Since the inception of the online tax portal, the process of online tax payment has become very easy. As a taxpayer, you can now simply visit the official government website and easily make tax payments using your preferred modes of payment. In this blog, we will take you through how you can use the online tax portal to pay income tax online, its benefits, required documents and eligibility, and more.

What is Online Tax Payment?

Online tax payments enable you to pay all your taxes online without any delays or lengthy paperwork. It eliminates all the disadvantages dished by the offline mode of tax payment and saves a lot of time and effort. For any online tax payment, all you need are the required documents, an active internet connection and your laptop or smartphone.

How to Pay Tax Online?

How to Pay Tax Online?

-

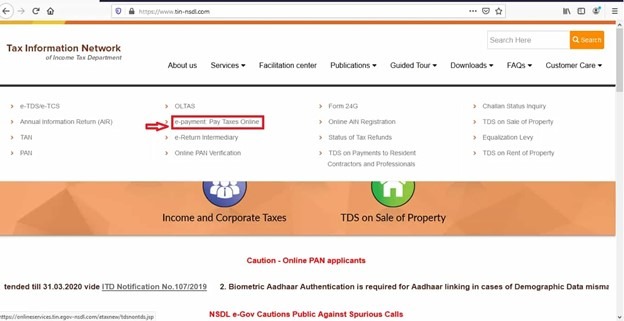

Step 1: Visit the online tax portal and click on ‘e-payment: Pay Taxes Online’

-

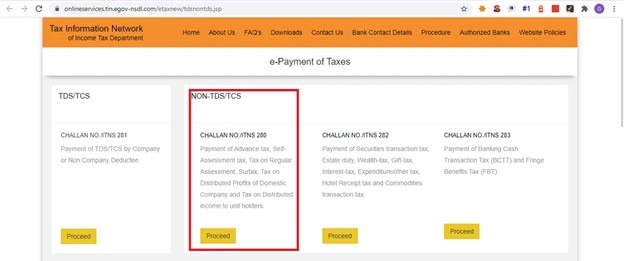

Step 2: Once you are redirected to another page, click on ‘Proceed’ as given under ‘Challan No./ITNS 280’ of the ‘Non-TDS/TCS’ tab.

-

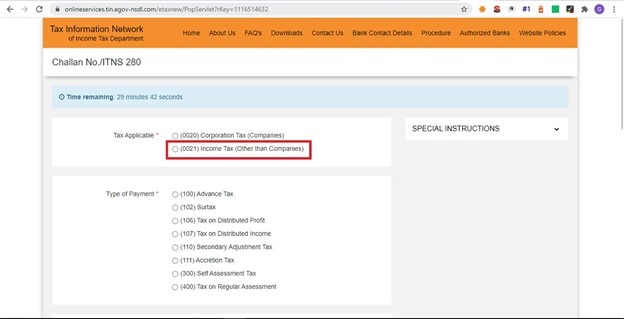

Step 3: On the resulting page, click on ‘(0021) Income Tax (Other than Companies)’ given under the ‘Tax Applicable’ option and provide all the required information.

-

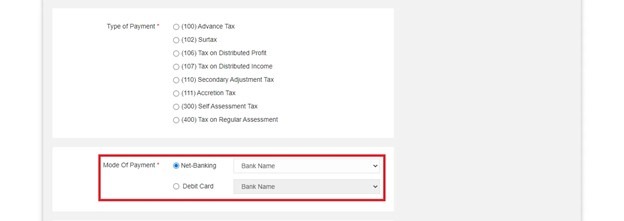

Step 4: Choose your preferred mode of payment.

-

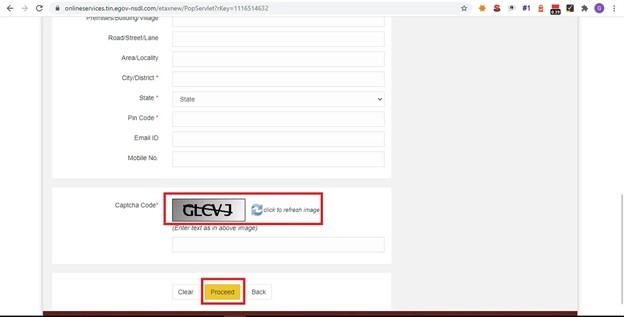

Step 5: Verify the captcha code and click on ‘Proceed’ to continue.

-

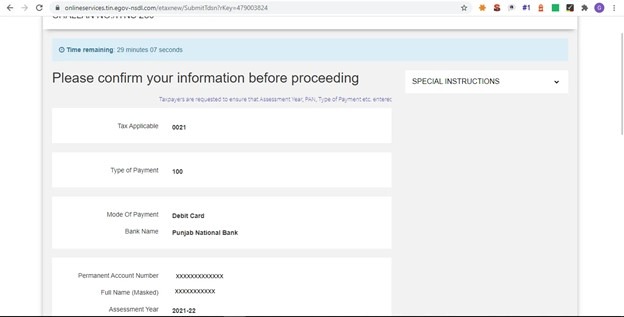

Step 6: Confirm all the information you entered on the previous page. Click ‘Submit to the bank’ to confirm the details.

-

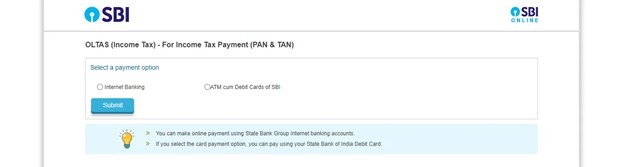

Step 7: This will redirect you to the bank payment portal to complete the payment.

-

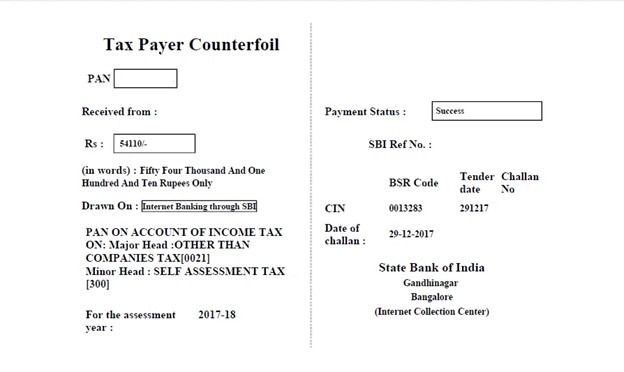

Step 8: Once the payment is complete, a payment receipt containing the challan number, challan date, payment amount, etc., will be generated, indicating that your online tax payment has been successful.

Given below are the steps to pay income tax online:

Step 1: Visit the online tax portal and click on ‘e-payment: Pay Taxes Online’.

Step 2: Once you are redirected to another page, click on ‘Proceed’ as given under ‘Challan No./ITNS 280’ of the ‘Non-TDS/TCS’ tab.

Step 3: On the resulting page, click on ‘(0021) Income Tax (Other than Companies)’ given under the ‘Tax Applicable’ option and provide all the required information.

Step 4: Choose your preferred mode of payment.

Step 5: Verify the captcha code and click on ‘Proceed’ to continue.

Step 6: Confirm all the information you entered on the previous page. Click ‘Submit to the bank’ to confirm the details.

Step 7: This will redirect you to the bank payment portal to complete the payment.

Step 8: Once the payment is complete, a payment receipt containing the challan number, challan date, payment amount, etc., will be generated, indicating that your online tax payment has been successful.

Eligibility Criteria for Online Tax Payment

As per the Income Tax Act, taxpayers need to fulfill the below eligibility criteria to pay tax online.

- The taxpayer is an Indian citizen with an annual income of over Rs 2.5 lakhs per annum.

- They are over the age of 60 with an annual income of more than Rs 3 lakhs.

- They are over 80 years old, having an annual income of over Rs 5 lakhs.

- They own a firm that falls under Section 44AB or is a co-operative society, AOP, BOI, and local authority.

- They have a property, have a financial interest in a business entity, or are a signatory of any overseas account.

- They have claimed tax relief under Sections 90 or 90A or deductions under Section 91.

- They are an assessee responsible for producing returns as under Section 139 (4B).

- They are a business entity operating inside the country.

How Does Online Tax Payment Work?

The process of online tax payment depends on the factors given below:

- PAN: The taxpayer is required to have a valid PAN card issued in their name having a 10 digit alpha-numeric number. The PAN is required to log in to the ITR portal. This is the most crucial element in paying income tax online.

- TAN: The Tax Deduction and Collection Account Number (TAN) is another important requirement for successfully paying income tax online. According to the Income Tax Act, the TDS deducted is submitted to the Income Tax Department by the employer. TAN is a must-have document for any entities involved in such dealings.

- E-payment: Valid TAN and PAN holders are eligible to make tax payments online through various government portals.

- OLTAS: The Online Tax Accounting System (OLTAS) is a database used by the Income Tax Department to regulate the collection of taxes all over the country.

- ERACS: The Electronic Return Acceptance and Consolidation System (ERACS) is an intuitive interface between the individual and an online portal for uploading TDS, TCS, and Annual Information Return on the central system.

Benefits of Online Tax Payment

The following are some of the advantages of paying your taxes using an online tax payment portal:

- Via the online method, you can pay your taxes instantly by transferring funds from any account.

- You can use net banking to make tax payments anytime and from anywhere you want.

- The transaction ID for the tax payment will reflect as a permanent record on your bank account, thus providing solid proof of your successful online tax payment.

- What you write on the electronic challan will automatically be sent to the Income Tax Department.

- You can check the status of your payment through the Tax Information Network website anytime you want.

Documents Required for Online Tax Payment

Given below is the list of documents that you will be required to furnish while making online tax payments:

- Form 16.

- Form 16A, Form 16B, or Form 16C.

- Form 26AS.

- Interest certificate as issued by the bank or post office.

- Aadhaar Card.

- PAN Card.

- Proof of tax saving investment.

- Capital gain acquired from sale of property/mutual funds.

- Deductions as stated under Section 80D to Section 80U.

- Statement of home loan from NBFC or bank.

How to Pay Your Taxes Offline?

If you want to follow the old-school offline method of paying your taxes, the below steps can help you do the same.

Step 1: Visit the nearest branch of your bank and obtain Challan 280.

Step 2: Duly fill the Challan with all the accurate details.

Step 3: Submit the tax challan on the bank counter with the total tax amount. You may make this payment in either cash or cheque. Banks may sometimes refuse to accept large payments in cash, so it is advisable that you use a cheque. Draft the cheque in favor of the Income Tax Department.

Step 4: Once the payment has been deposited, the bank official will tear a portion of the Challan, stamp it, and give it to you. Keep this handy as it is proof of your tax payment.

The tax payment will further reflect on your Form 26AS within 10 days of payment, either as Advance Tax or Self-Assessment Tax.

Frequently Asked Questions (FAQs)

What is online tax payment?

Online tax payment is when the taxpayer uses the online tax portal to e-file and pay taxes.

Is it mandatory to make tax payments online?

No, it is not necessary to make your tax payments online. You can also make offline payments by visiting your bank’s nearest branch.

What details will be mentioned on the receipt after completing an online tax payment?

The receipt generated after completing an online tax payment contains relevant details of the tax amount paid, challan serial number, date of challan, etc.

What do I have to do if any error happens at the time of online tax payment?

In case there is an error while making tax payments online, you are required to visit the assessing officer’s office and request corrections.

What common mistakes should I avoid while paying tax online?

Make sure to select the right financial year, assessment type and enter the correct codes when e-filing your taxes.

Are there any benefits of paying tax online?

Yes, paying tax online has numerous benefits. Not only is it time-saving, but you can do it anytime from anywhere. Additionally, unlike offline tax payment, the money deposited by you is immediately sent to the tax authorities.

Who should I contact if I face any issues during online tax payment?

If you face any issues while making an online payment on the NSDL website, you should contact the TIN customer care center. Contact your bank if you face any issues at the payment gateway.

Which taxes can be filed online?

These days, the e-payment facility has been made available for multiple taxes, including Corporate tax, TDS, Securities Transaction Tax, TCS, and Equalization levy.

What are some of the challans that can be used for tax payments?

Some challans that can be used for tax payments are ITNS 280, ITNS 281, ITNS 282, ITNS 284, ITNS 285.

What is the use of challan ITNS 281?

The ITNS 281 challan is used for TDS and TCS payments by corporate and non-corporate deductors.