NSE India- what is it? Every now and then, we keep hearing- today NSE went down by X%, BSE soared to Y%, and so on. But only a few of us truly understand what NSE and BSE mean.

NSE India is the largest and first stock exchange in the country. Over time, it has grown into a sophisticated financial market gaining huge popularity across the world.

With its current market capitalization of $ 3.1 trillion (as of May 2021), the NSE India has become the world’s fourth-largest stock exchange. It holds the record for highest trading volume in the country and is still growing at a great pace.

To know more about National Stock Exchange, its history, indices, and more, continue reading until the end. Don’t skip any section or you will miss out on crucial details about the topic. Let’s get started with the definition of NSE.

What is NSE India?

The National Stock Exchange of India (or NSE India) Limited is India’s largest stock/financial market established in 1992. The NSE has burgeoned into an advanced, electronic market holding the fourth rank across the globe, in terms of equity trading volume.

Just after the launch of the wholesale cash and debt market segment shortly in 1994, trading in the NSE India started. Moreover, the NSE India is the first-ever exchange in the country to render modern and fully automated digital trading. Nonetheless, it’s also the largest private wide-area network in the country.

Today, this stock exchange regulates transactions in the equity, wholesale, debt, and derivatives markets. One of the most popular offerings of the National Stock Exchange of India is the NIFTY 50 Index.

All the largest assets in the Indian stock market are tracked by NIFTY 50. In case you are a US investor, you can access the index with ETFs (Exchange-traded Fund), such as the iShares India 50 ETF (INDY).

The next thing you might want to know is what the heck is Nifty 50. Hold your horses, we will come on to that. Until then, let’s study the history of the National Stock Exchange of India as it will tell you the notion behind launching this organization.

History of NSE (National Stock Exchange of India)

The country’s largest stock exchange was established in the year 1992 with a motto to instill transparency in the Indian equity markets. Also, this stock exchange wanted to ensure that all the experienced and qualified individuals who satisfy the minimum requirements can freely trade.

Earlier, only a handful of people were able to access stock price details. However, with the inception of NSE, any client can access it with the same ease from a remote location.

Moreover, the National Stock Exchange of India replaced the paper-based settlement with electronic depository-based accounts. Also, the settlement of trades is now done in record time.

But the most significant change of all by NSE involves a robust risk management system. With this in place, the exchange guarantees that settlement would safeguard investors from brokers doing defaults.

After all this, a question arises- who introduced NSE? Well, a group of leading Indian financial institutions after a command by the Government of India established the exchange. The aim was to make the Indian capital market transparent.

However, it’s the Pherwani committee that laid out the recommendations to introduce NSE with a diversified shareholding, including domestic as well as global investors.

Well, this isn’t all but it’s enough what you should know for now.

Now that you have got a gist of NSE history, it’s time we should move on and find out about its index- NIFTY 50.

What are Nifty 50 Companies?

Before you figure out what NIFTY 50 Companies are, let me first introduce you to the concept of NIFTY 50.

Typically, the NIFTY 50 is an index of the National Stock Exchange of India. It’s a benchmark that constitutes the weighted average of India’s largest 50 companies listed on the NSE.

In fact, it is one of two highly significant stock market indices in India. The other one is the BSE SENSEX.

So, what are NIFTY 50 companies?

From the above discussion, it’s quite apparent that NIFTY 50 companies are the 50 largest companies listed on the National Stock Exchange of India.

So, it wasn’t rocket science. Right? Absolutely, not. So, without stretching it any further, let’s understand what is NIFTY Next 50. Don’t raise your brows! It’s a concept and is equally important to know as the NIFTY 50 companies.

Nifty Next 50

NIFTY Next 50 is an index of 50 companies on the National Stock Exchange of India. Their free-float market capitalization falls after the 50 companies in NIFTY 50. Therefore, NIFTY Next 50’s companies are potential candidates to be put in NIFTY 50 in the future.

As of October 2021, the following are Nifty Next 50 constituents:

| Company Name | Symbol | Sector |

| ACC | ACC | Cement |

| Adani Enterprises | ADANIENT | Metals |

| Adani Green Energy | ADANIGREEN | Energy – Power |

| Adani Transmission | ADANITRANS | Energy – Power |

| Ambuja Cements | AMBUJACEM | Cement |

| Apollo Hospitals | APOLLOHOSP | Healthcare |

| Aurobindo Pharma | AUROPHARMA | Pharmaceuticals |

| Avenue Supermarts | DMART | Retail |

| Bajaj Holdings | BAJAJHLDNG | Financial Services |

| Bandhan Bank | BANDHANBNK | Banking |

| Bank of Baroda | BANKBARODA | Banking |

| Berger Paints | BERGEPAINT | Consumer Goods |

| Biocon | BIOCON | Pharmaceuticals |

| Bosch | BOSCHLTD | Automobile |

| Cadila Healthcare | CADILAHC | Pharmaceuticals |

| Cholamandalam | CHOLAFIN | Financial Services |

| Colgate-Palmolive | COLPAL | Consumer Goods |

| Dabur | DABUR | Consumer Goods |

| DLF | DLF | Construction |

| GAIL | GAIL | Energy – Oil & Gas |

| Gland Pharma | GLAND | Pharmaceuticals |

| Godrej Consumer Products | GODREJCP | Consumer Goods |

| Havells | HAVELLS | Consumer Durables |

| HDFC AMC | HDFCAMC | Financial Services |

| Hindustan Petroleum | HINDPETRO | Energy – Oil & Gas |

| ICICI Lombard General Insurance | ICICIGI | Financial Services |

| ICICI Prudential Life Insurance | ICICIPRULI | Financial Services |

| Indraprastha Gas | IGL | Energy – Oil & Gas |

| Indus Towers | INDUSTOWER | Telecommunication |

| Info Edge | NAUKRI | Internet |

| Interglobe Aviation | INDIGO | Services – Transport & Logistics |

| Jindal Steel and Power | JINDALSTEL | Metals |

| Jubilant FoodWorks | JUBLFOOD | Consumer Goods |

| L&T Infotech | LTI | Information Technology |

| Lupin | LUPIN | Pharmaceuticals |

| Marico | MARICO | Consumer Goods |

| Muthoot Finance | MUTHOOTFIN | Financial Services |

| NMDC | NMDC | Metals |

| PI Industries | PIIND | Chemicals |

| Pidilite Industries | PIDILITIND | Chemicals |

| Piramal Enterprises | PEL | Pharmaceuticals |

| Procter & Gamble | PGHH | Consumer Goods |

| Punjab National Bank | PNB | Banking |

| SBI Card | SBICARD | Financial Services |

| Siemens | SIEMENS | Infrastructure |

| Steel Authority of India | SAIL | Metals |

| Torrent Pharmaceuticals | TORNTPHARM | Pharmaceuticals |

| United Spirits | MCDOWELL-N | Consumer Goods |

| Vedanta | VEDL | Metals |

| Yes Bank | YESBANK | Banking |

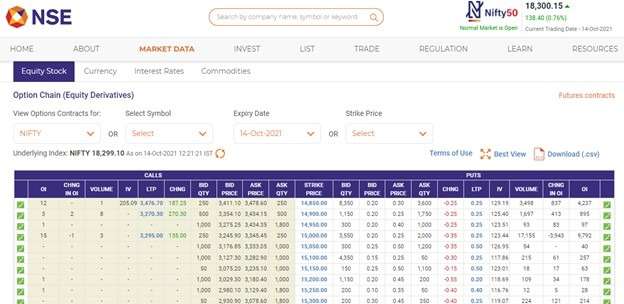

NSE India Option Chain

An option chain is a listing of all the call options and put option strike prices including their premiums for a certain maturity period. You can check them across stocks, indexed, and currency contracts.

You can visit nse india com to view the NSE India option chain. A sample of the same is given below:

All you have to do is to choose relevant filters. As you can see in the image above, I have opted for “View Options Contracts for Nifty” and chose ‘Expiry Date.’

However, you can also opt for ‘Select Symbol’ and ‘Strike Price.’

NSE Market Data

NSE Market Data offers market quotes of NSE and data for Futures and Options Segments (F&O), Capital Market Segment (CM), Corporate Bond Market Data and Securities Lending & Borrowing Market (SLBM), Corporate Data, Currency Derivative Market Segment (CDS), and Wholesale Market Segment (WDM).

To witness real-time market data of companies listed on the National Stock Exchange, visit the NSE’s official portal i.e. nse india com

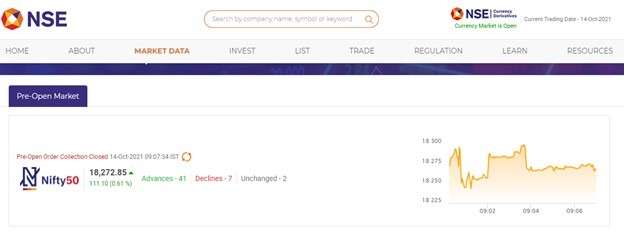

Pre-Open Market

Before the regular market session opens, there’s a period of trading activity that occurs before that. During that period, traders and investors try to analyze the pre-market trading activity and try to presume the direction of the stock market for the entire day.

This market session occurs both on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) and it is known as Pre-Open Market.

Typically, this pre-market session exists from 9:00 AM to 9:15 AM for both exchanges.

You can view the NSE pre-open market on its nse india com and track the performance of all the stocks listed on the exchange.

Equity and SME Market

An equity market is a platform where the shares of companies are issued and traded either over-the-counter markets or through exchanges. The equity market is also known as the stock market.

On the other hand, the SME Market is specifically for small and medium-sized companies having significant growth potential. The market shall be open on the exchange for Small and Medium Enterprises whose post-issue paid-up capital must be equal to or less than ₹ 25 crores.

Fixed Income and Debt Market

Typically, a fixed income market is known as the bond market or the debt securities market. It includes bond securities issued by the federal government, mortgage debt instruments, municipal bonds, and corporate bonds.

The bond market or debt market also refers to be as a capital market as it offers capital financing for investment in the long term. It is also called the credit market.

Call Auction for Illiquid Securities

Liquid securities are quite popular and almost all of us know about them but illiquid securities are less talked about. So, let us first understand what illiquid securities are.

Illiquid securities typically refer to the bond, stock, or other securities that are difficult to be exchanged or sold for cash without any substantial loss in value.

While in call auctions, market participants such as traders and investors place orders to sell and buy at certain offered or bid prices. Later, these bidding or asked prices are put together and matched at proposed time intervals.

Orders gathered at a call auction are all executed at the price that creates the best overall match. Further, the rules of call auctions vary from exchange to exchange.

Securities Lending and Borrowing

Securities Lending and Borrowing (SLB) or stock lending and borrowing is an act of lending and borrowing shares of stocks, bonds, or other commodities. It’s a process that allows short-sellers to borrow securities or bonds for initiating the delivery.

NSE India Indices

NSE Indices Limited is a subordinate of the National Stock Exchange of India. It offers a various range of index-related products and services and indices to traders and investors in Indian capital markets.

Previously, the NSE indices were known as IISL (India Index Services & Products Limited). The indices are located in Mumbai, Maharashtra.

It serves as a subsidiary/subordinate of NSE Strategic Investment Corporation Limited. The company manages more than a hundred equity indices. These include sectoral indices, broad-based benchmark indices, customized indices, and fixed income.

The NSE Indices Ltd. has created various benchmark index funds, exchange-traded funds (ETFs), and investment and risk management products. On the other hand, derivatives of NSE IFSC Ltd, NSE, and SGX are the products of NSE Indices abroad.

The subsidiary was born to render a range of indices as well as index-related products and services to financial markets.

How to Invest in NSE INDIA?

For an investor to buy or sell shares directly on the stock exchange isn’t possible. Only the registered members of the stock exchange known as stockbrokers have the authority to do so. Therefore, if you want to invest or trade on any stock exchange, you must contact a stockbroker, they will trade on your behalf.

Typically, a stockbroker could be either employed at a brokerage firm or an independent service provider. They are obligated to possess mandatory qualifications and experience in the field of finance. A broker in the stock market is known as a Trading Member.

A stockbroker is intimate with the formalities of the stock market. Therefore, you may follow their knowledge and judgment. They may help you in making the right decision in the market.

In a nutshell, a stockbroker can do the following for you:

- Buy and sell stocks

- Escort and represent you at the stock market.

- Render right information related to the investment choices available at the equity market.

- Offer accurate data on shares and their prices compulsorily.

- Acquaint you with the appropriate market moves.

Since stockbrokers are of so much importance, you must put some time and effort into finding the right stockbroker.

In case you are not satisfied with the broker’s services, the Arbitration Laws give you the right to file a complaint with SEBI.

Now that you have found your stock broker, create a trading or Demat account. Once you are done with the KYC verification and your account has been created, you would have to connect it with your bank account or put some money into the Demat account.

Once you are done with the account and the money, you can begin trading and investing in the stock market.

NSE Regulatory Framework

Every Indian Capital Market is monitored and regulated by the Reserve Bank of India, the Ministry of Finance, and the Securities and Exchange Board of India.

The Department of Economic Affairs from the Capital Market Division helps the Ministry of Finance regulate the market. The division mainly focuses on designing the policies associated with the orderly growth and development of the securities markets i.e. debt, share, and derivatives.

Moreover, the body also works toward safeguarding the interest of the investors and is particularly responsible for-

- Establishing regulatory and market institutions

- Offering an efficient legislative framework for the securities market

- Enhancing investor protection mechanisms, and

- Institutional reforms in the securities market.

The Division governs legislation and rules made under the

- Securities Contracts (Regulation) Act, 1956

- Depositories Act, 1996, and

- Securities and Exchange Board of India Act, 1992.

Market Rules and Regulations of National Stock Exchange

NSE works as per the guidelines issued by the regulatory authorities as mentioned in the above section.

NSE is supposed to frame and implement rules and regulations to govern the securities market. These rules and regulations apply to:

- Securities listing

- Member registration

- Compliance by members to RBI/SEBI regulations

- Transaction monitoring

- Investor protection, and more.

How Does the NSE Work?

The National Stock Exchange provides information about the financial strength of India’s economy. Here’s the flow chart of how the NSE actually works:

- The enterprise that is willing to captivate investors organize IPO. In addition, it gets registered under NSE.

- The enterprise put together the stocks which investors can avail. The investors must have a Demat account.

- Investors can then acquire these stocks depending upon their reputation. The whole process is gauged by NIFTY and SENSEX as they are the indexes to trade. Major 50 stocks are listed under NIFTY NSE and top 30 stocks are listed under SENSEX BSE.

- The increase or decrease of stock price entirely depends upon the enterprise breakthrough. Growth results in increased stock price of the venture on NIFTY or SENSEX. Investors can count on these trends to make their investment decisions.

- NSE is responsible for the regularisation of stock transactions to ensure that the investors get utmost transparency as well as accountability.

Functions of NSE India

Following are vital functions performed by the NSE India:

- To create a trading potential where investors can trade debt, equity, along with supplementary asset classes.

- To serve investors as a communication network and offer them the opportunity to participate seamlessly within the trading system with equal chances.

- To comply with the norms set for financial exchange markets internationally.

- To offer a mechanism of book-entry settlement along with trade settlement duration.

Benefits of Listing on National Stock Exchange of India

Whether you are an investor, a trader, or a company owner, investing, trading, and listing companies on the National Stock Exchange of India have their own perks, and here’s how and why-

Top-Notch Marketplace

The utter volume of trading activity guarantees that the impact cost is lower on the Exchange. As a result, investors have to pay less trading costs. Moreover, the automated trading system of NSE ensures transparency and consistency in the trade matching which improves the confidence of investors and visibility of our market.

Visibility

The trading system renders an unprecedented degree of trade as well as post-trade information. The trading system displays the best 5 buys and sells along with the total number of securities available for buying and selling. As a result, the investors have an in-depth insight into the market conditions. Moreover, corporate announcements, corporate actions, and results, etc. are also open on the trading platform.

Largest Exchange in India

The National Stock Exchange holds the record of having the highest trading volumes and hence, it is the largest exchange in the country. NSE reported a turnover of 25,77,412 crores during the year 2010-2011 in the equities segment.

Transaction Speed

The pace at which the order at the exchange processes, causes liquidity and the best prices available. The highest number of transactions recorded in a day was 11,260,392 on May 19, 2009.

Unparalleled Reach

The National Stock Exchange of India renders a trading platform stretching across the length and breadth of the country. Investors from 191 centers are allowed to access the trading facilities on the NSE Trading Network. The exchange employs the updated communication tech for providing quick access from every location.

Short Settlement Cycles

The NSE India has an excellent record of completing more than 2800 settlements without any setbacks or delays. And this is because the exchange has short settlement cycles.

Broadcast Facility for Corporate Announcements

The NSE network is good at promulgating information and company announcements across the nation. Significant details associated with the organization are notified to the market via the Broadcast Mode on the NEAT System. Whereas they are circulated through the NSE website.

On the other hand, corporate developments such as book closure, financial results, right, mergers, takeovers, announcements of bonuses, etc. are proclaimed across the country. This mitigates the risk of any price manipulation or misuse.

Trade Statistics for Listed Companies

For all the securities of the companies listed on the National Stock Exchange, listed companies receive monthly trade statistics.

Comparatively Nominal Listing Fees

When you compare the listing fees of NSE with other exchanges, you will find that the NSE charges quite a lower amount.

Investor Service Centers to Cater to Investors’ Needs

The National Stock Exchange has a total of six investor service centers across the country that cater to the requirements of investors.

Wrapping Up

Investing in stocks is a brilliant choice to earn passive income and improve your standard of living. But investing in well-known and thoroughly researched stocks is even a better decision. However, to ensure your deeds are fruitful, you should know how your stock exchange is performing.

NSE India, the largest stock exchange of the country, has the largest companies of the country listed on it. It renders all the required updates you need to know about the stock market and the performance of stocks to ensure your money is going in the right place. Therefore, before investing, do your research about the companies on NIFTY 50 ( NSE Indices) and invest in the right stock.

You May Also Like

Frequently Asked Questions (FAQ)

Can we start with investing ₹ 100 in the share market?

Yes, you can start investing with ₹ 100 in the stock market. In fact, you can start with even an amount lower than that. It totally depends on the stock you are investing in. However, you must know that if you are investing for the first time, you must open a Demat account, and for that, you must have to pay some charges associated with the account.

What are Nifty 50 companies?

The Nifty 50 companies are the largest Indian companies listed on the NSE (National Stock). Typically, the NIFTY 50 is a benchmark that stock market in India representing the average of 50 of the largest companies in India.

NIFTY 50 is among the two main indices used in India, the other being the SENSEX on the Bombay Stock Exchange (BSE).

What is Nifty PE today?

As of 4 October 2021, the Nifty PE Ratio stands at 27.09 while the Nifty Dividend Yield Ratio is 1.16, and the Nifty PB Ratio is 4.43.

What is NSE India?

NSE India or National Stock Exchange of India Limited is India’s leading stock exchange located in Mumbai, Maharashtra. NSE operates under the ownership of some leading banks, financial institutions, and insurance companies.

How to find a good stockbroker?

To find a good stockbroker, you must first check for the reputation and background of the broker, find out the brokerage charges, monitor the customer services, and more.

How to file a complaint against a trading member?

If you want to file a complaint against a trading member, then you need to follow the steps below:

Step 1: Go to the exchange’s website i.e.nse india com and bseindia.com. Then, download the form “Investors complaint form against the trading member.’

Step 2: Fill up the form, attach the relevant documents, and submit it to the investor service center of the stock exchange. You can send it either in person or by post.

Step 3: Once the authority has accepted your form, you will get a reference number, which you can use for any future communications with the exchange.

What are derivatives?

The derivative is a kind of security whose value is extracted or assessed from an underlying asset.

How can I get the list of companies in NSE?

You can easily get the list of Companies in NSE on its official portal- nse india com

Which is better NSE or BSE?

Saying that one of them is better wouldn’t be a fine judgment. Both stock exchanges have their own sets of pros and cons. While BSE is best for beginners, NSE is better for seasoned investors. However, if you are somebody who wishes to invest in the stock of new companies, the Bombay Stock Exchange could be an ideal choice.