated once the payment is processed successfully. Save the receipt for future reference.

Offline Payment Methods for Mysore City Corporation Property Tax

If you prefer to pay your Mysore City Corporation Property Tax offline, visit any of the city’s designated tax collection centres. Here are the steps:

Step 1 – Visit the nearest designated tax collection centre and obtain a challan form.

Step 2 – Fill in the required details, such as your PID, property details, and the amount of tax due.

Step 3 – Submit the form and payment at the designated counter.

Step 4 – Collect the receipt from the counter for future reference

Hassle-Free Payment of Mysore City Corporation Property Tax through Karnataka One Portal.

Karnataka One Portal is an online platform that provides a wide range of services, including payment of property taxes. Here’s how to pay your Mysore City Corporation Property Tax using the Karnataka One Portal –

Step 1 – Visit the official website of Karnataka One.

Step 2 – Select the Mysore city name to pay your Mysore City Corporation property tax.

Step 3 – Register on the portal by providing details such as your name, mobile number, and email address.

Step 4 – Login to the portal using your credentials if you have already registered.

Step 5 – Choose the Property Tax Payment Online option from the range of services in the drop-down tab. The Mysore City Corporation Property Tax Payment Page will be redirected to you.

Step 6 – After entering your PID number, click the Search icon.

Step 7 – Insert the necessary information, including the property number, ward number, phone number, and Mysore City Corporation Property Tax payment amount.

Step 8 – Select the mode of payment and enter the required details.

Step 9 – Accept the terms and conditions and pay the Mysore City Corporation property tax. To submit the transaction, you must click the Ok button. A receipt will be generated once the payment is processed successfully.

MUDA Property Tax Made Easy: Online Payment

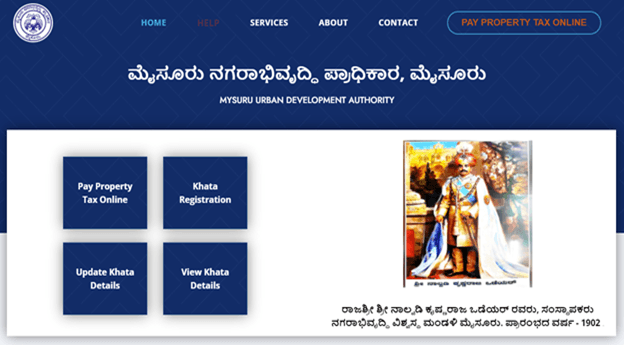

MUDA (Mysore Urban Development Authority) is a local planning and development agency that collects property taxes for properties under its jurisdiction. Here’s how to pay your MUDA Property Tax online:

Step 1 – Visit the official website of MUDA

Step 2 – Select the “Pay Property Tax Online” option and complete the required details.

Step 3 – Select the layout and site number and click the ‘Search’ button.

Step 4 – The payment can also be made using the Khata holder’s name and mobile number.

Step 5 – Select the mode of payment and enter the required details.

Step 6 – A receipt will be generated once the payment is processed successfully.

When is the Last Date to Pay the Mysore Property Tax?

Every fiscal year, the deadline for online payment of Mysore property taxes is March 31. Paying the tax before the due date is advisable to avoid penalties and interest charges. The authority imposes a 2% monthly penalty if the tax payment is not submitted on time.

The deadline is usually announced in the local newspapers and can also be checked on the official website of the Mysore City Corporation.

Don’t miss It!: Bangalore Property Tax

Mysore City Corporation Property Tax Exemption Categories

Certain properties are exempted from paying the Mysore City Corporation Property Tax. These include –

- Buildings or land owned by the union or state government, corporations, and political parties.

- Agricultural lands.

- Properties are owned by charitable institutions, educational institutions, hostels, libraries, and religious organisations.

- Disabled corporation officers.

However, it is important to note that the exemption is subject to certain conditions and eligibility criteria, which can be checked on the official website of the Mysore City Corporation.

Conclusion

In conclusion, paying property tax is a civic responsibility that enables the local government to provide essential services and maintain civic infrastructure. By understanding the payment methods, exemptions, and deadlines for the Mysore City Corporation Property Tax, property owners can fulfil their obligation and contribute towards the development of the city.

Read More – Municipal Property Tax Online

Frequently Asked Questions (FAQs)

When was the online portal for Mysore corporation property tax payment launched?

The Mysore City Corporation launched a new online service on April 2020 for the Mysore residents to enable them to pay property tax amidst the COVID crisis.

What are the different payment methods for Mysore corporation property tax?

Mysore property tax payments can be made online or offline. The various modes for online payment are NEFT, debit or credit card, UPI payments, or RTGS. However, for offline tax payment, you can pay through cash, cheque or demand draft.

What is the due date for the Mysore property tax payment?

Every fiscal year, the due date to pay the Mysore property tax online is March 31.

How much is the penalty for delay in Mysore corporation property tax payment?

If the Mysore property tax payment is not made on time, the officials charge a 2% penalty every month.