As you may know, PAN cards are important for every individual but do you know PAN cards for companies are mandatory?

PAN cards help the government keep track records about every financial transaction happening in the company under the PAN number. However, PAN is also useful for businesses. It helps companies in filing income tax returns, tax deductions and enjoy other perks. To apply and obtain the unique 10-character PAN card for the company certain documents are required.

We’ll go over a few things you should know if you want to get a PAN for your business or not in this article.

Why PAN Card for Company?

PAN is a unique number that is assigned to both individuals and businesses. Further, PAN is required for all taxpayers in the country because they are earning money. The rule is applied to all kinds of businesses such as firms, LLPs, corporations, partnerships, etc.

Which Type of Companies Need a PAN Card?

We have enlisted the type of companies and situations for which owning a PAN card is a must.

- Any commercial organisation that wants to establish its business in India must have a PAN card, whether Indian or foreign.

- As per the Income Tax Act, every establishment doing business in India requires a PAN card.

- Every corporation with anyone involved in acquiring money outside India must own a PAN card.

Note: For the above point, it doesn’t matter whether the company is registered or is permanently established in India or has an office in India.

- A complete list of bodies that need PAN cards for doing business in India:

- LLP (Limited Liability Partnership)

- Trust

- Any individual Company

- Firm in partnership

- Association formed by several people

- Individuals Body

- Ltd. companies

- Private firms

- Associations

- Investors of Foreign Institute

- Hedge Funds

- Incorporations

Why Does Your Company Need a PAN Card? – Reasons and Benefits

A company’s PAN card is of high value as every transaction takes place under this number. The Permanent Account Number assists the government in determining the flow of your company.

Further, we have examined several reasons as to why owning a PAN card for the company is necessary.

Note: PAN cards are mandatory even for startups (it doesn’t matter if you are eligible to pay taxes or not) as you are earning money.

- PAN card works as a reference number for every transaction and documentation. Permanent Account Number also helps the Income Tax Department in keeping eyes on the company’s trades.

- PAN card helps in fulfilling the payment of invoices without deductions, filing income tax returns, remittances, and many others.

- Every company registered in India or outside has to pay taxes for the business they are carrying out in the country. Further, the government will deduct taxes at the highest rate possible if companies don’t have PAN cards.

- Every company has to provide their TRN (Tax Registration Number) to the other party paying them. Note: Any company will have their TRN only if they own a PAN card.

- If companies do not have PAN, the government will charge the withholding tax. The interest rate of withholding tax will be more than 30% of the entire invoice payment.

- Some amendments were made in 2009, under Section 206AA of the Finance Act, about companies owning a PAN card. According to Section 206AA, every foreign company must have a PAN to continue their business with any company in India. Further, every individual is included in this act along with every kind of company.

Documents Required for PAN Card Application

While applying for the PAN card application for a company, they have to submit documents as proof of identity and address. Below you can see the documents Indian and foreign companies have to provide.

PAN Card for Indian Company

- Incorporation Certificate Copy

- No Objection Certificate Copy given by the Ministry of Corporate Affairs).

PAN Card for Foreign Company

As an applicant, you can submit any of the following documents as identity and address evidence:

- Registration certificate copy from the applicants country. Further, it will be attested by an Apostille or the Indian Embassy or an authorised official of an overseas bank registered in India.

- Registration certificate copy from India after the approval of Indian authorities.

Note: You will also require a bank draft to pay the Income Tax Department the application fee for the PAN card. Usually, the amount is payable in INR but you can choose a foreign currency in favour of NSDL – PAN or UTIITSL and pay the draft in Mumbai.

We have also created a table depending on the type of organisations and the documents they can submit as their identity and address proof.

| Type of Companies | Documents |

| Companies | Certificate of Registration issued by the Registrar of Companies |

| Limited Liability Partnership (LLPs) | Certificate of Registration issued by the Registrar of LLPs |

| Firms in Partnership | Partnership Deed; or Registration Certificate (issued by the Registrar of Firms) |

| Trusts | Trust Deed; or Registration Certificate number (issued by Charity Commissioner) |

| Association of persons (not Trusts) / Body of Individuals / Local authority / Artificial Juridical Person | Agreement; or Registration Certificate number (issued by charity commissioner/registrar of cooperative society/ other competent authority).

Registration Certificate number (issued by charity commissioner/registrar of cooperative society/ other competent authority). Any other document from the Central or State Government Department with the identity and address of such person. |

How to Get a PAN Card for a Company?

You can follow the steps written below for filling the PAN card application form for the company.

Step 1: Visit the online portal of NSDL and select the PAN application option.

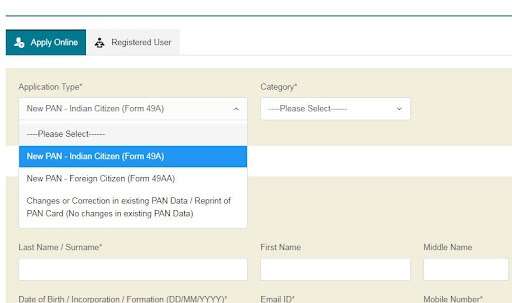

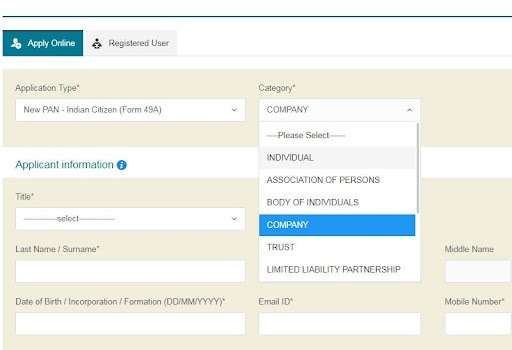

Step 2: Now, select Form 49A or 49AA from the drop-down menu of Application Type. Select the Category from the next drop-down menu.

For example – We selected the category as Company.

Step 3: Carefully fill in all the information such as company name, date of incorporation, email address, contact details, address, and others. Once you have filled the form, fill in the captcha code as given on the screen and proceed further.

Step 4: On your screen, a token number will be generated and the same will be sent to the company’s email address you mentioned in the form.

Step 5: After filling in all the details, only e-KYC and e-sign will be left. To complete these formalities, you have to manually sign the form and complete the KYC details.

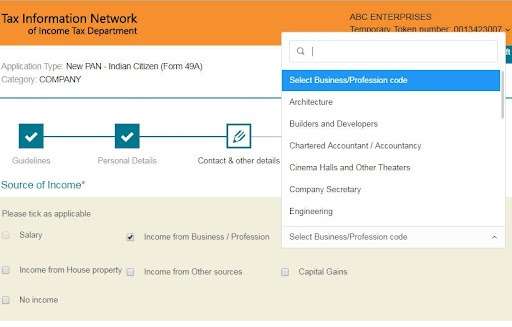

Step 6: You have to write the source of income in this section of the PAN application form. Choose one out of two options given – Income from Business or Profession.

Note: If you select business as an option make sure to select the type of business.

Note: If your source of income is from house property or capital gains or other sources then mention them as well.

Step 7: Write the address of the company that will be further used as a communication address.

Step 8: Write your AO (Assessing Office) code as per your area and location. Select the option Indian Citizen and then your State and City.

Note: If you don’t know your AO then go to the AO Code Search for PAN on the NSDL website.

Step 9: Go to the documentation page. Submit the Registration Certificate as issued by the Registrar of the company as your both address and identity proof.

Step 10: Sign the declaration defining your connection with the company (only the Director or Authorised Signatory can apply for the company PAN card).

Step 11: Submit the form with the declaration and upload the scanned copies of the documents.

Step 12: Review your application and submit the form.

Step 13: Pay the fee of the PAN card application for the company.

For communication address in India: INR 110

For Communication Address Outside India: INR 1020

Note: You can pay using Demand Draft, Credit card, Debit Card or Net Banking. All the net banking options must belong to the Director of the company.

Step 14: You will receive an acknowledgement receipt. You can use it for checking the status of the company’s PAN card.

After submitting the form you have to sign an acknowledgement receipt and send it to the NSDL office at the address mentioned below. Make sure to send a copy of the registration certificate and demand draft (if any).

Address:

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

How to Get Apostilles for the Documents?

If a foreign company is applying for a PAN card, all the documents must be apostilled.

An apostille is a person who validates the company’s documents. The validation is accepted by every country that chooses to be a part of the 1961 Hague Convention Abolishing the Requirement of Legalisation for Foreign Public Documents.

For apostille, documents will be sent to the following countries:

US – Secretary of State Office

UK – The Legalisation Office or The Foreign and Commonwealth office.

Tips on PAN Card for Companies

- Carefully read all the instructions written on the PAN application form.

- Provide all the documents as asked in the form.

- Fill your form in block letters (use a black ink pen if you choose to fill the form physically).

- The PAN application form should be signed by the CEO or any authorised person (with the same power as the CEO) of the firm.

- For any doubt or information, contact PAN customer care first.

- The fee will be different depending on the fact whether the company is Indian or not.

Frequently Asked Questions (FAQs)

Who needs a business PAN card?

Any business working with an Indian company or in India needs a PAN card. It is also needed if anyone is making income out of India whether the company is registered or has a permanent place or office in India.

Why do companies need PAN?

Companies need PAN if they are doing business in India or working with any Indian company as proof of their identity and address.

What are the benefits of having a PAN card for the company?

The primary benefits are payment of invoices without deductions, no heavy taxes, remittances, tax returns, etc.

What if I do not have a PAN card for a company?

If you do not have a PAN card for the company, your company has to pay a hefty amount of taxes to the government. Further, the company won’t be able to enjoy any perks from the government like tax deductions or income tax returns.

How can I get the PAN and TAN numbers of a company?

For TRN you can visit the official website of incometaxindiaefiling. And for PAN you can visit the online portal of NSDL – TIN or UTIITSL.