Residential project launches across the country had come to a standstill in March 2020 post the lockdown. One year hence, the situation seems promising. The latest data by Square Yards show a quarterly rise of 19% in the number of new project launches in the Jan-Mar 2021 quarter across the top six cities in the country.

Real estate markets across the country had significantly revived since the lifting of the lockdown in the third quarter of 2020. Today, the pent-up demand and supply have converted into investments and sales volumes that are higher than pre-COVID levels. The graph for new launches is no different.

Timely fiscal support by the government coupled with improved buying sentiments on the back of sustained low-interest rates and slashed stamp duty; the vaccine rollout, ease of lockdown restrictions, and resumption of construction activity have given developers the spine to launch projects that had been held back.

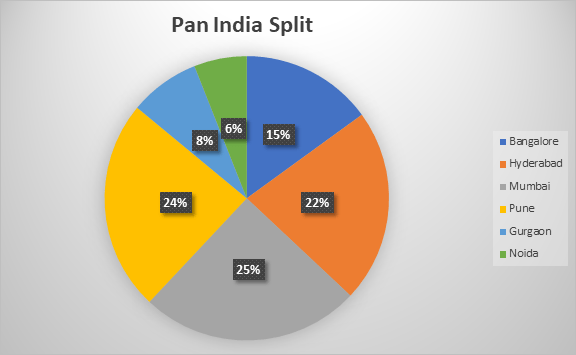

As per data with Square Yards, cities that have recorded significant growth in new launches in Q1 2021 are Mumbai, Pune, and Hyderabad. Together these cities accounted for more than 70% of the total new launches in the Jan-Mar 2021 quarter.

Mumbai and Pune were the most active with a share of 25% and 24% respectively.

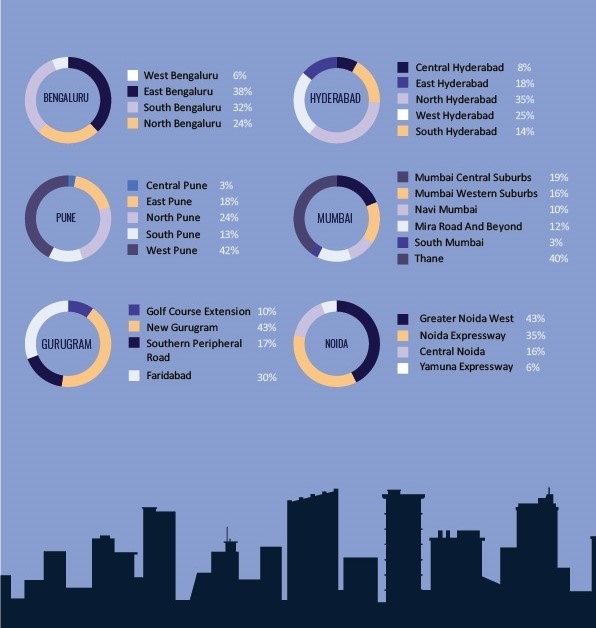

Here’s a closer look at the Zone Wise Supply- Q1, 2021

In Mumbai, Thane was the most active micro-market with a share of 40% in the number of project launches since the last quarter.

Multiple infra-projects such as the Thane-Wadala Metro 4, Mumbai Metro Line 4 A, Mumbai Metro Line 5, extension of the Mumbai Coastal Road to Ghodbunder road, Thane-Borivali underground tunnel, Thane-Ghodbunder elevated corridor, and multiple flyovers have rendered Thane an attractive investment destination. This has resulted in developers queuing up to have projects here.

Also, COVID has altered buyers’ preferences with respect to the location and sizes of homes. With work from home becoming the norm home buyers are now looking for homes that fulfill the need for safety and space. Staying close to the city centre is no more a priority. With relatively more space available for development, Thane scores over other zones in the MMR.

Pune was a close second with a 24% share of the new launches. West Pune contributed to 43% of these launches. Being home to multinational IT companies, several universities, and automobile plants makes it the top choice for residential development. Moreover, excellent connectivity to Mumbai-Pune Expressway also ensures high demand here.

Hyderabad has surpassed Bangalore with a 22% share of the new launches. Talking about the residential development of the city, the Telangana government’s good deeds can’t be overlooked since they launched a TS-BPASS scheme that turned out to be a blessing in disguise for the realty developers. It promoted the single clearance window that paved the way for easy clearances for the construction of houses.

Moreover, the most active micro-market North Hyderabad contributed to 35% of the launches. The one-stop reason for these numbers was the saturation level of west Hyderabad that paved the way for investments in northern and eastern parts of the city, backed by a couple of infra-projects such as the Shamirpet, Genome Valley 2.0, and Siddipet.

Coming to Bangalore’s share, it contributed 15% of the new launches. The numbers were justified as launching new projects in Bangalore’s real estate market has always been a wise investment as it offers sound prospects in regards to price appreciation and rental returns. Likewise, the Bangalore government has always been on roll to boost the real estate sector. They sanctioned a stress fund of Rs 25,000 crore to complete stalled projects and also introduced an incentive package to give income tax relief to developers.

New Gurgaon a flourishing hotspot contributed to 43% of the new launches. The reasons for this number are self-explanatory since Gurgaon is on a verge of saturation and developers are left with no option other than to shift their focus towards New Gurgaon. Being a breeding ground to 500 multinational companies and IT firms makes it a top choice for residential development.

Last but not least, Greater Noida West was the most active micro-market with a share of 40% in the number of project launches since the last quarter. In no time it saw an upward trajectory due to the state-of-the-art development of the Yamuna Expressway, extension of the metro line, and international airport at Jewar.

Real estate developers are optimistic about the future of the real estate industry and are looking forward to fruitful and brighter days. There is a prediction that there will be higher demand and lesser supply in the foreseeable future, that is why developers are all geared up to launch new projects. In a nutshell, they are all set to get the best bang for their buck as they want to leave no stone unturned.