NSE Bulk deals and NSE Block deals are two different types of deals on the stock exchange that every trader and investor must know. Therefore, if you are a beginner in the stock market and pondering what they are, we have got you covered.

Institutional and Retail are two market participants that drive the stock market. After extensive research and valuation in the market, the participants trade in a large number of shares.

When a high volume of shares are traded on the National Stock Exchange or Bombay Stock Exchange in one tranche, such deals are referred to as Bulk and Block deals. The volume and numbers of shares involved are significantly large.

If you are an active participant in the stock market, you will often stumble upon such terminologies. Moreover, you can end up following these deals for trading or investment. Amongst them, many may take months or years to render returns.

To know more about their working process, etc., keep reading until the end!

What is the NSE Bulk Deal?

NSE Bulk deal refers to a deal where more than 0.5% of the number of equity shares of the registered company are bought or sold on the National Stock Exchange. Bulk deals take place during the regular trading window that your brokers offer. It’s a market-driven deal.

Every market participant has access to view trading on the stock exchange. The broker in charge of handling the bulk deal has to render information about the transactions.

If the deal takes place via a single transaction, the broker has to notify the exchange instantly. On the contrary, if the deal ensued via multiple transactions, the broker must report the exchange within an hour from the closure of the trading day through the Data Upload Trading Platform.

Once the broker has informed the exchange, they have to notify the public as well. Notification is issued after the market closes, therefore, it becomes crucial to inform the participants on the same day of the trade.

In case 0.5% or more shares are bought and sold during the same trading session, it would be considered as two separate bulk deals and will need two different disclosures.

What is the NSE Block Deal?

NSE Block deal refers to a deal type where more than 5 lakh shares of trading take place.

The deal requires a separate trading window. It occurs at the beginning of trading hours, which is from 9:15 AM to 9.50 AM. It implies that the deal continues for 35 minutes.

According to the rules of SEBI (Securities and Exchange Board of India), the price of a share ordered at the window must vary within the current market price of +1% to -1% or the closing price of the previous day.

Unlike bulk deals, block deals aren’t visible to the regular market participants as it takes place in a separate window. However, similar to bulk deals, the broker should notify the exchange about the transactions.

Difference between NSE Block Deal and Bulk Deal

Many of us live in the dilemma that NSE block deals and bulk deals are the same. However, they differ from each other in various aspects. Some of them are as follows:

|

Parameters |

NSE Block Deal |

NSE Bulk Deal |

|

Definition |

NSE Block deal refers to a deal type where more than 5 lakh shares of trading take place, or the trading is done for a value of more than 5 crores of a company. |

NSE bulk deal refers to a deal where more than 0.5% of the number of equity shares of the registered company are bought or sold on the National Stock Exchange. |

|

Form of Transaction |

Single transactions |

Single or multiple transactions |

|

Window Type |

Regular window trading |

Separate window trading |

|

Deal Visibility |

As block deals happen in a regular window trading, everybody has access to view the transactions taking place. |

As bulk deals have separate window trading, the regular market participants can’t view the trading taking place. |

What is the Procedure of NSE Bulk Deals?

Often, investors monitor bulk and block deals to adjudicate the interest of big investors in the stock market. If multiple deals take place in stock constantly for a certain period, you can see it as a sign of confidence. It also implies that the price of the stock may rise in the future.

Nevertheless, if a big investor or institution is buying shares via such deals that doesn’t mean that the stock rate will surge. Several times, the large block of share purchase, which is revealed to the stock exchange, could be the last leg of purchase made by big investors willing to signal their interest in the stock.

In a nutshell, some large HNIs (High Networth Individuals) use this as bait to lure more buyers. Voila! This is how bulk or block deals take place in the stock exchanges.

What is Deal Type?

Once startups have successfully secured funds, they have to undergo a deal between them and the investors. Typically, the deal refers to the amount invested and what the investor receives in return.

The investors’ main goal is to have their investment back with a handsome return. Both parties, in the deal, agree on how that should take place. The investor may receive an equity stake in their company based on the deal type. Otherwise, their investment will be utilized as a loan which will be paid back with interest over time or something utterly different.

There are a plethora of deal types with nuances that can be very specific and detailed. The three most popular deals amongst startup investing are equity, convertible bond, and funds.

Guidelines for the Execution of Block Deals on the Stock Exchanges

Recently, the market regulator updated the framework for block deals by offering two different trading windows of 15 minutes each. It also raised the minimum order size to ₹10 crores.

The prime objective behind the move is to secure the confidentiality of stable prices and large trades for such transactions. As per new rules, the Securities and Exchange Board of India will render two-block deal windows. It will include morning and afternoon, and each window will open for 15 minutes.

Moreover, the minimum order size for the trade execution in the block deal window has increased to ₹10 crores. Currently, a block deal for shares worth ₹5 crores can take place through a single transaction.

The transaction value of a share must lie within +1% and -1% of the previous day’s closing price. However, the current framework allows a window duration of 35 minutes that is between 9.15 am to 9.50 am.

In a nutshell, the new norms regarding the block deals would be as follows:

- The market regulator SEBI will render two-block deal windows. It will include morning and afternoon, and each window will open for 15 minutes.

- The prime motive behind the move is to secure the confidentiality of stable prices and trades for such transactions.

- The morning window will function between 8.45 am to 9.00 am. Besides, the reference price for the block deals execution in this window would be the closing price of the previous day of the stock.

- The afternoon window would function between 2:05 pm to 2:20 pm.

Historical Data on NSE Bulk Deals

You can check the historical data of different stocks listed on the National Stock Exchange on various brokerage and financial websites such as Moneycontrol, etc. You can also monitor the same on the official portal of the National Stock Exchange.

NSE Bulk Deals Today

Dolly Khanna, a well-known investor, bought 140,000 shares of Ajanta Soya in a bulk trade on the BSE today at Rs. 147.7 per share.

To check the NSE Bulk Deals today, you can either visit NSE’s official website or the website of Moneycontrol. In fact, these portals allow you to have a look at the real-time data of the deals.

Learn More About Stock Market

| NSE India | BSE India |

| Equity Shares | Market Capitalization |

| Stock Market | Intraday Trading |

| Coin Market Capitalization | Cryptocurrency |

Frequently Asked Questions (FAQ)

How do you find whether a block deal is for buying or selling?

You can check it on Moneycontrol.com in the ‘Trans’ section. You will find the buy and sell options written in front of the companies.

How do I find bulk/block deals in NSE in real-time?

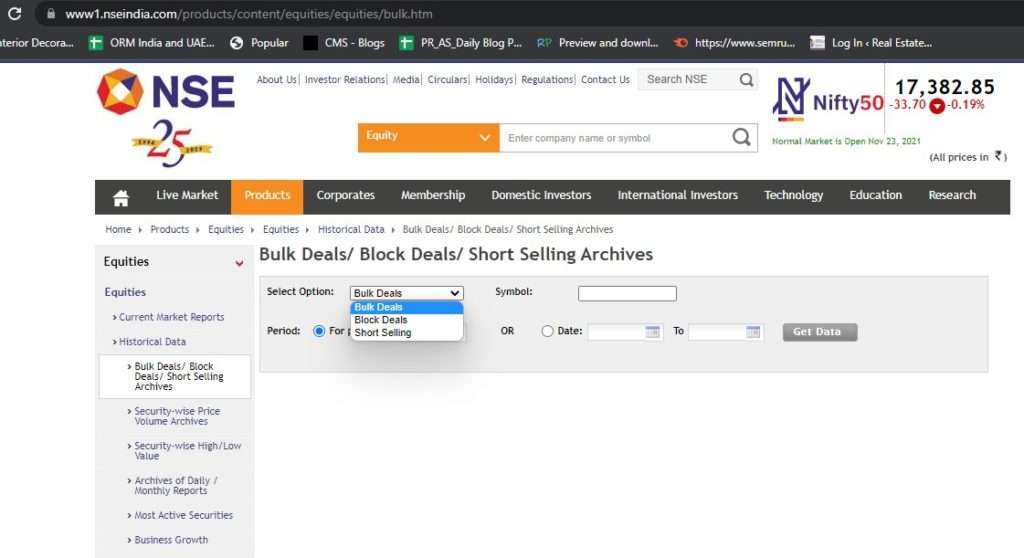

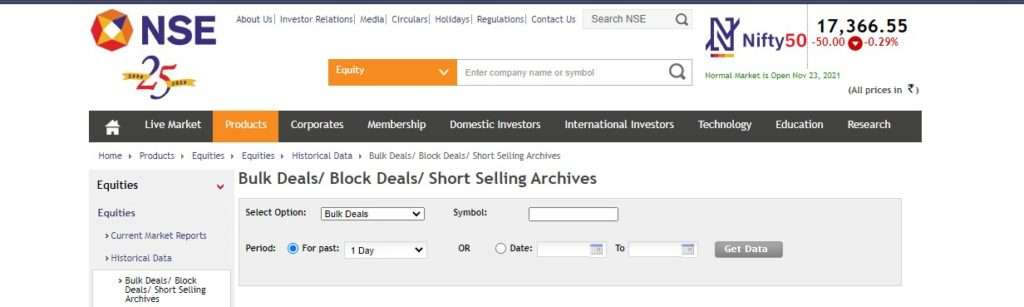

To get bulk/block deals in NSE in real-time, visit NSE’s official portal. Then click on ‘Products’ in the menu bar and select ‘Equities.’ Next, in the Equities section, click on ‘Historical Data’ and then, tap on ‘Bulk Deals/ Block Deals/ Short Selling Archives.’

What are block deals on the NSE?

Block deals refer to a single transaction between two entities that are especially institutional players. A minimum transaction quantity of five lakh shares or a minimum value of ₹5 crores is done. The transaction takes place via a different trading window. The deals start at the beginning of trading hours for 35 minutes.

What is the NSE block deal window?

Call it a block deal or block deal window, it’s the same. It’s a single transaction conducted between two parties consisting of a minimum of five lakh shares or a minimum value of ₹5 crores.

What are bulk deals on NSE?

A bulk deal refers to single or multiple transactions initiated by a single investor. The total quantity of shares bought or sold in this deal is more than 0.5% of the company’s share capital.