The PAN card plays a crucial role in every citizen’s life. With PAN, you can pay taxes, file for returns, use it as your address and identity proof and much more. PAN application online is acceptable in two verified and prominent websites: one of which is NSDL (National Securities Depository Limited). Offering an easy PAN application and tracking process, NSDL is a reputed and trusted website for PAN cards.

To get your new PAN card or apply for corrections to it, you can visit the NSDL online portal. In this article, let’s get to know how to apply for NSDL PAN, submit payment, and fill the correction form as and when required.

TIN NSDL Offered Following PAN Services

Here are the PAN services offered by the TIN NSDL portal:

- Apply for a PAN card online at NSDL online portal.

- Enquire about the PAN status.

- Reprint your PAN card using existing PAN details or revised information.

TIN NSDL PAN Card Application Procedure

Here’s a concise guide on how to apply for a PAN card through NSDL, simplifying the process for all.

- Initiate Registration: Indian citizens, whether within the country or abroad, can use Form 49A for PAN application. Upon selecting the appropriate category and title, applicants fill in the required details and submit. A unique token number is generated and sent to the provided email for reference.

- Data Entry Convenience: The online PAN application allows applicants to save details for future edits using the temporary token number. This feature ensures flexibility and accuracy in submitting the final form.

- Selecting Application Options: During the online application process, applicants can choose from four options. This customisation caters to individual needs, making the process more buyer-oriented.

- Format Validation: The system promptly identifies and displays any format-level errors, enabling applicants to rectify and resubmit the form. This ensures that the application adheres to the required standards.

- Confirmation and Modification: Once the application passes validation, a confirmation screen displays the filled data. Applicants can edit or confirm the information, providing a final review before submission.

Offline Procedure

The following depicts the steps involved in applying for a PAN Card offline.

- Download or Collect the Form: You can download the PAN Card application form from the official NSDL website or pick up a copy from nearby NSDL agents.

- Carefully Fill the Form: Follow the instructions meticulously while filling in the form. Provide accurate details such as your full name, residential address, birth date, gender, and contact number.

- Submit the Form to the NSDL Office: Once complete, submit it along with the required processing fee to the nearest NSDL office.

- Wait for Processing: NSDL will process your application, and you can expect to receive your PAN Card within 15 working days.

Steps to Apply NSDL PAN Application

Given below are the steps you need to follow for an NSDL PAN Application.

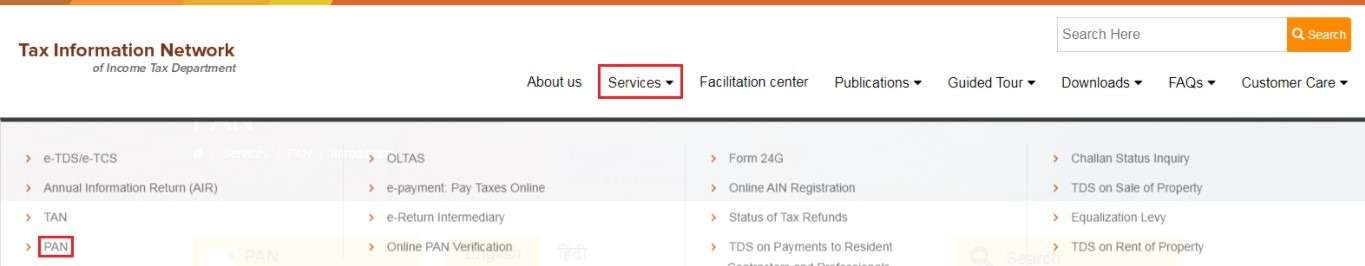

Step 1: Go to the TIN-NSDL online portal. Select Services and choose the PAN option from the dashboard.

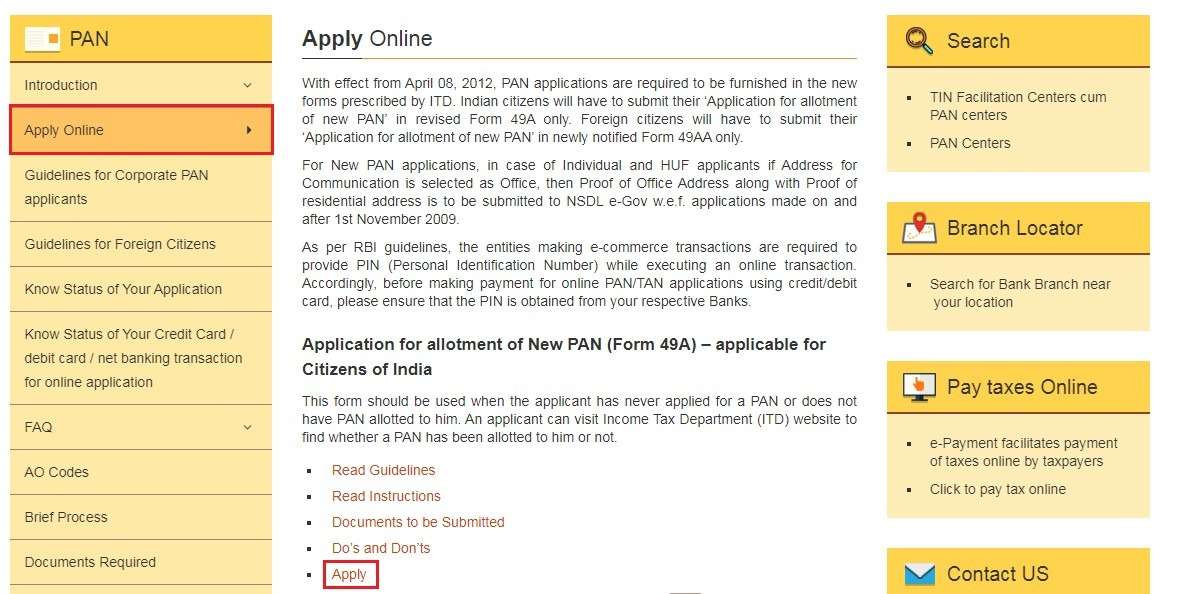

Step 2: Press the Apply option. After choosing your nationality as an Indian citizen, select Form 49A. If you are a foreign citizen, select Form 49AA.

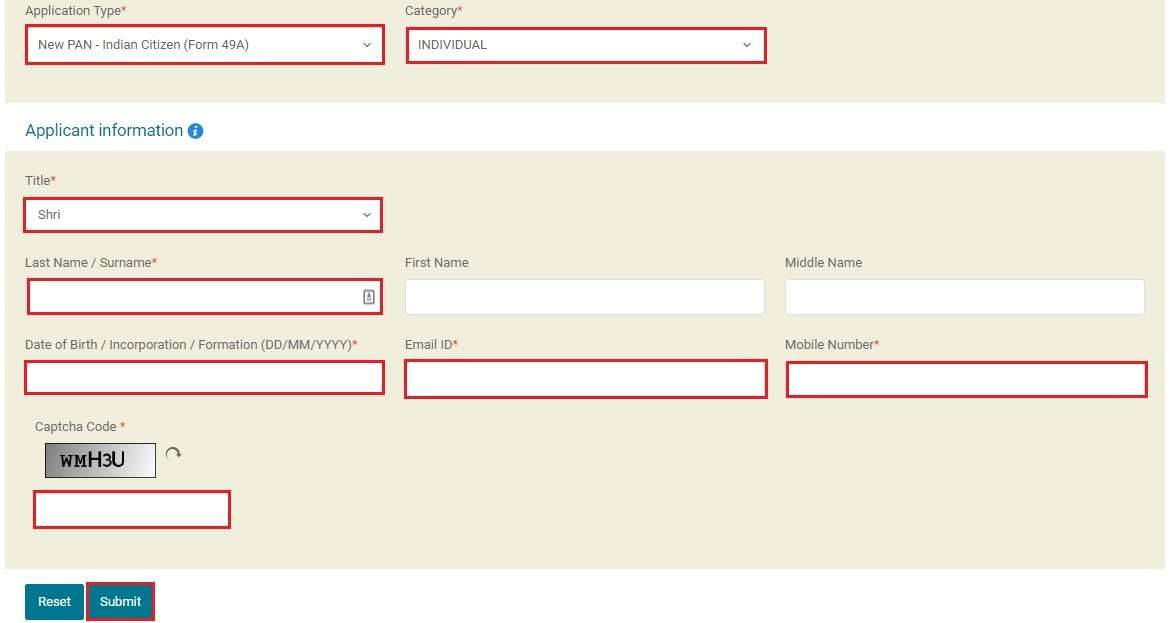

Step 3: Enter all the following details by selecting the correct information from the drop-down boxes.

- Your Application Type

- Your Category

- Your Title

- Your Name and Surname

- Birth Date

- E-Mail Address

- Contact Number

- Captcha Code (from the image given)

Step 4: Press the Submit option. Ensure that the details you gave are correct. Before submitting the form, please check them once.

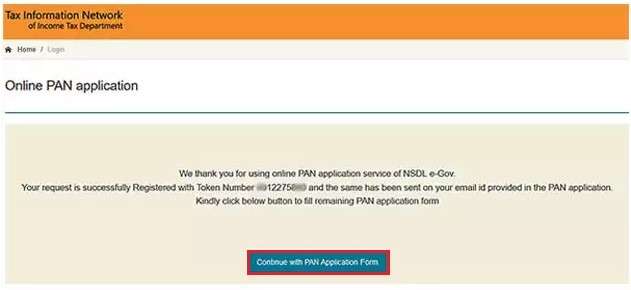

Step 5: Within a matter of a few seconds, a token number will appear on your screen. Click on the given link to continue to the next page.

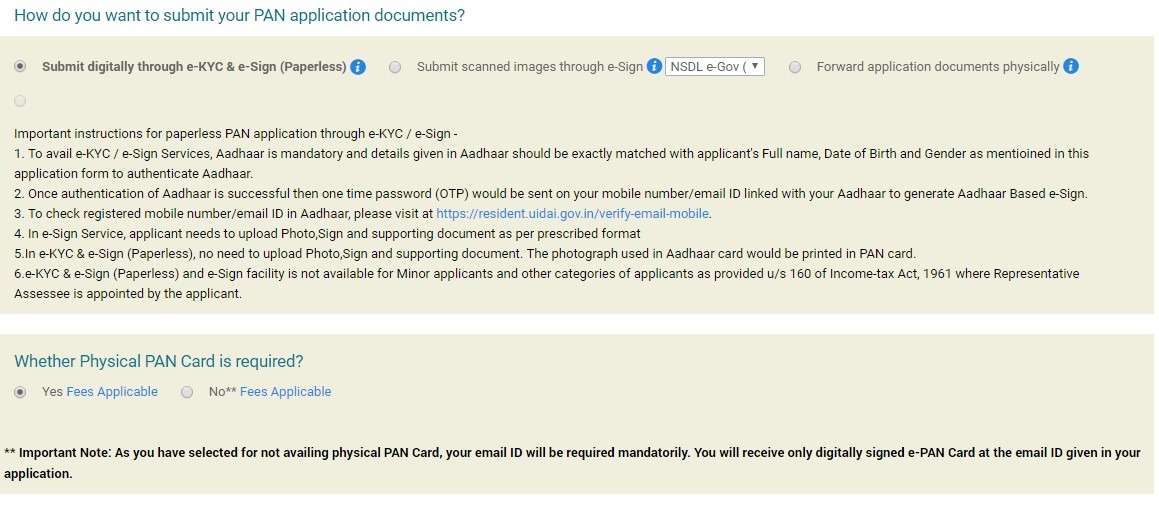

Step 6: Select any of the following options:

- Submit the documents and signature digitally via e-KYC and e-Sign.

- Submit the scanned images using e-Sign.

- Forward your PAN application documents manually.

Step 7: Select from the options whether you want PAN in physical form or need e-PAN.

- To receive PAN in the physical form, enter your communication address.

- To get a digitally signed e-PAN, enter your email address.

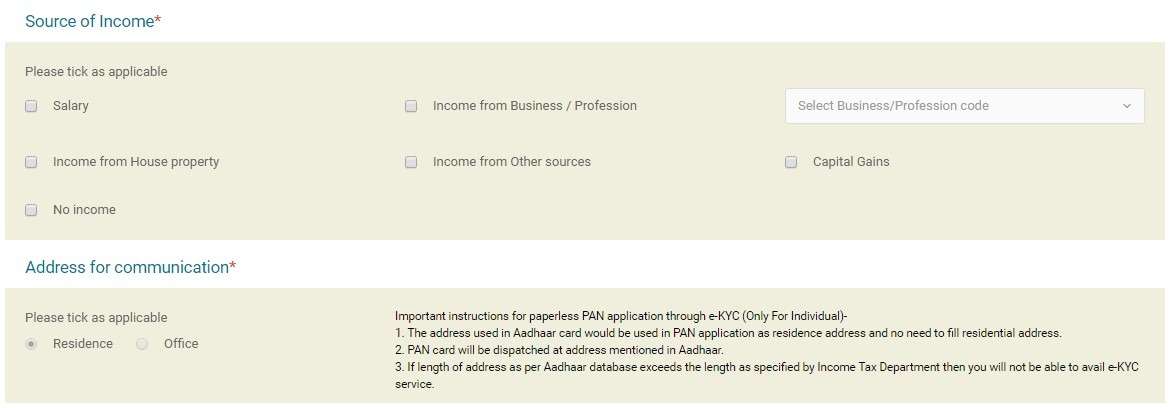

Step 8: Tick the check-box and select the Source of Income and Address option for the communication segment in the form.

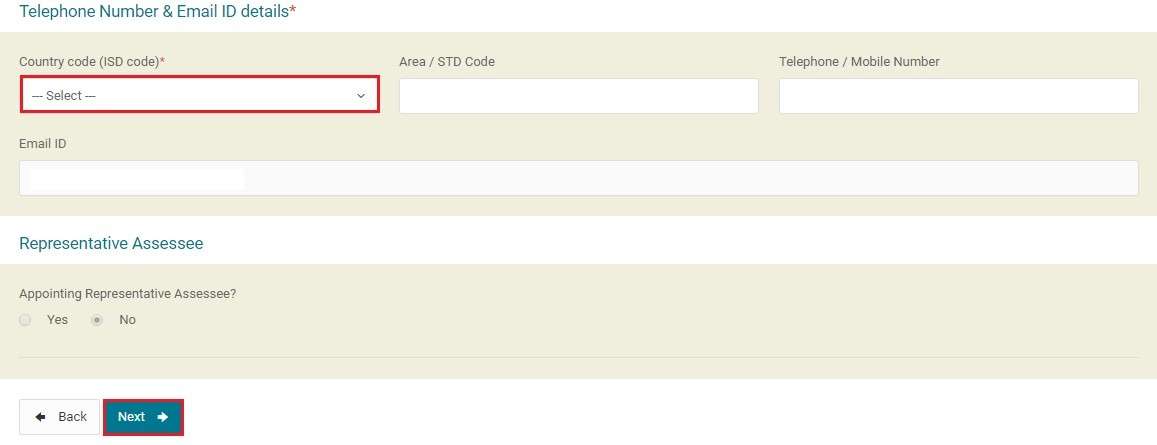

Step 9: Write your country code (ISD Code). The option will be given under the Telephone Number & Email ID Details section. Click on the hit option.

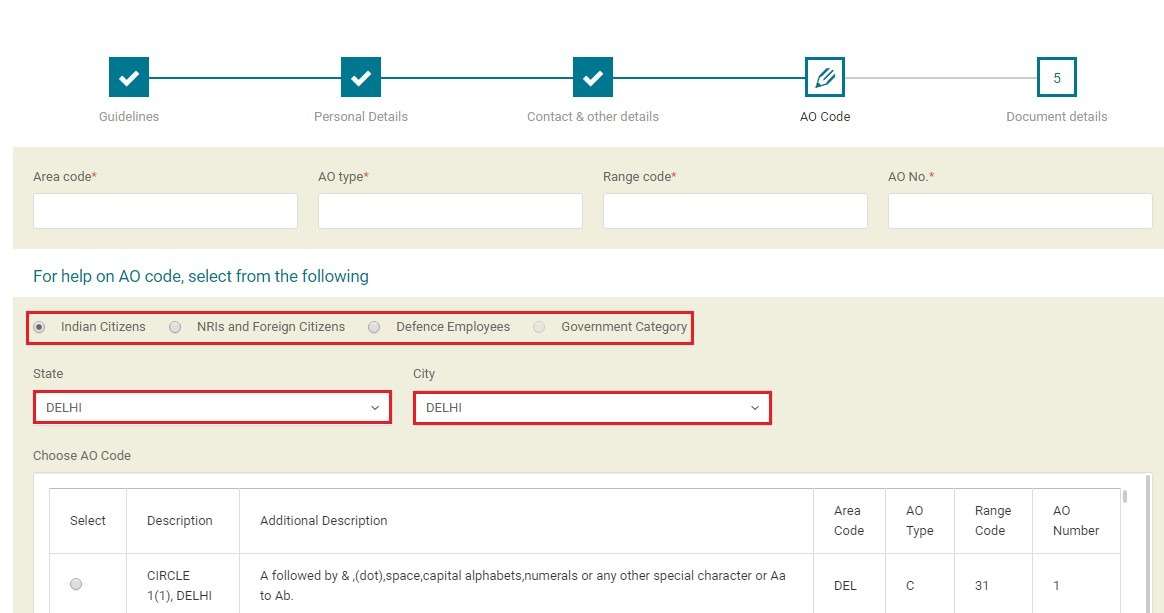

Step 10: Fill in the required information in the AO section. Write Applicant type, State, and City.

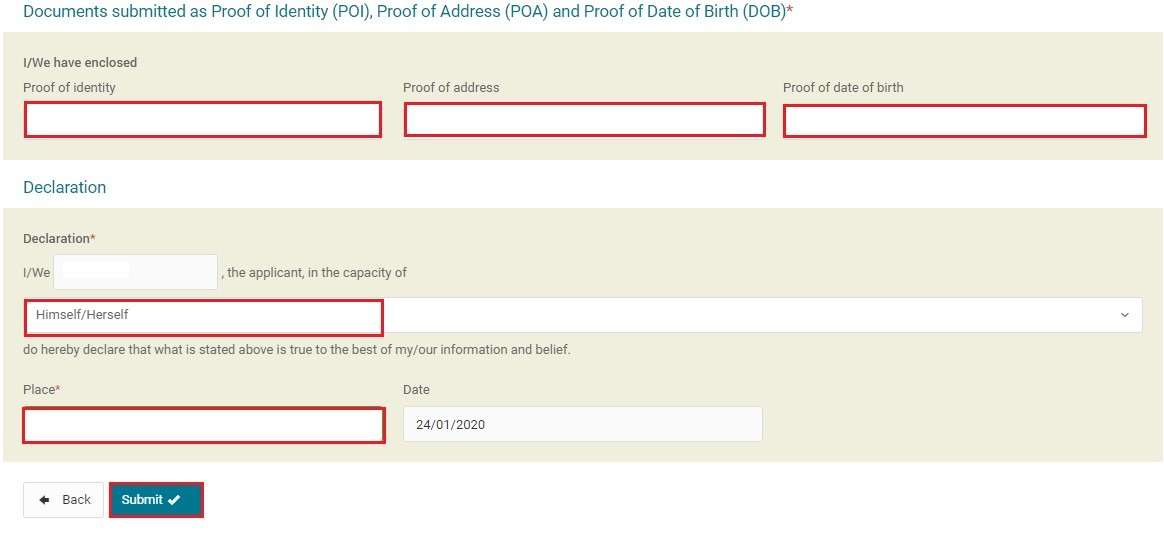

Step 11: Upload the scanned copies of the following:

- Identity Proof

- Address Proof

- Birth Date

Step 12: Select the applicant type from the drop-down list. Finally, hit the submit option.

Step 13: Submit the documents digitally through the e-KYC and e-Sign (option after step 8).

- Digital Photograph

- Digital Signature

- Supporting Documents

After the completion of the payment process, you will receive your PAN within 15-20 days. You can also track your PAN status if you want on the NSDL portal.

How to download an updated PAN card via NSDL?

Here is how you can download an updated PAN Card via NSDL.

- Visit the NSDL PAN Application Portal: To initiate the process, access the NSDL PAN application portal. The user-friendly interface ensures a seamless experience.

- Select ‘Reprint of PAN Card’: Navigate to the portal’s ‘Reprint of PAN Card’ section. This option allows you to download an updated version of your PAN card.

- Provide Necessary Details: Accurately enter your PAN number and other required details. This ensures that the updated card reflects the correct information.

- Validate Through OTP: NSDL ensures the security of your information. To validate your details, a one-time password (OTP) will be sent to your registered mobile number.

- Make the Payment: A nominal fee is charged for the reprint service. You can securely make the payment through the available online payment options.

- Download PAN Card PDF: Once the payment is confirmed, you can download the updated PAN card in PDF format. This digital copy is valid and can be used for various purposes.

How to fill PAN Card Form 49A Online for Indian Citizens?

Indian residents have to fill Form 49A available on the NSDL website. Here are the details you have to fill in your new PAN application card.

- Assessing Officer Code

- Complete name

- Name you to want to see on your PAN card

- Other names (if any)

- Your gender

- Your birth date or date of incorporation, agreement, partnership or trust deed, an association of persons

- Information about parents (individuals only)

- Complete Communication Address (office or residential)

- Official Indian addresses and documents. R for residential and O for office

- Contact number and email address

- Applicant status

- Registration number

- Income source

- Name and address of the representative assessee

- Proof of identity and address

- Depository account

- Signature or impression of left thumb

How to Submit Online PAN Card Application and Make Payment?

After you fill the PAN card application form, submit it. If there are any errors or missed fields, you will be prompted to make the necessary changes. After confirming all the data, you have to resubmit the form.

Delivering charges for PAN cards (India): Fee is Rs.110 + processing fee of Rs.93 + 18% GST

Delivering charges for PAN cards (Outside India): Fee is Rs.1020 + Application fee of Rs.93 + Dispatch Charges + 18% GST

On the payment page, use any of the net banking modes as follows:-

- DD (Demand draft)

- Debit Card

- Credit Card

- Net banking

After paying successfully, a PAN card acknowledgement number will appear on the screen. Take a printout of this document with all the information. You will have the following data on the screen:

- A unique 15 digit Acknowledgement Code

- Applicant’s category

- Name of the Applicant

- Name of Applicant’s Father (Individual)

- Birth date (individual) or date of incorporation (for organisations/agreements/trust/ association of persons)

- Communication address

- Name and address of the representative assess

- Photograph

- Details of the payment

- Signature space

- Your Aadhaar number

- Address and identity proof details

- An acknowledgement to indicate the change or correction in required fields.

How to Pay for a Pan Card Application Form?

- After taking out the print of your form, affix your photograph (in the case of individuals).

- If you are using a Demand Draft, attach it with your form.

- Attach the copies of each of your IDs along with your address and birth date.

- Sign your document.

- Now place the form and document in an envelope and write Application for PAN for change request along with your 15-digit Acknowledgement Number.

Make sure that your documents reach the following address within 15 days.

Address: Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016′.

Note: In 15 days, your PAN card will reach your address.

How to Fill PAN Card NRI Form 49AA Online?

All foreign citizens, companies, firms, or corporations who want to open offices in India have to fill Form 49AA on the NSDL website. Here are the following details NRIs have to fill in.

- Assessing Officer Code

- Complete name

- Name just like you want to see on your PAN card

- Any other name, if you have any

- Your gender

- Your birth date or date of incorporation, agreement, partnership or trust deed, an association of persons

- Information about parents (individuals only)

- Complete communication address (office or residential)

- Official Indian Addresses and documents. R for residential and O for office

- Contact number and email address

- Applicant status

- Registration number

- Income source

- Name and address of the representative assessee

- Country of citizenship

- ISD Code of the country of citizenship

- Proof of identity and address

- Depository account

- Signature or impression of left thumb

How to Submit an Online NRI PAN Card Application and Make Payment?

After submitting the PAN card application form, if there are any errors or missed fields, you will be asked to make the necessary changes. After confirming all the data, resubmit the form.

Delivering charges for PAN cards (Outside India): Fee is Rs.1020 + Application fee of Rs.93 + Dispatch Charges + 18% GST

Now, on the payment page, use any of the following net banking modes:

- DD (Demand draft)

- Debit Card

- Credit Card

- Net banking

After paying successfully, a PAN card acknowledgement number will appear on the screen. Take a printout of this document with all the information. You will have the following data on the screen:

- A unique 15 digit Acknowledgement Code.

- Applicant’s category

- Name of the applicant

- Name of applicant’s father (Individual)

- Birth date (individual) or date of incorporation (for organisations/ agreements/trust/ association of persons)

- Communication address

- Name and address of the representative assessee

- Photograph

- Details of the payment

- Signature space

- Your Aadhaar number

- Address and identity proof details

- Country of citizenship

- ISD Code of the country of citizenship

- An acknowledgement to indicate the change or correction in required fields

How to Pay for an NRI PAN Card Application Form?

- After taking out the print of your form, affix your photograph (in the case of individuals)

- If you are using a Demand Draft, attach it with your form.

- Attach the copies of each of your IDs along with your address and birthdate

- Sign your document

- Now place the form and document in an envelope and write Application for PAN for change request along with your 15-digit Acknowledgement Number

Make sure that your documents reach the following address within 15 days.

Address: Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016′.

Note: In 15 days, your PAN card will reach your address.

How to Reprint NSDL PAN Card Online?

There are two reasons for which a new PAN card can be issued:

- You need a duplicate PAN card.

- You want to make some changes to your PAN card information.

To make any change in the information or PAN card change, you have to fill a form. The form is available for both Indian and foreign citizens.

You have to fill in all the mandatory details as asked in the application form. For changes you want, tick on the left side of the option. Otherwise, you can leave the field empty.

How to Fill NSDL PAN Card Corrections Form Online?

Follow the below steps to fill in your NSDL PAN Card Corrections Form online.

- Write the following mandatory information in your PAN card application form:

- Your complete name.

- Your name as you want on your PAN card.

- Write your Gender.

- Write the birth date (individual) or incorporation date (for organisations/ agreements/ trust/association of persons).

- Complete information about your parents (individuals only).

- Make sure to mention if there is a mismatch of the photo or signature.

- Right communication address.

- Update your other address (If any).

- Contact number and email address.

- Aadhaar number (individual).

- Any other PAN you have.

- Your signature or left thumb impression.

- Enter your ten-digit PAN card number.

- Tick the boxes of the appropriate fields on the left margin that require correction.

- Upon filling the form, verify and confirm all the details.

- An acknowledgement notification will be displayed on the screen along with the information you have provided in the form.

- Save and print the acknowledgement.

What to do after Printing in the Acknowledgement?

- For Individuals: Attach a current colour photograph in the blank space designated for the photo. Do not staple or clip it.

- Put your signature in the assigned box in the acknowledgement.

- Send the acknowledgement to the NSDL office in Mumbai along with the following documents:

- Existing PAN card

- Identity and address proof

- Proof for the change/correction requested in PAN.

- On the envelope, mention Application for Change Request (in block letters) followed by your acknowledgement number.

- Add your demand draft or cheque for PAN correction payment with the set.

- Finally, send it to the below address:

National Securities Depository Limited, Trade World, A Wing, 4th Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel (W), Mumbai 400013

The whole set of acknowledgements, documents and payments will reach the NSDL office within 15 days from your online application. Ensure that you provide the correct documents else your application will not be processed.

Things to Keep in Mind When Making Payment for NSDL PAN Correction

- The fee for Changes/Correction in PAN is Rs. 96, wherein Rs. 85 is the application charge, and an added 12.36 percent service tax is levied.

- PAN correction fees are only accepted on demand draft or cheque in favour of ‘NSDL – PAN’.

- If you pay the fees by cheque, deposit a local cheque, mentioning NSDLPAN on the deposit slip at any HDFC Bank branch.

- Ensure to mention your name and acknowledgement number on the backside of the demand draft or cheque.

- The demand draft and cheque can only be paid in the Mumbai branch of NSDL.

How to Check the NSDL PAN Status?

You can quickly check the status of your PAN card application and the payment following the steps written below:

NSDL PAN Status of Application

- On the NSDL website, press the Track your PAN/TAN application status available under the PAN card option.

- Choose the type of Application.

- Write your PAN acknowledgement number.

- Write your birth date and name.

- Hit the submit option to check your status.

All the information you have written in the application form must be correct and appropriate. Non-individuals can fill in the surname in the name text field. Further, you can search for the status using your name or birth date within 24 hours of application.

Pan Card Status NSDL for Application Payment

To find your payment status, click the option of Know Your Pan Card Status Transaction for Online Application.

- Enter your Transaction number or Acknowledgment number of your PAN Card.

- Write your name.

- Write your birth date.

- Click on Show Status to view your status of the transaction.

You will see the transaction ID once you pay using a credit card, debit card, or net banking on the screen.

Frequently Asked Questions (FAQs)

What is NSDL in a PAN Card?

NSDL is a National Securities Depository Limited company established in 1996. You can visit NSDL for a PAN card, fill PAN card application, and check PAN Card Status on NSDL.

Is NSDL a government company?

No, NSDL is not a government-owned company but a privately held and professionally managed establishment under government authorisation to offer depository services.

How to find my AO code?

You can check the AO codes available on the NSDL portal. Go to the homepage, select the Services option and choose the PAN card option. From there, you will see another option of AO Codes. Hit the option. You will see the following:

● PAN AO Codes for International Taxation

● PAN AO Codes for Non-International Taxation (apart from Mumbai region)

● PAN AO Codes for Non-International Taxation (Mumbai region)

● PAN AO Codes for Defence personnel

For PAN, the demand draft made must be in whose favour?

If you are paying the PAN application fee using Demand Draft, it will be in the name of NSDL-PAN at the Mumbai address.

Is it possible for someone to pay for my PAN Card application on my behalf?

Yes, anyone from your immediate family can pay for your PAN card application. You can check the points mentioned below:

● Individual: You can do it on your own or any immediate family member, including spouse, parents, or children

● Company: Director(s) of the company

● Limited Liability Partnership or Firm: Any partner of the LLP

● Association of Person(s)/ Person(s) Trust/Artificial Juridical Person/Local Authority/Body of Individuals: Authorised Signatory under section 140 of Income Tax Act, 1961

● HUF – HUF Karta

Are there service charges while paying online for the PAN application?

Yes, there are service charges for paying the PANM application fee. It depends on the mode of online payment you are using. The fees are a 2% fee and applicable tax by the payment gateway on both credit and debit cards. For net banking, the service tax by the payment gateway is Rs. 4.

In which circumstances can I cancel my PAN Card?

In two cases, you can cancel the PAN card. Here are they:

● You are surrendering your PAN card (because you have multiple PAN cards). To surrender, visit the nearest local Income Tax Assessing Officer. You have to submit a written letter requesting to cancel one of your PAN.

● To surrender one of your multiple PAN online, you can visit the Income Tax Department website. Share the details of both the PANs (the one you want to cancel and the one you want to retain).

What are the benefits of NSDL?

NSDL offers the issuance of non-cash corporate benefits like bonuses, rights, and others. It also provides direct credit of non-cash corporate to investors accounts, thus, ensuring disruption faster. Further, it helps avoid the risk of loss or mixup of certificates.

Can a person keep more than one PAN card?

No, individuals are strictly prohibited from holding multiple PAN cards. Maintaining one PAN card per person is essential to ensure accurate financial transactions and compliance with income tax regulations.

How to change or update the photo on the PAN Card?

To update the photo on your PAN card, you can submit a ‘Request For New PAN Card Or/ And Changes Or Correction in PAN Data’ application. Download the form from the official website. Complete the form, attach the necessary documents, and send it to the designated NSDL address for processing.